On today’s show, we are joined by Joe Mallen, CIO of Helios to discuss what he’s hearing from advisors in this environment, insourced vs outsourced CIOs, bond and equity attractiveness going forward, and much more!

On today’s show, we are joined by Joe Mallen, CIO of Helios to discuss what he’s hearing from advisors in this environment, insourced vs outsourced CIOs, bond and equity attractiveness going forward, and much more!

Some random thoughts about markets and investing I’ve been thinking about lately: The fear of missing out and the joy of missing out are two sides of the same coin. In bull markets, you feel like an idiot for not going all-in on the highest of high fliers. In bear markets, that FOMO quickly turns…

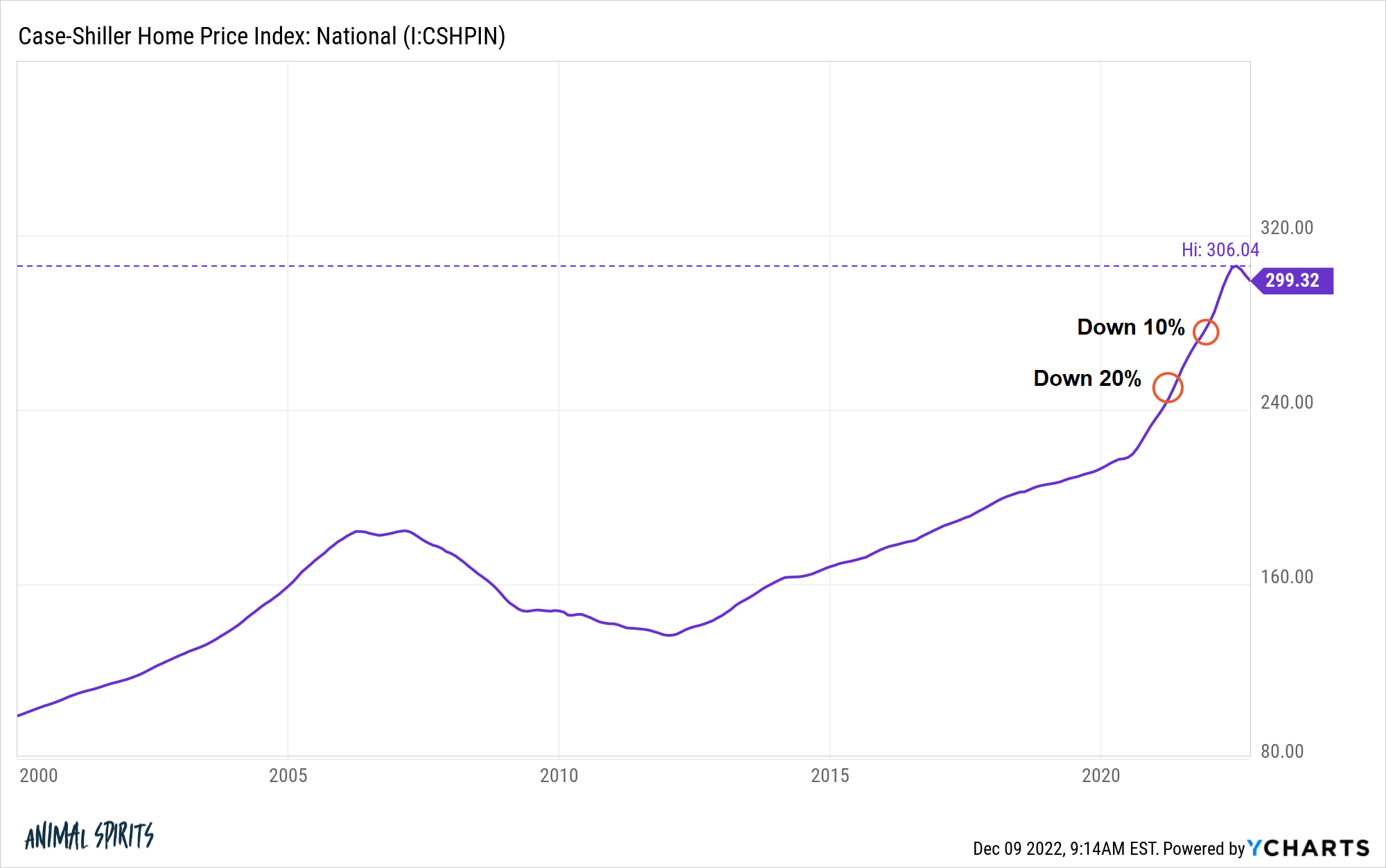

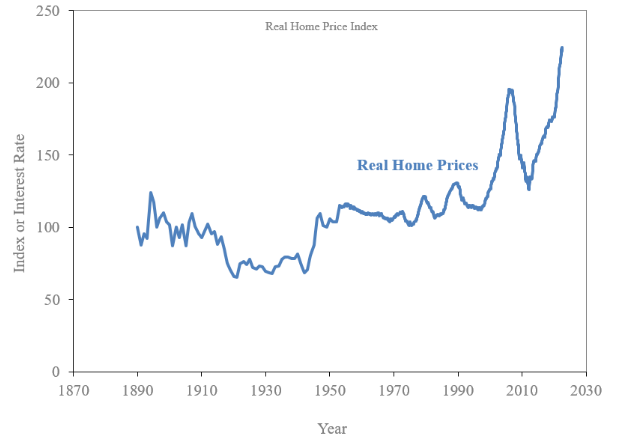

Nationwide price declines in the housing market are relatively rare. Since 1987, there have been just three times when the Case-Shiller National Home Price Index has been in a state of drawdown: The first was in the early-1990s when housing prices fell a little more than 2% nationally. Then you have the housing crash at…

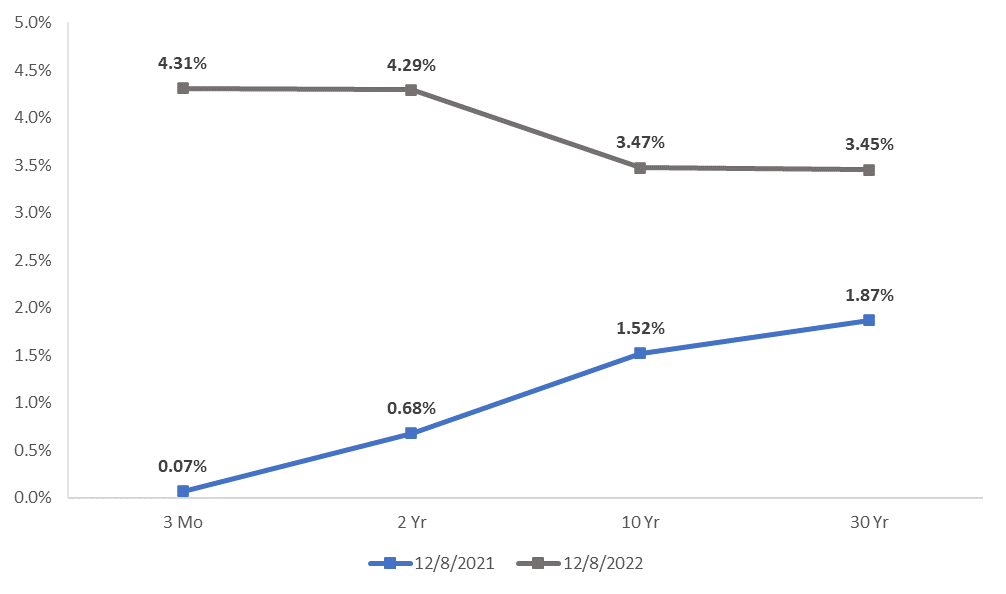

Is the bond market a reliable indicator of the economy?

