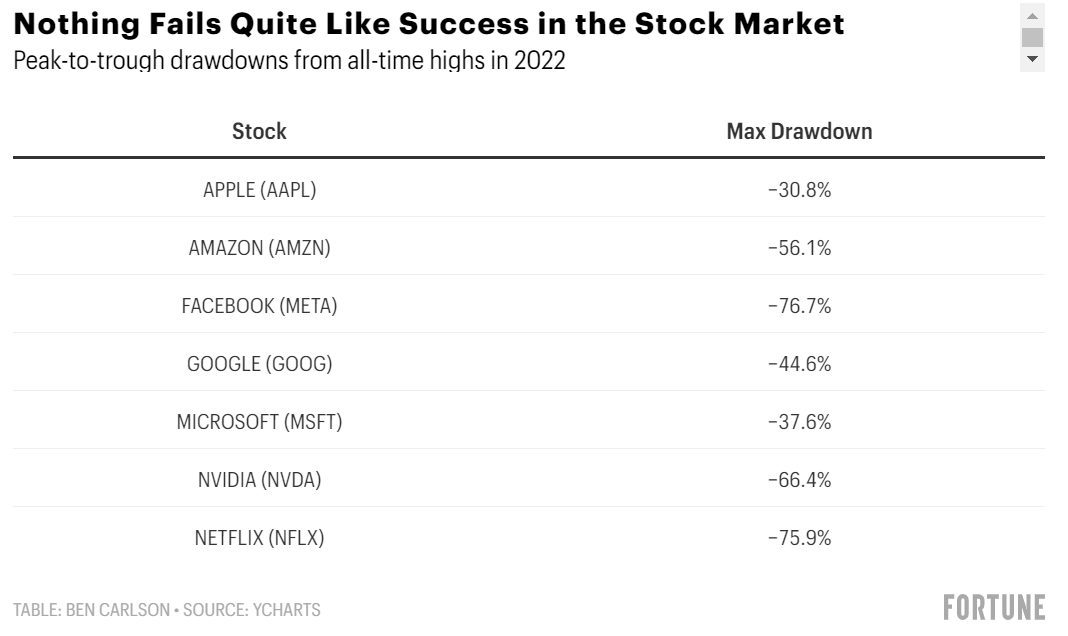

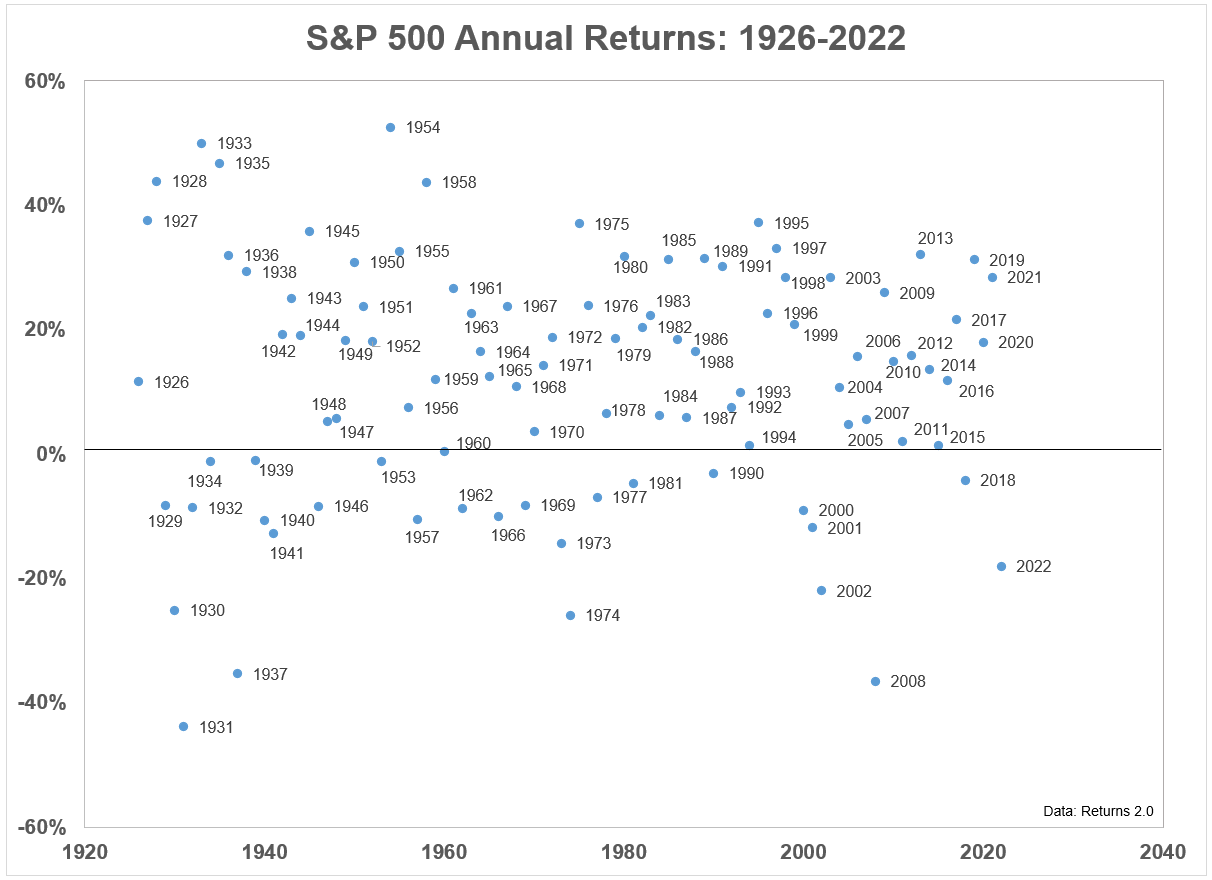

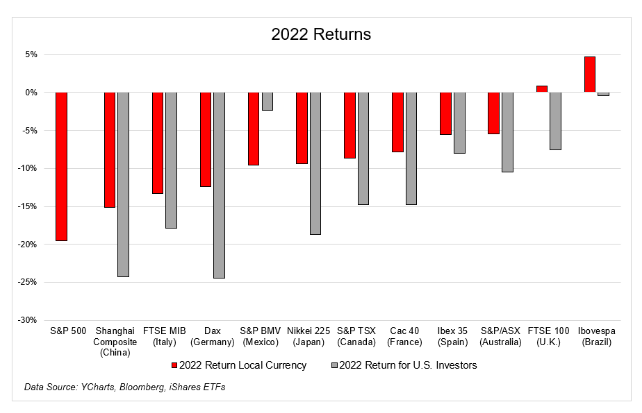

Some takeaways from a terrible year in the markets.

Some takeaways from a terrible year in the markets.

