A reader asks:

I’m 46 and plan to retire by 55. I’ve calculated that I’ll reach my retirement number in another 6 years giving me a decent buffer for retirement. I have a $500k mortgage at 5.625% with 28 years left. I’m comfortable with debt and don’t see a big concern. I agree with your thoughts on liquidity, and inflation reducing the debt load. The only concern is retiring with the mortgage. We plan to move after retirement and not stay at this house. I’ve run calculations and there’s no significant difference either way. Discretionary spending is slightly reduced until retirement in the payoff scenario but increases by $50k over lifetime. It seems like it’s ultimately my decision. I’d appreciate any suggestions on how to approach it. -Raj

There are a lot of good personal finance angles to this question.

First of all I’m always fascinated as to why people invariably pick 55 as their early retirement age. I get questions like this all the time. The age is never 53 or 57. It’s always 55. Maybe people just like round numbers.

Paying off your mortgage early is a hotly debated personal finance topic. Both sides of the argument have strong feelings.

I’ve talked to plenty of people who have paid off their mortgage early and none of them regret it. It’s more about peace of mind than a spreadsheet decision. That’s understandable.

However, I do feel strongly that it basically never makes sense to pay off a low-rate mortgage early. And plenty of people still have ultra-low rates from the pandemic:

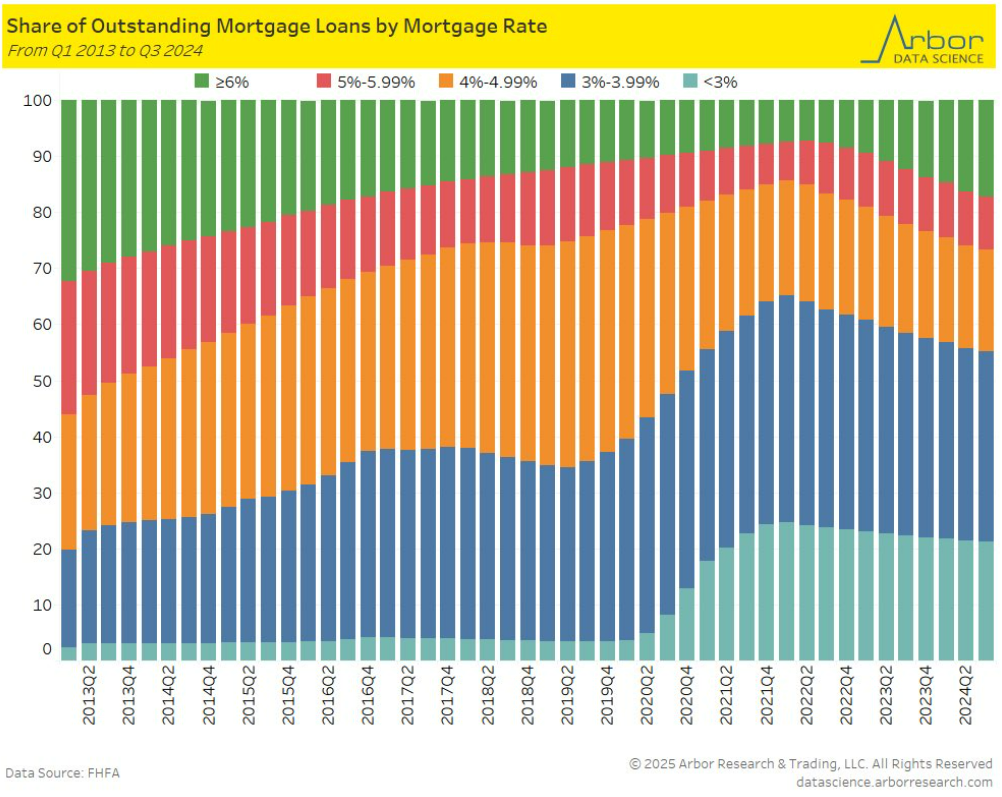

Around 60% of all mortgages are 4% or less. When you factor in the tax breaks and inflation it just doesn’t make sense to me why you would want to get rid of debt at such favorable rates. You’ll have to pry my 3% mortgage from my cold, dead hands.

To each their own I guess.

However, I think the calculus changes when considering early retirement.

Retirement itself involves a seemingly unending list of unknowns — future returns, inflation, your lifespan, interest rates, unexpected events, family circumstances, sequence of returns, withdrawal rates, etc. Retirement requires taking a huge leap of faith. Retiring early only adds to the degree of difficulty.

I like the fact that Raj ran the numbers here to understand the financial impact of paying off the debt.

As much as I hate paying off your mortgage early, I actually like the idea of having no mortgage in retirement. It offers an added margin of safety and peace of mind.

One of the reasons a fixed-rate mortgage is such a good deal is because your wages should grow over time. When you retire there are no more wages to rely on to help shoulder that monthly mortgage burden.

But there is another piece of information he shared with us here that is relevant — Raj and his wife don’t plan on staying in the house when they retire. That changes the equation for me.

You almost have to look at this from more of a financial asset perspective than a personal finance angle.

If you’re planning on selling the house when you retire anyway I don’t see the need to pay off your mortgage. Either way, you’ll receive the proceeds from your home equity when you sell. Yes, the amount would be much larger if you paid it off earlier, but that also means you would be tying up that money as an illiquid asset in the meantime.

Who knows what the housing market will look like when you go to sell in a decade? What if you can’t sell as quickly as you would like?

This is the kind of choice where there likely is no right or wrong answer. It all depends on your relationship with debt, illiquidity and risk.

You also have to remember that 9 years is a long time. Maybe your plans change. Maybe circumstances change.

I would put a premium on flexibility.

We covered this question on this week’s Ask the Compound:

Barry Ritholtz joined me on the show this week to discuss questions about timing market corrections with your savings account, how your portfolio should look heading into retirement, managing your parent’s financial plan and how to force yourself into splurging a little when you have more than enough money.

Further Reading:

How Much is a 3% Mortgage Worth?