Today’s Animal Spirits is brought to you by NEOS Investments and Fabric:

See here for more information on NEOS Investments’ option-based ETFs

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

On today’s show, we discuss:

-

- Why Trump Blinked on Tariffs Just Hours After They Went Into Effect

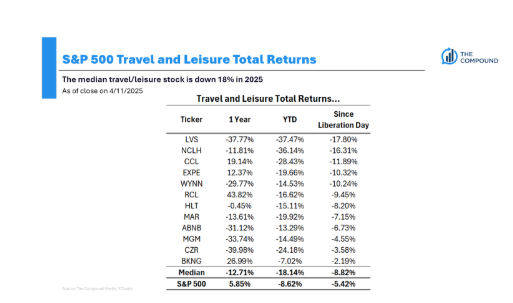

- The Companies and Markets Hit Hardest by Trump’s Tariffs

- There’s No Coming Back From Trump’s Tariff Disaster

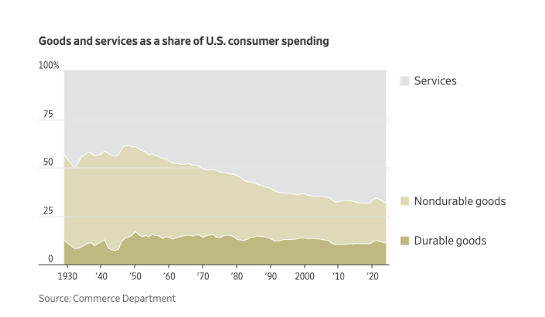

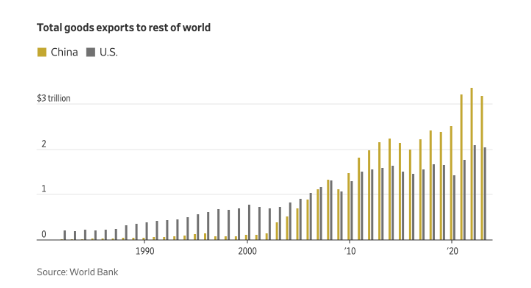

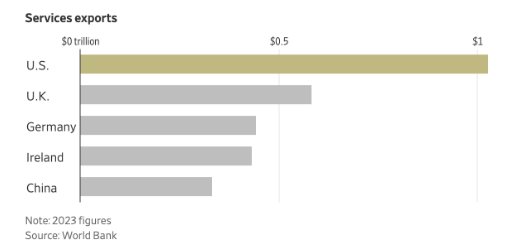

- What to Know About the U.S. Trade Imbalance, in Charts

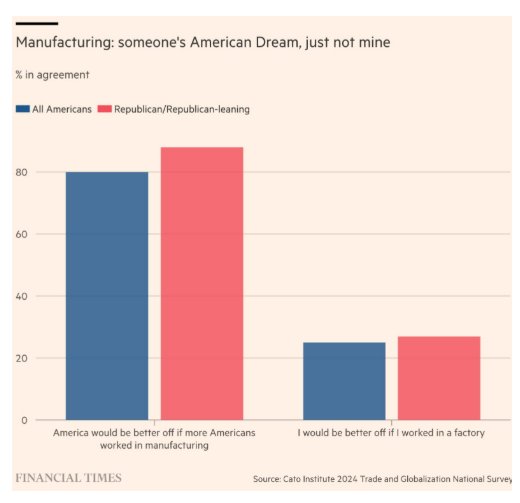

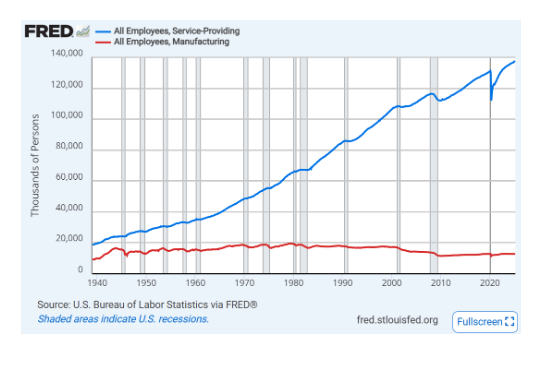

- How the U.S. Lost Its Place as the World’s Manufacturing Powerhouse

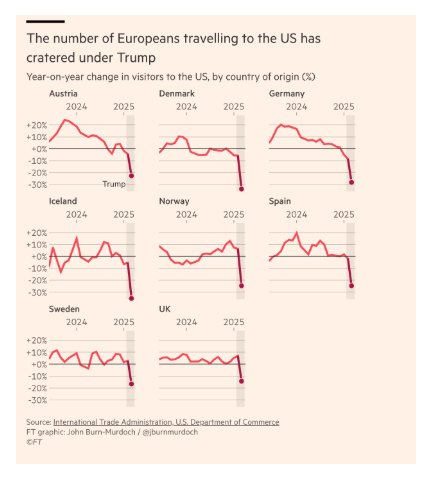

- European travellers cancel US visits as Trump’s policies threaten tourism

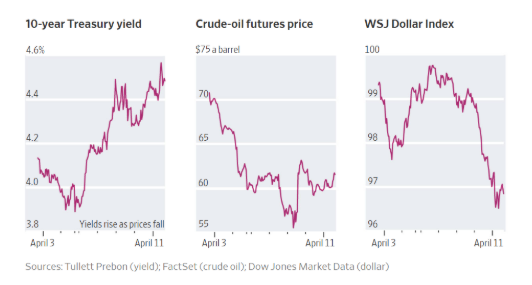

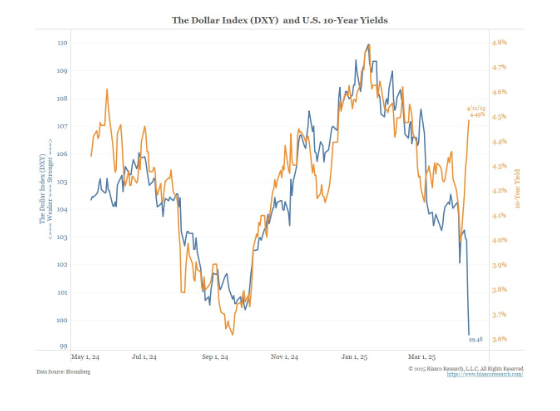

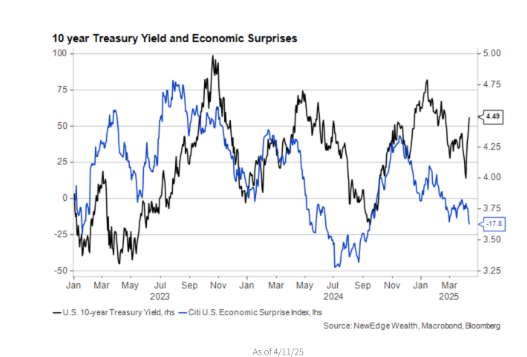

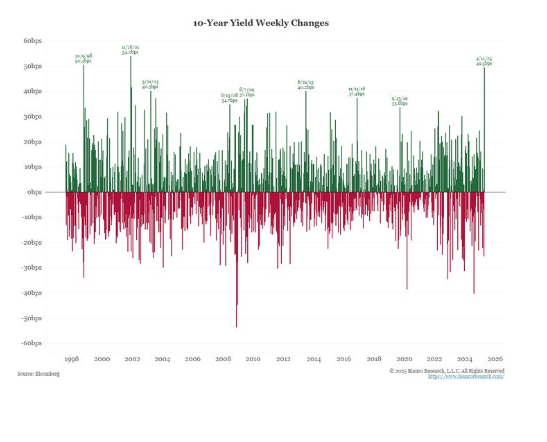

- Bond Vigilantes

- Maybe You Should Sell Some Stocks

- Mike White Slams ‘White Lotus’ Composer Quitting: “A B**** Move, He Didn’t Respect Me”

Listen here

Recommendations:

- A Complete Unknown

- Civil War

- 1923

- The Pitt

- White Lotus

- Severance

- Your Friends and Neighbors

- Dope Thief

- The Studio

Charts:

Tweets/Bluesky:

Hearing everyone’s thoughts 24/7 is the worst thing to happen to society since the mosquito.

— Michael Antonelli (@BullandBaird) April 11, 2025

