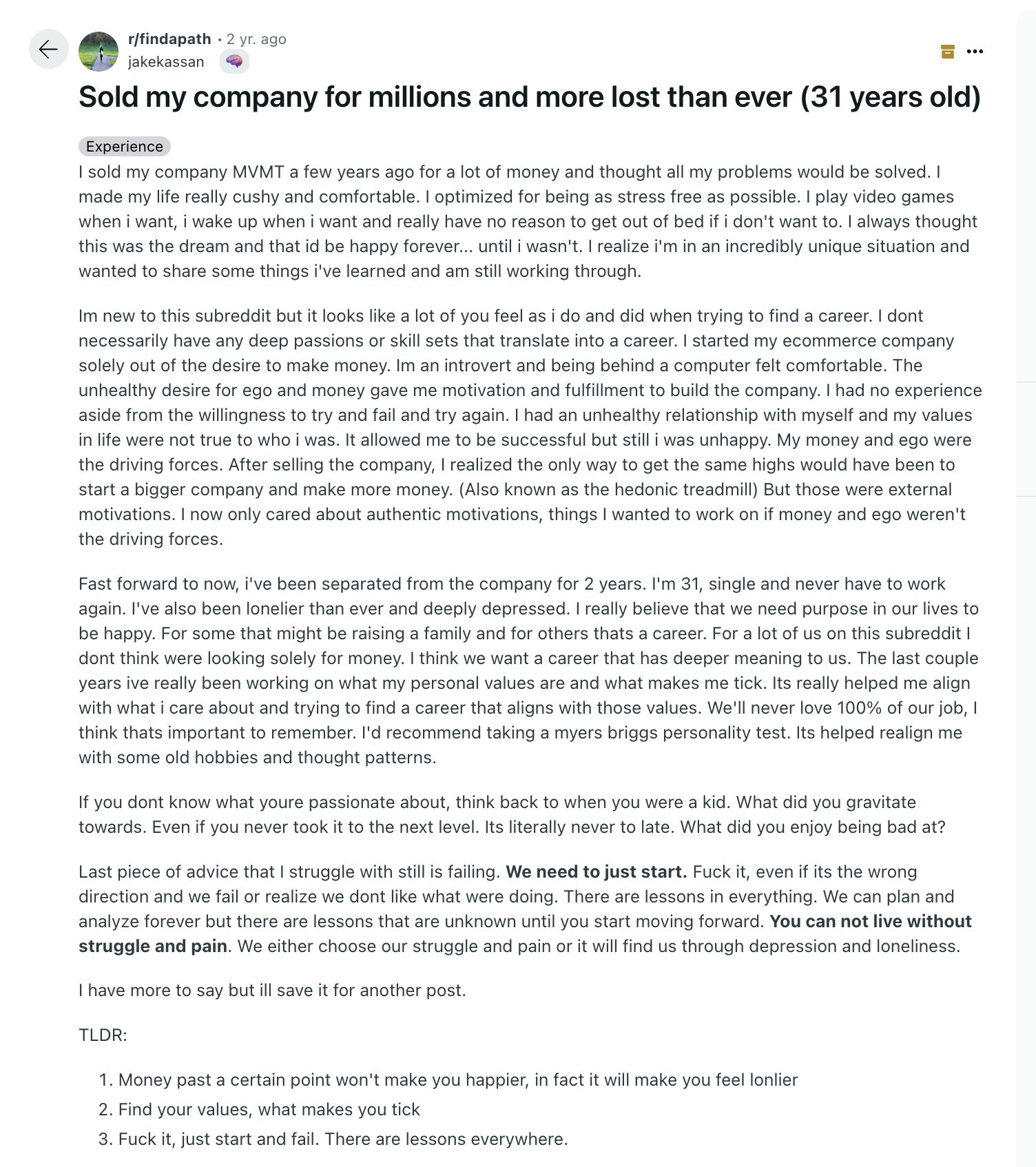

Why money doesn’t make you content.