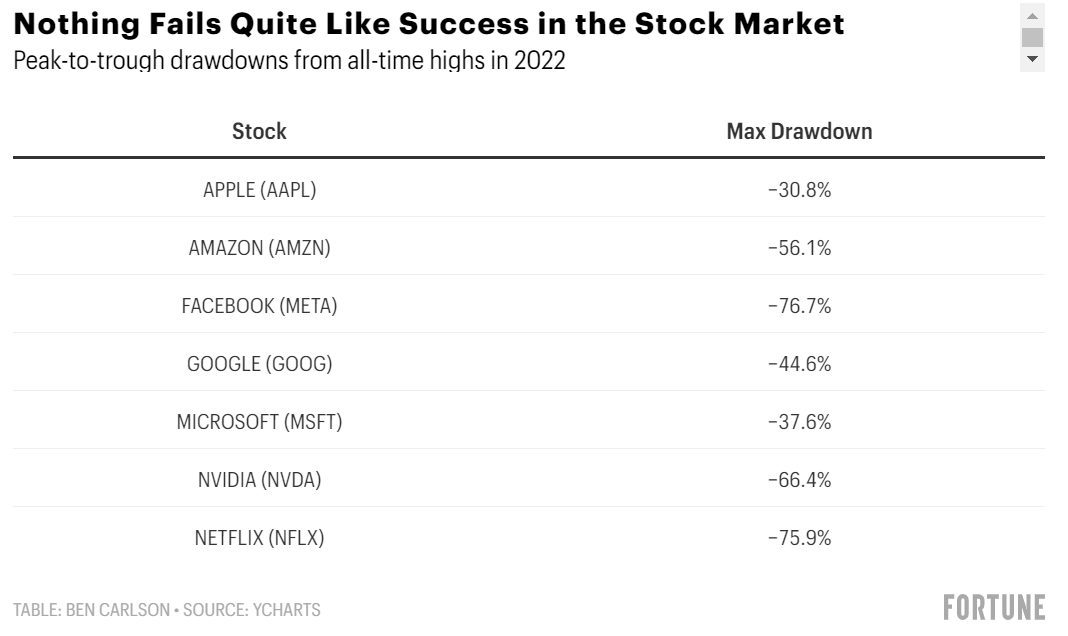

On today’s show, we are joined by Fran Rodilosso, Head of Fixed Income ETF Portfolio Management at VanEck to discuss rising stars vs fallen angels, how to be tactical with fixed income, what a fallen angel is, and much more!

Some people might think it’s bizarre that turning the page on the calendar should matter to investors. Why do investment professionals care about the end of a month, quarter or year? These periods do seem arbitrary but the changing of the calendar from one year to the next offers a good chance for market nerds…

What happens if we get a soft landing?

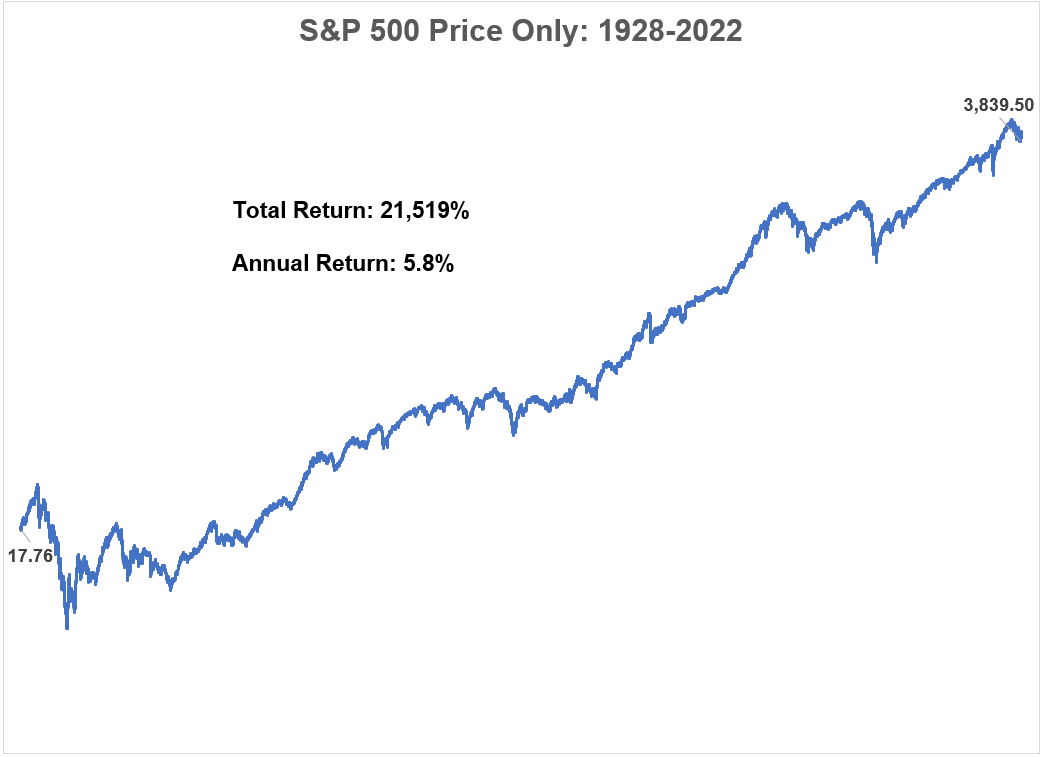

Why dividends are more important than you think for stock market returns.

