Today’s Talk Your Book is brought to you by Jensen Investment Management:

See here to learn more about Jensens Quality Growth ETF

On today’s show, we discuss:

- What quality means to Jensen

- Why META is not in the Quality growth strategy

- Thoughts on AI and tech bubbles

- How Jensen thinks about valuation

- Sectors Jensen is excited about for the long-term

- How higher interest rates affected Jensen’s discounted cash flow models

- Hallmarks for great quality businesses

Listen here:

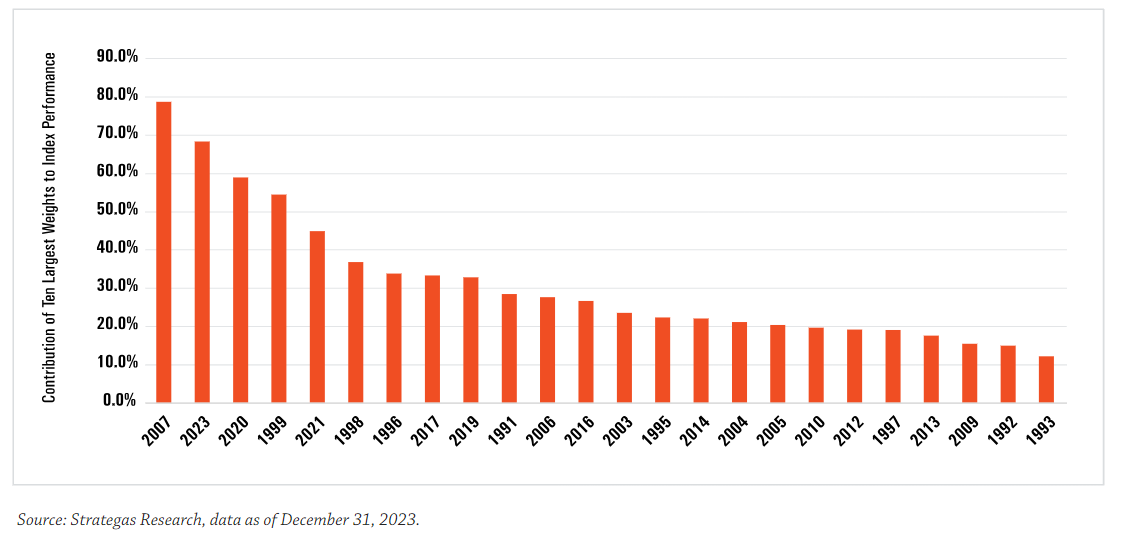

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Discounted Cash Flow (DCF):

Analysis uses future free cash flow projections and discounts them (most often using the weighted average cost of capital) to arrive at a present value, which is used to valuate the potential for investment.

Return on Equity (ROE):

Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Return on Invested Capital (ROIC):

A calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. Return on invested capital gives a sense of how well a company is using its money to generate returns.

Initial Public Offering (IPO):

The first sale of stock by a private company to the public.

Margin of Safety:

A principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value.

Risk-Free Rate (RFR):

The theoretical rate of return on an investment with zero risk. As such, it is the benchmark to measure other investments that include an element of risk.

Webvan:

Webvan was a dot-com company and grocery business that filed for bankruptcy in 2001 after 3 years of operation.

Dollar-Cost Averaging:

A strategy that involves a series of periodic investments on a regular schedule such as weekly, monthly, or quarterly.

A Unified Managed Account (UMA):

A professionally managed private investment account that can include multiple types of investments all in a single account.

Turnover Rate:

The percentage of a mutual fund or other portfolio holdings that have been replaced in one year.