Why money doesn’t make you content.

My talk with Fred Barstein about how financial advisors can become more profitable.

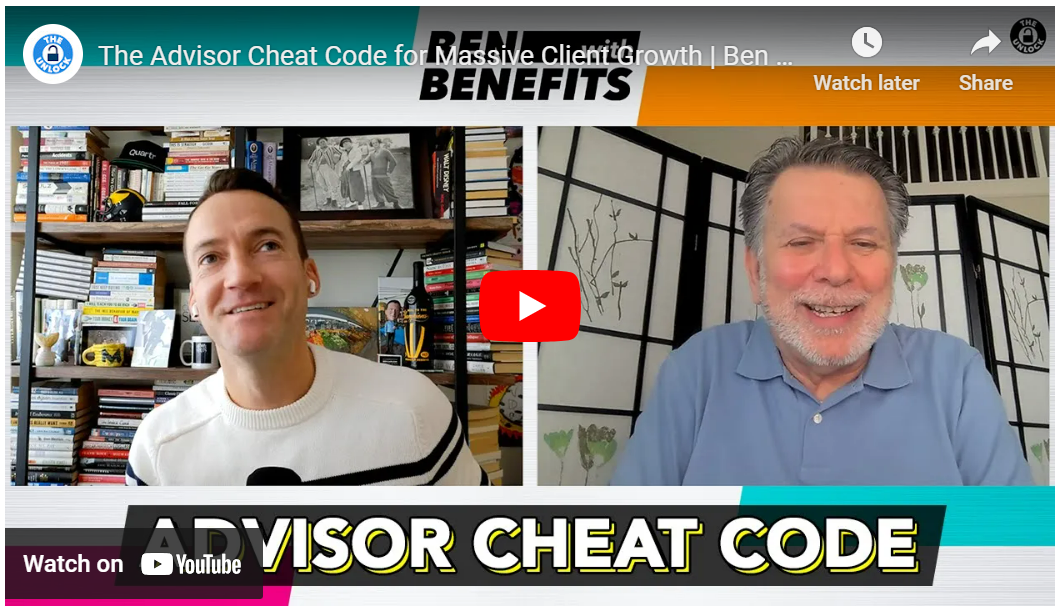

A deep dive with some help from Howard Marks on bubble talk in the markets.

A closer look at the pros and cons of a buy the dip strategy.

On today’s show we discuss Future Proof Citywide in Miami, the DeepSeek rug pull on Nvidia, what this means for the Mag 7 stocks, the most beloved bear market of all-time, Howard Marks on why this isn’t a bubble (yet), hedge fund fees, leveraged ETFs, the price of eggs, hiring a private chef, a young couple’s monthly budget in Brooklyn and more.

Some thoughts on AI and a bunch of other stuff.

