A reader asks:

I know Ben talked about rate cuts and the stock market a few weeks ago but what about the economy? Did Powell just guarantee a soft landing by cutting 50 basis points this week?

There are no guarantees in life or the markets, unfortunately.

The rate cut helps the soft landing scenario but you never know with these things.

Let’s invert this question and start with what Fed rate cuts don’t mean.

Rate cuts don’t mean a recession is coming. Sometimes the Fed is forced to cut rates because of a financial crisis or slowing economy but rates cut in and of themselves don’t just happen during a slowdown.

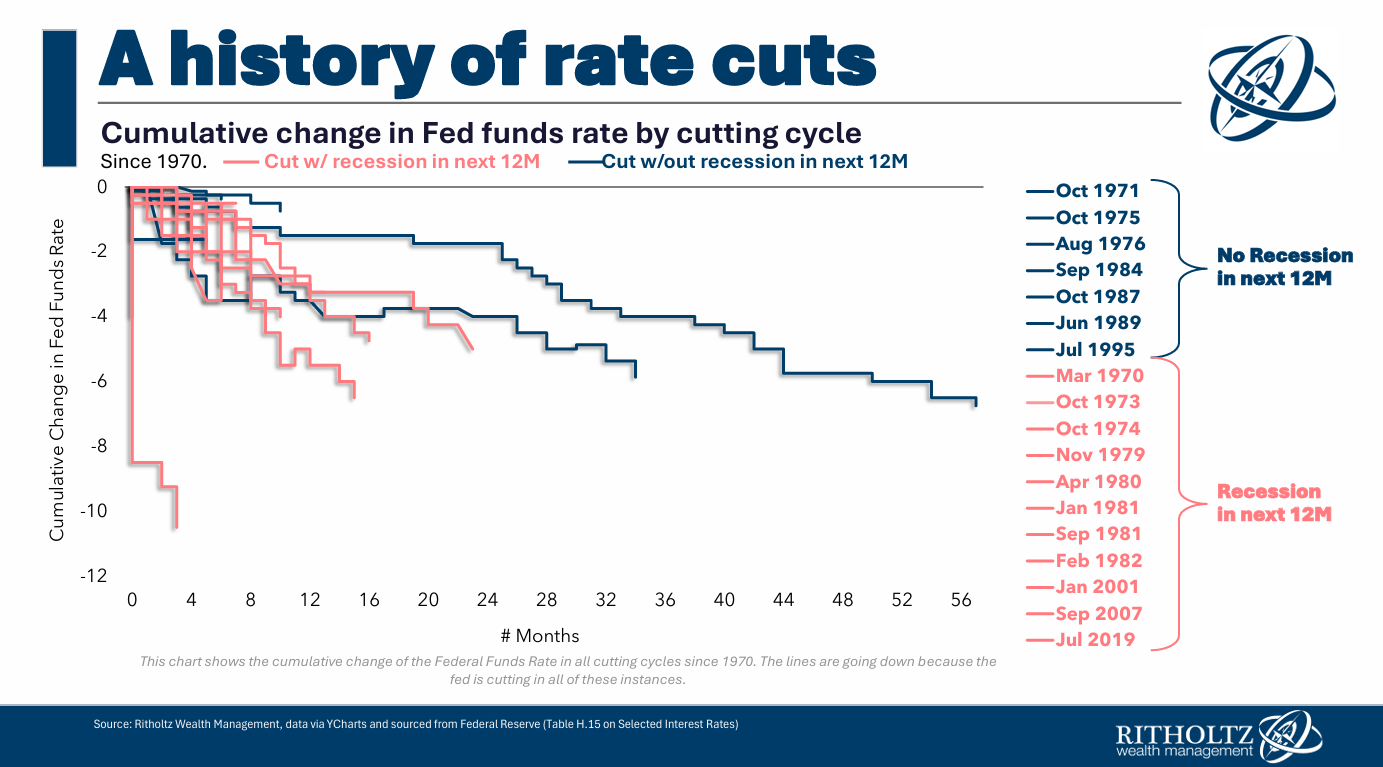

Here’s a look at every Fed rate-cutting cycle going back to 1970:

It’s been a while since the Fed went on a rate-cutting spree outside of a recession, but Alan Greenspan and company pulled off a soft landing in 1995, which was followed by one of the biggest boom times in history.

A recession is possible but not the only potential outcome here.

Rate cuts don’t mean inflation is coming back. Some people are worried that inflation will rear its ugly head again after we just tamed it.

