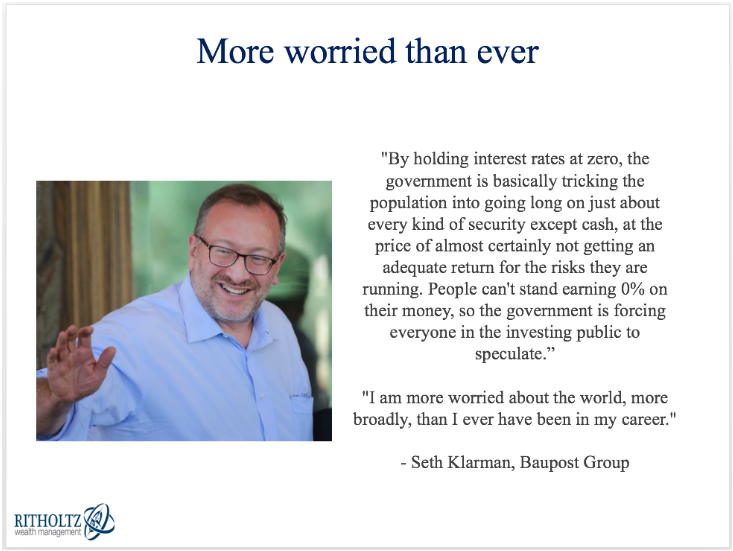

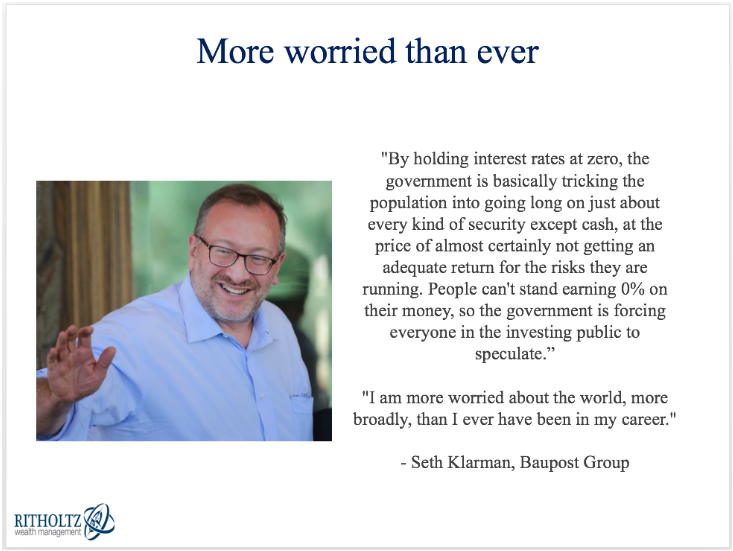

Why Seth Klarman has underperformed.

Why Seth Klarman has underperformed.

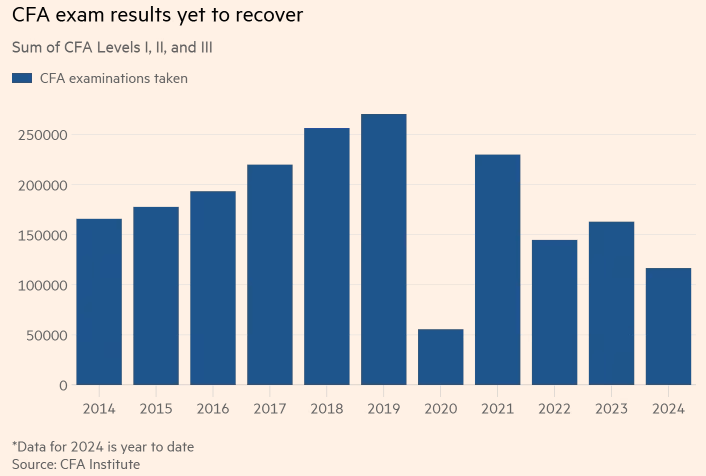

A deep dive into the difference between getting your CFA and CFP designations.

