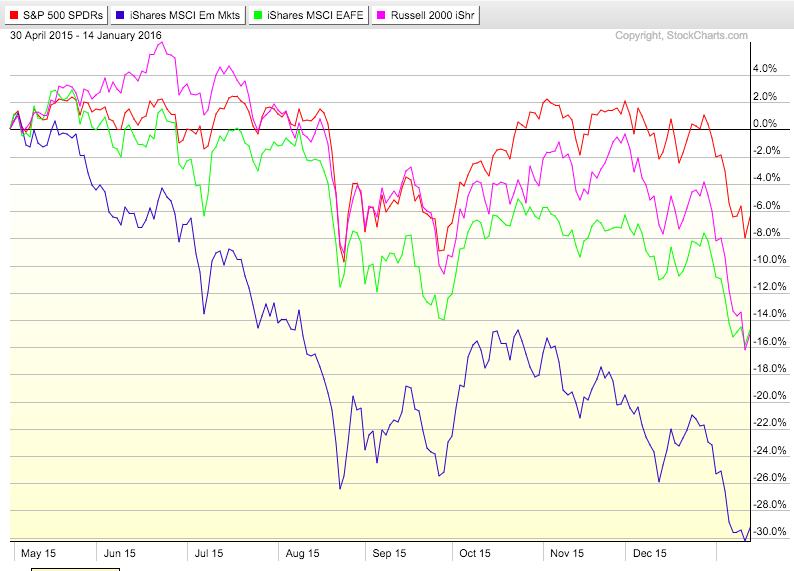

As they are wont to do on occasion, the markets are in the mist of a decent sell-off. The last 6 months or so have not been kind to the global markets. The S&P 500 is holding up surprisingly well in the face of much deeper losses in small caps, foreign stocks and emerging markets:

Now is a good time to remember that it’s not necessarily volatility that makes investors nervous; it’s losing money. No one really complains about upside volatility. Because of the recent losses a number of people have asked me over the past few days some variation of, “What’s going on with the stock market? Is the next move higher or lower from here?”

Investors are always worried about whether it’s time to be bullish or bearish. At times like this it’s much more effective to be humble in your approach. Last weekend the New York Times summed up the 2016 outlook piece from the excellent team over at Bespoke Investment Group (highlights are mine):

Not everyone has come up with a year-end target for the index, however. Among the reports on the future path of the market, one was perhaps the most useful and certainly honest. Bespoke Investment Group published it. Its three authors, Paul Hickey, Justin Walters and George Pearkes, began their 2016 forecast with this disarming statement: “We have no idea.”

This candid disclosure ensured that the authors will not have to eat their words. They acknowledged that their lack of specificity might be unsettling: “That’s probably the last thing you wanted to hear from us regarding our views towards the next year in the stock market. In all honesty, though, to try and look out one year from now and tell people what the market will or will not do is a fool’s errand.”

Yet they had plenty of interesting and skeptical things to say in the 161-page report. They explained why it is possible that the market will soar and finish 2016 with a double-digit gain — and why it is also quite possible that the long bull market is coming to an end this year. There is no certainty about either outcome, of course.

Very few firms or individuals on the sell side would admit to this line of thinking to the public or their clients. There are plenty of big egos involved in the financial markets. It takes self-awareness to be able to admit that you don’t really know what’s going to happen in the next 12 months. Even though they know better, many investors just can’t or won’t admit this to themselves. Others blindly assume that their favorite overconfident pundit really does know what’s going to happen.

In a recent interview with a European business publication, legendary investor Howard Marks shared similar sentiments when discussing the current environment:

This is one of the factors that contributes to making the world a risky place today. In the United States, we had seven years of super low interest rates to try to stimulate. That has never happened before. What are the long term effects on the economy? What’s the effect on lending behavior? And, how will that go now that the Fed has started to raise rates? What will that do to the world? The answer is very simple: We don’t know. And anybody who thinks he knows is kidding himself.

The only thing that seems obvious to me is that those who are certain of the outcomes from all of this are bound to be wrong.

There are times when it pays to be bullish. And there are times where it pays to be bearish. But there are also those times where it makes sense to be humble in your market views and admit that we’re in a difficult environment. There’s never been certainty in the markets, but today we’re at a point in the cycle where I would be long humility, in size.

