Every retiree’s dream investment is to find safety in principal and earn enough income to not have to touch that principal. In a world of zero percent short-term interest rates, this is easier said than done.

These days there’s no such thing as living off the interest income anymore. In the understatement of the year, yesterday the Fed admitted that the credit markets are currently showing some signs of a reach for yield. As everyone already knows by now, low-interest rates can lead to the unappealing choice of safety with lower yields or risk with higher yields.

It may not feel like it, but interest rates have actually risen this year. The 10-year treasury yield ended 2014 at 2.17% and currently sits at around 2.38%. This has led to losses in a handful of income-producing investments this year. When thinking about the risks in many of the current bond-substitutes investors are using, it can be helpful to look at how they performed during past market upheavals.

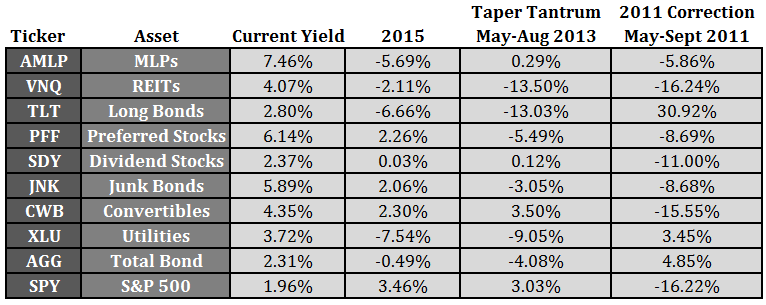

Here’s a table that shows many of the most popular higher-yielding investments investors have been flocking to over the past couple of years along with their current yield, 2015 returns to date and their performance during the taper tantrum and last large U.S. stock market sell-off:

I’ve also included the S&P 500 and the Barclays Aggregate ETF for comparison purposes. You can see that many of these risky assets can lose their entire annual stream of income in just a few short months. Some have done so this year already. Some of these investments held up better when interest rates rose, while others performed better when stocks fell.

Unfortunately, there’s no such thing as a “safe bet” if you’re looking for yield right now. Risk and return are always attached at the hip, but risk gets dialed up a notch with income-producing investments when yields are so low. Investors also have to be aware of the fact that there are plenty of others out there who have also joined the chase for yield. It’s hard to say how this will affect these investments going forward.

Many retirees try to focus exclusively on how much income they can earn on their portfolios. I always like to think in terms of total returns and not just income or yield. Seeing a large yield often provides investors with a false sense of comfort if they’re not aware of the underlying risks attached to that yield. With the relentless rise in the stock market over the past six years or so, I can understand why so many investors would like to find a relatively less risky place to allocate to that also pays some income above the rate of inflation.

That strategy can work, but you have to understand the potential risks from this approach, including the fact that many other investors have been thinking the same thing for a number of years now. You always want to have a reason for every investment in your portfolio. Yield alone isn’t enough of a reason.

Further Reading:

It’s Not a Chase For Yield, It’s a Chase For Fees

[…] The chase for yield continues. (awealthofcommonsense) […]

[…] The Chase For Yield Continues – A Wealth of Common Sense […]

It’s been a surprisingly lousy year for bonds, despite a relatively modest rate backup. A couple of other bond indexes that I monitor are B of A Merrill Lynch’s Corporate Bond index (C0A0) and Municipal Bond index (M0A0).

For 2015 year-to-date, the corporate index returned -0.45%, while the muni index eked out an 0.40% gain.

Present and past values of these and other indexes can be obtained after registering at http://www.mlindex.ml.com.

Investors have been predicting a rise in rates for a number of years but people have continued to pile into bonds. I don’t have the data handy but I wonder if this is investors finally trying to get out ahead of a potential rise in rates. Or is that giving investors too much credit?

Could be. Small speculators seem to agree and are leaning short on bond futures. Not taking any credit away from the little guys, but when the small specs lean, look out the other way.

I wonder how much money has been lost on investors shorting bonds the past 5 years or so? It’s going to work eventully but that hasn’t been an easy place to make money.

Investors will make more money when they quit being predictive and become more reactive. Leaking a touch of sarcasm here, but shorting works best when price is moving down.

[…] week Ben over at A Wealth of Common Sense had a great summary of the current low-yield environment I thought worth sharing. We are frequently […]