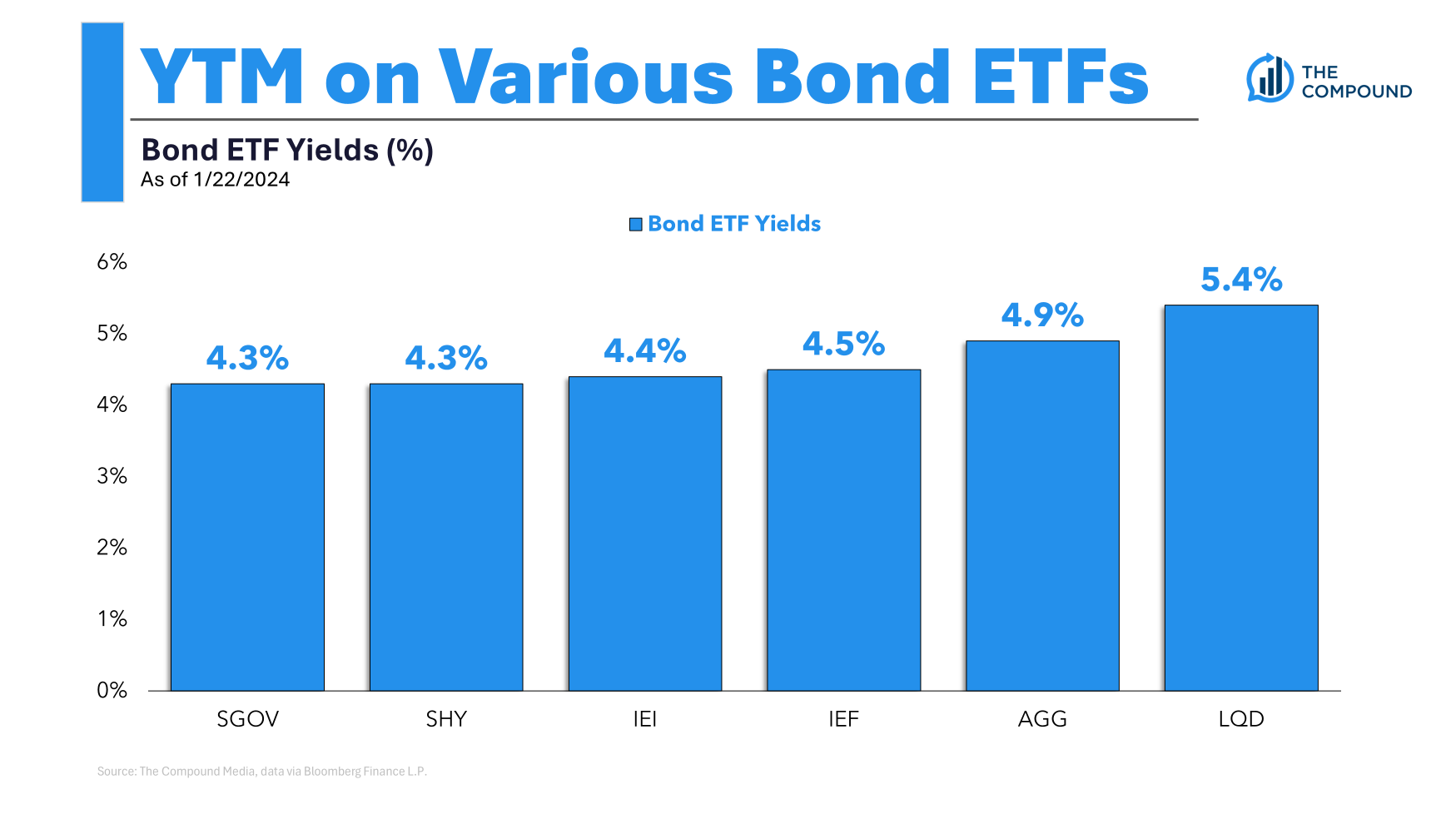

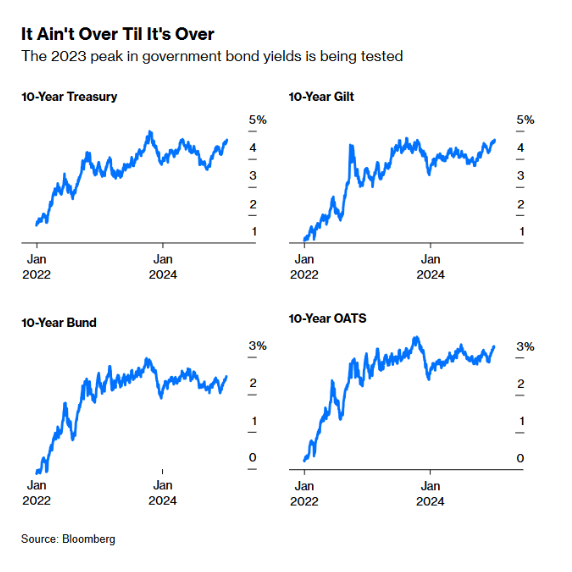

What’s the best way to lock in 5% bond yields?

