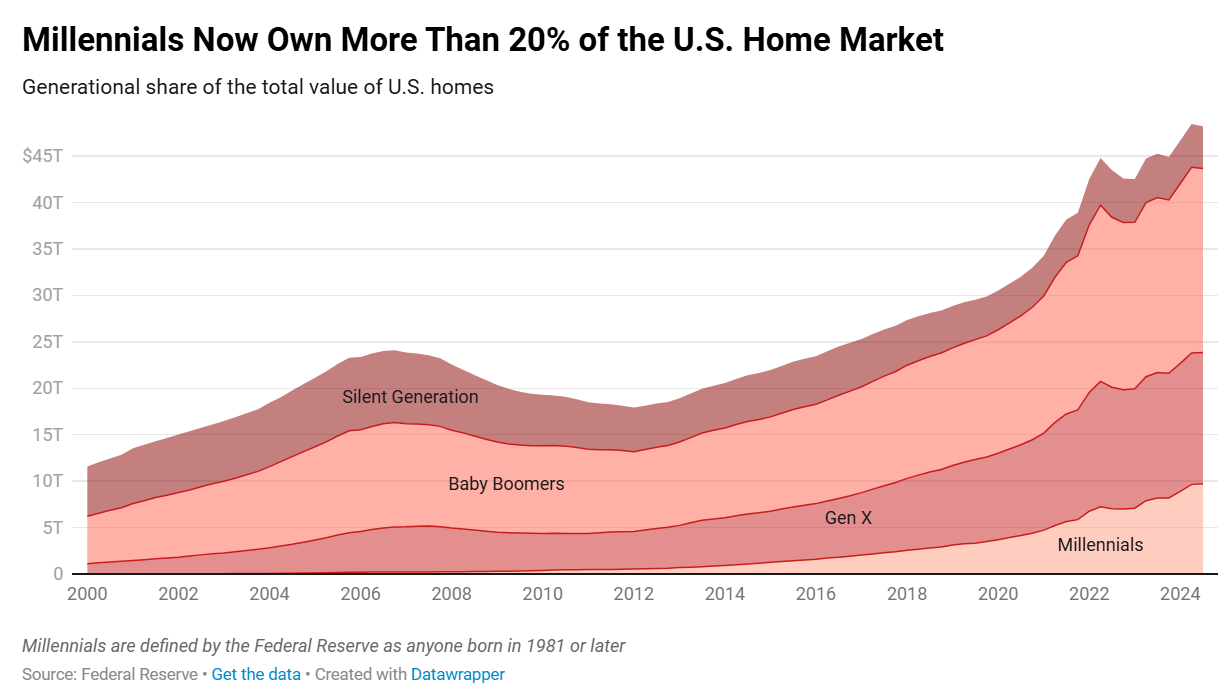

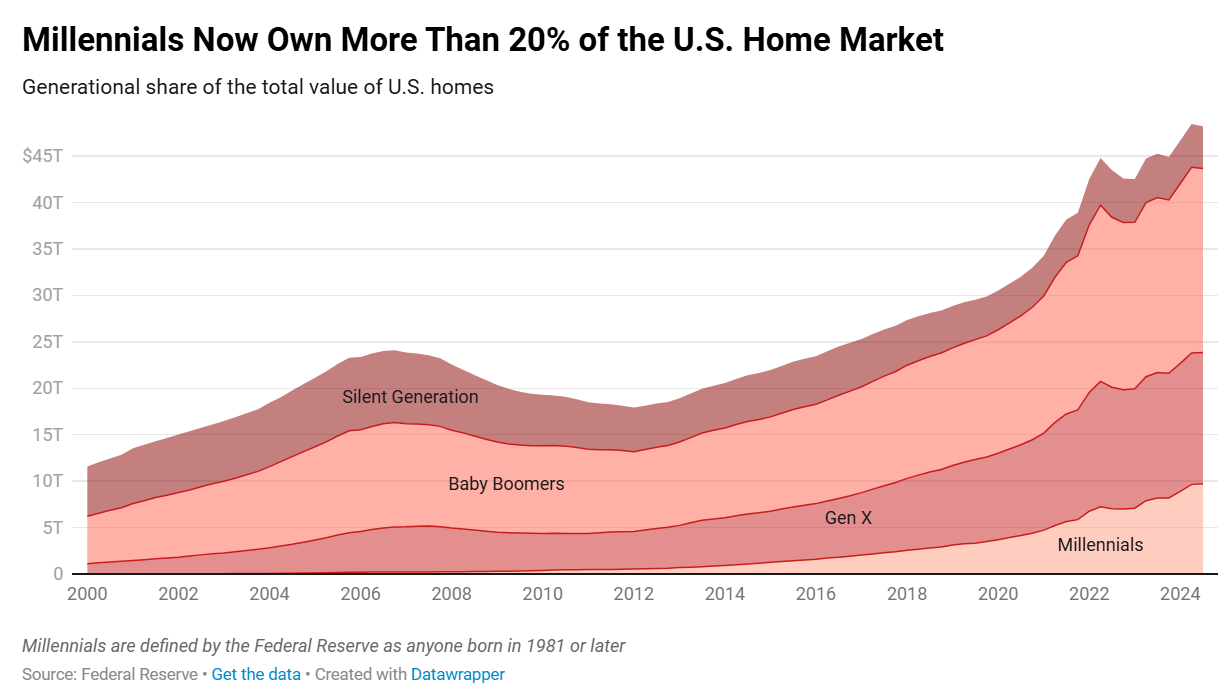

The US housing market is worth nearly $50 trillion.

The US housing market is worth nearly $50 trillion.

