“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” – Evan Esar

On of the biggest reasons that people seem to place on the recent stock market underperformance in emerging market countries is the fact that ‘growth is slowing.’

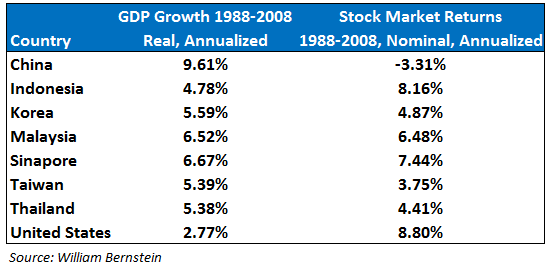

Take a look at the following table of economic growth rates and stock market returns to see an example of why this argument rests on a faulty assumption:

The economy and the stock market are two different animals. The economy matters much less to stock market returns than most professional investors would have you believe.

It can matter during recessionary periods but using economic growth as the sole reason for an investment thesis will usually turn out bad.

Economic data lags, gets revised, has seasonality and is just generally hard to use when making investment decisions for all but a very small percentage of investment professionals.

Economic growth slowed in the U.S. during the 80s and 90s and stocks went on to have the strongest bull market ever.

The stock market is a relative game and the expectations of market participants plays a huge role in determining future returns.

When expectations are too high, results tend to disappoint. And when expectations are too low, the results tend to surprise investors on the upside.

Case in point is the hard charging bull market in U.S. stocks since 2009 despite a less than stellar economic recovery.

A few years back, many investment strategists were telling everyone to get out of U.S. stocks because of the ‘New Normal’ of slower economic growth. We were told emerging markets and their superior economic growth rates were the place to be.

This was Wall Street selling you a high-flying growth stock (EM) while completely missing out on the un-loved value stock (U.S.).

There could be more pain ahead in EM stock markets, but investors with a long time horizon should view this ‘growth is slowing’ narrative as a positive sign.

Expectations of future growth in many emerging market countries were completely out of whack with stock market fundamentals. Those expectations are now coming down.

There are legitimate reasons why certain investors should not own emerging market stocks (they are extremely volatile, prone to crises, suffer long periods of underperformance, etc.).

The slowing of economic growth is not one of them.

Source:

The Investor’s Manifesto

Further Reading:

The Truth about Stocks and the Economy

Putting Emerging Markets Losses in Perspective

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] ‘Growth is slowing’ is not a valid reason to dump emerging market stocks by A Wealth of Common Sense […]