Today’s Animal Spirits is brought to you by YCharts:

See here for YCharts research on the best-performing ETFs of 2023

See here to register for the Future Proof Retreat in March!

On today’s show, we discuss:

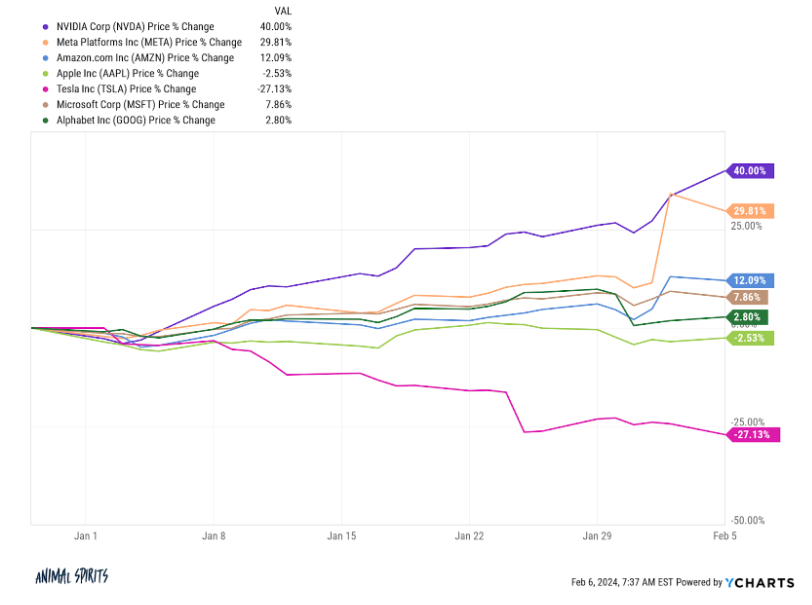

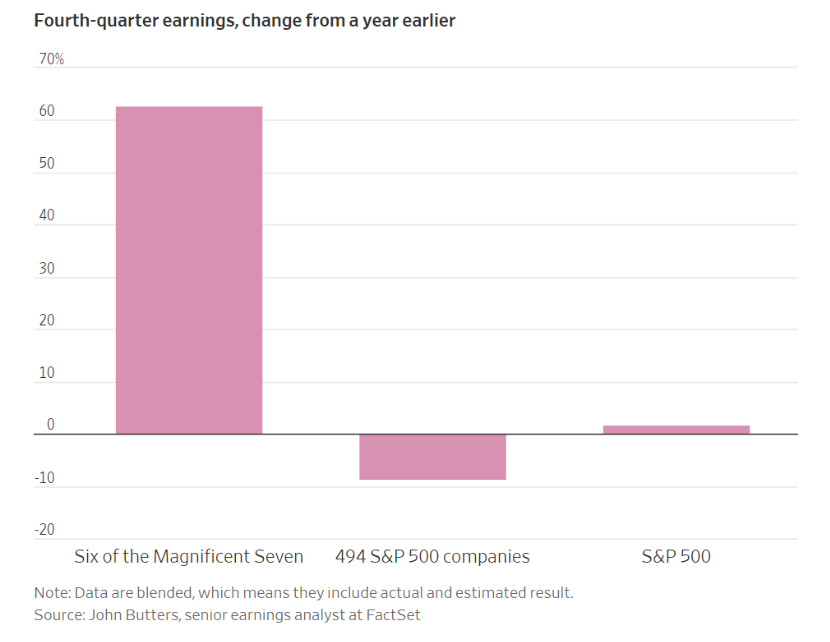

