Here’s an email we got from a podcast listener recently:

This sounds like something people only say during a bull market. But it’s also kind of a fair question in some ways.

Volatility is not risk unless it causes you to make an investment error. In fact, volatility is an opportunity if you use it correctly.

And the U.S. stock market has bounced back to new all-time highs from every single correction, bear market and crash in history so that can make it feel like stocks are risk-free in some ways.

However, even a ten-ish plus year time horizon can be painful at times.

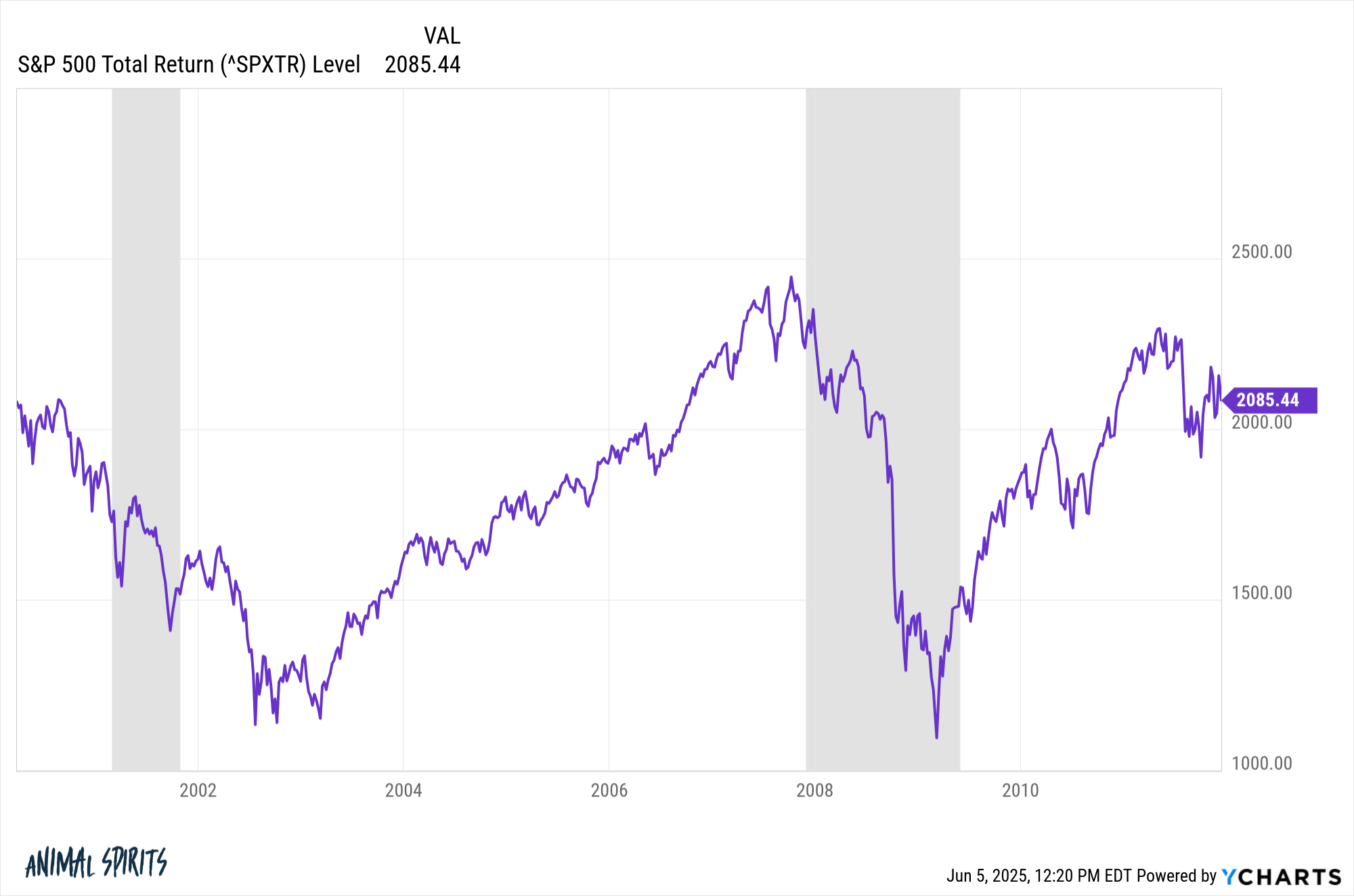

You don’t have to look that far back in history to find a lost decade scenario:

From early-2000 through the end of 2011, the S&P 500 went nowhere. And this is total returns including the reinvestment of dividends. That’s a lost 12 years where the market did nada for you. It certainly felt risky to investors at the time.