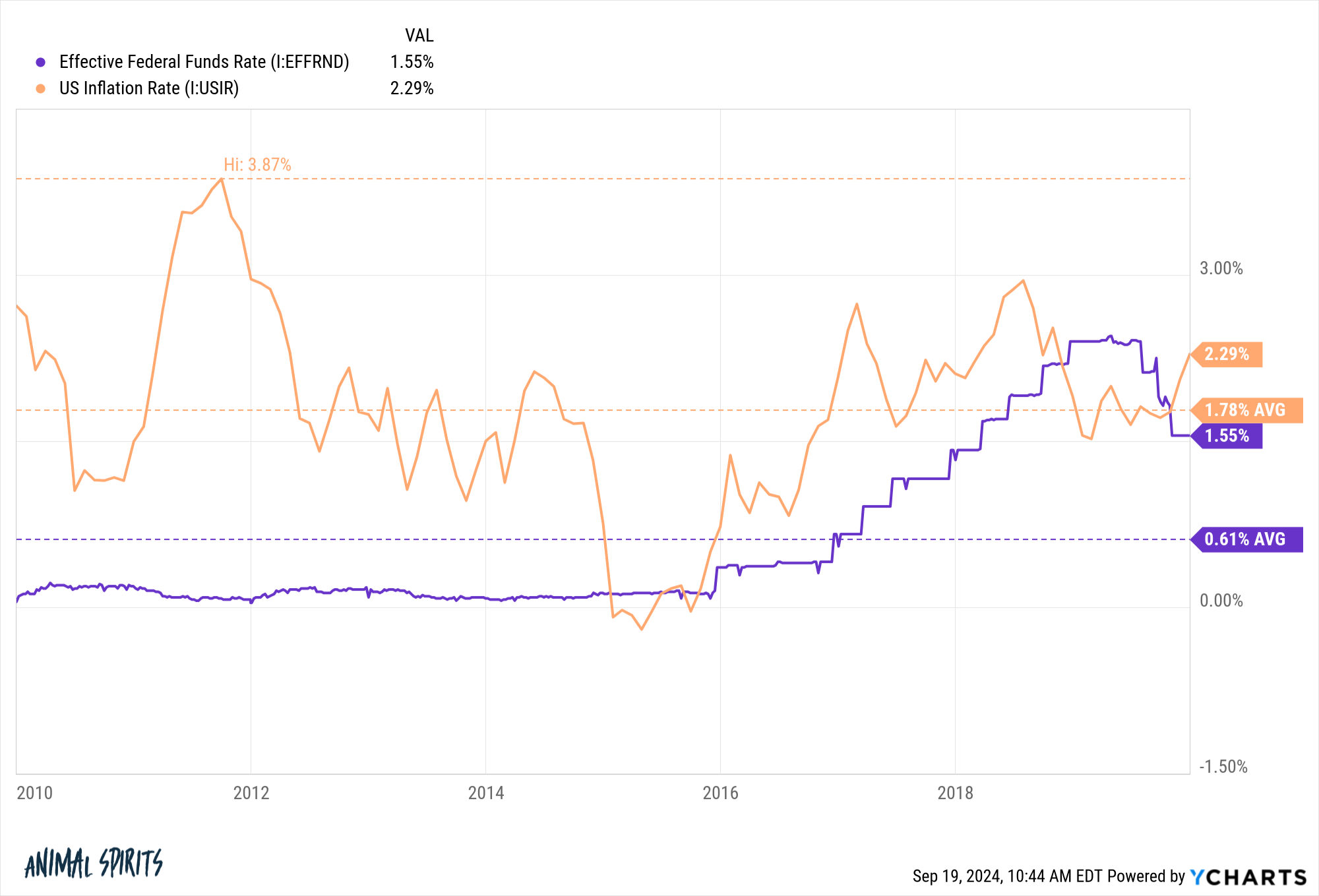

Again, anything is possible, but I would be dubious of people predicting higher inflation from interest rate cuts alone. We learned in the 2010s that low rates from the Fed don’t cause inflation:

We had 0% rates for years following the Great Financial Crisis. Rates averaged less than 1% in the 2010s yet the inflation rate for the decade was under 2% per year.

Government spending has a much greater impact on inflation than monetary policy.

Rate cuts don’t put a floor under equities. A lot of the Zero Hedge crowd assumes there has been a Fed put in place that drives equities higher.