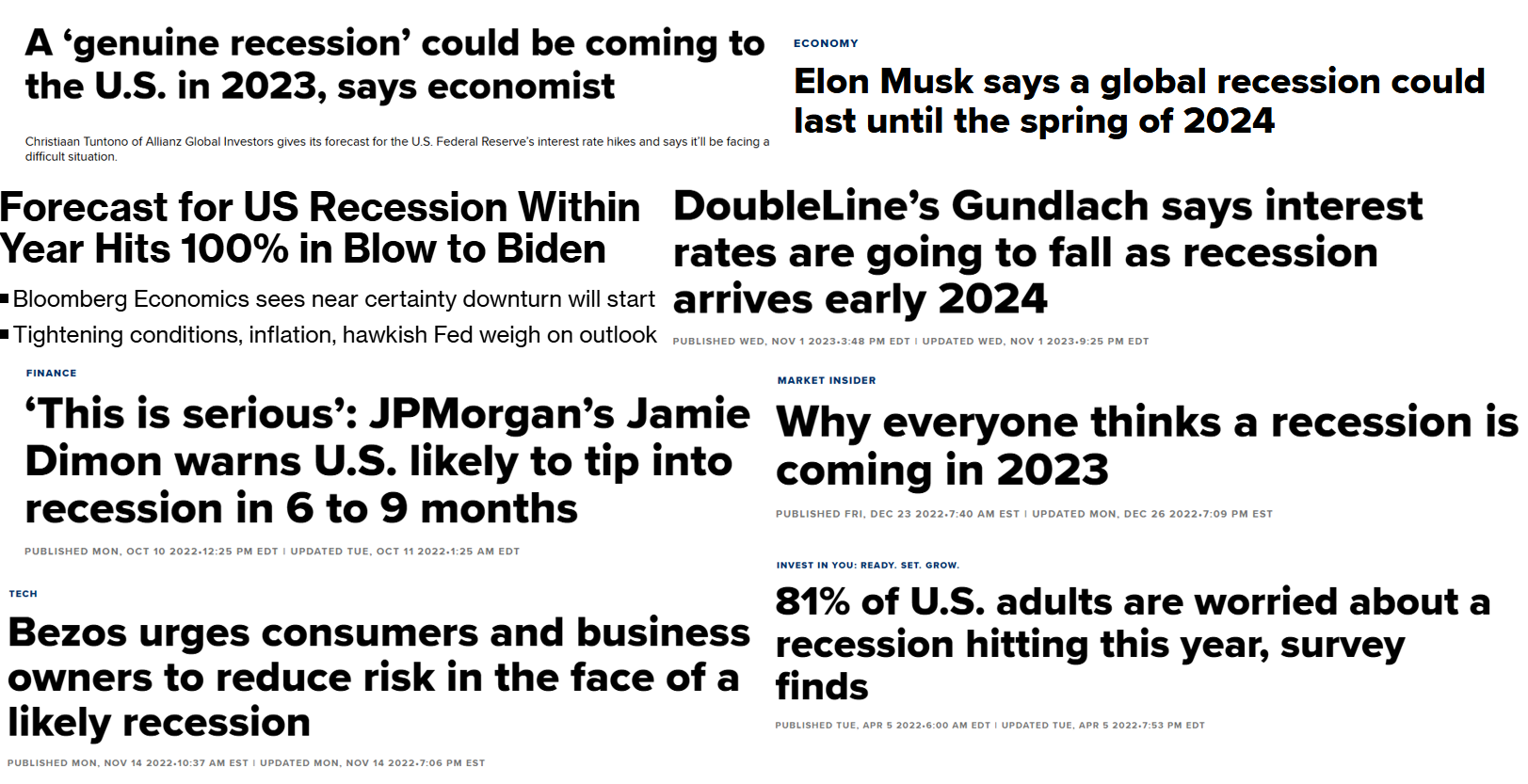

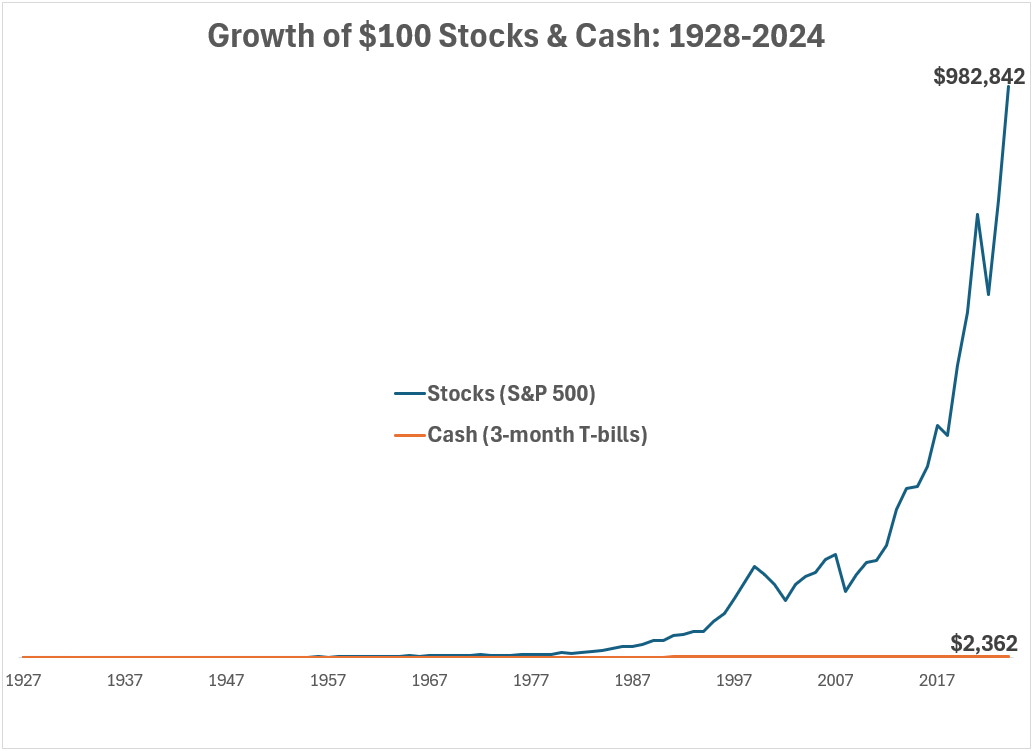

Some thoughts on market timing and recessions.

The Dunning-Kruger effect is real and it is spectacular.

