Here’s something you don’t see every day:

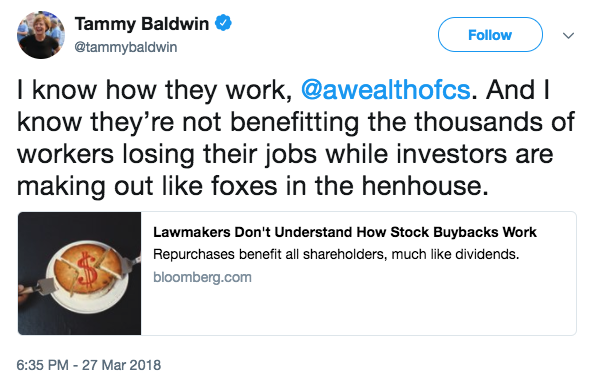

This was a tweet sent by a Senator from Wisconsin in response to a piece I wrote for Bloomberg this week about a bill she proposed to ban share buybacks.

My main point was that share buybacks are not as evil as some people in politics or the media make them out to be. And banning them won’t stop workers from losing their jobs.

And I get the sentiment. Wealth inequality is getting out of hand. Middle-class wages have been stagnant for years. I’m on record saying that the new tax cuts will only exacerbate this inequality.

But banning buybacks isn’t going to force corporations into paying their employees more. That money would simply be shifted to other capital allocation decisions such as M&A, dividends or R&D. I suppose they could always propose a bill to tax buybacks just like dividends to bring in more tax revenue but this wouldn’t force corporations to increase wages or hiring either.

Punishing corporations after just giving them a massive tax break is not going to help the labor force increase their wages or improve their net worth.

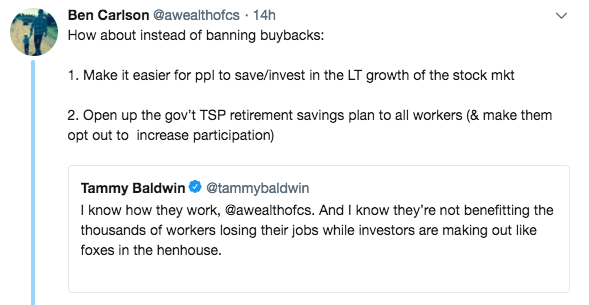

This was my response to the Senator (Who am I kidding? She didn’t write this tweet. I’m sure she has a social media manager who tweets on her behalf):

Two-thirds of all workers aren’t putting any money into an employer-sponsored retirement plan. The biggest reason for this is many simply don’t have access. One study found that just 14% of employers across the country even offer their employees access to a retirement plan (per Bloomberg):

Census researchers Michael Gideon and Joshua Mitchell analyzed W-2 tax records from 2012 to identify 6.2 million unique employers and 155 million individual workers, who held 219 million distinct jobs. This data produced estimates starkly different from previous surveys.

For example, previous estimates suggested more than 40 percent of private-sector employers sponsored a retirement plan. Tax records uncovered a much bigger pool of small businesses, showing that, overall, just 14 percent of all employers offer a 401(k) or other defined contribution plan to their workers.

People could always save in an IRA but the getting people to save for their future will require behavioral psychology, not tax policy (hence my idea to sign everyone up for a retirement plan and force them to opt out).

And obviously, there are many people who simply don’t have the ability to save money because they don’t earn enough. Politicians could always make the tax code more progressive to help out the lower and middle class but my hope is that market forces will help with rising wages.

The unemployment rate is at 4.1%. The Fed thinks it could easily go sub-4% in the not too distant future. It hasn’t been this low since the late-1990s/early-2000s tech boom and before that, the last time it was at this level was in the late-1960s. I’m hopeful that a full employment situation will put pressure on businesses to raise wages.

It’s easy to demonize corporations and see the stock market as a place reserved for the wealthy. But innovation isn’t going away. Corporate American isn’t going to stop making profits. Those people who are invested in the stock market will continue to earn their share of those profits, no matter how they’re paid out.

As I concluded in my Bloomberg piece — if you really want to help more American families improve their standing in this country, make it easier for them to take part in those innovations and profits by helping them invest in the stock market.

Further Reading:

Lawmakers Don’t Understand How Stock Buybacks Work

And check out this week’s podcast for a more in-depth discussion on the buyback debate:

Animal Spirits Episode 22: Horizontal Support