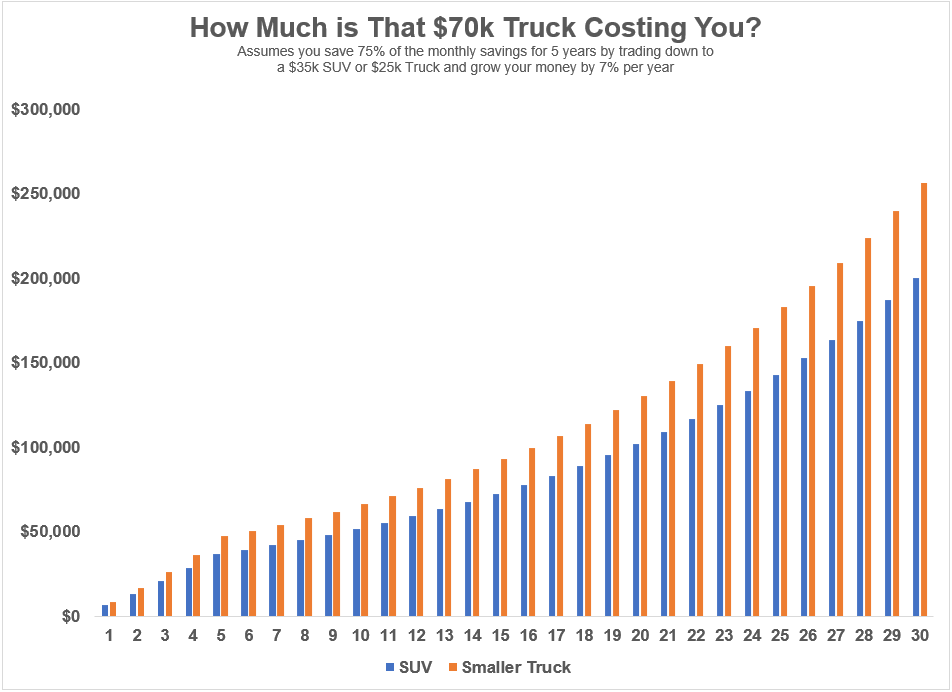

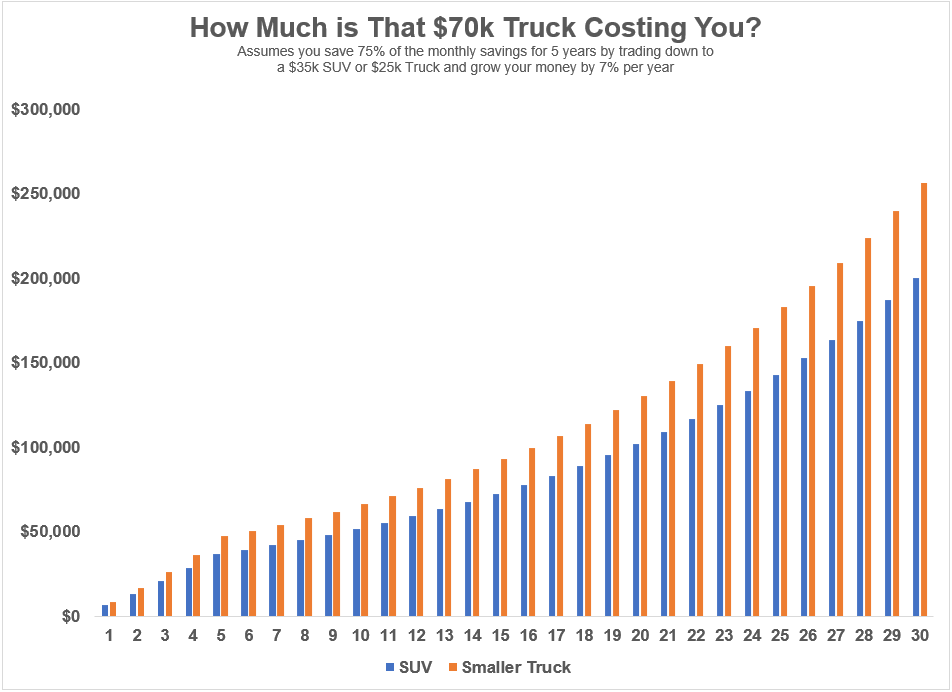

Why housing and transportation are by far your most important expenses.

Why housing and transportation are by far your most important expenses.

