GMO’s Jeremy Grantham thinks we’re on track for yet another stock market bubble, but not until mom and pop get in on the action. Here’s what he had to say yesterday while giving the keynote speech for the annual Morningstar conference, courtesy of CNBC:

“No bubble has ever broken until individuals pour money into the market,” and retail investors have avoided the stock market since the financial crisis, Grantham said.

Every sentiment survey you read should be taken with a grain of salt, but they mostly show investors are confused with how they feel about the markets these days. You can pick and choose almost any sentiment indicator to fit your narrative. However, you always have to consider what people are doing, not just what they’re saying as Jason Goepfert recently pointed out:

I think this is one of the reasons so many investors are having such a difficult time handicapping the current market environment. It would be difficult for anyone to claim that investors are anywhere close to approaching a state of euphoria, but in a low interest rate world, there are very few choices for investors looking to earn decent returns on their capital. Thus, stocks have continued to climb the wall of worry. It’s been a begrudging bull market for most investors.

I get the sense that no one wants another bubble. If this turns into one, it will be the first time in history that a bubble is basically forced onto investors. Investors who have been burned twice over the past two decades may have to be dragged kicking and screaming into another huge boom and bust. Who knows? The pendulum always seems to swing too far in either direction.

But I’m finding it more and more difficult to continue to blame the excesses in the markets on the average individual investor. Professional investors love to point to anecdotal evidence of gullible individual investors who quit their job to day-trade or pile into the markets after a huge run-up as signs of a market top. I just don’t think we’re in the same type of market structure that will allow the small-time mom and pop investor to control market sentiment anymore.

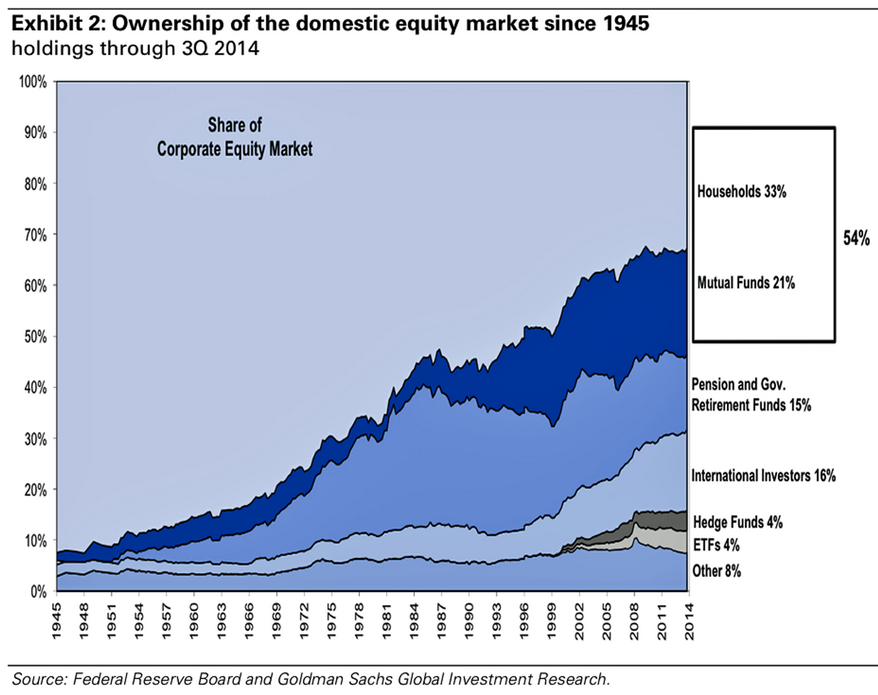

Take a look at this graph from Goldman Sachs from late last year which shows the breakdown of U.S. stocks by ownership:

You can see the share owned by households has been rapidly declining over the years. Even if that’s the case it still appears households own a decent chunk of stocks indirectly. But this kind of data needs to be put into context. A few stats to consider:

- Financial professionals now do over 95% of the daily trading on the New York Stock Exchange. Fifty years ago they did just 10% of the trades. The pros set the prices.

- According to Federal Reserve data, only 14% of Americans own stocks directly. That number was 21% in 2001.

- 93% of the wealthiest 10% of Americans own stocks, but just a quarter of the bottom 40% of people do.

- The top 10% of Americans by net worth hold more than 80% of all stocks (either directly or indirectly through funds). Wealth has become more and more concentrated at the top of the pyramid.

- More Americans own cats than stocks.

What this tells me is that mom and pop can’t be blamed for the lion’s share of the fear and greed in the markets anymore. Professional investors have to shoulder most of the blame for when things get out of whack at this point. They control the markets. Passing the buck is a time-honored tradition on Wall Street, but I think it’s time to stop worrying so much about the impact that the small-time investor will have on the markets.

Wealthy individuals and professional investors alike love to call themselves “sophisticated investors” or the “smart money.” When you control the majority of the market, as these two parties do, it’s impossible for everyone to be sophisticated or smart. And even if they are, many of these “sophisticated” investors will have to lose. It’s the simple math of the markets.

It’s time for these two groups to take some responsibility for their role in the market’s cycles. The odds of this actually happening? Slim to none.

Further Reading:

Experience or Expertise?

What Stage of the Bull Market Are We In?

Here’s what I’ve been reading this week:

- How to think about a 60/40 portfolio now (Irrelevant Investor)

- Every aspect of investing comes with baggage (Novel Investor)

- Why every stock has a built-in fear premium (Crossing Wall Street)

- What the NFL draft can teach us about investing (Institutional Investor)

- Howard Marks: The uncomfortable idiosyncratic billionaire (Observer)

- Charley Ellis in defense of active management (CFA)

- What Swingers can teach you about communication with clients (Meredith Jones)

- 7 reminders for investors from Jurassic World (Fortune)

- 4 things Morgan Housel has learned from the stock market (WSJ)

- The benefits of a diversified investment team (Abnormal Returns)

- The top 10 questions to ask a financial advisor (Sherman Wealth)

- Calling tops and bottoms (Irrelevant Investor)

“Professional investors love to point to anecdotal evidence of gullible

individual investors who quit their job to day-trade or pile into the

markets after a huge run-up as signs of a market top.” Mom & Pop phenomenon was true in the past but nowadays more and more main street people use index funds and don’t bother with stock picking and star stocks like nifty fifty. John Bogle made a revolution and there are an incresing number of followers.

In Larry Swedroe’s book The Incredible Shrinking Alpha he makes the case that one of the reasons it’s becoming harder and harder to beat the markets is because there aren’t as many suckers at the poker table (for the very reason you cite). Basically it’s now very intelligent professionals fending against one another so it’s become much harder to outperform.

[…] This post takes to task those who blame market overvaluations on the retail investor, or the dumb investor. It refers to them as mom and pop investors. It points out that markets have changed, and analysts often use data selectively to prove their case about the individual investor. […]