On today’s show, we discuss continued strength in the labor market, sticky high inflation, why the market isn’t listening to the Fed anymore, the case for a 20% decline in housing prices, why Netflix rules streaming, sending back a drink at the bar, and much more.

Building wealth vs. conserving wealth.

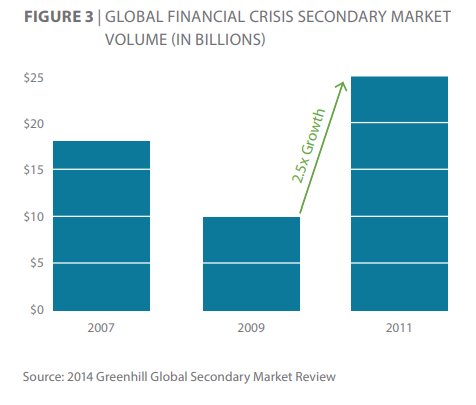

On today’s show, we are joined by Bob Long, CEO of StepStone Private Wealth to discuss timing private markets, how valuations have held up in private markets, an update on venture capital, and much more!

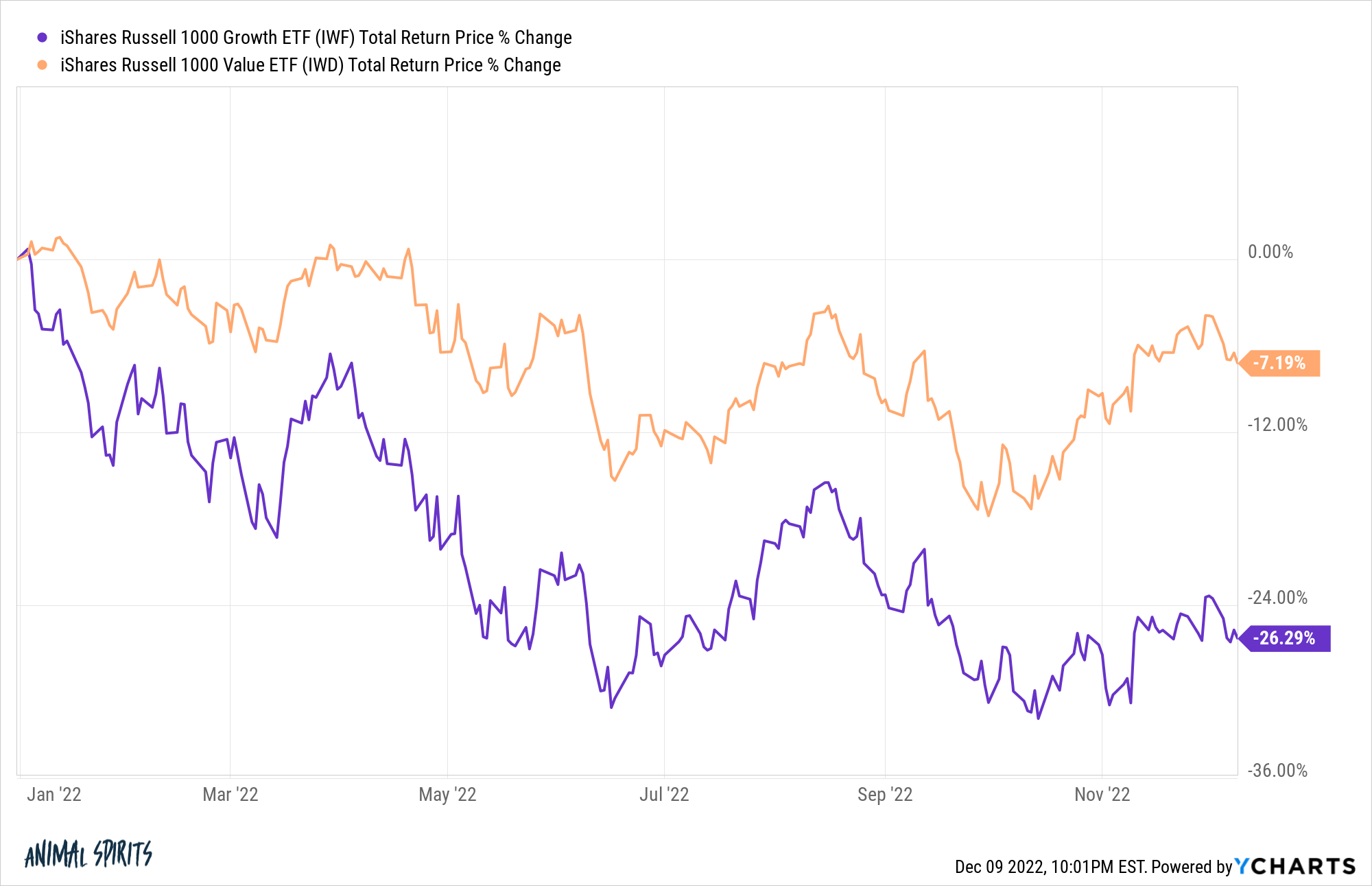

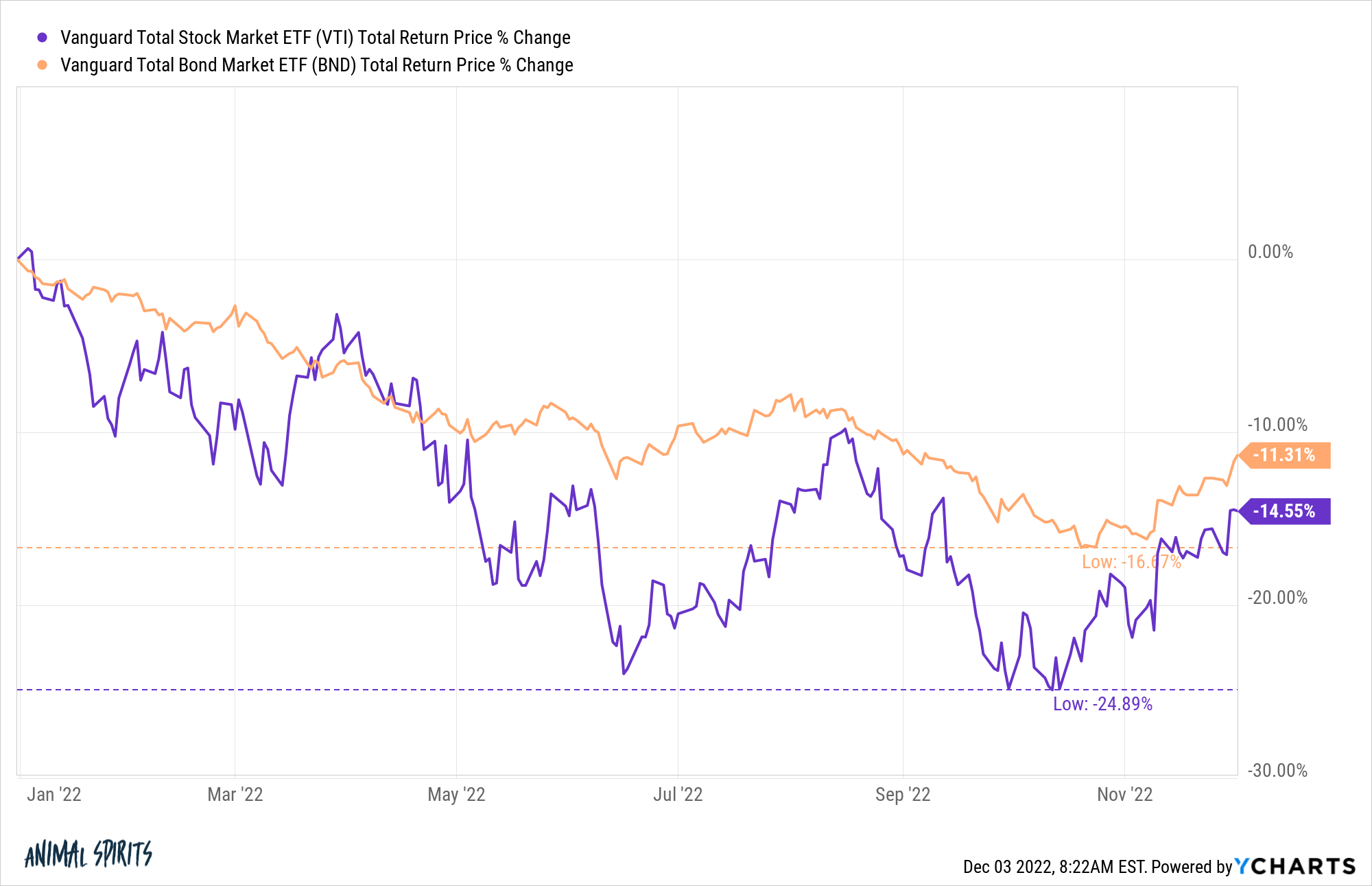

2022 hasn’t been great for investors but it could have been a lot worse.

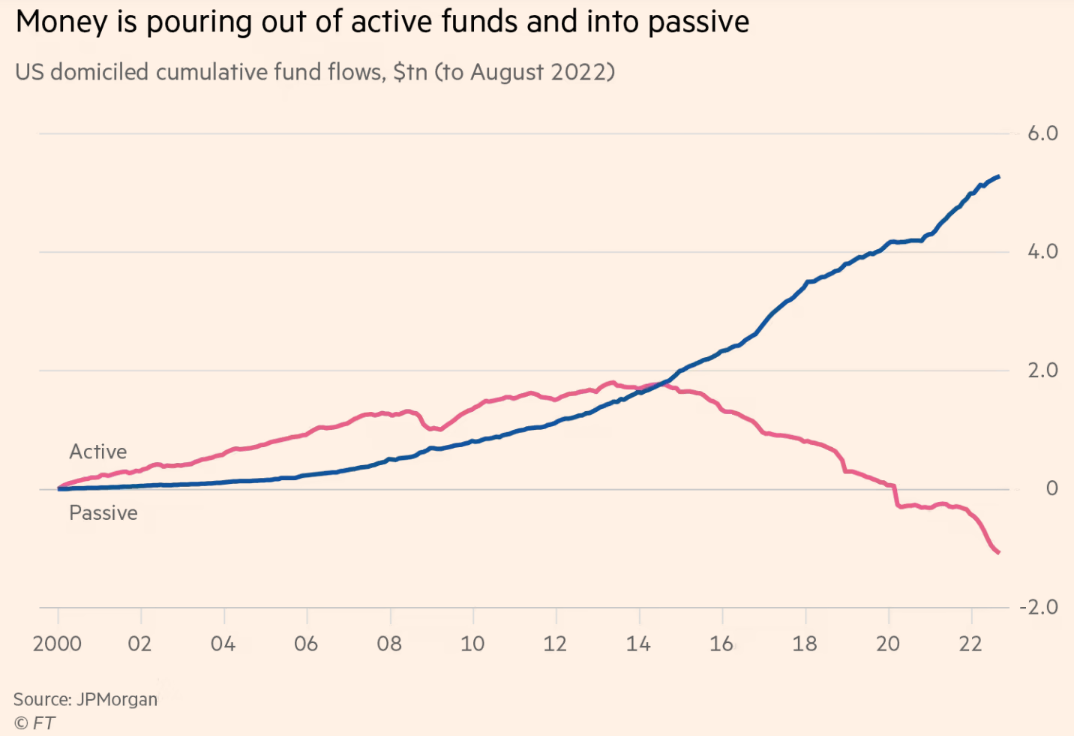

Some thoughts on some charts.

The pros & cons of owning rental properties.