A reader asks:

My wife and I plan on selling our house once my youngest graduates high school in 2.5 years. My wife is pushing for us to sell it this Spring of 2025 instead of waiting until Spring of 2027 because she believes home prices will be down considerably in 2027 due to Trump’s policies and inflation. I tried to channel my inner-Ben and let her know that there is no way to predict these things, but she is pressing me hard. Any suggestions on how to address someone who thinks they know home prices will be lower in 2027 than in 2025?

I’m not sure how I feel about being used in a marital disagreement but I like the topic here.1

Ben’s common sense rule of thumb #347 is don’t mix politics with your portfolio. Have all the political views you want but predicting how any one political party or individual politician will impact the market is a fool’s errand. Investors are almost always wrong about these predictions.

Vibes are not actionable for investing purposes.

I’m also not a huge fan of timing the housing market.

Back in April 2021, I received a question from a homeowner in Seattle who was wondering about taking some cash off the table:

The housing market is still crazy, my neighbor just sold his house for $1M+, based on what the real estate apps say I could sell this same house less than 3 years after I bought it and, after costs and paying the mortgage, walk away with about $500k. I know it is not a lot of money & I am not planning to sell because this is my primary residence but it made me think: there has to be a point where it makes mathematical sense to sell a house and just start renting. What are your thoughts?

The housing market did seem crazy back then. Mortgage rates were at 3%. There were bidding wars all over the country. Prices were going bananas.

And guess what?

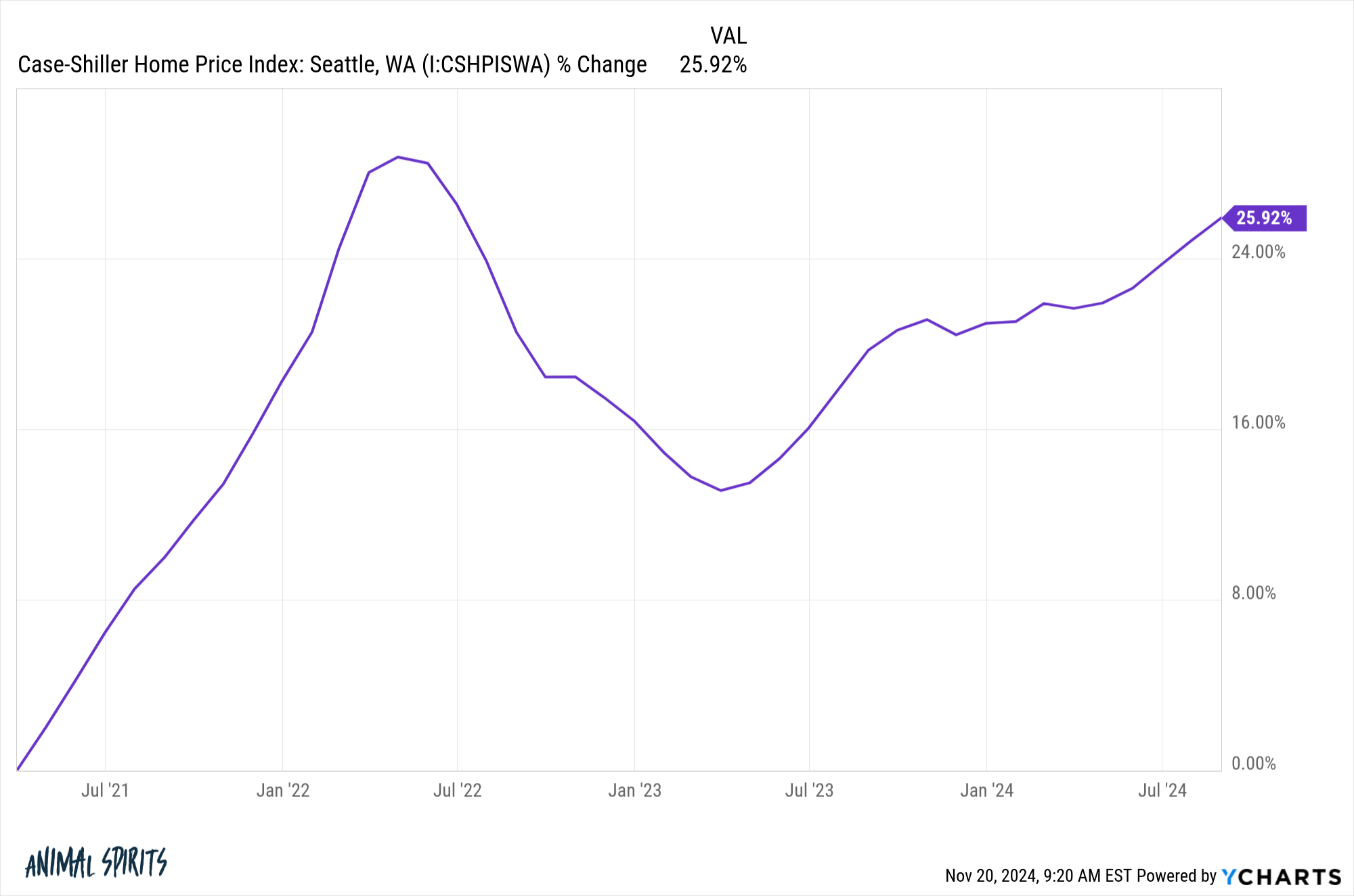

Things got even crazier. Look at housing prices in Seattle since then:

They’re up almost 30%, despite a brief pullback.

Taking money off the table would have meant leaving money on the table.

Obviously, no one times these transactions perfectly. Plus, a house isn’t meant to be traded like a stock. You’re not supposed to jump in and out of it or timing the market.

If you can afford to service the debt and the ancillary costs of home ownership, you should buy if that’s what you want to do.

If you need to sell your home, you should do so in a time frame that suits your needs and psyche.

I especially hate the idea of trying to time the housing market using macro variables. Mortgage rates first hit 6% sometime in the fall of 2022. How many people have been waiting for them to fall ever since? And they’ve actually gone higher, yet prices never came down!

Maybe Trump is bad for the housing market, maybe not. Let’s say his policies do cause inflation to come roaring back. Inflation is typically good for housing prices. Housing was the best asset class in the 1970s, outperforming stocks, bonds and cash. Housing was a wonderful hedge against high inflation in 2022.

So thinking about it from that perspective doesn’t make a lot of sense.

But maybe your wife simply wants some peace of mind. She knows you have to sell in a few years. Waiting around with that hanging over your head can be stressful. Buying a new house while selling an existing property can be a tricky situation from a timing perspective.

When my wife and I were building our lake house we already owned another property in the same development. We knew we had to sell the first home at some point to help with the down payment on the new place.

This was back in the summer of 2022 when mortgage rates were just starting to rise. We saw them go from 3% to 5% in a hurry and we were nervous about how it would impact potential homebuyers. So we put the house on the market a full year before the new house was finished.

Maybe we missed out on further upside but we didn’t care because locking in the sale ahead of time completely took that worry off our plates.

A home is already the most emotional financial asset in existence so I don’t like introducing politics into the equation. That supercharges the emotions even further, turning it into a 3x leveraged ETF-like situation.

However, I do think it’s worth discussing the pros and cons of selling now versus waiting from a stress management perspective.

It’s hard to put a price on peace of mind.

Barry Ritholtz joined me on Ask the Compound this week to discuss this question:

We also answered questions about when it’s time to fire your financial advisor, the impact of the presidential election on the markets and economy, investing a pile of cash during a bull market and the best hedge for China invading Taiwan.

Further Reading:

The Problem With Timing the Housing Market

1Who am I kidding? I love it!