Here’s a headline you only see during a bull market:

This is from the article:

“It’s a new way of making money,” Nova told Fortune. “New possibilities for people: that you don’t have to, in this day and age, work as hard. Work smarter, not harder.”

Following the stars has worked out for Nova. She quit her job as a tarot reader and astrology consultant this year to day-trade, finding it a more consistent stream of income and earning about $5,000 a month. But that doesn’t mean it’s a good idea for everyone, one expert warns.

Young people quitting their jobs to day trade. Using astrology to make stock picks. Pffft.

This is the point where the grizzled market vet is supposed to say I’ve seen this movie before and I know how it ends.

Yeah, this is bull market behavior to be sure. You don’t see these kinds of stories when the market is going down. Contrarian indicators aren’t hard to find right now if that’s how you view the markets.

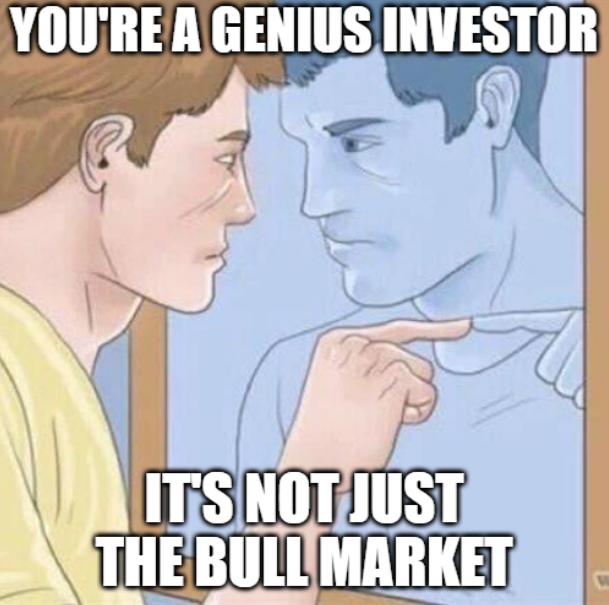

Bull markets are a breeding ground for bad habits. It’s easier to get lucky during a bull market. You begin to believe you’re a genius because everything you buy goes up.

But this happens during every bull market. There are always people who believe they can day trade their way to millions who end up blowing themselves up.

This is a story as old as markets.

There are also positive externalities from this bull market. This is from that same article:

Of course, the desire to control their uncertain future is one of the major reasons why Gen Z has fallen in love with investing in the first place. Driven by the fear of missing out and determination to escape the corporate rat race, over 70% of the generation owns stock, according to NASDAQ, more than prior generations at the same life stage.

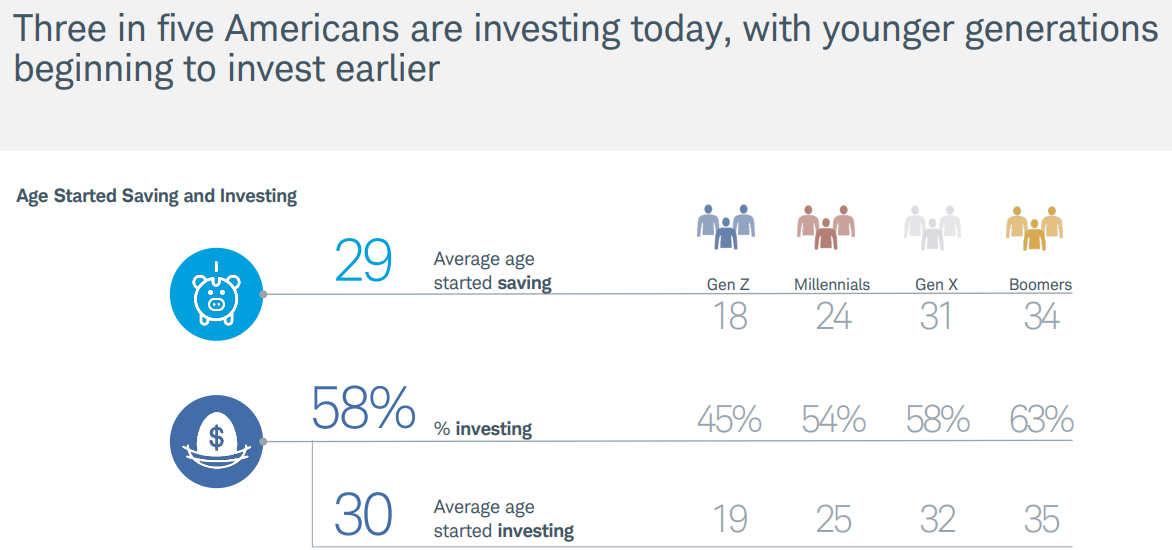

Some combination of lower barriers to entry, reduced fees, zero commission trading and improved technology means more young people are now investing. This is a good thing!

And they’re doing so at an earlier age than previous generations. Here’s some data from Charles Schwab:

In the pre-internet age, investing in the stock market required going to a physical location, filling out paperwork and writing a check. The fees were often egregious. Index funds and ETFs haven’t been around all that long in the grand scheme of things.

The ease of access has been a blessing to a new generation of savers and investors.