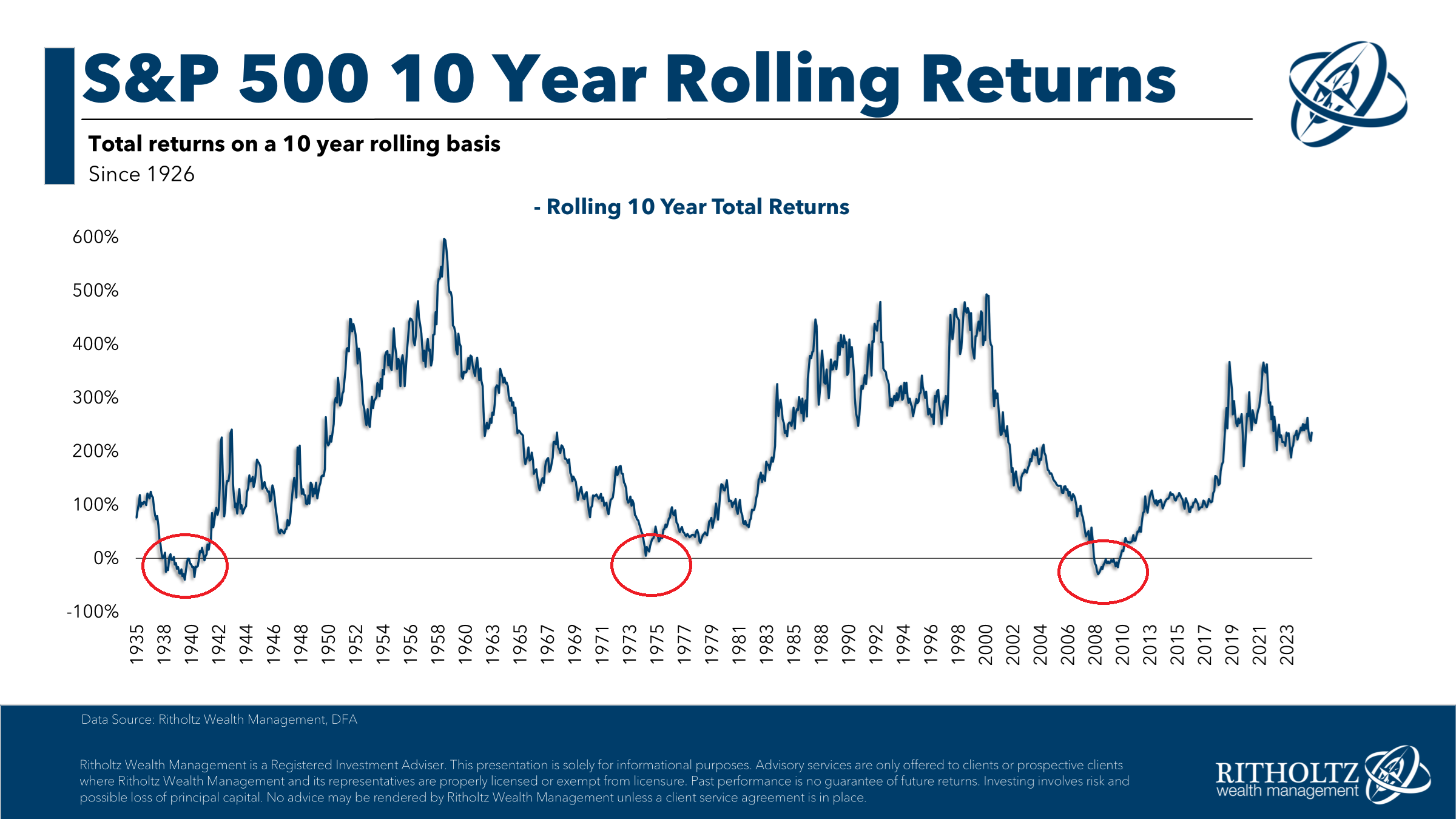

To be fair, it’s rare to see this type of risk. Over the past 100 years or so, returns have been positive over rolling 10 year returns 95% of the time:

That’s a great win rate. The median 10 year return was a +175%.

But you can see there have been three distinct periods of poor decade-long returns — the 1930s, 1970s and 2000s.1 Ten years can feel like an eternity when it comes to watching your portfolio just treading water.

That’s real risk.

But risk is also in the eye of the beholder when it comes to market environments like this.

If you’re still saving and investing on a regular basis, a highly volatile market that goes nowhere for a decade is a godsend. If you dutifully plowed money into the market from 2000-2011 you set yourself up for the epic bull market that followed the lost decade.

Some people do not have the ability to simply sit tight during markets that spin their wheels for 10 years so they diversify. Diversification can offer you a smoother ride and gives you the ability to lean into the pain through regular rebalancing.

But all of this talk is purely theoretical to an investor who hasn’t lived through a lost decade and felt the agony they can bring.

As Fred Schwed so eloquently wrote:

Like all of life’s rich emotional experiences, the full flavor of losing important money cannot be conveyed by literature. You cannot convey to an inexperienced girl what it is truly like to be a wife and mother. There are certain things that cannot be adequately explained to a virgin by words or pictures. Nor can any description that I might offer here even approximate what it feels like to lose a real chunk of money.

It’s easy to say what you would do in that situation but you don’t know for sure until you actually live through it.

I don’t know when this will happen again.

Maybe market cycles have sped up and we get more frequent drawdowns but they don’t last as long. Or maybe that’s wishful thinking and the next financial crisis will lead to a prolonged period of discomfort in the stock market. In fact, the assumption that we’ve somehow done away with extended downturns probably makes it more likely we will see one because of a Minsky mindset.

Either way, it’s always good to stress-test your portfolio to better understand the types of risks you could encounter in the markets.

I agree that extending your time horizon as an investor is always helpful.

But risk still exists.

Michael and I talked about the idea of the S&P 500 being risk-free and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Could We See Another Lost Decade in the U.S. Stock Market?

Now here’s what I’ve been reading lately:

- What does generational wealth look like? (Whitecoat Investor)

- What do we do when it breaks? (Seth Godin)

- 12 amazing facts about the Dow (Carson Group)

- The impact of sports betting apps (Kyla’s Newsletter)

- The money pit (Fast Company)

- Panic is a bad strategy (Random Roger)

- What’s the best retirement withdrawal strategy? (Dollars & Data)

Books:

1And the 1970s results are worse than they look because inflation was so high.