There are certain financial publications that you can just tell have a European bent to them.

They use words with an extra “u” like favourite, glamour, or colour. They use cheque instead of check. And per cent has a space for some reason.

The Financial Times and The Economist come to mind.

The Economist has a new special report with a series of stories about how America is the envy of the world, economically speaking:

Some people would have you believe America is falling apart right now. It’s crumbling before our very eyes.

Reading through the report this was the feeling I got from our European counterparts:

What’s wrong with you bloody Americans?!

Allow me to summarize using some graphs they produced.

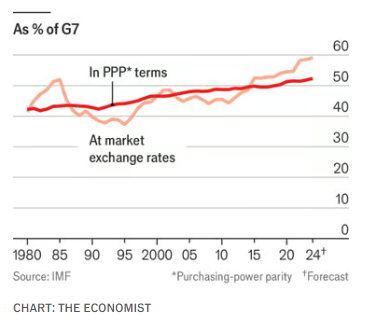

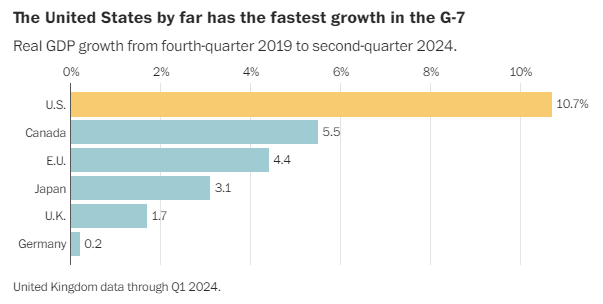

Our share of economic growth relative to the biggest developed nations continues to rise:

Productivity is increasing at a faster rate too:

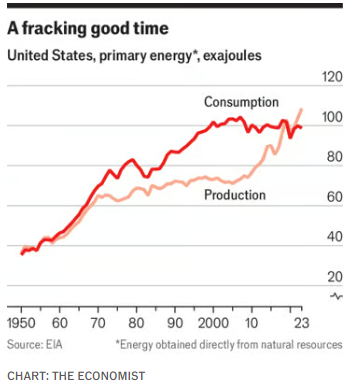

We are basically energy-independent:

And dominate the world’s financial markets:

We’re the richest, most prosperous nation on the planet and there’s not a close second (sorry China).

I know we’re in an election year and that colors the messaging but it feels like no one is celebrating this fact.

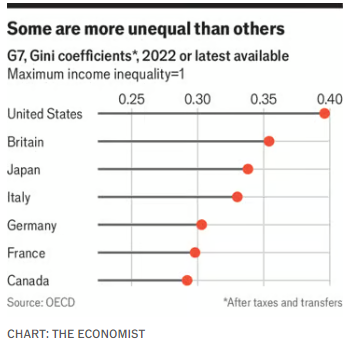

Of course, our system is far from perfect. The Economist points out we also have the worst inequality:

Unfortunately, I don’t think we become the wealthiest nation in the world without this outcome. It’s the catch-22 of the American way.

The world is awash with negativity these days so let’s stick with the positive.

Here’s some more good news from The Washington Post:

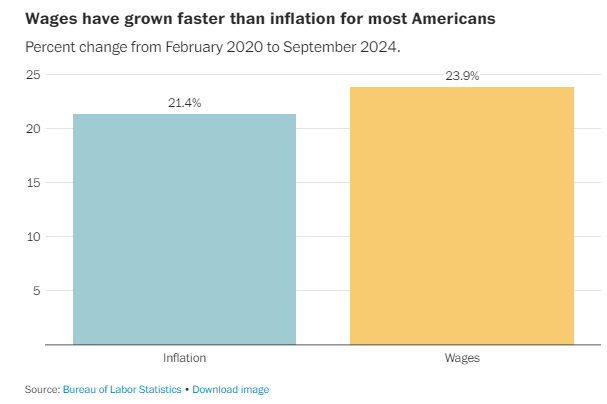

Inflation has been painful but wages have more than kept pace since the start of the pandemic. The people screaming about inflation never tell this side of the story.

