Charlie Munger has long championed the benefits of acquiring worldly wisdom through the development of mental models which utilize a number of different subjects — physics, biology, sociology, psychology, finance, philosophy, literature, etc. — to understand the world and make better decisions.

As far as I’m concerned, Michael Mauboussin is Munger’s heir apparent in this effort. All of his books (the most underrated, in my opinion, being Think Twice: Harnessing the Power of Counterintuition), white papers, speeches, and interviews include thought-provoking studies, anecdotes, data and ideas from a wide variety of fields.

In his latest missive for Credit Suisse, Mauboussin tackles the active versus passive investment debate. This is one of the most well thought-out pieces I’ve read on this topic. It’s an investment nerd’s (i.e., me) dream.

Mauboussin brings up a study performed by Blake LeBaron, an economist at Brandeis University who has performed in-depth research on asset prices and market crash dynamics.

One of the more compelling arguments I’ve heard about the current state of the markets is that they’re more or less micro efficient and macro inefficient. The idea is that it’s becoming extremely difficult to pick securities, but the market as a whole can still become unhinged from reality. These explanations are never quite this simple, but it seems like the past 15 years or so has followed this blueprint.

Here’s LeBaron’s take on how market crashes tend to transpire:

During the run-up to a crash, population diversity falls. Agents begin to use very similar trading strategies as their common good performance begins to self-reinforce. This makes the population very brittle, in that a small reduction in the demand for shares could have a strong destabilizing impact on the market. The economic mechanism here is clear. Traders have a hard time finding anyone to sell to in a falling market since everyone else is following very similar strategies. In the Walrasian setup used here, this forces the price to drop by a large magnitude to clear the market. The population homogeneity translates into a reduction in market liquidity.

LeBaron is basically describing the herd mentality here. Once enough people hop on a trend or idea in the markets the momentum can feed upon itself right up to the point where it can no longer support itself. No one can really predict how far these things can go, but this is a nice definition of how bubbles are created.

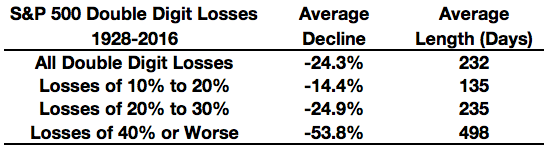

One of the hardest parts about the markets is the fact that you know (or should know) eventually they’ll go down. You just never know how much they’ll drop once they start to fall. For example, I took a look at all of the double digit losses in the S&P 500 from 1928 to 2016 along with a split by different magnitudes:

Breaking stock market losses down even further gives you a sense of how often these losses tend to occur over time. Here are the frequencies in which certain loss thresholds have occurred, on average, in this same time frame:

- 5% losses three times a year.

- 10% losses once a year.

- 15% losses once every two years.

- 20% losses once every three to four years.

Average historical returns never tell the whole story because so few years or cycles ever follow the averages, but these numbers can be instructive. Stock market investors should expect to lose a little money quite often, see a correction occasionally, lose a decent amount every couple years and lose a lot of money on an Olympics-like schedule.

These definitions are by no means scientific, but that’s because it’s difficult to know in advance what will distinguish one type of market drawdown from another. Certainly, there are certain variables that can make some market losses worse than others — economic conditions, valuations, investor preferences, etc. But really it’s the human element that determines when things will go from a correction to a bear market to a crash.

And the problem with trying to predict when these things will happen, why they’ll happen or how far they’ll go is because of that human element. Very few people are able to accurately predict the actions of the entire group of market participants because the markets are made up of all sorts of individuals, businesses and organizations who have competing goals, idea, and desires.

I have no idea how I will personally feel tomorrow morning. How will I ever be able to predict how millions of other investors will be feeling one week, month, year or decade from now?

So here’s my mantra on future stock market losses:

Stocks will have periods of poor returns…

…I just don’t know when.

Stocks will have corrections…

…I just don’t know when.

Stocks will go into a bear market…

…I just don’t know when.

Stocks will crash…

…I just don’t know when.

This realization that you know something is eventually going to happen, but you have no control over when or why it will happen can be extremely liberating as an investor. Understanding what you do and don’t know is a huge step in the right direction in terms of thinking like Munger or Mauboussin.

Source:

Looking for Easy Games: How Passive Investing Shapes Active Management (CS)

Further Reading:

Charlie Munger’s Investing Principles