“What difference does this sort of volatility make if you have a long term time horizon.” – Charlie Munger

I attended a CFA conference a few weeks ago and had the pleasure of listening to a presentation by Dr. Jeremey Siegel.

Siegel is a professor at Wharton Business School and has authored two really great books on stock market history, Stocks for the Long Run and The Future for Investors.

He has been called a perma-bull in the past for his tendency to have an optimistic outlook most of the time, but he at least admitted to making some bad calls over the years in his talk. Many well-known investors fail to admit their mistakes and simply continue to make forecasts.

Siegel is probably most known for his data series on the markets that extends all the way back to the early 1800s.

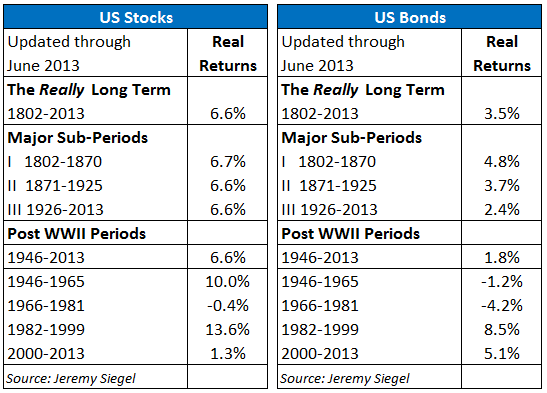

Here are his updated long term real (after inflation) stock and bond returns for US markets:

I’m always amazed at the consistency of stock returns over the really long term. You can see that after accounting for inflation, over the long term the returns of the major sub-periods are all fairly close.

However, over much shorter time frames stock performance is anything but consistent. You can see the major cycles had been boom and bust since WWII. It would be great to clip that 6.6% real return year in and year out but it’s not that easy.

As for bonds, it might be surprising to anyone who has only been investing post-1980 that bonds can lose money to inflation over longer time frames. We could be entering one of those periods again as rates in the US are at such low levels and could continue to rise.

I’m not saying you shouldn’t own bonds, because they still have a very different risk profile than stocks. Just something to think about as returns could be lower going forward.

I’ve probably spent far too much time discussing the short term level of the market lately (here, here & here) so it’s nice to take a step back and look at the bigger picture from time to time to keep the proper long term perspective.

Source:

Jeremy Siegel

With US markets continuing their strong rise don’t forget about international markets. Dividend yields matter greatly for your long term returns and yields are much higher around the globe right now. Read my piece at Dividend Ninja for more: Go Global for Higher Yield Dividend Stocks

Now for the best stuff I’ve been reading this week:

- Foreign stocks for the long run (Rick Ferri)

- Why do risk adjusted returns matter? (Oblivious Investor)

- Investors today should feel lucky (Jason Zweig)

- 5 ways to get a better night’s sleep (The Week)

- A solid list of investing books to get you started (Dividend Growth Stock Investing)

- Why you should always buy investments on Black Friday (MarketWatch)

- The key to happiness is saving not making more money (Financial Samurai)

- Michigan and Alabama made the right decisions even though they both lost (Businessweek)

- 5 financial priorities to make in your 30s (Bason Asset Management)

- What’s in Dividend Ninja’s portfolio? (My Own Advisor)

[widgets_on_pages]

Stocks for the Long Run is a great book and for me is one of the reasons I believe in long term dividend stock investing. I haven’t read his other book but need to check it out.

The Post WWII 15 year sub periods are what I find most interesting. The period between 1966 and 1988 would have been tough to get through. But even looking at the 1.3% return from 2000 to 2013 doesn’t seem too great. However, looking at my own investment results in that period and they are much better. It’d be interesting to look at different investing strategies over these time periods and compare to his total market returns. I believe the dividend growth strategy would have led to better results than his total market returns report.

I think you’d enjoy The Future for Investors because much of the book is focused on the importance of dividends on long term returns. His firm, WisdomTree, is founded on that concept.

Also, the positive about those down times like 1966-1981 is for those that are still accumulating capital and saving. They are usually far more volatile investment times and offer more bargains and lower entry points to invest. So constantly investing in those time frames is actually a good thing because once future returns eventually snap back you’ve got a nice low cost basis over many years.

Nice post Ben! You’ve really showed the benefits of investign for the long term! That must have been a great conference, and a great opportunity.

I’m going to check out the Wisdom Tree, sounds interesting.

Cheers

Avrom

It was a great conference. Plenty of good information. Wisdom Tree is mostly ETFs but is worth looking into.

[…] the dividend stock strategy makes sense for you, you’ll be interested in Ben Carlson’s post, Stocks for the (Really) Long Term. Ben looks at the work of Jeremy Siegel, and gives a great synopsis on the real returns for both […]

[…] a previous post on Jeremy Siegel’s long run stock return numbers, I showed the following return series for the stock market going back to the early […]