Money and friendship are not always on the same page.

Money and friendship are not always on the same page.

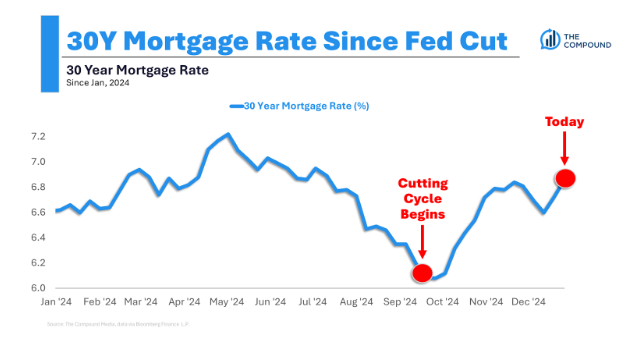

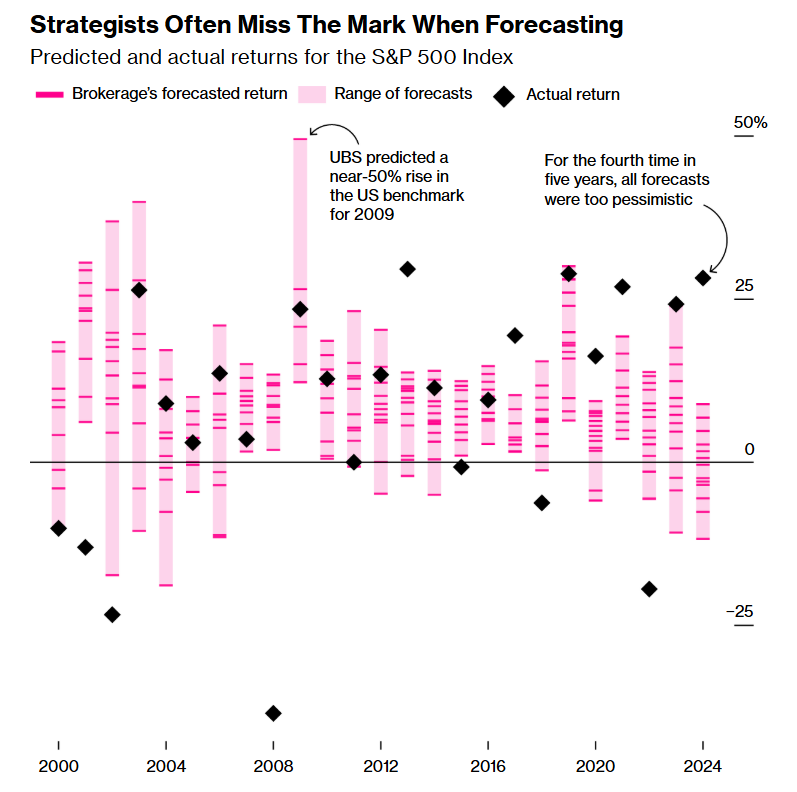

On today’s show we discuss the year that was in the stock market, expectations for 2025 returns, the Steve Ballmer portfolio, record ETF flows, the new normal of speculation, rich retirees who won’t spend their money, the new normal of 7% mortgage rates, eff you money vs. your job, speaker phones, travel budgets and much more.

On today’s show, we are joined by Charly Travers, Portfolio Manager at Motley Fool Asset Management to discuss how the Motley 100 Index is constructed, growth vs value investing, how Motley analysts approach stock picking, thoughts on S&P top 10 market cap turnover, and much more!

My annual list of things that won’t happen in 2025.

Should your 16-year-old drive a new or used vehicle?

My annual list of books read.

