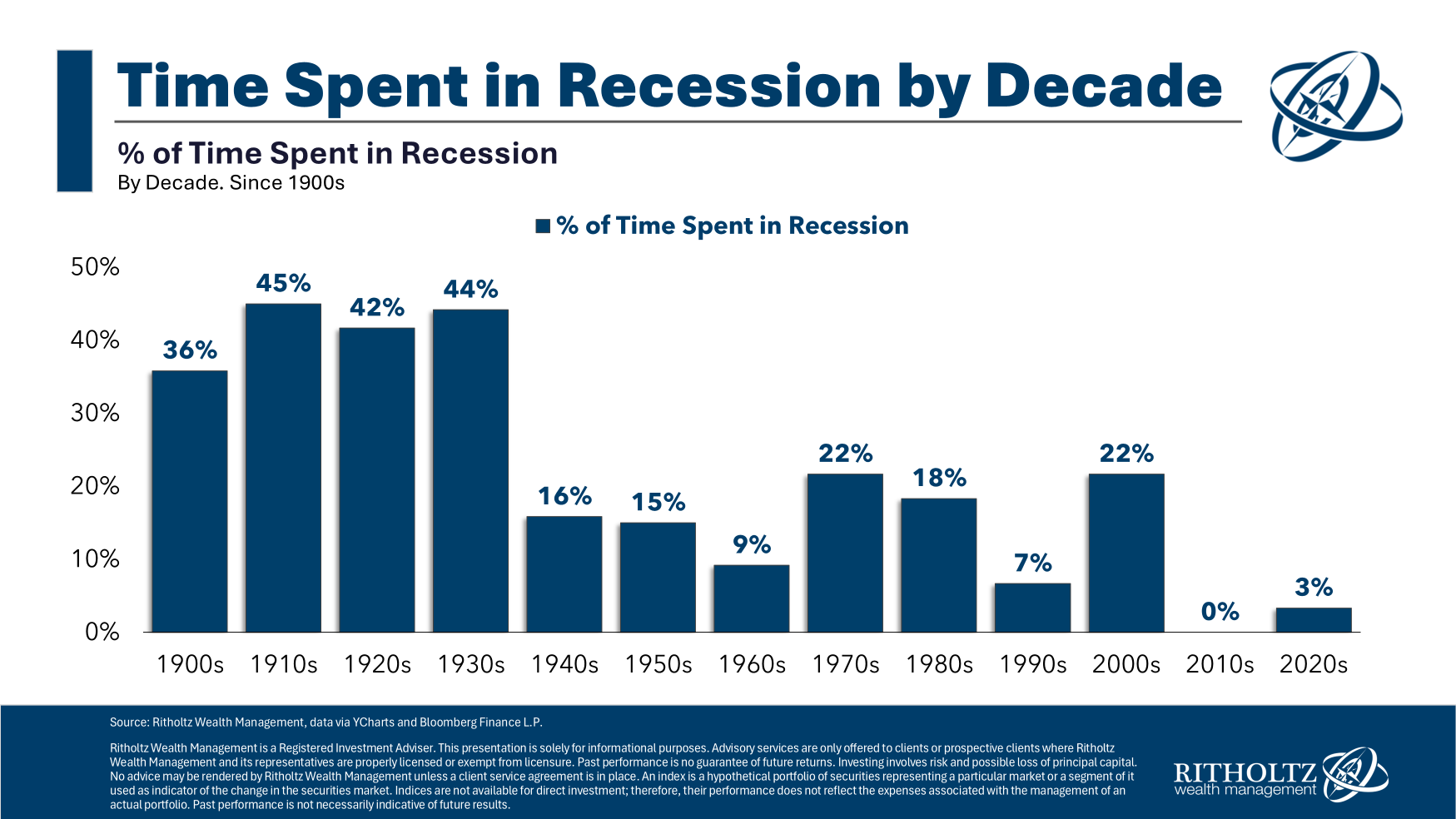

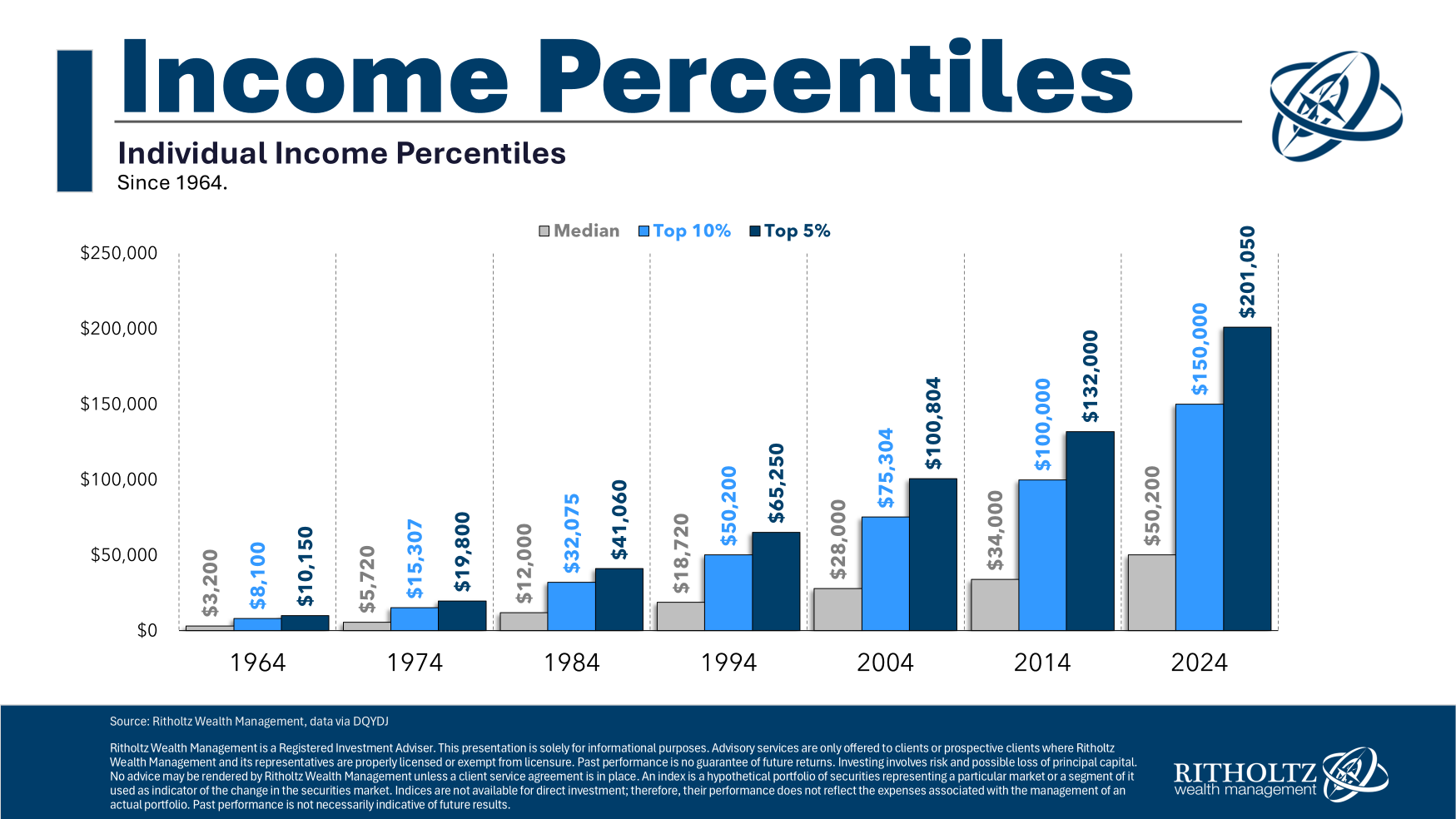

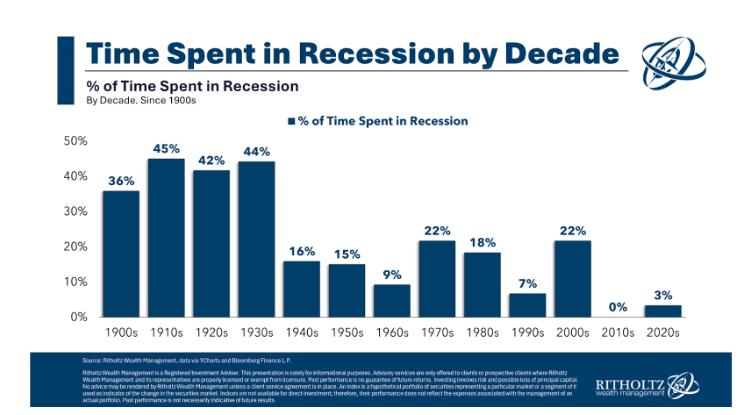

On today’s show we discuss a memecoin from the President, what’s next for the crypto industry, the golden age of financial fraud, recessions are becoming less prevalent, how much income it takes to be rich, the Sonos app crash, Wall Street thinks houses are overpriced, youth sports for Millennial parents and much more.