The best compliment I can offer any financial writer:

I wish I had written that.

I’ve had that thought about John Rekenthaler’s work numerous times over the years. I’ve always admired his common sense, straight-shooter approach to investment writing.

Last week, Rekenthaler penned his farewell column for Morningstar. Instead of providing a retrospective on his own career, he wrote an ode to the U.S. stock market.

Rekenthaler joined Morningstar in 1988. He wrote about how the stock market has been doubted ever since:

Among the first issues of Barron’s that I read featured a gentleman named Bob Prechter, who predicted that the Dow Jones Industrial Average would soon drop to 400. At the time, the DJIA was at 2,000. It’s now just north of 44,000.

Prechter’s claim was extreme, but his sentiment was typical. The arguments against stocks were legion. After 12 years of GOP prosperity, a Democrat was in the White House. Equity investors were irrationally exuberant. The CAPE ratio showed that stocks were historically expensive. The global economy’s “New Normal” after the 2008 global financial crisis would depress equity prices. The Federal Reserve had propped up the marketplace through its policy of quantitative easing. Beware when it removed the training wheels!

That is my salient career memory: the perpetual belief that equity investors had missed the party. Yet, they never have.

There was an ever-present wall of worry for Rekenthaler’s entire 37+ year career in the investment business.

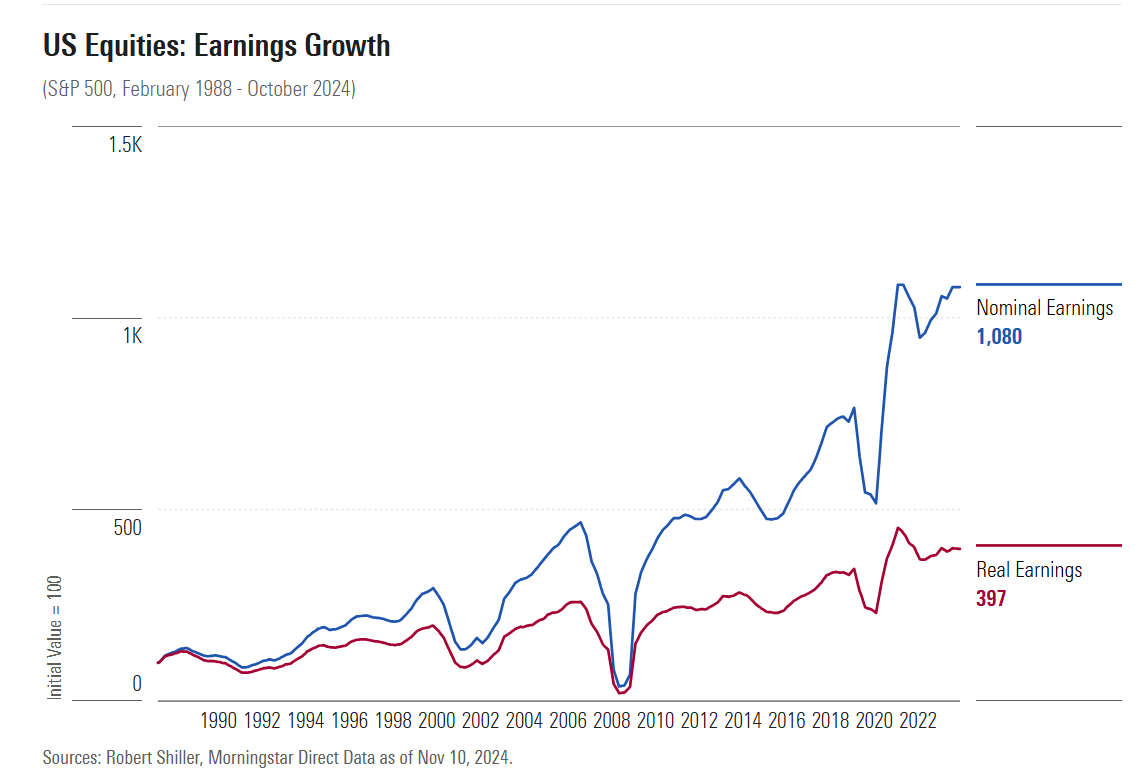

You could credit the Federal Reserve, interest rate policies, government spending, rising valuations, etc. for this run but look at the fundamentals:

Earnings were a ten-bagger. Revenues grew. Dividend payments grew. So stock prices went up…a lot.

Rekenthaler called his farewell column “a tribute to the miracle of U.S. equities.”

Now I could hit you over the head with the wonderful returns during the bull markets and best times but the truly miraculous returns include all the bad stuff that’s taken place over the decades.