The U.S. has experienced far and away the highest growth among developed nations since the pandemic:

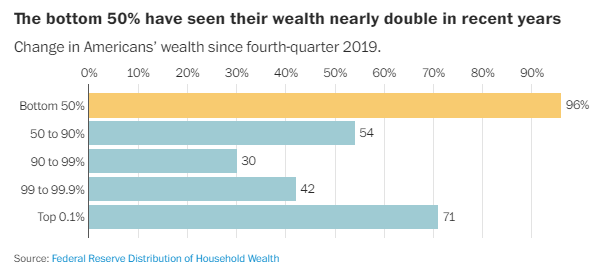

Wealth has skyrocketed, especially for the bottom 50%:

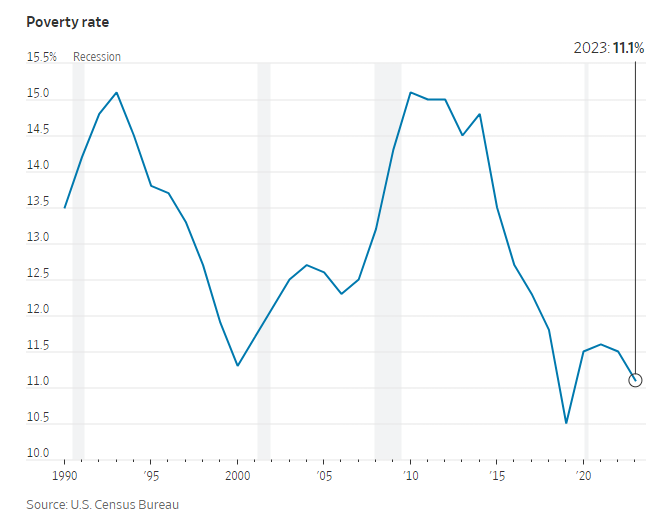

Let’s keep going. Check out this chart on the trend in the poverty rate from The Wall Street Journal:

The 1990s were economic nirvana. We’re currently in a better place than that.