On today’s show, we discuss:

– The types of people you see on every flight in America

– Why new highs in the stock market are perfectly normal

– Why the Fed should cut rates even in a strong economy

– This is more like the 1990s than the 1970s

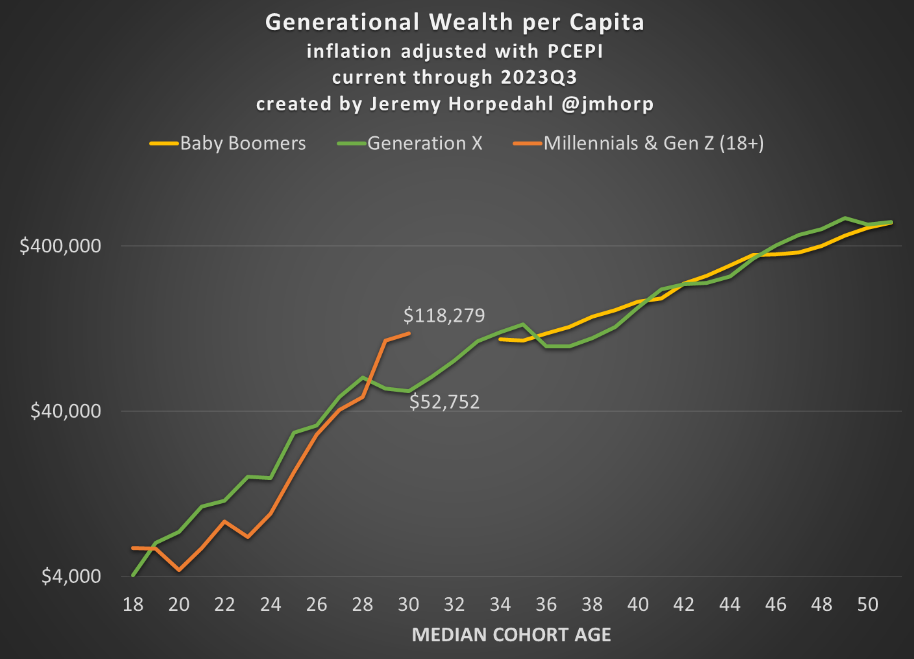

– Young people are wealthier than you think

– The biggest story about the economy no one is talking about, and much more!

Some random thoughts about saving, spending and finding financial contentment.

On today’s show, we are joined again by Alex Morris, CIO of F/m Investments to discuss:

