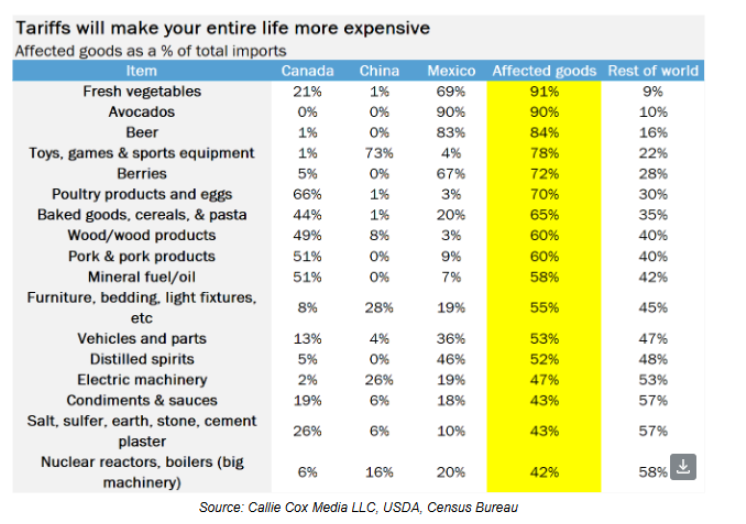

On today’s show we discuss the financial impact of tariffs, why AI could save the stock market, market return assumptions for the next decade, the Vanguard Effect, levered ETFs, AI Ben, crypto is not a tariff hedge, using Bitcoin instead of a 529 plan, the remodeling boom, peer pressure from friends to go skiing and much more.