There aren’t all that many millionaires in the world.

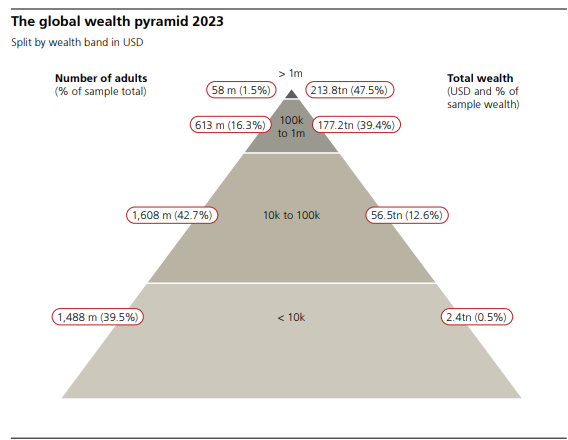

People with wealth in excess of $1 million make up just 1.5% of the world’s population.

Yet this group controls nearly half of the world’s wealth (around $214 trillion in total).

There are even fewer billionaires — a little less than 2,700 worldwide or a number that rounds down to 0% of the global population. Just 26 individuals are worth $50 billion or more. Collectively, they control more than 20% of the world’s wealth.

This data comes from the annual UBS (formerly Credit Suisse) Global Wealth Report, which confirms that wealth inequality remains a problem:

While wealth inequality is still an issue (and probably always will be), living standards have been rising for people on the lower end of the wealth spectrum as well.

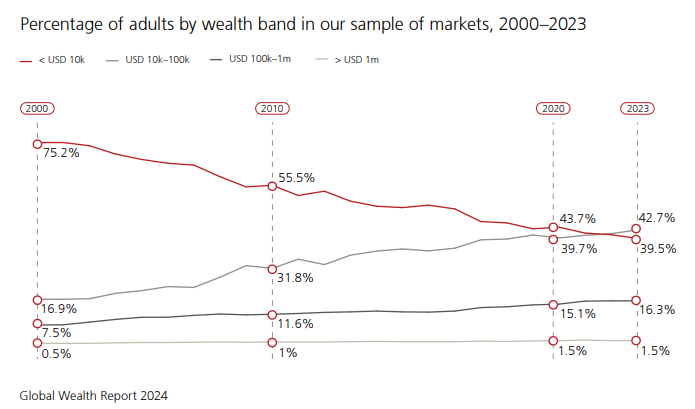

UBS shows the percentage of adults worldwide by different levels of wealth going back to the year 2000:

Over three-quarters of adults in 2000 held $10k or less in wealth. That number has now shrunk to less than 40%. That cohort is no longer the largest group, which now belongs to those with between $10k and $100k in wealth.

Obviously, inflation plays a role here. Ten thousand dollars in 2023 is not the same as $10k in 2000, but this is progress.

The millionaire group has tripled from 0.5% of the global population to 1.5%. The United States has the most millionaires of any country, with 22 million1, while 6 million people in China can claim that title. There are 3 million millionaires in the UK, and no other country has more than 3 million.

The rich are getting richer but the lower income class has experienced gains too.

No one enjoys inflation but there are ancillary benefits to price increases, namely wage gains.

