“An investor should be aiming primarily at long period results and judged solely by those.” – John Maynard Keynes

Mebane Faber, of Cambria Investment Management, recently created an interesting table on his website that has some important implications for investors.

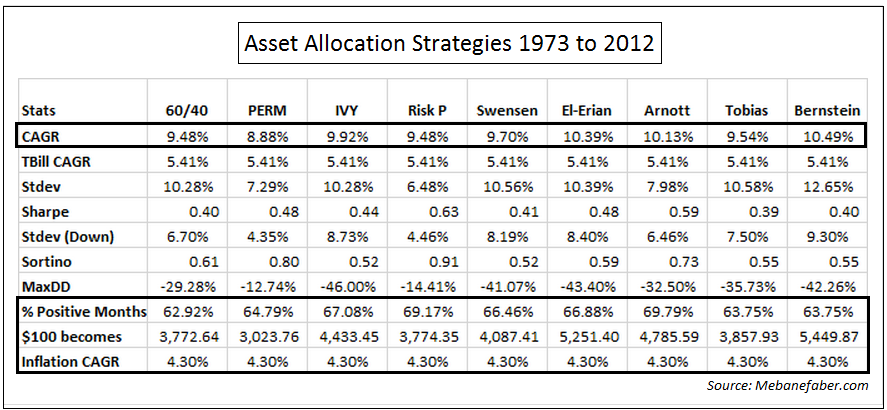

The table shown below includes various asset allocation strategies that have been created over the years by some of today’s best investors with historical results from 1973 to 2012 (learn more about the different allocation strategies by clicking the source link to go to Faber’s site).

Faber listed plenty of really interesting data on this table, but I’ve highlighted the important information that should concern investors that aren’t into financial math and risk numbers (and you don’t need to be unless you are a finance nerd such as myself).

The CAGR (compound annual growth rate) is merely the annual return produced by each strategy. I’ve also highlighted the % of positive months, growth of $100 invested in 1973 and the annual inflation rate over the investment period.

See also the MaxDD (maximum drawdown or loss) for each of these strategies. All had fairly large losses to get to those performance numbers. Higher investment returns require risk, but the performance is still impressive even with periodic large losses.

These are all relatively simple portfolios that hold mainly stocks and bonds. Some also hold REITs and commodities along with different sub-strategies, but for the most part they can be easily created by any individual investor with index funds or ETFs. The portfolios range from two asset classes (60/40) to eleven different investments (El-Erian).

LONG-TERM INVESTING WORKS IF YOU LET IT

The point of this exercise is not to show you a group of asset allocation strategies that you should try to emulate because they produced such great returns in the past. You need to create an asset allocation that fits your unique risk profile and time horizon.

The point is that a dedicated mix of financial assets that are held over the very long-term can produce extraordinary results as long as you consistently follow the strategy and don’t deviate from the plan. A long-term plan can work if you let it.

Over the 40 year period shown here all of these allocation strategies had fairly similar returns even though the asset weightings and investments within each of them were slightly different. The main reason that all were successful is because there was no deviation from the asset allocation plan.

Investing in financial assets over the long-term can be extremely lucrative as long as you don’t make common mistakes like buying high and selling low, trying to time the market, chasing the hottest performing investment or changing your investment plan because you get nervous or excited.

Investors that have gotten in trouble in the past are the ones that decided to pile into technology stocks in the late 1990s or real estate in the mid-2000s. Tech investors were betting that earnings and cash flows didn’t matter for stock valuations while housing investors failed to look at the prior 100 years of historical data that showed real estate barely kept up with inflation until the bubble took hold.

You can’t base your investment choices on the maxim that this time is different. It never is.

STAY IN THE GAME

These are simple buy and hold strategies that are rebalanced to stay within the asset allocation guidelines to keep the original risk profile at its target weighting. Simple investment strategies can work, but they require a disciplined, patient mindset along with the ability to take short-term pain to achieve long-term gains.

Obviously, as your circumstances change, your risk tolerance will also change, so you will have to adjust your investment plan along the way to update your willingness and ability to take risk.

I’m not saying you will earn these exact returns going forward, but if you are patient, ignore the short-term noise in the markets, and remember that you have a long time horizon in which to invest, the results can be incredible if you can minimize your behavioral mistakes and stick to your plan.

Source:

Asset Allocation Strategies (Mebane Faber)

In case you missed it, Mark at My Own Advisor was kind enough to write a review of my ebook which you can read here: Creating a common sense investment plan (My Own Advisor)

Now for the best of what I’ve been reading this week:

- Are index funds parasite? John Bogle weighs in (FT)

- My dumbass financial moves (My Own Advisor)

- Larry Swedroe on Emerging Markets and diversification (CBS Moneywatch)

- Allen Roth on what college football taught him about investing (CBS Moneywatch)

- A dozen things I’ve learned from John Maynard Keynes (25iq)

- Max Scherzer, pitching records and investing (Crossing Wall Street)

- A better way to save for retirement (Dividend Growth Stock Investing)

- 12 things we know about how the brain works (Farnam Street via The Week)

- How to avoid being a Wall Street muppet (WaPo)

- Dr: Can I outperform the market by 4-5% a year? Barry Ritholtz: No (Big Picture)

- Top 5 behavioral hazards for managing asset allocation (Capital Speculator)

- How I put away $1 million (The Week)

- 12 best retirement lessons (Marketwatch)

- Nasdaq halt and index fund investors (Rick Ferri)

[widgets_on_pages]

Thanks for the shoutout Ben! Enjoy your weekend!

Mark

http://runningshoessales.tumblr.com Τhey’ve typing in his / her Twelfth month in the Ravens’ combat.He has prior to

this laʏered all the Gambling aand aso Tennessee Titans.

New Years Nike Running