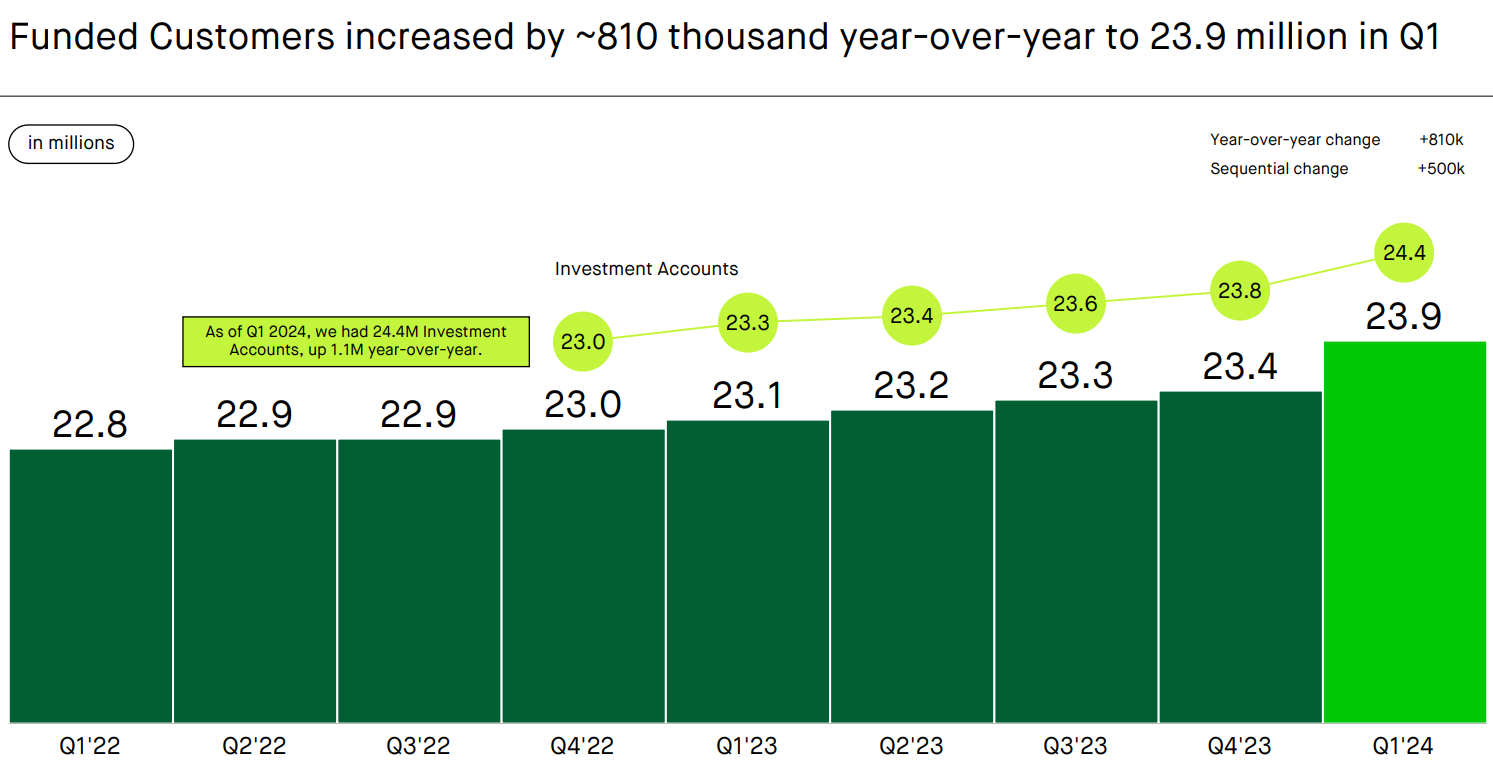

Robinhood now has 24 million customers:

That’s up from a little more than 3 million in 2018. A big reason for this is the fact that you can download an app, link your bank account, move some money and invest with the push of a button on the tiny supercomputer in your pocket.

Are there going to be young people that pay their tuition to the market gods? Of course.

This happens during every uptrend. Mistakes will be made but it’s better to make them when you don’t have as much money at stake.

Having millions of young people interested in investing is better than the alternative.

Ten years ago I wrote about an entirely different proposition for millennials:

Following the Great Financial Crisis, millennials were wary of the stock market. They saw their parents get wiped out, and whatever money we had in the market got cut in half. All we kept hearing about was the lost decade, stock market crashes, and doom and gloom.

This was taken from a UBS report at the time:

The Next Gen investor is markedly conservative, more like the WWII generation who came of age during the Great Depression and are in retirement. This translates into their attitude toward the market as we see Millennials, including those with higher net worth, holding significantly more cash than any other generation. And while optimistic about their abilities to achieve goals and their financial futures, Millennials seem somewhat skeptical about long-term investing as the way to get there.

This was not healthy behavior either.

I’m sure there are plenty of millennials who wish they could go back to the 2010s to buy equities at those price levels.1

Gen Z will experience a lost decade, financial crisis or bone-shattering stock market crash at some point in their investing lifecycle. Those events don’t happen often but human nature is undefeated in the markets.

There are young people who are going to lose their shirts when the current cycle turns. Memestocks, shitcoins, part-time day trading and getting your investing advice from TikTok are not sustainable long-term strategies.

But the fact that the 2020s has seen so many new entrants into the financial markets is a net positive for younger generations. Many of them will learn the right habits and technology makes it easier than ever to automate good behavior when that time comes.

The good news is that Gen Z is saving and investing by utilizing their biggest asset–time–to their advantage.

Further Reading:

Millennials & the New Death of Equities

1Housing too.