$DXY US Dollar Index worst 2-week plunge since 2009 pic.twitter.com/jyv5uYFgvv

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) April 11, 2025

The outlook for new orders from NY Fed regional manufacturers literally hit the lowest level in the history of the survey. (HT: @fcastofthemonth) pic.twitter.com/vkbaVJTG4c

— Joe Weisenthal (@TheStalwart) April 15, 2025

BofA: Total card spending per household (HH), as measured by BAC aggregated credit and debit cards, was up 2.2% year-over-year (y/y) in March.

We forecast a robust March retail sales report. Mixed evidence on front-loading. No sign yet of negative wealth effects from stock…

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) April 11, 2025

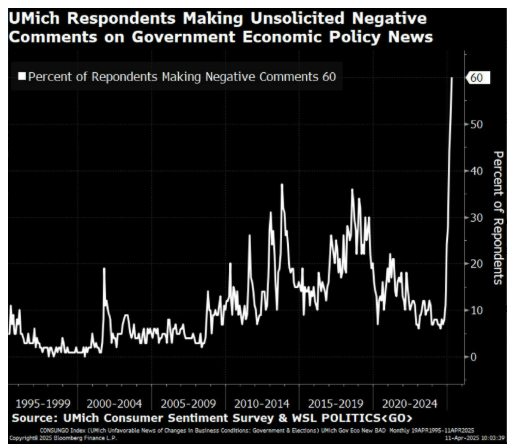

Consumer sentiment among self-identified independents is now lower than it was at the low point of Biden's presidency, when gas prices and inflation were soaring, according to the latest University of Michigan survey. pic.twitter.com/93NTlvmMzu

— Nick Timiraos (@NickTimiraos) April 11, 2025

Market timing will never die bc humans but man it took one on the chin today. I have to imagine a lot more ppl just joined Vanguard's 'not changing course regardless of what i see or hear' camp. COVID rally did same thing- which could be why the inflows seem to get stronger with…

— Eric Balchunas (@EricBalchunas) April 9, 2025

60% of general admission ticket buyers at Coachella used Buy-Now-Pay-Later to finance their tickets, per Billboard.

— unusual_whales (@unusual_whales) April 14, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product