In mid-October the U.S. stock market was in the midst of a pretty painful bear market.

Inflation was still running at nearly 8% on an annualized basis. The Fed was aggressively raising interest rates.

At that time the S&P 500 was more than 25% off its all-time highs. The Nasdaq 100 was down more than 35%.

Things seemed bleak.

They say no one rings a bell at the top but no one sounds the all-clear at the bottom either.

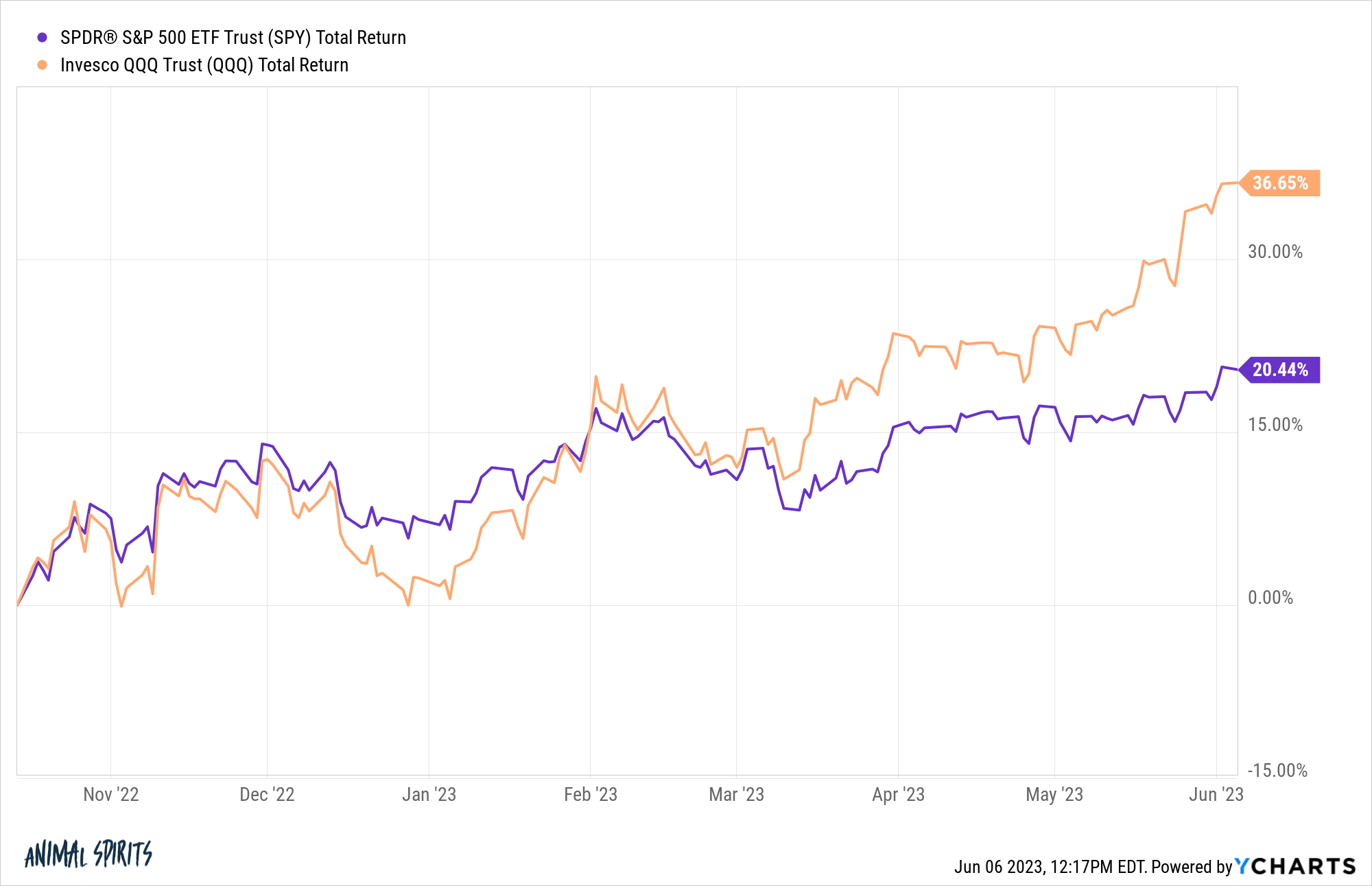

From those mid-October levels, the Nasdaq 100 is up a blistering 37% while the S&P 500 has risen more than 20% from the lows:

We’re still below all-time highs but this has been quite a rally in the face of everyone and their mother predicting a recession for the past 18-24 months.