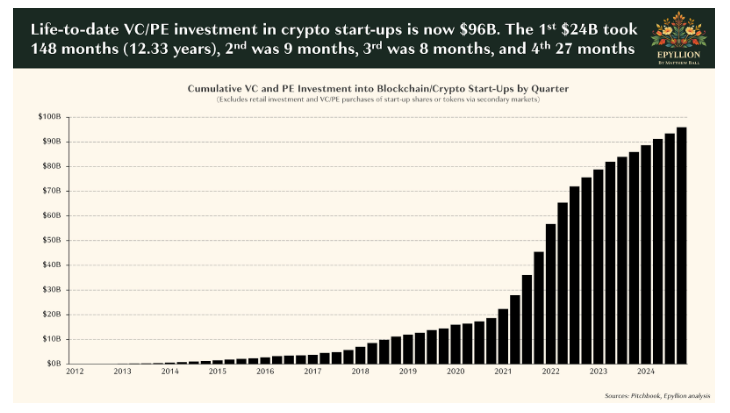

On today’s show we discuss the potential for an economic slowdown, Steve Cohen gets bearish, the labor market is slowing, giving the US economy the benefit of the doubt, the top 10% owns everything, rich people are everywhere these days, Berkshire Hathaway pays a lot of taxes, Robinhood is a casino and much more.

