The infamous 1979 Businessweek cover story entitled “The Death of Equities” is widely viewed as one of the best contrarian indicators of all-time.

Stocks went on to have one of the greatest bull markets in history not too long after this story was published.

But when I read through the original article recently I was interested in another angle.

From the Businessweek (emphasis mine):

The problem is not merely that there are 7 million fewer shareholders than there were in 1970. Younger investors, in particular, are avoiding stocks. Between 1970 and 1975, the number of investors declined in every age group but one: individuals 65 and older. While the number of investors under 65 dropped by about 25%, the number of investors over 65 jumped by more than 30%. Only the elderly who have not understood the changes in the nation’s financial markets, or who are unable to adjust to them, are sticking with stocks.

It’s almost like this story was mocking the older investors for sticking it out with stocks after years of terrible performance. Yet the experienced older investors had the last laugh.

As everyone is now well aware, stocks went on a two-decade tear from 1980 on with close to 18% annual returns.

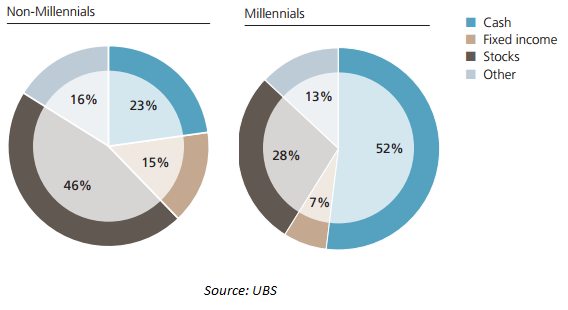

According to a recent UBS Investor Watch survey, younger investors are once again avoiding stocks just as they did in the past (emphasis mine again):

The Next Gen investor is markedly conservative, more like the WWII generation who came of age during the Great Depression and are in retirement. This translates into their attitude toward the market as we see Millennials, including those with higher net worth, holding significantly more cash than any other generation. And while optimistic about their abilities to achieve goals and their financial futures, Millennials seem somewhat skeptical about long-term investing as the way to get there.

Here’s a chart from the that study that shows how conservative younger investors have become today with more than 50% of their savings in cash:

There is something to be said for gaining experience in the markets by going through many different investing environments to prepare yourself for future possibilities.

You learn that the good times don’t last forever just like the world doesn’t come to an end every time there’s a recession or a bear market.

Unfortunately, the conundrum here is that it can take decades for investors to become comfortable with the cyclical nature of the markets and their own risk tolerance.

Harry Markowitz remarked in a recent interview with the Financial Times that, “Investors are always fighting the last war, when in fact all crises are different.”

Most Millennials saw their 401(k) balance take a huge hit during the crisis or had a friend or family member that nearly got wiped out. Many sold at the bottom which compounded their losses.

This leads to the mindset that the stock market is a casino that’s rigged against the little guy.

These types of ordeals can leave scars.

Equity and bond flows from the past 5 years have shown that many investors sold their stocks to buy bonds under the illusion of safety from another crash.

The long-term data shows that stocks are your best bet at beating inflation over a multiple decade time horizon. Yet to earn those higher returns you must be willing take risks. This means at times you will lose a pretty good chunk of your money in stocks.

That’s the trade-off.

In the end, long-term returns are the only ones that should matter, but this is a very difficult concept for younger investors to accept when they don’t know the history of the markets.

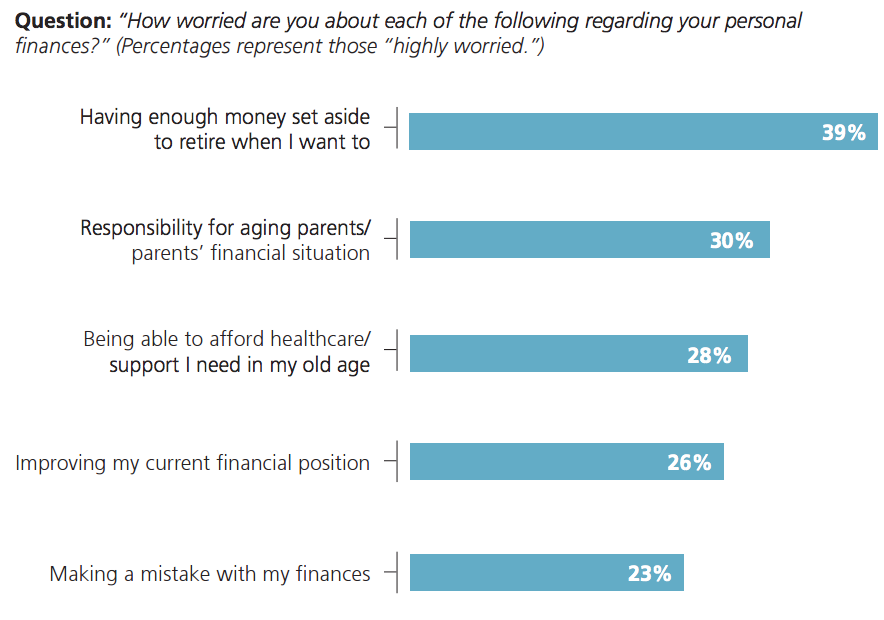

Here are the main financial worries of the Millennials from UBS:

This group has decades until retirement, which happens to be their number one worry (By the way, the last one should not be a worry. Make mistakes when you are young and have time and future earnings power on your side).

The biggest assets you have as a young person are your human capital for future savings and the ability to allow those savings to compound over many years.

I’m not sure what it’s going to take to get my fellow Millennials to understand that their aversion to stocks will only make it harder to achieve their financial goals in life.

The unfortunate reality is that it takes investors time and experience to learn about how the markets work.

The stock market doesn’t care if young people invest or not. It’s not going to wait around until you get more comfortable taking risk.

Those that invest increase the probability of reaching their goals while those that don’t risk falling behind.

The fact is that the best way to build wealth for the majority of people is to slowly invest over the long-term and let compounding do most of the work for you. Somehow this gets lost on younger investors.

Sources:

Think You Know the Next Gen Investor? Think Again (UBS)

The Death of Equities (BusinessWeek)

Ziggy Stardust fears still haunting stocks (FT)

[…] Death of stocks […]

Outstanding

[…] is part of the reason Millennials want nothing to do with stocks right now. The same was true for the so-called Depression Babies who dialed down their risk […]

[…] Millennials hate stocks right now, just like the Baby Boomers did in the early 1980s. My fellow Millennials will come around eventually. They have to so they can use their longer time […]