From 1836-1928 the U.S. averaged a recession every 2.1 years. This included seven depressions (they were actually called panics back then) that led to an average contraction of 29% in business activity. Part of this had to do with the fact that the U.S. was on the gold standard at the time, but it’s also true that the U.S. was once an emerging market.

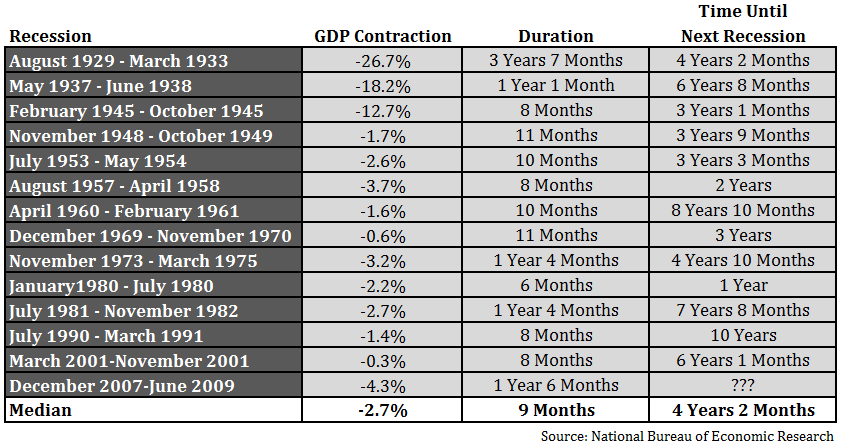

Following the Great Depression, the U.S. hasn’t experienced that type of business contraction since. Although it was the worst recession in the post-WWII period, even the Great Recession was relatively mild compared to the panics and depressions from the 19th and early 20th centuries. Here is a list of every recession since the Great Depression began in 1929 (click to enlarge):

You can see that roughly every four years the U.S. has entered a recession. Even though they’ve been more spread out after WWII, recessions have still occurred once every five years or so since then. The longest period of calm in the economic cycle was during the 1990s when the economy went a full decade without a down cycle. It’s been just shy of six years since the last recession technically ended, so it makes sense to consider when we’ll see the next one.

Recessions don’t necessarily follow a set schedule, but you can be sure that the business cycle will rear its ugly head eventually. And just like stock bear markets, most investors will be shocked every time the next downturn hits.

I caught the highlights of the Daytona 500 last week on SportsCenter and the analysts said the drivers make somewhere between 5-8 pit stops over the course of the 200 laps in the 500-mile race. I thought that pit stops were an apt analogy here. NASCAR drivers can’t push their cars to the extreme for the duration of the race without taking a break. They need to stop and fill up their gas tanks, change their tires and make other adjustments.

Economies need recessions to take a breather every few years, as well. Growth can’t continue uninterrupted forever. Although they’re painful, recessions are needed to weed out the strong companies from the weak, as many companies go out of business during the downturns and new ones emerge.

Many great companies were formed during the depths of economic contractions as they force people to innovate. Fortune magazine was formed ninety days after the 1929 market crash. Walt Disney was another company formed during the Great Depression. The first Charles Schwab branch opened in 1975 following the severe bear market in 1973-74. UPS was founded during the Panic of 1907. General Motors came along the following year. I could go on.

The current recovery has been fairly slow so it’s likely the expansion still has a few years left to run. It’s possible we won’t see another recession until somewhere in the 2017-2020 time frame. That would put the current recovery in the eight to eleven-year duration. With the Great Recession in our recent memory, many are concerned that every future recession will be a similar calamity. That’s highly unlikely as future cycles are never quite the same as past cycles.

One of the things I find most interesting about the prospect of the next recession is the question of the Fed’s policy toolkit when it finally does happen. Will we go into the next recession with loose monetary policies still in place?

Either way, the experts are highly unlikely to provide advanced warning on when the next one will begin. A group of well-known economists for the Survey of Professional Forecasters assigned just a 3% chance of the economy shrinking by any margin in 2008. And they placed only a 1-in-500 chance of the economy shrinking by at least 2%, which of course it did.

Investors have to understand that recessions are an unavoidable fact of life. But they also provide investors with lower prices to buy stocks. So while they’re painful in the short-term, if you have the guts and capital to make purchases, recessions can offer some of the best buying opportunities in the long-term.

Further Reading:

Do We Need a Recession for a Meaningful Correction in Stocks?

The Origins of Economic Terminology

[…] When will the US have its next recession? (A Wealth Of Common Sense) […]

[…] Smart traders don’t hate the fed – they use the fed to their advantage, going long equities during low rates environments such as the on we are in now (and will remain so for a very long time). […]

So the length of time between recessions has doubled and the depth of the recessions is shallower on average. Is this attributable to the Fed’s role as backstop? And has it improved it’s performance since 1945? And then do we see further improvement beginning around 1980? The data seems to support such interpretations, but feels too limited in scope to draw hard and fast conclusions. I am a supporter of the Fed, and subject to the standard forms of cognitive bias when I look at this kind of limited data set, so I’m interested in other opinions/insights.

More to your point, I scaled out of stocks into bonds over the course of the year, so I had a limited loss in the last downturn… I scaled back into stocks the next year, but more slowly than I was supposed to – I let the fear get to me a little. Still did well, but there’s an old saying about being lucky vs being good. It’s a hard lesson that I need to nail down my process and stick to it.

yeah it’s really hard to say for sure. I’m sure the Fed has something to do with it but it’s much more than that as demographics played a large role in the booms during the 80s and 90s and it’s true that the US is a much more mature economy now than it was pre-WWII.

Good point on the process. The rules are important but don’t matter much if you don’t or can’t stick with them.

[…] Ben Carlson wondered when the U.S. will have its next recession. […]

[…] few weeks ago I urged readers to get used to the fact that recessions are a fact of life that they need to get used to every 4-10 years or so. I shared the following table with each recession since the […]

[…] few weeks ago I urged readers to get used to the fact that recessions are a fact of life that they need to get used to every 4-10 years or so. I shared the following table with each recession since the […]

[…] People are quick to blame every market move on the Fed these days. It’s as if they think bubbles didn’t exist in the pre-Fed era. Maybe the Fed changes the timing and the magnitude of these things, but it would be silly to assume that human behavior wouldn’t cause the pendulum to swing too far in both directions even if the Fed didn’t exist (do yourself a favor and see what the economy was like before Fed intervention). […]

[…] Further Reading: What Happens to Stocks & Bond When the Fed Raises Rates? When Will the U.S. Have Its Next Recession? […]

[…] In a swift drop like we’ve seen in the recent drawdown it’s easy for many investors start to confuse the stock market and the economy. This latest episode has many on recession watch. And it makes sense that people would think this way considering how long this current economic cycle has lasted. […]

[…] This latest episode has many on recession watch. And it makes sense that people would think this way considering how long this current economic cycle has lasted. […]

[…] This latest episode has many on recession watch. And it makes sense that people would think this way considering how long this current economic cycle has lasted. […]

[…] In a swift drop like we’ve seen in the recent drawdown it’s easy for many investors start to confuse the stock market and the economy. This latest episode has many on recession watch. And it makes sense that people would think this way considering how long this current economic cycle has lasted. […]

[…] Source: A Wealth of Common Sense […]

[…] the Great Depression, the American economy has fallen into recession about every five years (on average) since the recession preceding it […]