“It makes little sense that we should care about a bad day or a bad year in the stock market if it provides us with good long-term returns.” – William Bernstein

Bill McBride at Calculated Risk shared an amazing stat a few weeks ago:

Imagine if you were born in 1900. You’d have a 23% chance of dying before age 20 (a 13% change before age 1). You’d have a 38% chance of dying before age 45.

Compare that to kids born recently. You’d have about a 1% chance of dying before age 20, and about a 4% chance of dying before age 45. A dramatic change over the last century.

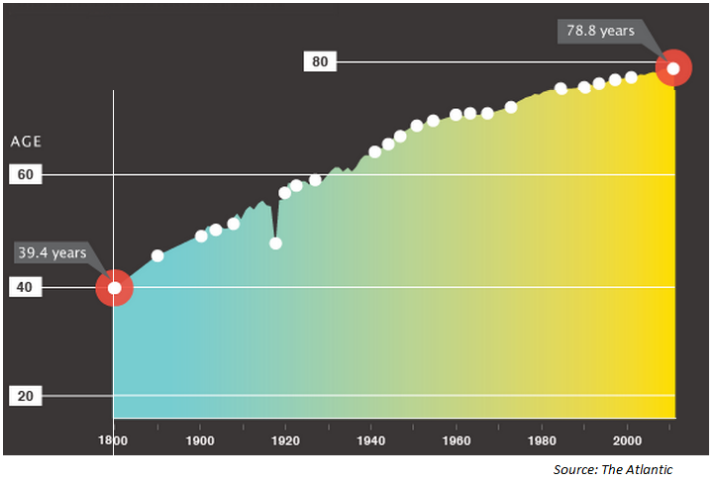

This reminded me of one of my favorite charts that I’ve used before which shows how the average life expectancy has nearly doubled since 1880:

This graph is one of the main reasons many think we have a retirement crisis. But is it really a crisis when people are living longer because of advances in human health? (Each of the white dots on this chart represents a major medical discovery or breakthrough.)

I tend to consider it more of an additional financial planning issue than a crisis. An extended lifespan for investors could have huge implications for the financial markets.

It’s hard to go a day without reading a story from the financial news outlets about the fact that retirees have no good choices for safe fixed income because of the low interest rate environment. While it would be great if we could all earn a riskless return, a singular focus on investment options that are designed for the short to intermediate term ignores the fact that time horizons are much longer now than they’ve been in the past.

There is a seemingly endless list of risk factors to consider for any investment portfolio, but only one that really matters for every single investor – longevity risk. Longevity risk is simply the risk that you will outlive your savings.

One possible outcome from the steady climb in life expectancy is that investors will have to increase their equity exposure to ensure the ability to keep up with inflation. It’s impossible to predict how this could play out but markets move based on investor preferences above all else. As pseudonymous blogger Jesse Livermore has pointed out:

Ultimately, the price of equity is determined in the same way that the price of everything is determined–via the forces of supply and demand. For any given stock (or for the space of stocks in aggregate), price is always and everywhere produced by the coming together of those that don’t own the stock and want to allocate their wealth into it, and those that do own the stock and want to allocate their wealth out of it. If there is a different supply sought by the first group than offered by the second, the price will shift until the imbalance equalizes.

A potential shift in asset allocations is just one of many possibilities. Even though my fellow millennials have been taking a ton of flack for not investing aggressively enough (a view I agree with), as a group we are starting to save much earlier than previous generations.

A recent study from Transamerica showed that 70% of millennials started to save for retirement by age 22. On average, Gen Xers didn’t start until they were 27 while baby boomers began saving at age 35.

Saving money as early as possible is one of the best ways to improve your odds of outlasting your portfolio because of the compounding benefits. Other options for lowering longevity risk include (1) saving more money over time, (2) taking more risk, (3) working longer or (4) dialing back spending in retirement.

It’s up to each individual to figure out which one or combination of these options makes sense for their personal circumstances.

Not everyone is going to be able to stomach an increased allocation to stocks even with a longer runway ahead of them. This means that most investors will have to choose option number one and rachet up their savings rate to deal with a longer life expectancy.

Saving more money actually lowers your risk in a number of ways while the other choices all carry unintended consequences that could harm your portfolio.

Remember — in most cases saving trumps investing.

Sources:

Demographics and behavior (Calculated Risk)

The single greatest predictor of future stock returns (Philosophical Economics)

Longevity risk is compounded by the fact that the cost of healthcare is rising higher than the rate of inflation. Since the demographic that requires these services are seniors, it will accelerate the rate that they deplete their nest egg.

Probably the best way for millennials and Gen Xers to counter longevity risk is a combination of saving more and investing more aggressively while they’re young.

For millenials, campaigning for meaningful healthcare reform in the US could lead to healthcare costs falling nearer to the world average, ie much less than they are now.

Healthcare in Japan and the UK (two countries I have lived) is not a significant enough cost to factor into my retirement planning 🙂

[…] Long Term is Getting Longer […]

[…] Why invest? You may live a lot longer than you think, and you’re going to need some money. (WealthOfCommonSense) […]

As a life actuary I would certainly agree that on average people are living longer and need to be concerned about making sure they don’t deplete their savings before they die. However people unfortunately still die early due to accidents or various diseases so buying a tax-free Term to 100 life policy not provides protection for premature deaths but can now be converted into a monthly income senior for seniors through http://www.life-funding.com which will fund the purchase of a life annuity through a secured “reverse mortgage” loan on their T100 life policy, where the principal plus accrued interest are repaid from the life policy proceeds.

Term is especially cheap for younger people. You can get a 500K policy for around $20 a month depending on your health history. A good idea for those with families to support.

What amazes me about that life expectancy chart is the big dip around 1919 from the Influenza epidemic.

Me too. I read that it was like 50 million people worldwide that died from that. That’s a huge number even by today’s population standards. Pretty crazy.

[…] Further Reading: Life Expectancy & Longevity Risk […]