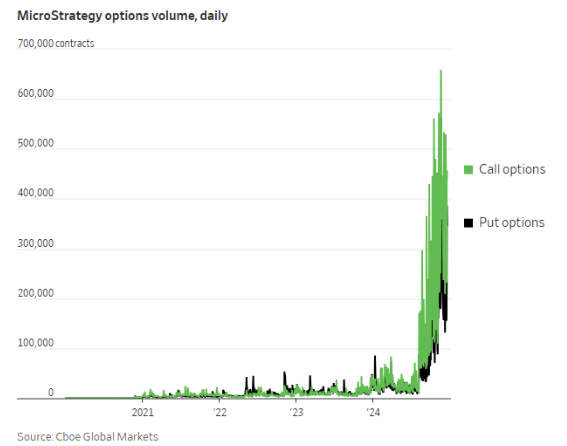

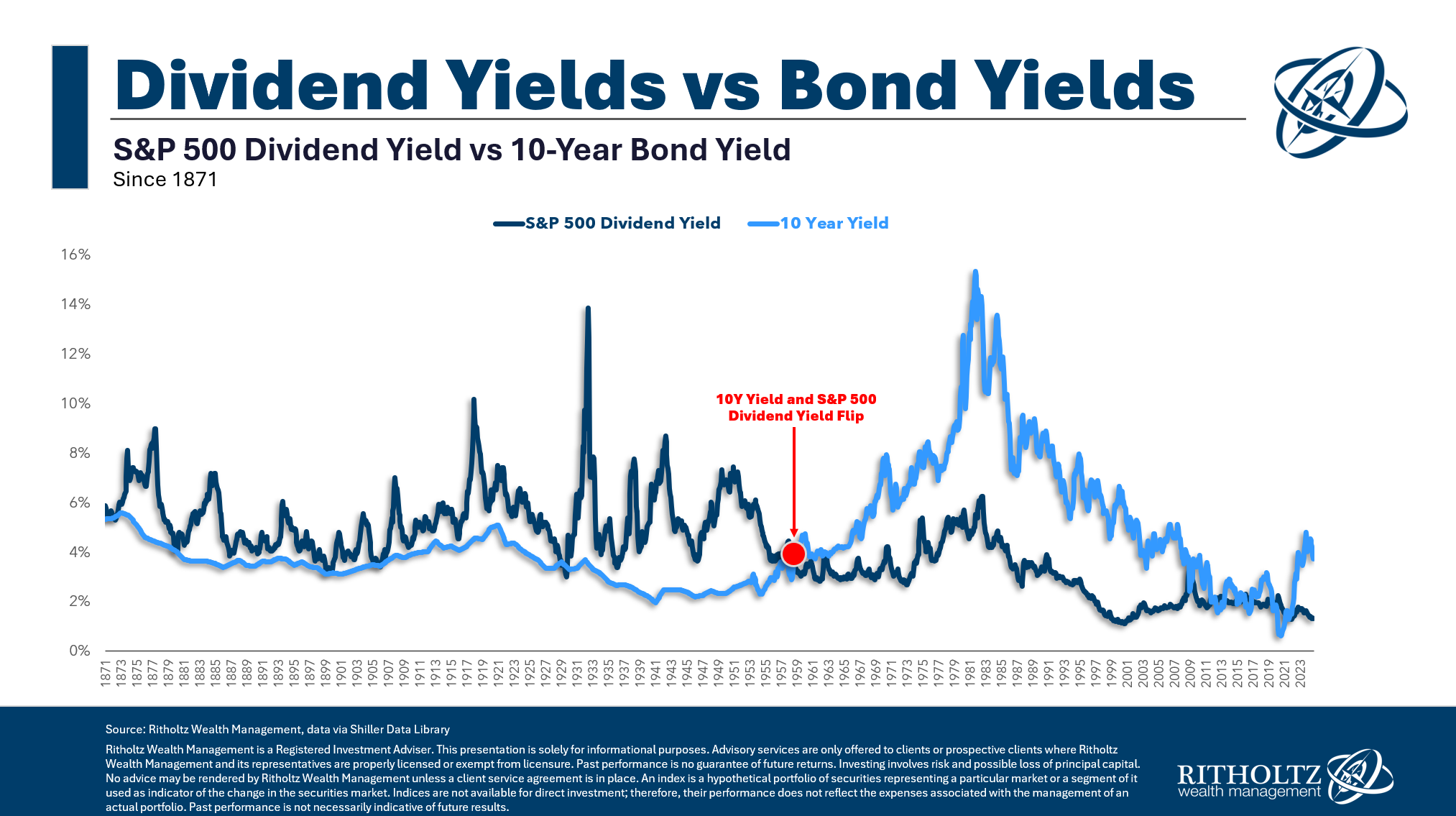

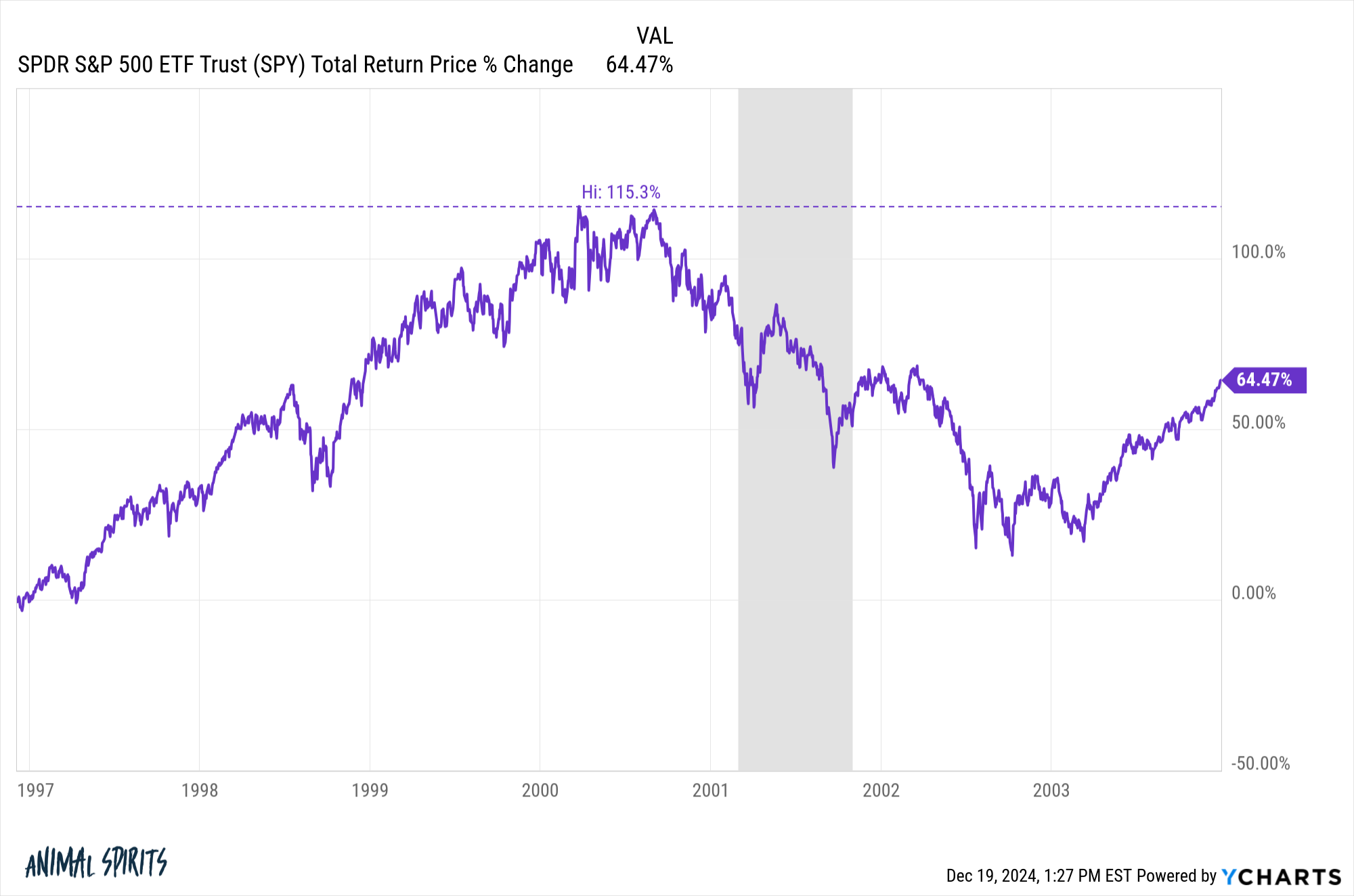

On today’s show we discuss healthy corrections, rate cuts vs. the stock market, terrible sentiment towards foreign stocks, the crack cocaine of the stock market, addiction in the information age, deflation in China, AI eats the world, houses are getting older, new vs. used cars for your kids, everyone is drinking Guinness and much more.