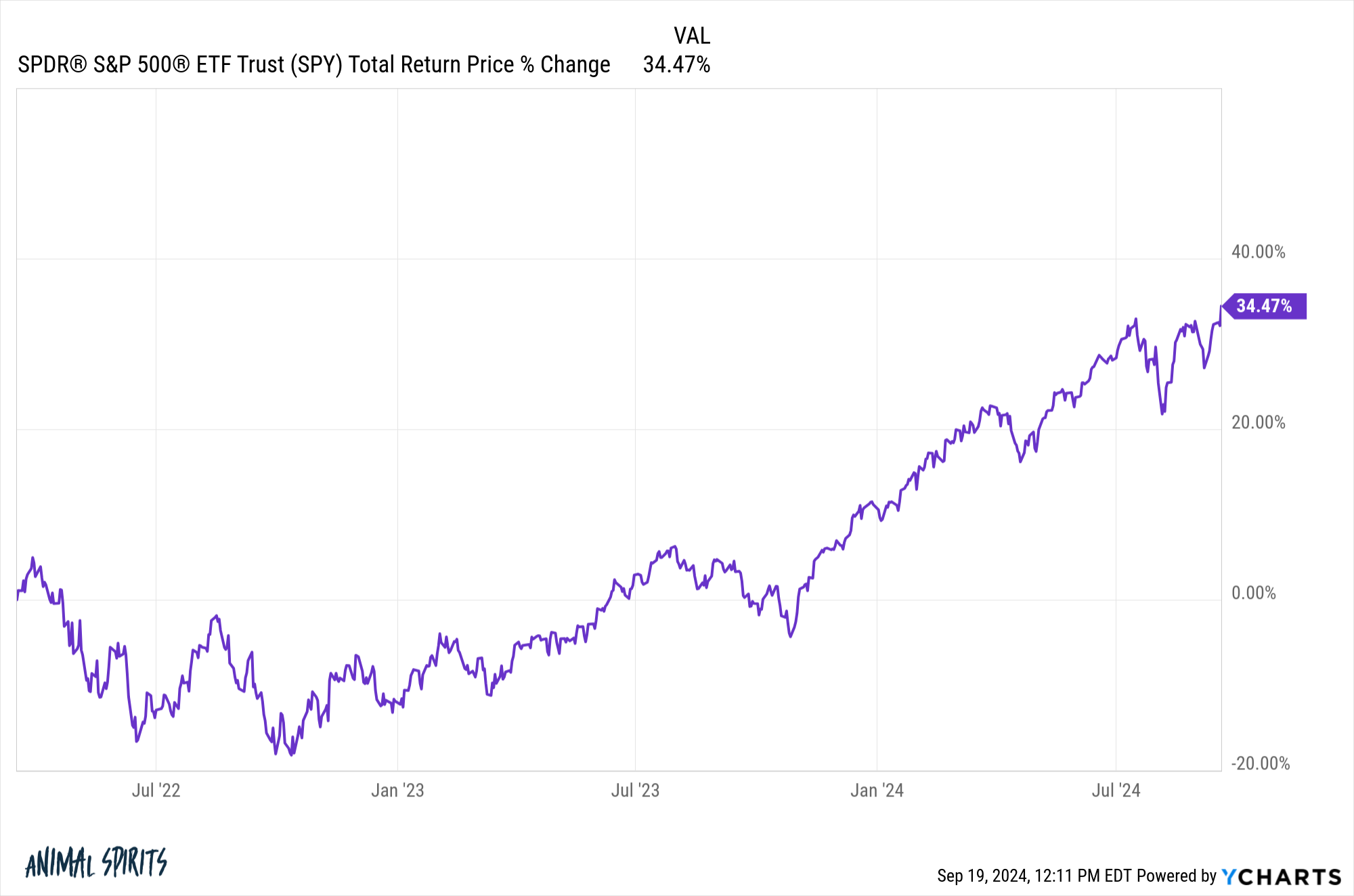

Well, we just went through one of the most aggressive rate hiking cycles in history and the stock market has held up just fine:

The Fed first began raising rates on March 17, 2022. There was some volatility along the way but since then the S&P 500 is up nearly 35%.

That’s pretty good.

But this should also be instructive on the other side of the equation. The stock market can do just fine during a rate-cutting cycle. But the Fed cutting rates doesn’t necessarily mean the stock market is now better-protected against risk.

Low rates don’t guarantee the stock market has to keep going up.

Rate cuts don’t guarantee bond gains. Here’s a meme I made:

Bonds could do well in a rate-cutting cycle but it could be more complicated than that.