Sources:

One Market Prediction Is Sure: Wall Street Will Be Wrong (NY Times)

The Risks Today Are Substantial (FUW)

Further Reading:

Common Sense Thoughts on Stock Market Losses

Now here’s what I’ve been reading this week:

- Institutional investors, their just like us! (Meb Faber)

- Short-term luck vs. long-term skill (What Works on Wall St)

- Are commodities a necessary portfolio component? (Reformed Broker)

- 9 advantages of goals-based investing (Betterment)

- Probably everything you need to know about bear markets (Irrelevant Investor)

- A cautionary tale on teacher’s pension funds (A Teachable Moment)

- Cash is not king in your 401k (Cramer’s Shirt)

- The farce awakens (TRB)

- Personal finance sophistication (Abnormal Returns)

- The do’s and don’ts of a market crash (WaPo)

The We Don’t Know approach represents the kind of humility and candor that is rare in the industry and few firms believe they can use with success to grow their business. Vanguard is a great example, though, that it can be done.

Yeah I often wonder how much of this is hubris and how much is incentives.

There isn’t a firm or expert out there who has anything other than a guess. Their predictions are usually based on what they think will make them more money.

So if a financial professional “doesn’t know” but charges you a huge fee on assets under management, why should you employ them?

if you’re looking for someone who can predict the next 12 months as an advisor you’re doing it all wrong. that person doesn’t exists. here’s where a good advisor can help:

https://awealthofcommonsense.com/financial-advisors-can-fend-robots/

https://awealthofcommonsense.com/real-financial-advisors/

https://awealthofcommonsense.com/managing-someones-elses-emotions/

Behavioral coaching and financial planning are under-rated aspects of a financial advisor’s job.

My question was tailored more towards the purpose of a financial adviser. Especially one that admits they really don’t know a lot. You answered my question with the last sentence.

I agree that making a forecast for the next year is a fool’s errand, and anyone who asks an adviser/fund manager/investor to do blind forecasts is fooling themselves. Yet, those are the people who get a lot of the visibility.

Behavioral coaching/guidance is the primary key to clients’ successes in equities. If you are no good at that, you will not be very successful as an advisor. Discretionary management is a must for me. Otherwise, not a good fit.

Exactly.

Because they are willing to admit they do not know!

So you are willing to pay huge fees to someone who admits they do not know? Why do you think those on the sell side don’t admit it? They know it would be financial suicide

Their admittance should make you realize your best bet is to save fees and use index funds or ETFs.

Because you aren’t paying the professional for their predictive skills (if you are, you shouldn’t be.) You should employ them because they manage your money well. That is a different thing than knowing where the S&P500 will be in 6 months. Investing is pretty easy to do well, but it’s also easy to make big and costly mistakes. The professional is there to keep you from making those mistakes.

You shouldn’t! All “financial professionals” don’t know. Warren Bufett himself has said many times he has no idea what the market will do in a few months or even years, but he does know that over time they will be up. What does that tell you?

As time goes on, we are learning more and more that the value of a financial advisor is not in their ability to manage money. It’s to shape behavior and help in other areas. But to pay a fee to an advisor or money manager is throwing money away, as more and more studies have shown. Low fees lead to better results.

Steve,

I have come to the conclusion that the person with the most at stake at managing my money is myself. This is why I need to do my best at making the decisions that will affect me.

This is why it doesn’t make sense to outsource the management of my own money to someone else who doesn’t really know more than the average investor. I believe that ordinary investors have the same tools at their disposal that “advisers” or “money managers” have.

That being said, I do try to spend time on that activity and I am satisfied with my results. Some would call me overconfident, but that is fine with me. I am afraid that a lot of research on biases is used as a sales tool to make investors constantly doubt themselves, and therefore get “professional help”. ( or perhaps I am just blinded by the Dunning-Kruger effect ;-))

If someone has absolutely no idea about anything finance related, then an adviser is probably helpful.

I agree. However, the person who has absolutely no idea about investing or finance is the ideal candidate for the salesman out to make a commission. The average investor with average intelligence can do a little reading and put together some ETF’s or index funds in an allocation they are comfortable with. The internet makes it even easier now.

Then there’s known unknowns and unknown unknowns:)