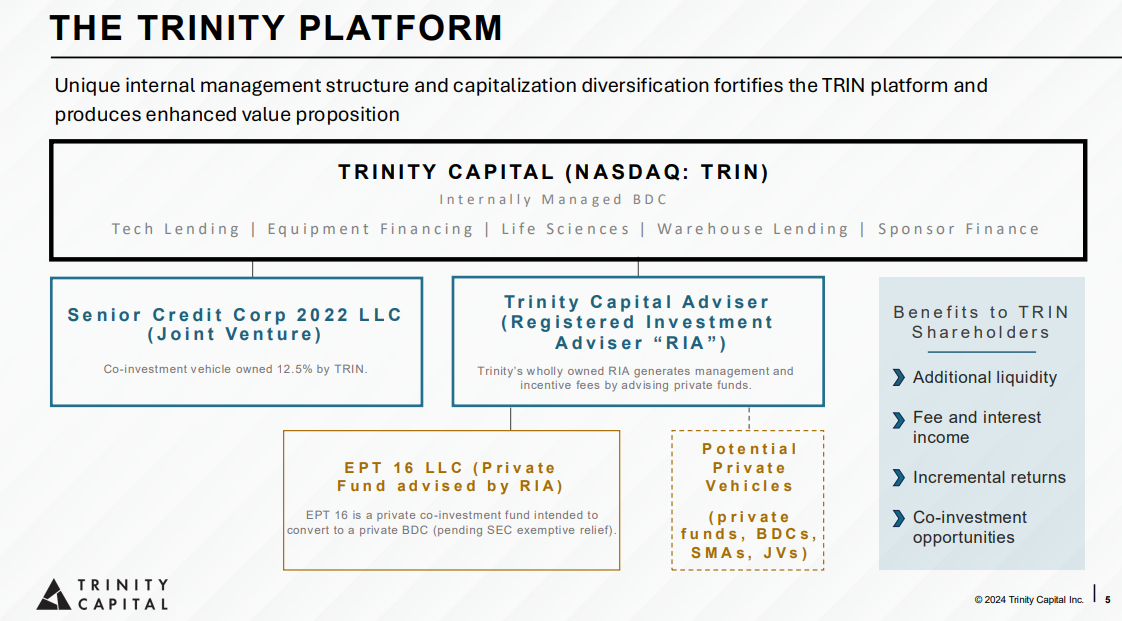

On today’s show, we are joined by Kyle Brown, CEO, President, and CIO of Trinity Capital to discuss valuations in the VC market, what advisors should be asking about when investing in this space, issues with crowding within the private credit space, and much more!

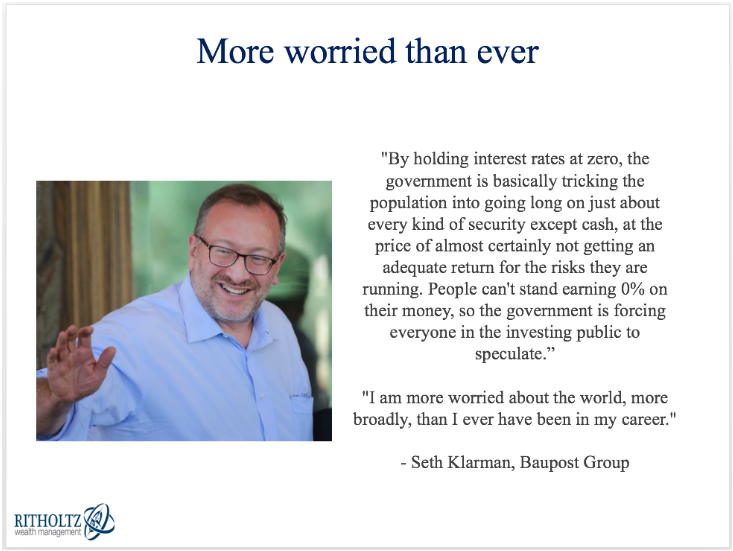

Why Seth Klarman has underperformed.

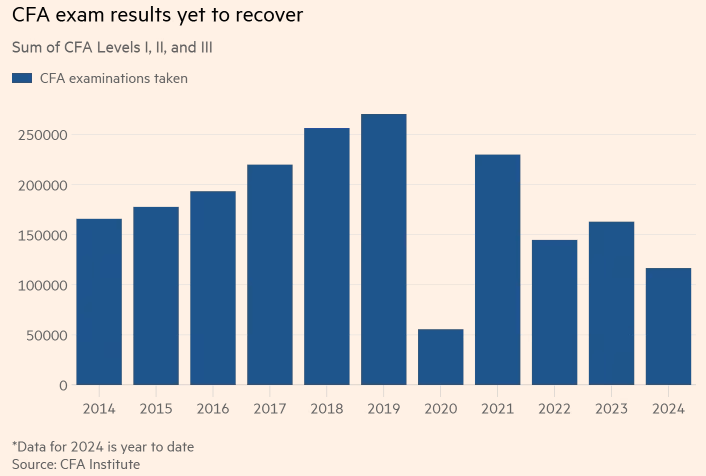

A deep dive into the difference between getting your CFA and CFP designations.

