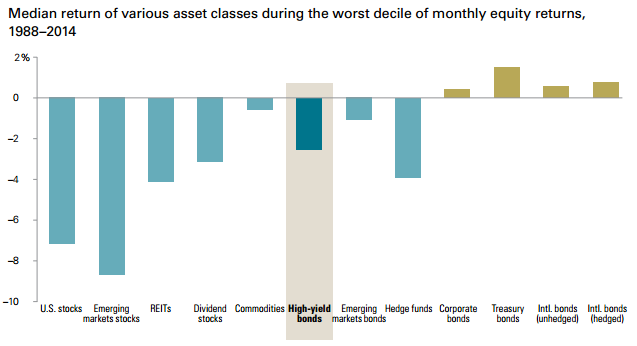

Vanguard has a great chart in their latest ETF Perspectives newsletter that gives you a good idea about where risk usually lies during a severe stock market sell-off:

Vanguard highlighted high-yield bonds to show how they typically perform worse than other types of bonds during a stock market drop. There are many investors out there who are nervous about bonds at these interest rate levels, and rightly so. Interest rate risk is worth considering since volatility is heightened at lower yield levels. But I think investors are forgetting the kind of emotional hedge that high-quality bonds can provide during a stock market route.

Obviously, everyone has a different appetite for risk and some can handle the increased volatility more than others. The bond bull market may be coming to an end (it has to eventually, right?), but I think it’s a mistake for risk-averse or diversified investors to completely give up on high-quality bonds because they’re worried about poor returns from low yields. It’s just not going to be as easy in fixed income as it has been in the past.

I was on SiriusXM radio for an interview with Jeremy Schwartz of WisdomTree last week and the other guest on the show was an unconstrained bond fund manager from Western Asset Management. During our talk, I shared with this portfolio manager that I don’t envy his position in the coming years. Investors are infatuated with the stock market, but I actually think that bonds are going to be even more interesting over the coming decade or so.

There’s really no place to hide. If you’re looking for higher-yielding securities, prepare yourself for the probability of more volatility and larger drawdowns. If you’re looking for safety and a lower probability for losses during stock market corrections, high-quality bonds should still prove to help more often than not. But, as I shared with Jeremy, there is a legitimate possibility that we could see both stocks and bonds down during the same year at some point in the near future. Are investors prepared for that scenario?

And think about this for a minute — high yield bonds were basically created in the mid-1980s by Michael Milken and his team at Drexel Burnham. Although there have been many ups and downs in this extended rate cycle, junk bonds and the portfolio managers who buy and sell them have never experienced a rise from these yield levels before. It really is uncharted territory. The dispersion in bond fund returns has been fairly narrow compared to stock funds in the past, but I think there could be a much greater dispersion going forward as certain investors will be able to navigate the challenging fixed income environment better than others.

There will be no more wind at a bond investor’s back from consistently declining interest rates anymore. The bond market is going to start getting interesting. Buckle up.

Source:

Winning the advisor’s game (Vanguard)

Further Reading:

Common Sense Thoughts on Stock Market Losses

What’s An Investor to Do About Bonds?

Ben,

Any thoughts on what an annual rebalance into a 10 or 20 year slow moving bond bear market would do to a 60/40 mix? Say perhaps, the 10 yr went from a yld of 2.3% to say 8,9, or 10%. Of course, it seems inconceivable, but …..

Perhaps you may have covered this in a previous post relative to rates increasing from the 60’s through the early 80’s and perhaps the overall effect would less pronounced than I am imaging.

Good question. Try one of these posts and let me know what you think:

https://awealthofcommonsense.com/the-blueprint-for-a-bond-bear-market/

https://awealthofcommonsense.com/looking-beyond-interest-rate-risk-bonds/

https://awealthofcommonsense.com/bursting-bond-bubble/

I would think long term bond mutual funds are not the place to invest over the next few years as you will lose principal. Individual bonds would be better but then you have the credit risk. Seems like the traditional safe investments are gone for years to come.

Could be. It all depends on how long it takes rates to rise (if they rise that much at all). I think a bond ladder w/individual bonds helps but that really just makes it about opportunity cost if rates do rise.

High yield bonds rank low enough in seniority that they behave a lot like equity. Their best performance is in the early stage of an economic expansion. But that’s true of equities, too. So junk is largely an illusory diversification.

Your chart shows why Ray Dalio uses long Treasuries in his All Weather Fund: they are usually anticorrelated to equities, more so than anything else. Long Treasuries returned about 10% in 2008, while nearly all other investment grade credit posted losses.

Crucially, Treasuries held up during 1929-1932, when stocks plunged 85%. Plenty of investment-grade credit bonds suspended coupon payments in the Depression, transiting directly from A to D rating without even making a pit stop at a C junk rating.

David Swensen offers a savage takedown of junk bonds in his book Pioneering Portfolio Management. But some folks will have to learn the lesson all over again.

Yeah, investors often confuse yield with fixed income risk, but I agree that junk bonds are much closer to stocks from a risk perspective. People have quickly forgetten high yield got cut in half from 07-09. It’s been a while since I’ve read Swensen’s book. I’ll have to find that passage.

[…] At A Wealth of Common Sense – if there is a stock fall, what will happen to (probably) overpriced high yield bonds? […]

[…] The Most Interesting Asset Class Over the Next Decade “Vanguard highlighted high-yield bonds to show how they typically perform worse than other types of bonds during a stock market drop.” […]

“there is a legitimate possibility that we could see both stocks and bonds down during the same year at some point in the near future.” My thoughts exactly! Over the last few years stocks have risen and bond yields have fallen (their prices have risen). There’s no reason to think the reverse won’t happen. Particularly when yields are unlikely to fall much further (it’s hard to fall far past zero after all) making bonds surely as close to a one-way bet as there is. Or am I missing something?

1969 was the last year it happened. You’re right that the margin of safety is so much smaller in bonds because the yield won’t be there to pick up the slack. Should be interesting.

[…] Further Reading: Not All Active Funds Consistently Underperform The Most Interesting Asset Class Over the Next Decade […]

[…] Further Reading: The Most Interesting Asset Class Over the Coming Decade […]