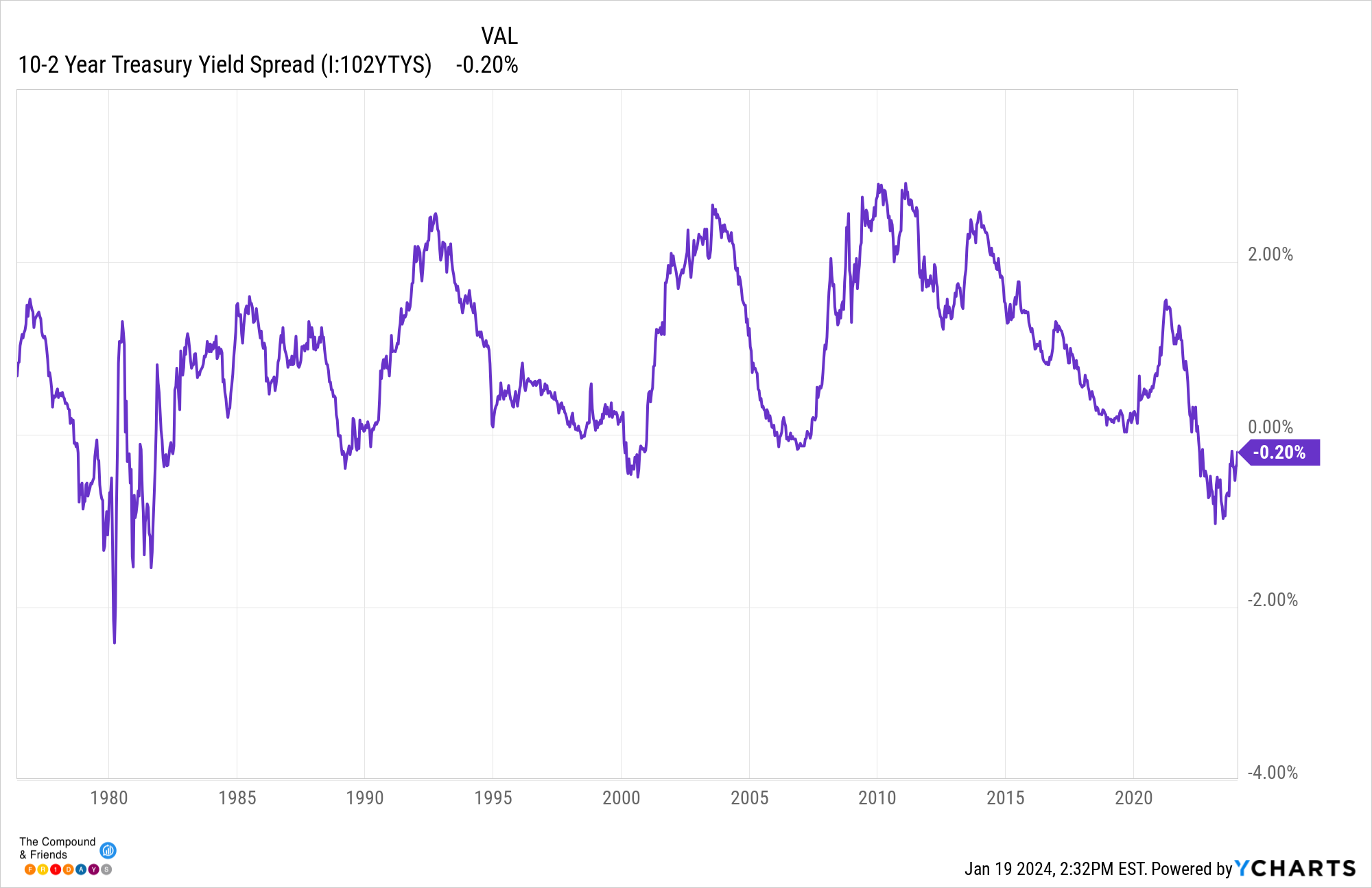

– 2024 rate cut possibilities

– The difficulty of forecasting, and why everyone got 2023 so wrong

– Utilizing spreads as a forecasting tool

– Why solving for corporate duration can be a useful risk management tool, and much more!

Millennials and Gem Z have more money than you think.

Allow me some 1990s nostalgia.

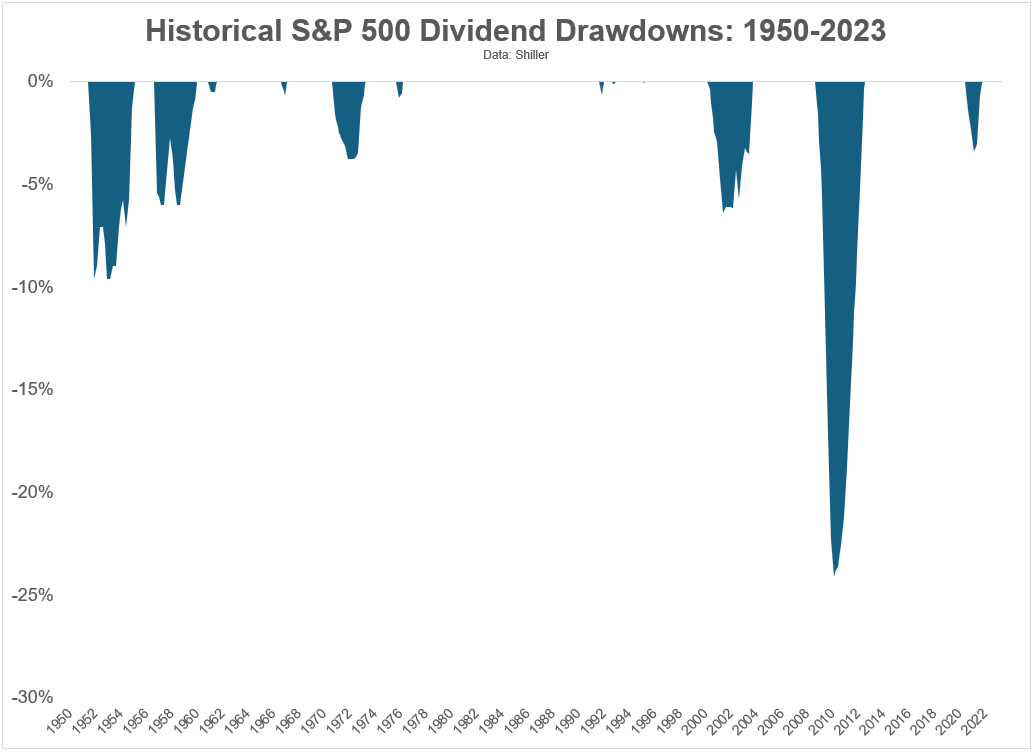

A short history of dividends on the U.S. stock market and what it means for retirement planning.