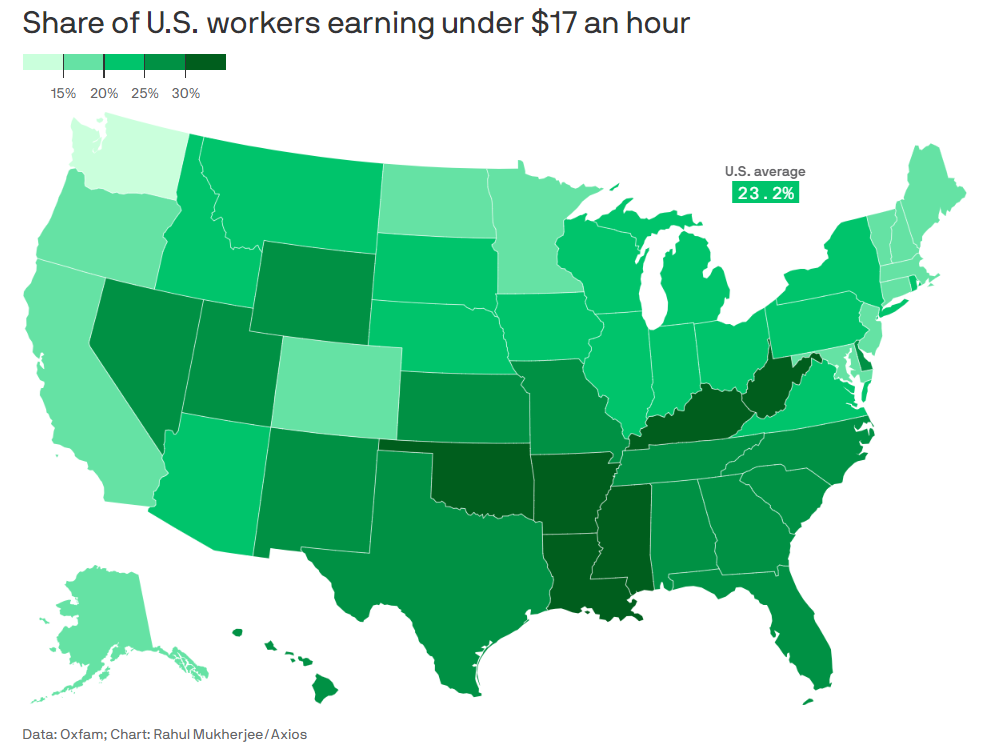

Axios highlights research from Oxfam that shows there are fewer low-wage workers in the United States:

Just 13% of workers in the U.S. are now earning less than $15 an hour; two years ago, that number was 31.9%, per new data from Oxfam.

Even accounting for inflation — $15 an hour in 2024 has the same buying power as about $14 in 2022 — this is remarkable progress.

Oxfam revised its definition of a low-wage worker this year, from those earning less than $15 an hour to those earning less than $17.

Here’s a chart that shows these numbers by state:

There are still many low-wage workers but the number is dwindling.

This is good news.

Unfortunately, we tend to view wealth on a relative basis instead of looking through an absolute lens.

So, while it’s great news that poverty is falling around the globe, people compare themselves to those who have more, not those who have less than them.

If you’re one of the lucky millionaires, you have far more people in your peer group who are also millionaires than the global average. There are always people with more money, higher incomes, better toys, nicer vehicles and bigger houses than you.

Those are the people you compare yourself to.

It’s never been easier to see others flaunt their wealth than it is today. Every day on social media you get force fed people’s trips to Europe, fancy houses, investment wins and the best version of other’s lives.

Plus, we now have access to the wealthiest people on the planet, their thoughts, their lifestyles and their excesses. John Rockefeller wasn’t posting on Twitter or Instagram back in the day about how amazing his life was.

It’s difficult to see the progress in your own life when it feels like there are so many people who are doing better than you are.

A study done years ago asked people who had inherited money how much they would need to feel secure. No matter how much they had gotten passed down, the answer from every respondent was twice as much as they had received.

I don’t think the secret to happiness is necessarily wanting less. There is something to be said for wanting to improve your station in life.

I do think showing gratitude for what you have can help though.

As philosopher Arthur Schopenhauer said, “Wealth is like seawater: the more we drink, the thirstier we become.”

Further Reading:

The Happiness Paradox

1Out of the roughly 260 million adults in the U.S., that means around 8% of them are millionaires. Also here is their definition of wealth: Net worth or “wealth” is defined as the value of financial assets plus real assets (principally housing) owned by households, minus their debts.