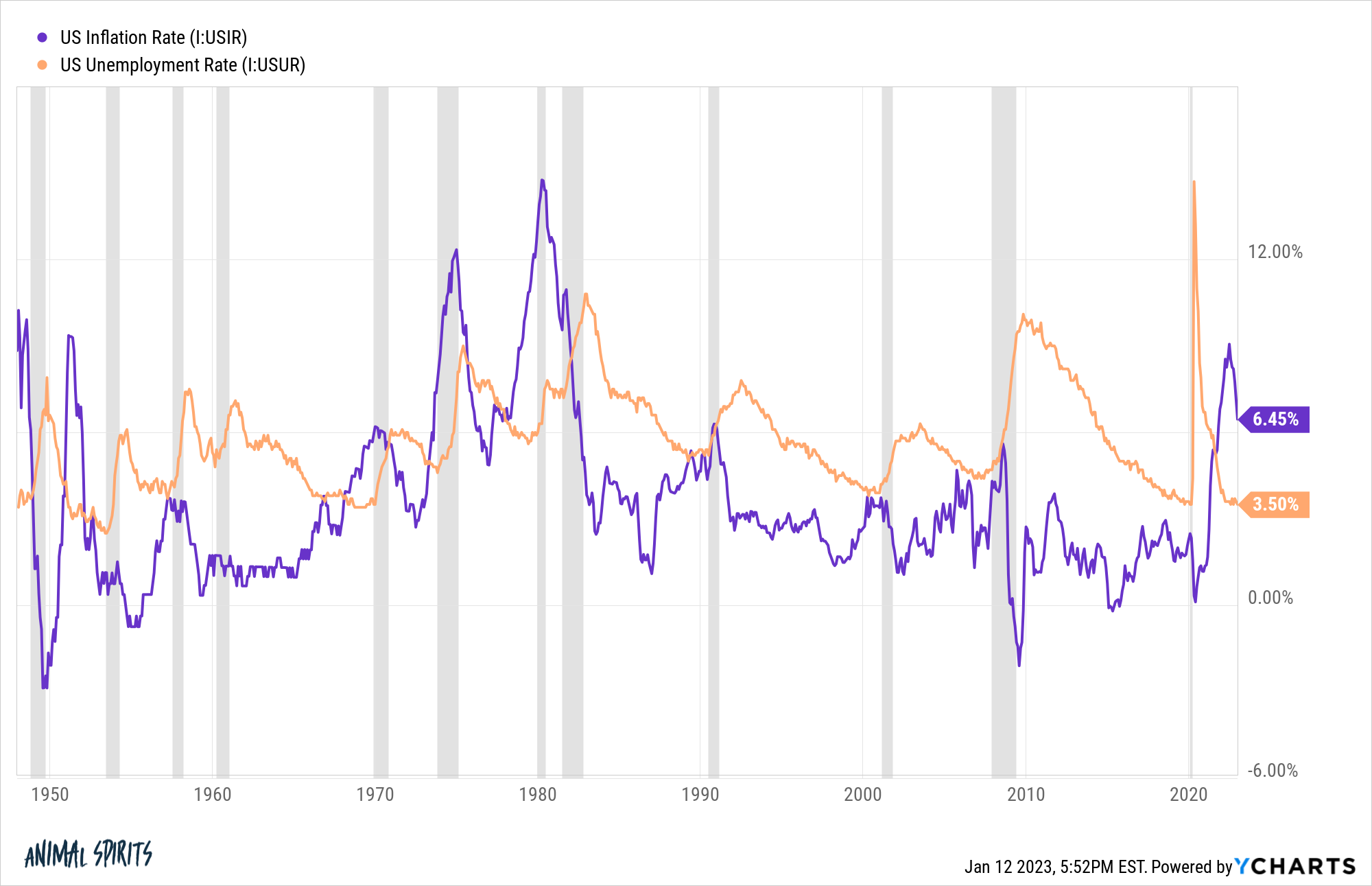

On today’s show, we discuss Michael becoming famous for a Bezos prediction, the case for no recession in 2023, the bullish case for stocks, the bearish case for stocks, false signals from an inverted yield curve, why this is not 1970s-like inflation, 2023 movies and much more.