On today’s show, we discuss:

– The average length of bull and bear markets

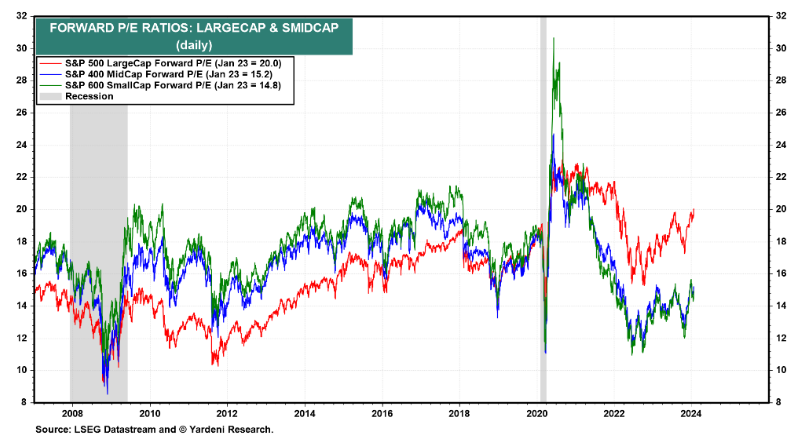

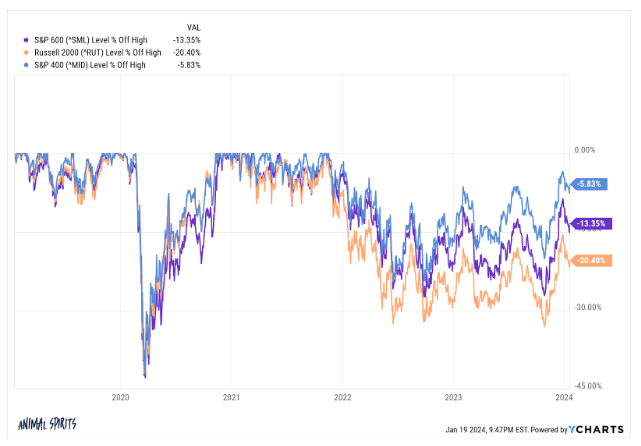

– What’s up with Small Cap stocks

– $8.8T in cash

– No show China

– The vibesession is over

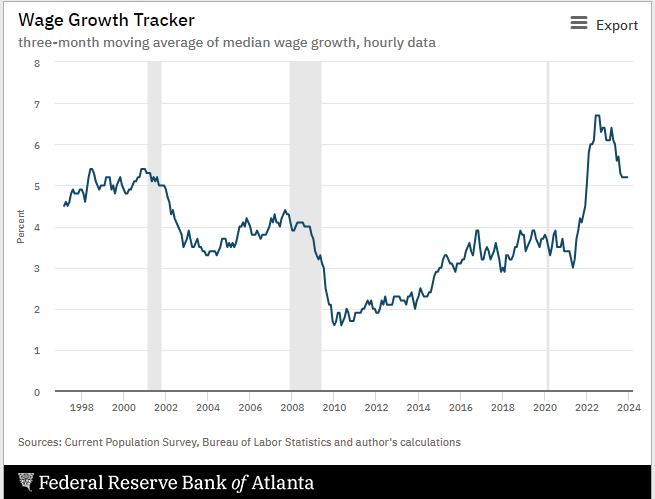

– The softening labor market

– Airline credit cards

– 0% rate loans

– The Bitcoin ETF, and much more!

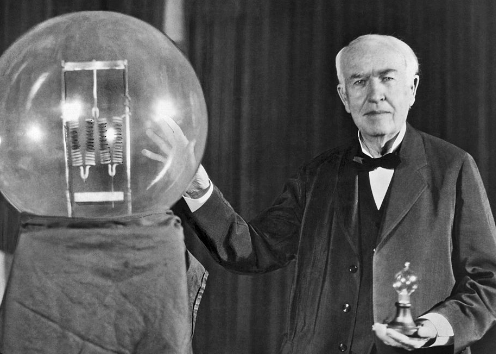

Some stories about Thomas Edison, Micheael Ovitz and Michael Crichton.

On today’s show, we are live at FARMCON to discuss:

– The macro economy and inflation in 2023 and 2024

– Commodity trading with legendary trader Andy Daniels

– How behavioral finance affects investment decisions, and much more!