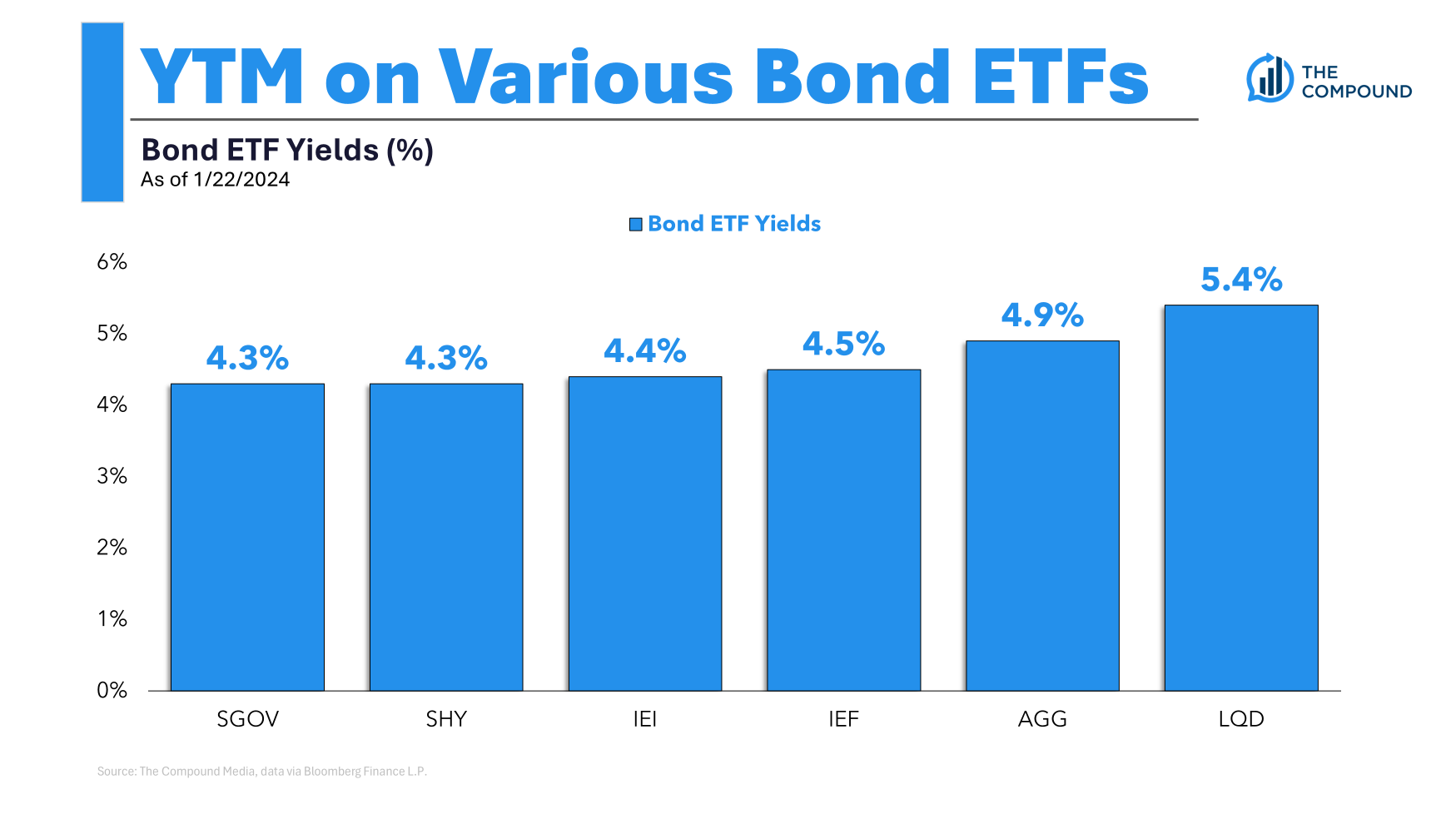

What’s the best way to lock in 5% bond yields?