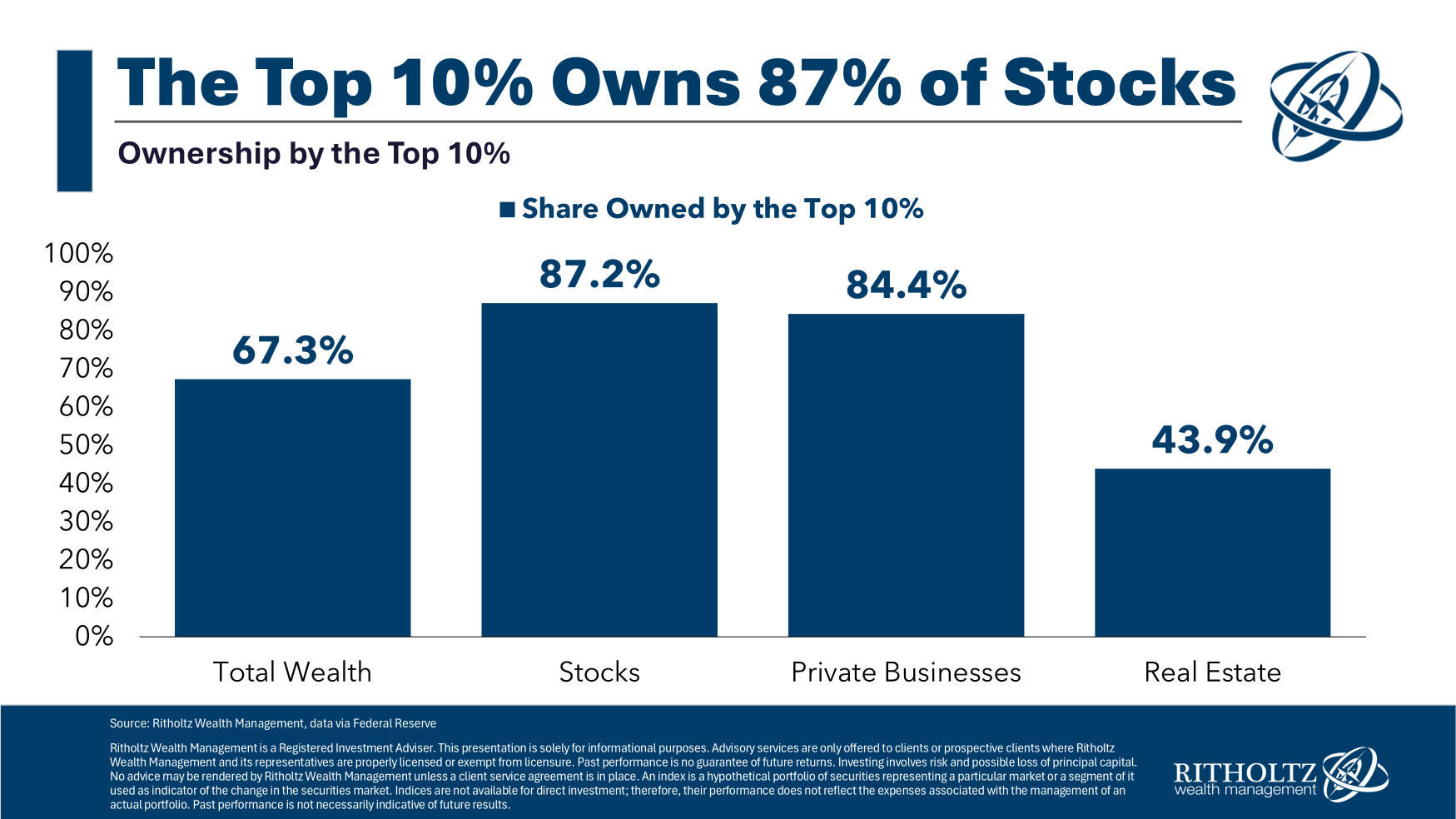

Wealth inequality is driving the economy.

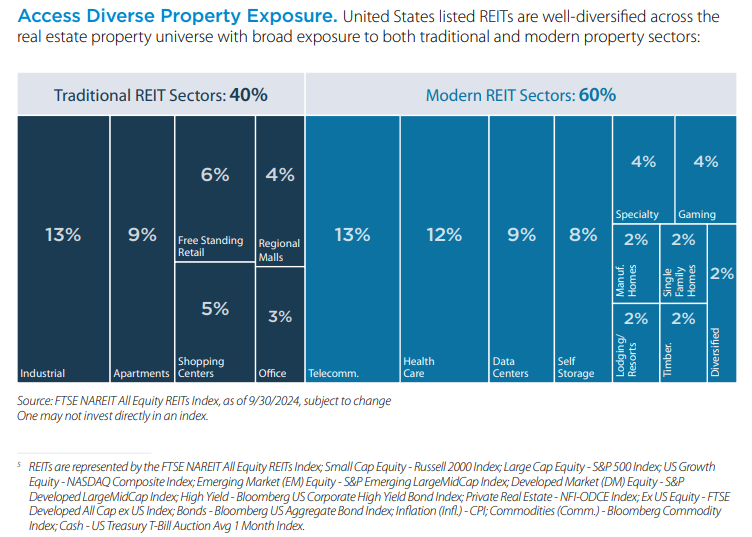

On today’s show, we are joined by Paul Baiocchi, Chief ETF Strategist of SS&C ALPS Advisors and Nick Tannura, Portfolio Manager and CIO of GSI Capital Advisors to discuss an update on office real estate, how investors view REITs, the fundamental argument for investing in malls, why it makes sense to actively manage REITs, an update on flows into the real estate asset class, and much more!

Loss aversion in the price of eggs.

The stuff that really matters is becoming clearer by the day.