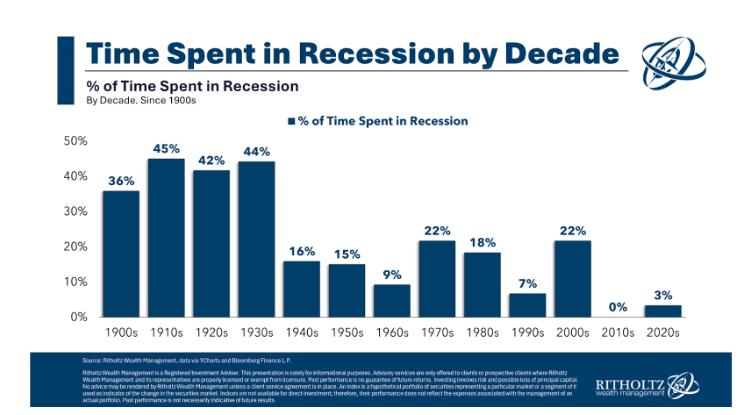

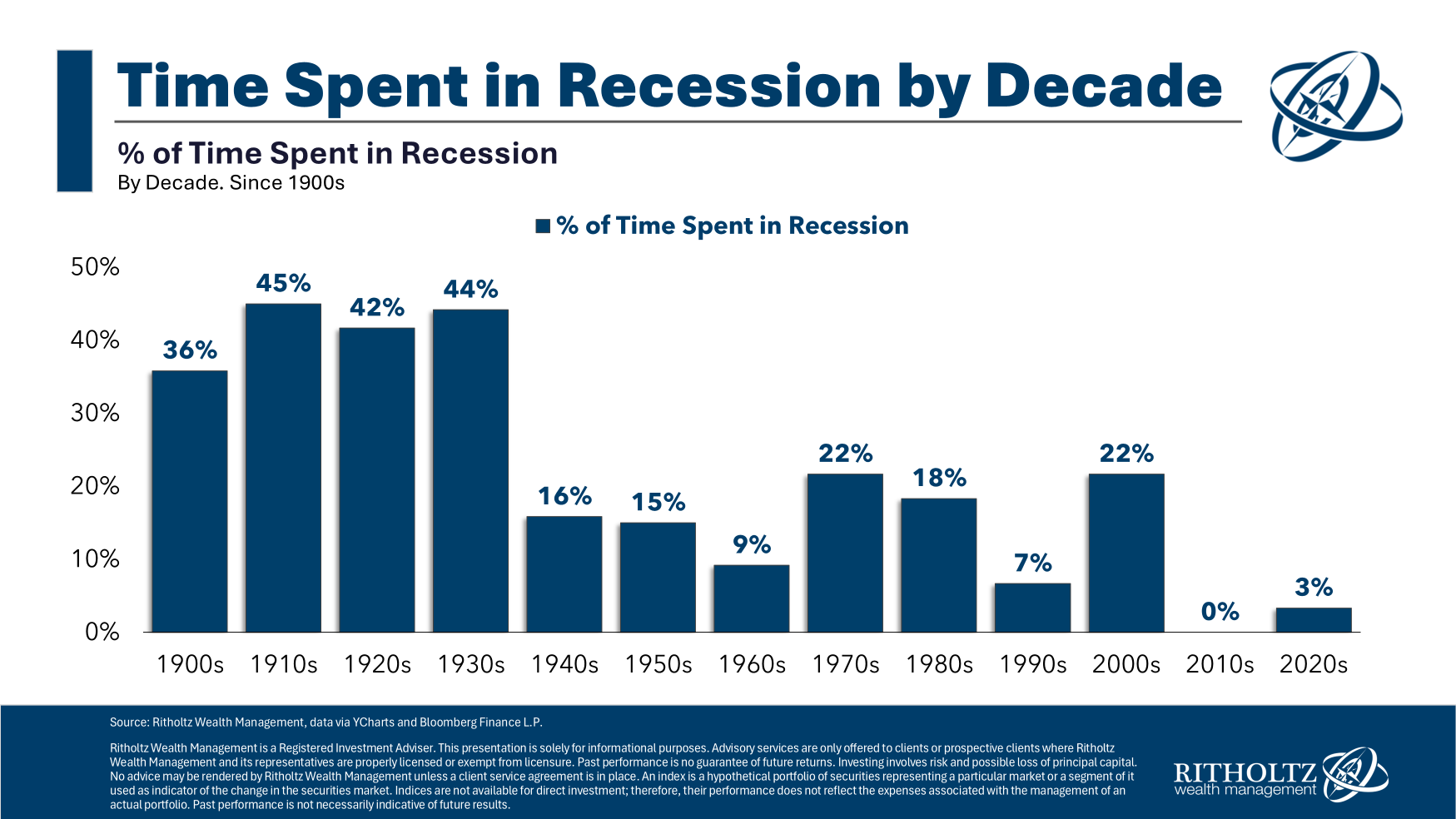

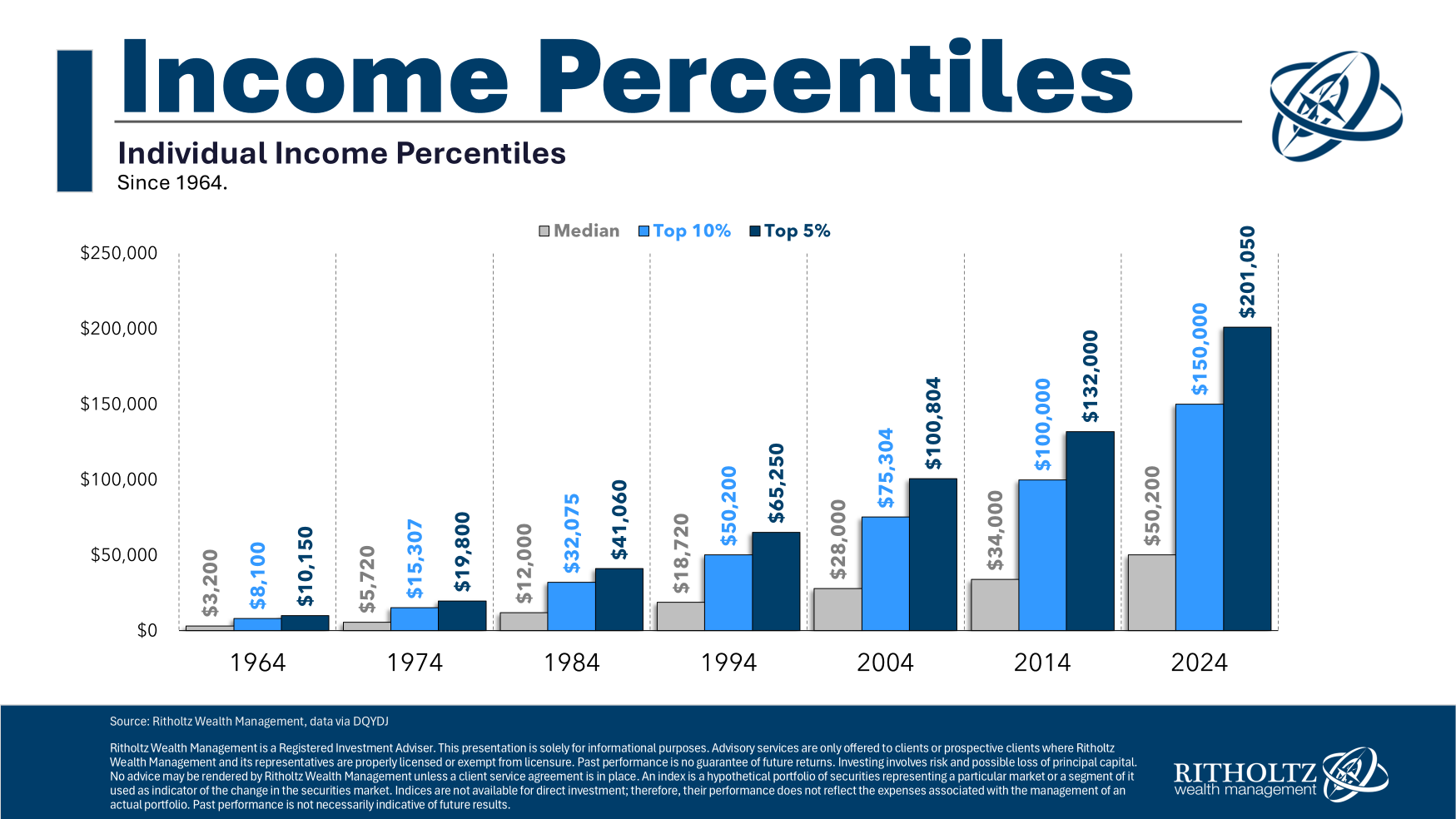

On today’s show we discuss a memecoin from the President, what’s next for the crypto industry, the golden age of financial fraud, recessions are becoming less prevalent, how much income it takes to be rich, the Sonos app crash, Wall Street thinks houses are overpriced, youth sports for Millennial parents and much more.

A historical look at recessions and bear markets in the United States going back 100+ years.

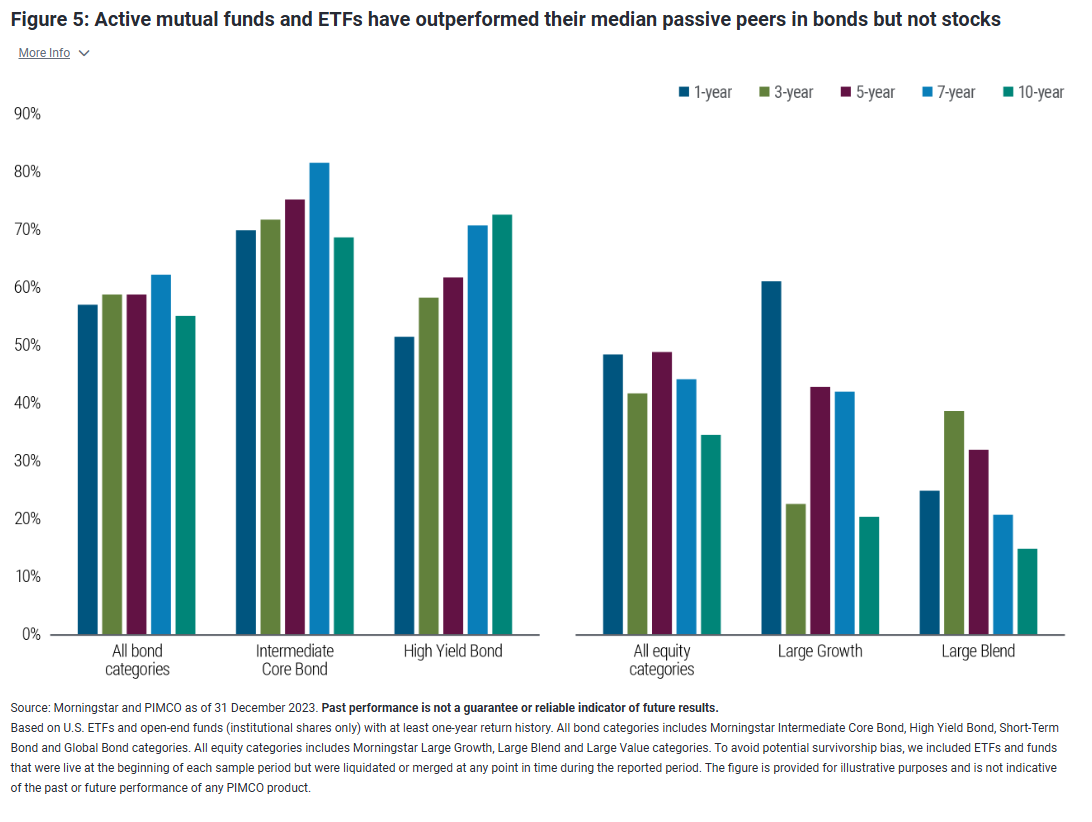

On today’s show, we are joined by Dave Braun, Managing Director and Generalist Portfolio Manager at PIMCO to discuss why rates have been moving higher, if the Fed will get us a soft landing, why mortgage bonds look attractive right now, the resiliency of the US consumer, and much more!