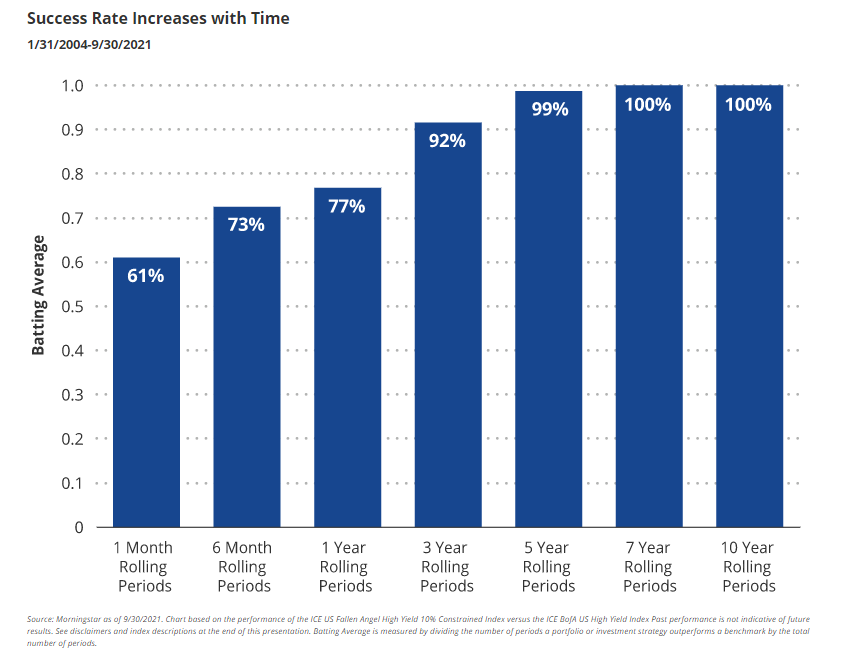

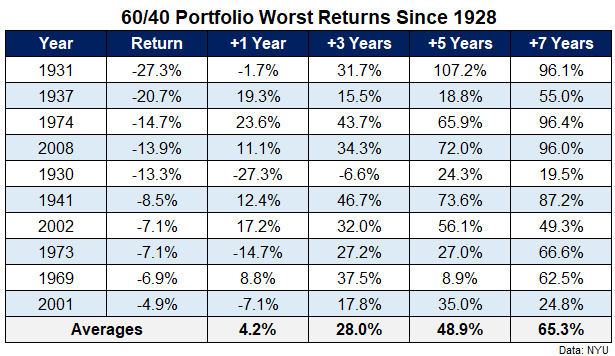

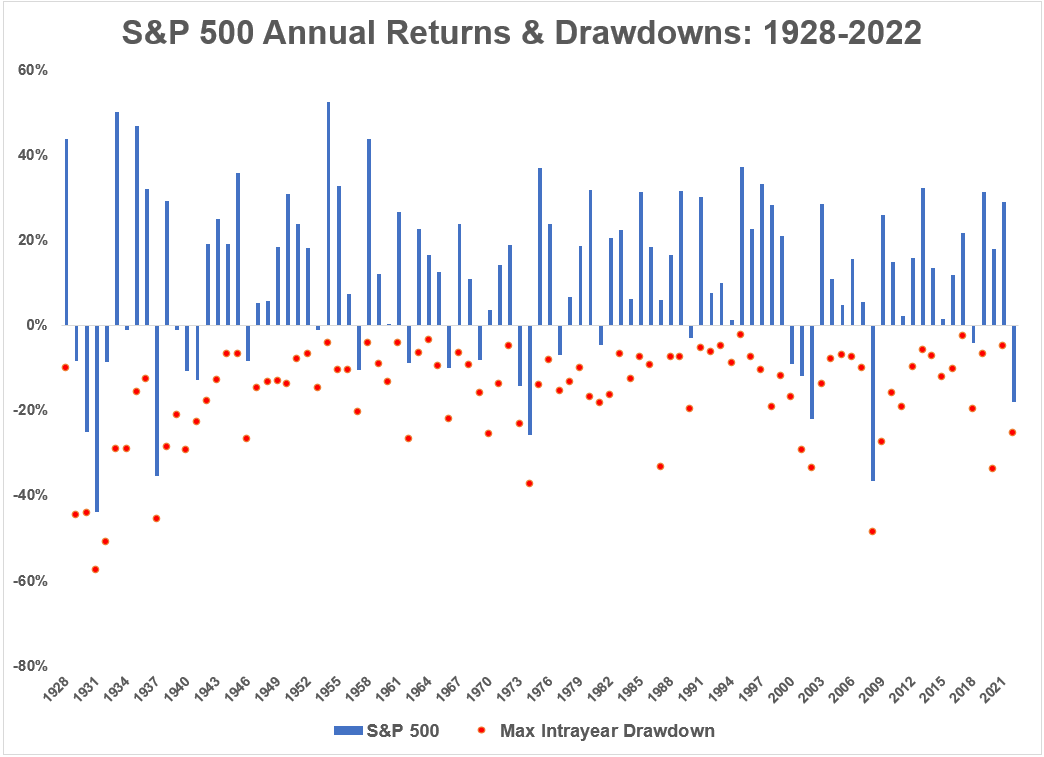

Market performance after the worst years in history for stocks, bonds and a diversified portfolio.

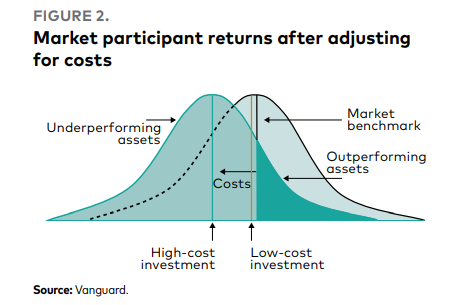