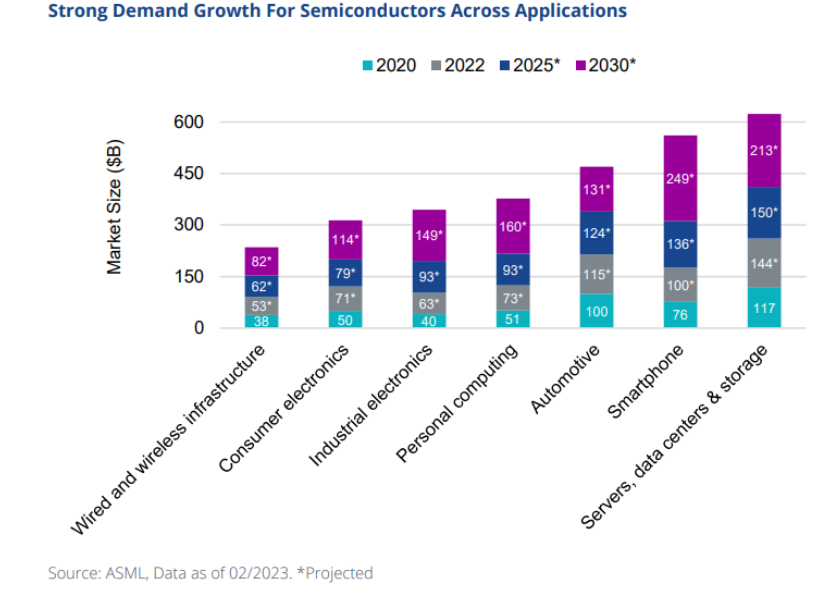

On today’s show, we are joined by Nick Frasse, Product Manager at VanEck and Angus Shillington, Deputy Portfolio Manager at VanEck to discuss NVDA vs everyone else, how the SMH is constructed, why other semiconductor companies are catching up, the issues at Intel, geopolitics and the semiconductor industry, and much more!

Have international stocks ever been this hated?

Some thoughts on the difficulty of calling a top in the market.