A reader asks:

I read something this past week that, while I trust the source, it seems hard to comprehend, let alone believe… that virtually all of the nearly 30% gain in the S&P 500 since ‘17 has come outside of normal US market trading hours. More specifically, that since January ‘17 just 2% of the return occurred between 9:30am and 4pm EST – amidst the normal hysteria of a given day’s headlines on cable and financial news.

Have you heard/seen this kind of data before? And if accurate, what are your thoughts?

The idea here is the bulk of the gains in the stock market have come after the market is closed. So if the market closes at 100 one day, if it opens the next day at 101, that means there was a 1% gain that occurred outside regular trading hours.

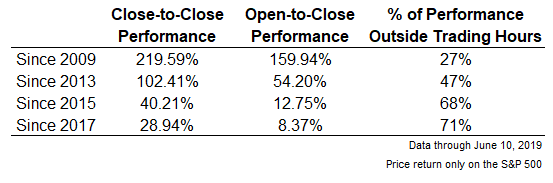

I ran the numbers going back to the start of 2017 for the S&P 500 and here’s what I found:

- On a price basis (no dividends included) the S&P 500 is up roughly 29% from the start of 2017 through the close on Monday (June 10).

- The gain in the S&P in that time from open-to-close during regular trading hours (9:30 am-4:00 pm est) was 8.4%.

- That means more than 70% of the gains have come outside of normal business hours in the stock market or from the close one day until the open the next day.

Looking at a few different time horizons, it doesn’t look that out of the ordinary for stocks to see gains when it’s closed (or simply see a pop at the open):

Most of the gains over the past few years look to have come when the market was closed but going back to 2009 shows the majority of gains have come during market hours in this cycle.

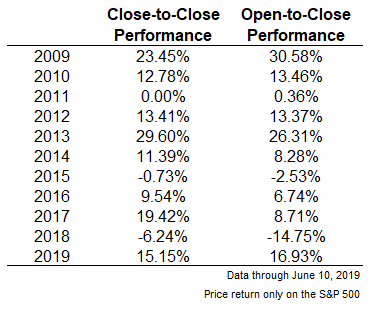

But it’s also difficult to find much of a relationship here when you break things down by year:

2017 saw most of its gains come outside market hours but last year most of the losses actually happened when the market was open.

The question is: Does any of this really matter?

Well, it could matter if you’re trading short-term moves in the market. If you’re trying to buy every single dip and sell every single rip and time the intraday tops and bottoms, sure, this could have an impact on your bottom line.

But for normal, long-term investors it doesn’t really matter all that much. The day-to-day, week-to-week or even month-to-month movements in the stock market shouldn’t have that much of an impact on your results if you have a time horizon measured in years or decades.

Some people may worry for some reason about these numbers but I actually think it’s kind of neat that stocks can basically go up overnight and we don’t have to do a thing about it.

This is amazing — you’re making money while you sleep!

Is the stock market the new 4 hour work week of life hacks?

Maybe we should ask the stock market what time it wakes up in the morning to create these gains out of thin air. Gotta be 3:30 am, right?

The truth is those overnight or pre-market gains are just another cog in the wheel that is the compounding machine called the stock market. When you add in some dividends, sprinkle in some earnings growth, and a pinch of up days during market hours, eventually we’re talking about real gains over time.

Since 2008, roughly 1 out of every 20 trading days in the S&P 500 has seen at least a half percentage point difference between the close-to-close performance and the open-to-close performance.

What this tells us is that the stock market has a hard time making its mind up in the very short-term. It has no memory from day-to-day and can reprice itself without warning.

You could make the point that so much of what goes on during regular trading hours is noise but I’m not sure there’s much of a signal in the gains or losses when the market is closed either.

There will always be things to worry about in the stock market but this doesn’t appear to be one of them.

Further Reading:

How Compounding Works in the Stock Market