On today’s show, we are joined by Rodney Comegys, Head of Vanguards Equity Investment Group to discuss how indexing works, what makes Vanguard so special, active investing vs passive investing, and much more!

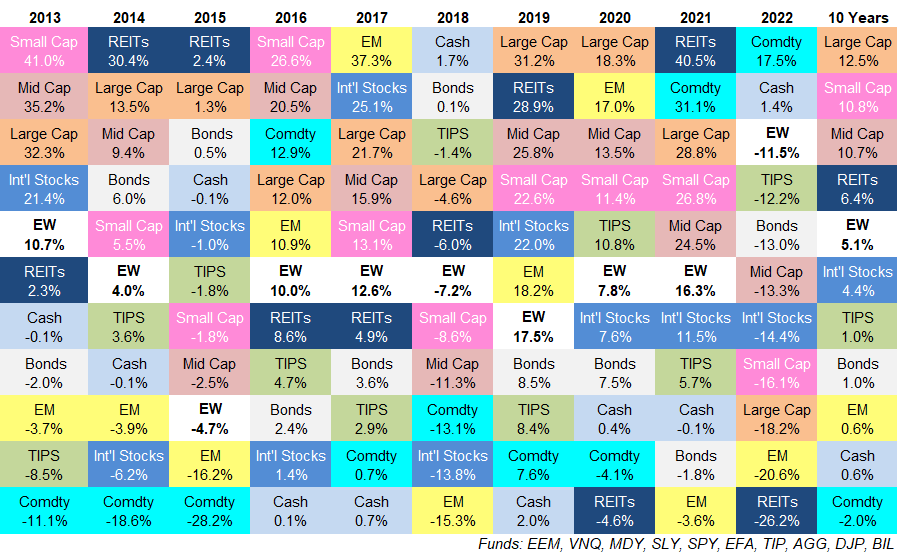

Ben’s 2022 asset allocation quilt.

Why you should expect a correction in the stock market this year.