So is this it? Is the bear market over? Is this a new bull market?

As usual, I don’t know but it’s worth noting how confusing the stock market can be during times like these.

Take the biggest company in the U.S. stock market as an example.

Apple was down nearly 30% from all-time highs through the middle of last summer. Then the stock rallied 35% from the lows. From that rally, it proceeded to fall another 30%. Now it’s almost back to all-time highs.

So you had all-time highs to 30% crash to 35% rally to 30% crash to 40%+ rally all within the span of less than 18 months.

Bull market, bear market, bull market, bear market, bull market and so it goes.

I suppose we’ve reached the technical definition of a bull market since the stock market is now 20% off the lows but this is the kind of thing that only really matters to market people. And you only really know the answer with the benefit of time.

Most people assume the 1980s and 1990s mega-bull market started sometime in the 1980-1982 range.

But from the end of the bear market in late-1974 through the end of 1979, the S&P 500 was up nearly 120% in total or 16% annualized. No one really remembers that because the 1970s were such a difficult decade for financial assets (mostly on a real basis).

We didn’t hit new all-time highs following the Great Financial Crisis until 2013. By that point, the S&P 500 had risen more than 150% or 25% annualized from the 2009 lows.

Did it matter if those gains took place during a technical bull market or just a bear market rally?

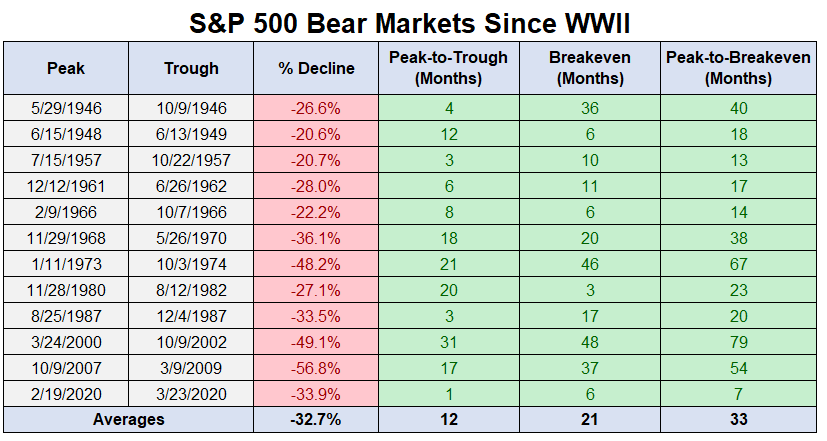

It’s also important to remember that bone-crushing crashes are rare. Here’s every S&P 500 bear market since World War II:

There was a 30 year period there from the 1940s through the 1970s where the market didn’t fall by 40% or worse. There were bear markets but they weren’t of the extreme variety.

I’m not saying that will happen again but a lot of people were conditioned to believe by the lost decade of the 2000s that every downturn had to turn into a calamity.

Sometimes we can have a bear market without the world completely falling apart in the process.

Obviously, looking at things from the exact bottom or the exact top will always make performance numbers seem more extreme. No one actually times the tops and bottoms perfectly (short of getting lucky).

The panicked feelings during a downtrend and the euphoric feelings during an uptrend are always the same but no two bull or bear markets are ever completely alike.

That’s what makes it so hard to predict.

We never know how high things will go during a bull market or how long it will last. We never know how low things will go during a bear market or how long it will last.

Even if we are in a new bull market there is likely to be some kind of pullback in the coming year. Two out of every three years since 1928 has experienced a peak-to-trough drawdown of 10% or worse. In close to 95% of all years there is a drawdown of 5% or worse.1

I’m like a high schooler when it comes to relationships for defining bull and bear markets — I don’t like labels. Maybe that’s because you don’t get married to bull or bear markets when investing.

The long-term trend is always up but you have to deal with short-term downturns along the way to get to the long-run.

Whatever happens from here will look obvious in hindsight.

But ‘I don’t know’ is my default position when it comes to predicting what will happen next in the stock market.

My investment plan was built with the assumption that I would experience a number of both bull and bear markets over the years.

Further Reading:

One More Prediction For 2023

1We’ve already hit that 5% bogey this year. The S&P 500 was down almost 8% from early February to mid-March.