What income does it take to be in the top 5% and top 10% in the US?

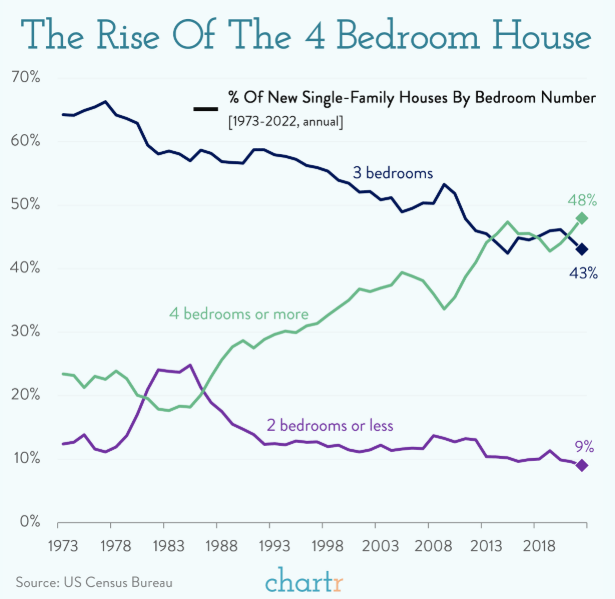

How the loneliness epidemic could impact the housing market.

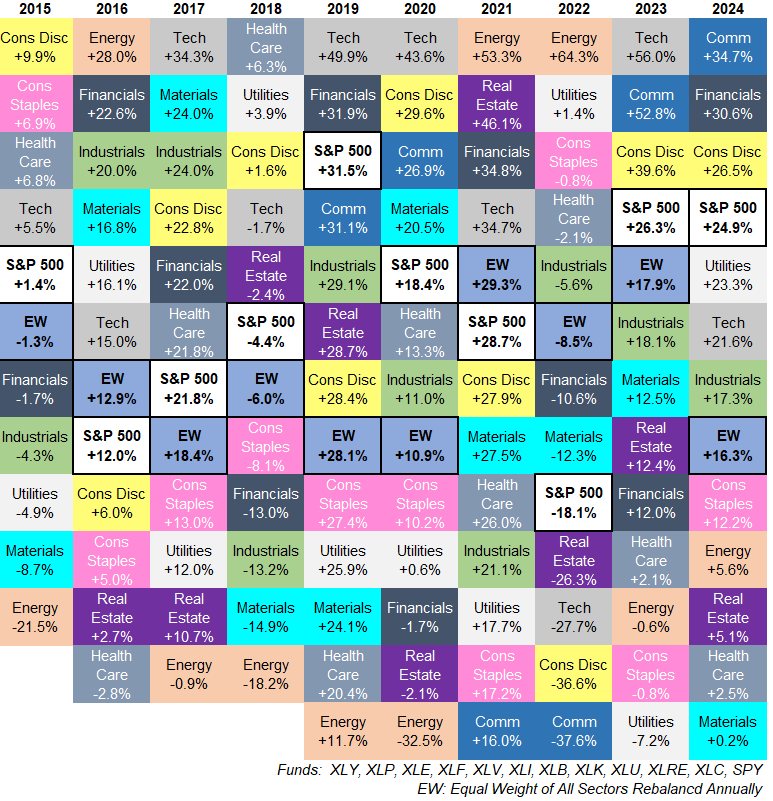

Some thoughts on picking and choosing S&P 500 investors.

On today’s show we discuss the devastating fires in LA, why homes are the most important financial asset for the middle class, a roundtrip in stocks since the election, why rates are rising, nitpicking the economy, Howard Marks is on bubble watch, quantum computing stocks, the anti-social century, Jerry Springer and much more.