On today’s 400th episode of Animal Spirits we discuss Jon’s story, dealing with grief, why financial planning matters, Jon’s life advice, the power of kindness and the mundane, gambler’s fallacy on Meta, the mental freedom of index funds, YouTube’s reach, Mr. Belding’s age, how to save money at Disney and much more.

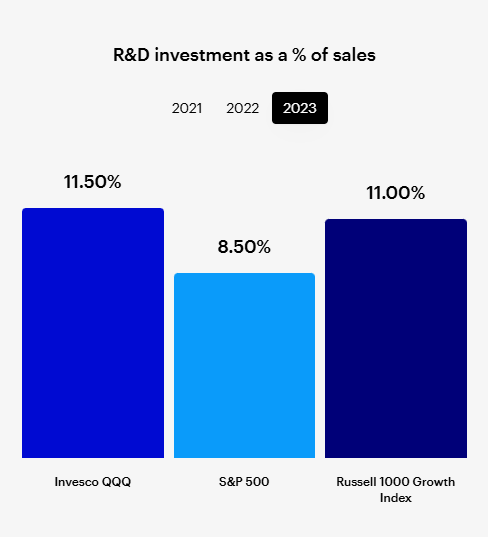

On today’s show, we are joined by Emily Spurling, SVP, Global Head of Index at Nasdaq and Mark Marex, Senior Director of Index and Research and Development to discuss the original inception of the Nasdaq 100, understanding tech exposure within the Nasdaq 100, why Nasdaq is winning the listing race, why companies enter and exit the index, thinking about the dot com bubble and the Nasdaq 100, and much more!