Finance definitions are tough to pin down because money is often in the eye of the beholder.

The goalposts are always moving as you age and mature, and tastes change.

Your perception of wealth can be impacted by:

- How you were raised.

- The wealth and material possessions of your peers.

- Your lifestyle.

- Your contentment with what you have.

- How your circumstances change over time.

My definitions of wealth have certainly changed over the years. My income and net worth goals are far different in my 40s than they were in my 20s and 30s, just as they’ll likely be different in my 50s, 60s and beyond.

Here are my current definitions of rich and wealthy, which I consider different money concepts:

Rich: Being rich means having a high enough income to spend money freely. Rich people generally have a big houses, new vehicles, nice clothes, etc.

Wealthy: Being wealthy means have a high enough net worth that affords you some level of financial freedom.

Maybe this is all semantics. You may not agree with these definitions because living a rich life means different things to different people.

Many people with high incomes are able to translate the amount of money they make into a high net worth.

But there are certainly households with a high income who spend too much money and don’t live below their means.

And there are households who don’t have a high income who are able to live below their means to create a high net worth.

However, I do feel strongly about the fact that income and net worth can bring about very different feelings about money.

I believe in the idea that money doesn’t buy happiness but that old axiom requires context.

If you’re a generally happy person, more money probably can make you happier. If you’re a miserable person, money is not going to fill some void.

Researchers at the University of Pennsylvania released a new report last year that looked to answer the age old money and happiness question. They found unhappy people see their happiness increase up to an income of $100k a year. Anything over that and happiness didn’t improve.

People somewhere in-between happy and unhappy experienced a linear relationship between money and happiness, meaning as income increased, so did happiness.

And those people with a disposition that leans happy actually saw their happiness levels improve even faster as income rose.

I don’t think behavioral research is the be-all end-all when it comes to determining how money impacts our happiness. We humans are complex beings. There is so much that goes into the happiness equation that it’s difficult to use a single variable to explain everything.

But it does make sense to me that happier people become even happier when they make more money. Money can provide comfort and convenience, which can make your life easier.

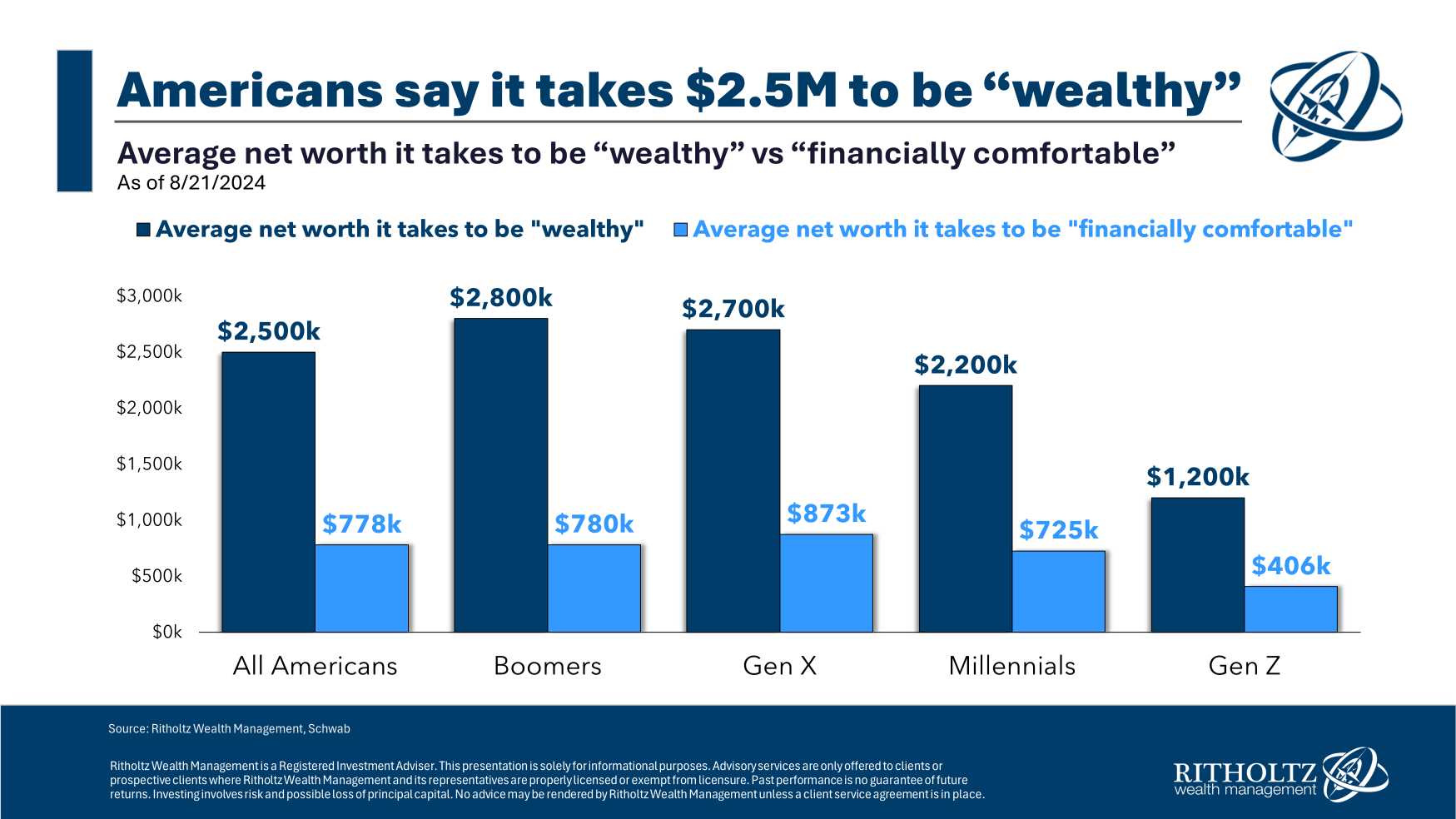

The latest Charles Schwab Modern Wealth Survey looks at the wealth side of things.

They asked a group of Americans how much it takes to be considered wealthy and how much it takes to be considered financially comfortable:

The numbers go up as you age which makes sense. The average for the group was $2.5 million and just shy of $780,000, respectively.

Both of these amounts would put you ahead of the vast majority of American households.

A net worth of $2.5 million would put you in the top 7%, while $780k is just outside of the top 20%.

There are no easy answers when it comes to this stuff.

Most of us are making it up as we go, moving the goalposts continually and never settling on a specific definition of money or happiness.

I personally care more about building wealth than being considered rich but increasing your income can make your life a whole lot easier if you play your cards right.

The hard part about money is being content with how much you make and how much you have.

I could offer you some pithy personal finance quote about the importance of figuring out what ‘enough’ means for you but I don’t think anyone ever truly gets there.

You do your best to get to the point where money isn’t your biggest worry in life.

If you worry about money all the time it’s hard to consider yourself rich or wealthy.

Michael and I discussed what it takes to be rich, wealthy and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How Many Millionaires Are There?

Now here’s what I’ve been reading lately:

- Home prices in an age of uncertain insurance (Abnormal Returns)

- We’ll never have it as good as our parents did (Irrelevant Investor)

- How historical returns have varied by country (Monevator)

- Some lessons on showing up (More to That)

- Reflections on 60 years (A Teachable Moment)

- What’s the actual grocery store inflation data? (Economist Writing Every Day)

- How WWII was won (Astral Codex Ten)

- George Clooney and Brad Pitt are Hollywood’s BFFs (GQ)

Books: