Good advice vs. effective advice.

Good advice vs. effective advice.

Financial advisors and 401k plans are going to see more private investments in the years ahead.

We’re doing a live podcast and meeting with prospects on June 2-3 in Chicago.

On today’s show we discuss Warren Buffett’s legacy, no one can guess where the market is going, a 9 day win streak for stocks, Americans love to buy the dip, the next recession is going to be wild, Wall Street is very bearish, retail is bullish, Bitcoin didn’t decouple yet, a housing market slowdown, the benefits of drinking and more.

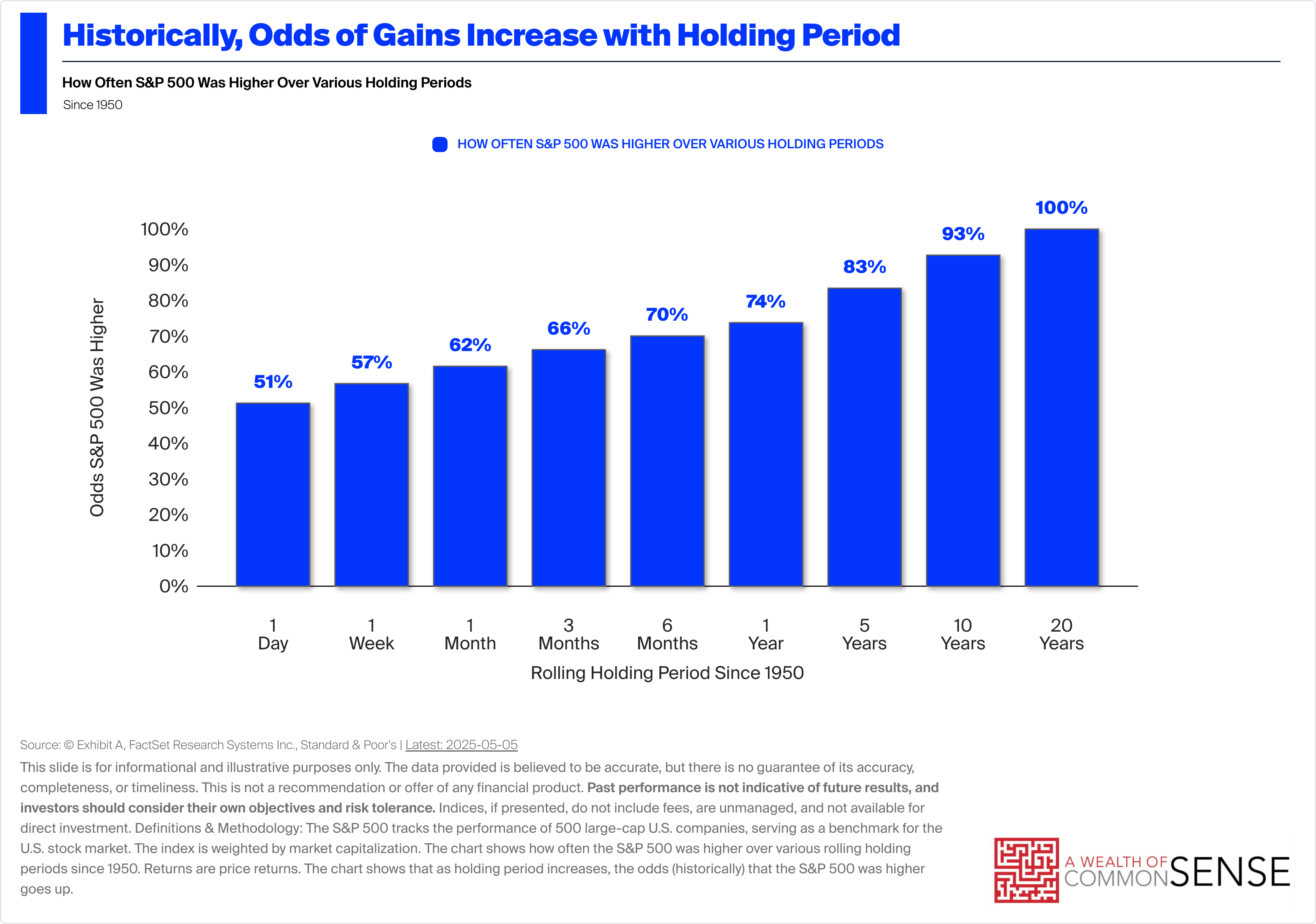

Some of my favorite Warren Buffett quotes about investing for the long-run.

On today’s show, we are joined by Shiloh Bates, Partner and CIO of Flat Rock Global to discuss the relationship between income and volatility, how CLOs perform during recessions, what CLO equity is, what happens when loans default, characteristics to look at for CLO managers, and much more!

A story about Quentin Tarantino and what it says about financial decisions.

Why isn’t housing a bigger political priority?

How the dollar’s movements impacts the returns of various asset classes.

On today’s show, we discuss a wild month of stock market performance, bear market rallies, a shift in tariffs, Amazon fighting back, an update on earnings, thoughts on conferences, a new Netflix recommendation, and much more.