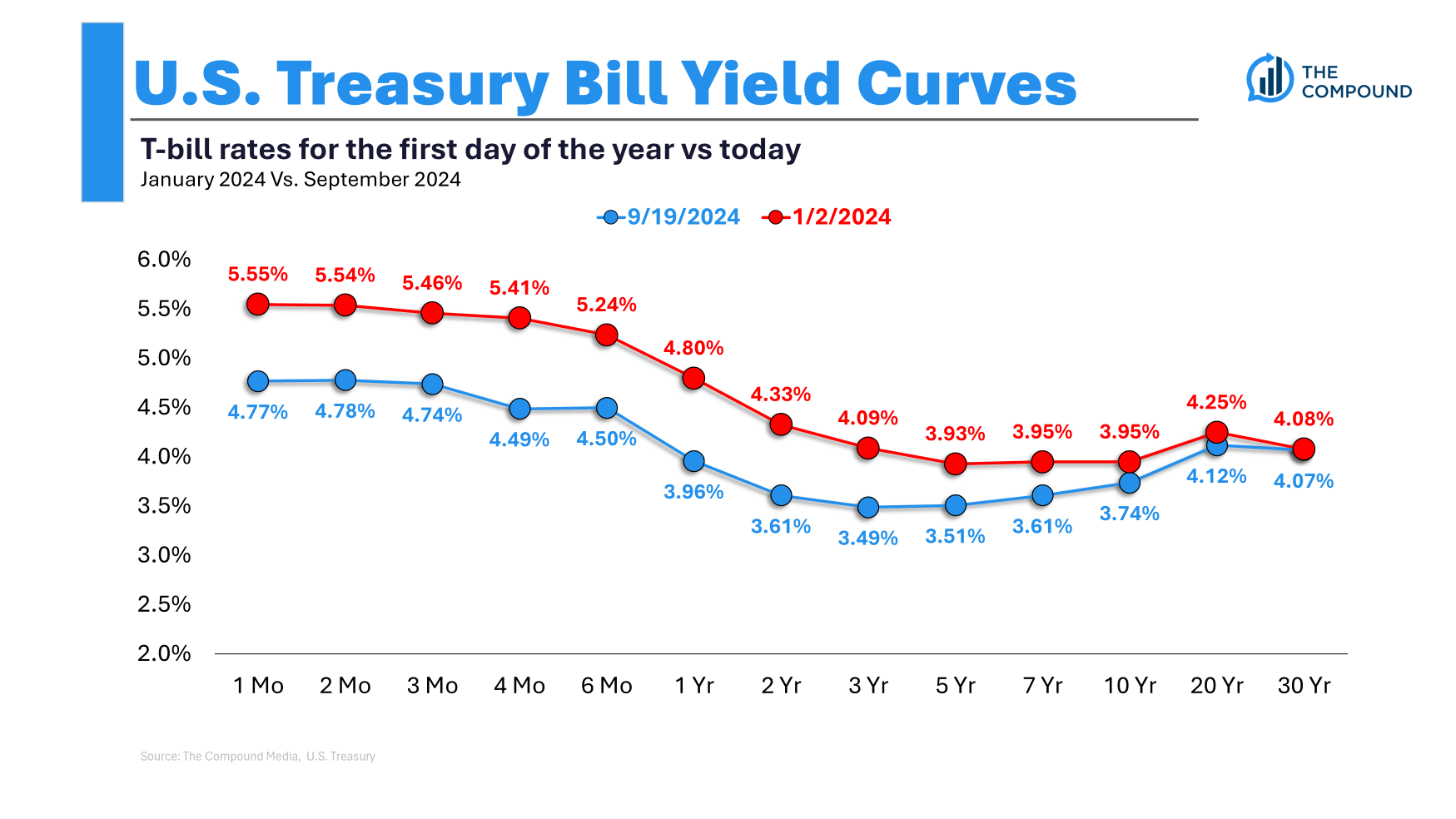

Short-term rates have been higher than long-term rates for some time now. Bond yields have already come down in anticipation of Fed rate cuts:

The market is forward-looking. It doesn’t wait around for the Fed to move. It moves before they do.

What if intermediate and long-term rates don’t budge all that much as short-term rates fall and the yield curve dis-inverts (un-inverts? de-inverts?)? Those rates never rose as much as short-term yields in a rate-hiking cycle.

If we go into a recession or inflation falls well below the Fed’s 2% target you would expect bond yields to fall.

But bond yields aren’t guaranteed to go down in a soft landing-like scenario.

The good news is that bond yields are decent right now, so rates don’t have to fall for bonds to offer reasonable returns. Timing the stock market is hard but timing the bond market is not a walk in the park either.

I guess what I’m trying to say is that not much is guaranteed by the Fed cutting rates.

You should expect rates on your savings account, CDs, money markets and T-bills to fall immediately. You should expect borrowing costs to fall.

Other than that, the future is uncertain, just like any other time.

I covered this question on the latest edition of Ask the Compound:

We also tackled questions about how bond yields are impacted by rate cuts, when you should refinance, AI financial advisors and how to break into the world of wealth management.

Further Reading:

The Impact of Fed Rate Cuts on Stocks, Bonds & Cash