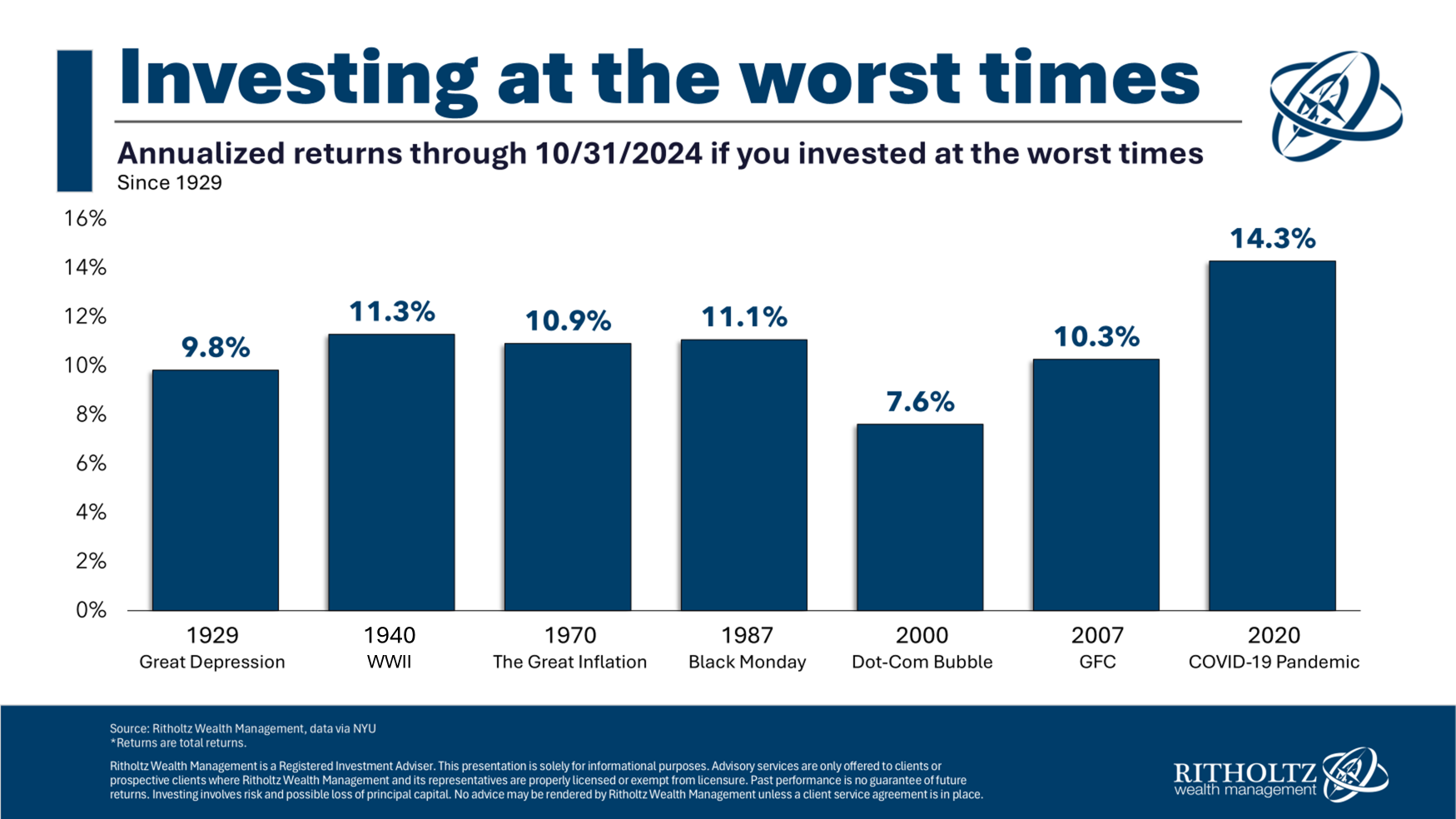

I looked back at the historical returns from some of the worst starting points in stock market history to be an investor:

I took the returns from the start of each year that included some of the most unfavorable market, economic and geopolitical events of the past 100 years or so.

The results have been spectacular even from awful starting points. Time heals all wounds in the stock market.

Obviously, the usual caveats apply here. The winners write the history books. We don’t know if the next 100 years will be as good as the last 100 years blah, blah, blah.

I’m a fan of celebrating your wins.

We should be celebrating the miracle of the U.S. stock market.

It’s the greatest wealth-building machine on the planet.

Further Reading:

31 Years of Stock Market Returns