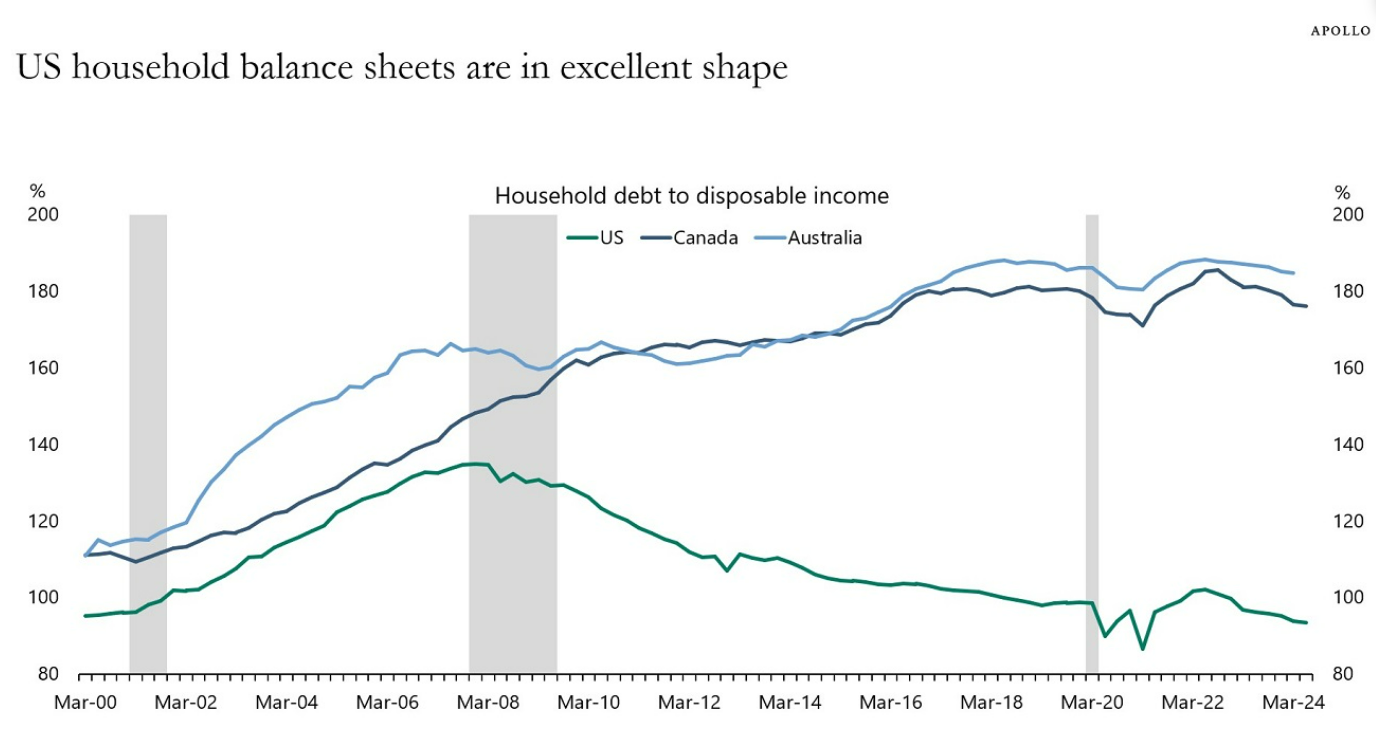

It’s not just economic growth were America outpaces our global peers. Per Apollo, our household balance sheets are in far better shape too:

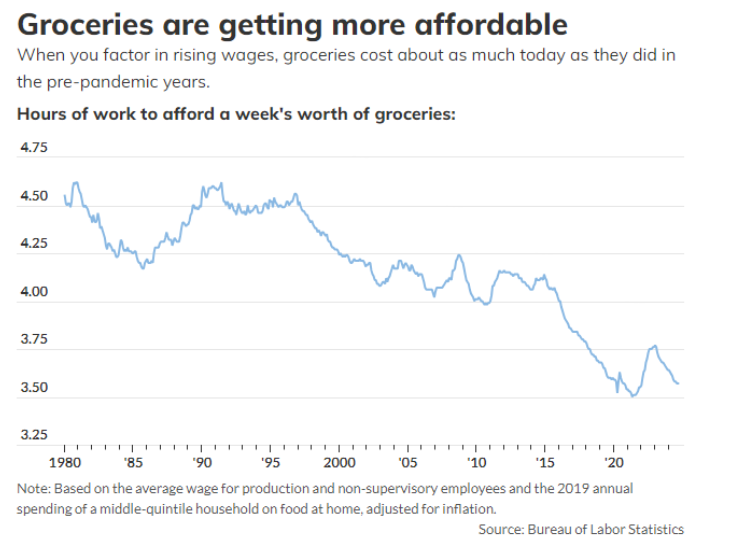

I know inflation is one of the reasons so many people remain negative on the current economic environment but look at this chart from MarketWatch on grocery prices relative to wages:

Things were far worse in the 1980s, 1990s and 2000s. Yes, there was a spike when inflation went crazy but it’s rolling over again now that wages are outpacing price growth again.

Things were far worse in the 1980s, 1990s and 2000s. Yes, there was a spike when inflation went crazy but it’s rolling over again now that wages are outpacing price growth again.

It’s surprising when you put prices in context, isn’t it?

Look, I’m not saying we have to throw a parade. I know there are still people who are hurting and being left behind.

The U.S. economy is the envy of the world but it’s far from perfect.

Still, we are living through one of the best economic environments of the past 50 years, and so many people are stuck in a doom-loop of negativity. They think this country is falling apart.

It’s not!

Inflation peaked two-and-a-half years ago. The unemployment rate has averaged 3.8% for the past two years (it never got that low even once in the 1970s, 1980s, or 1990s). Real GDP keeps growing by roughly 3% per quarter.

We made it through a pandemic and four-decade high inflation and came out the other side in a great place!

Things are objectively good in the U.S. economy right now.

Yet we’ve entered a new normal of negativity where people think they’re doing fine but the world has gone to hell.

A combination of social media and the increasing polarization of politics is obviously playing a huge role here.

This excerpt from Sebastian Junger’s Tribe has stuck with me since reading the book:

The United States is so powerful that the only country capable of destroying her might be the United States herself, which means that the ultimate terrorist strategy would be to just leave the country alone. That way, America’s ugliest partisan tendencies could emerge unimpeded by the unifying effects of war.

This does worry me.

I am glass-is-half-full by nature but I’m not naive. I know we’ll have recessions, geopolitical crises and financial crashes in the future.

Regardless of our issues I remain a long-term bull on the United States.

The Economist concludes its special report with the following:

Our view is that it has ample economic capacity to do just that, as long as its politics allow. There will, of course, be downturns, doubts and drama along the way. But if you want to bet against America, The Economist will gladly take the other side of the wager.

Me too.

God bless America.

Further Reading:

The News is Making You Miserable