- Big tech stocks find little room for error after monster run

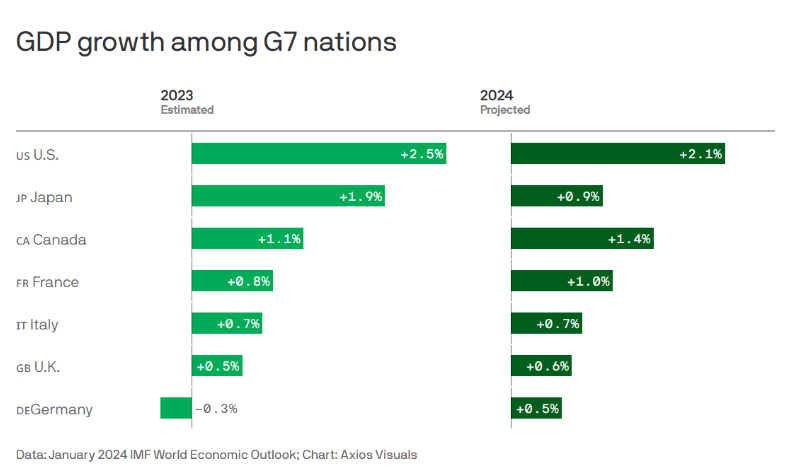

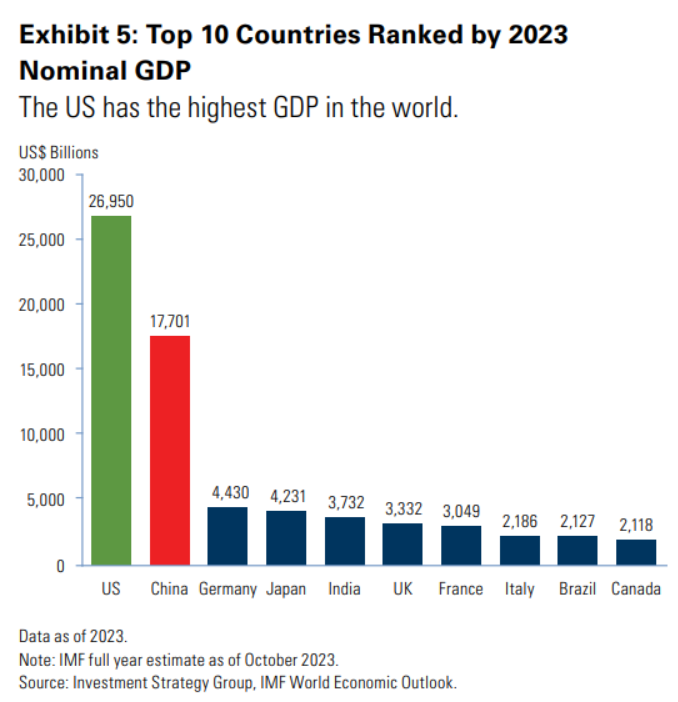

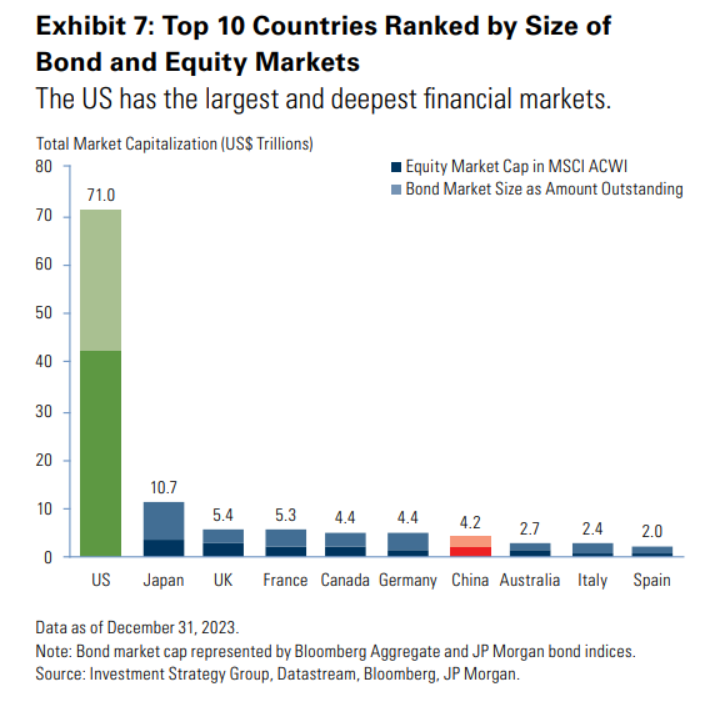

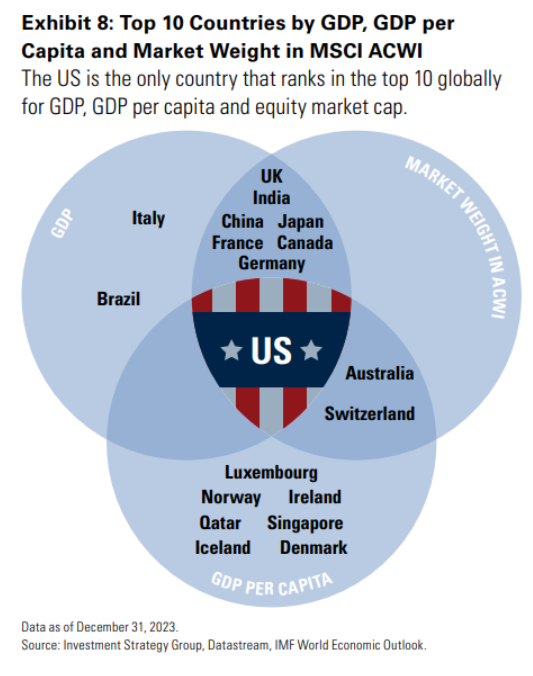

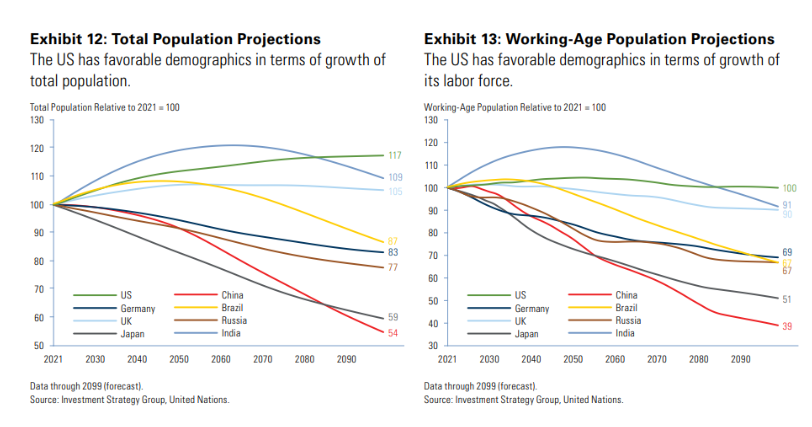

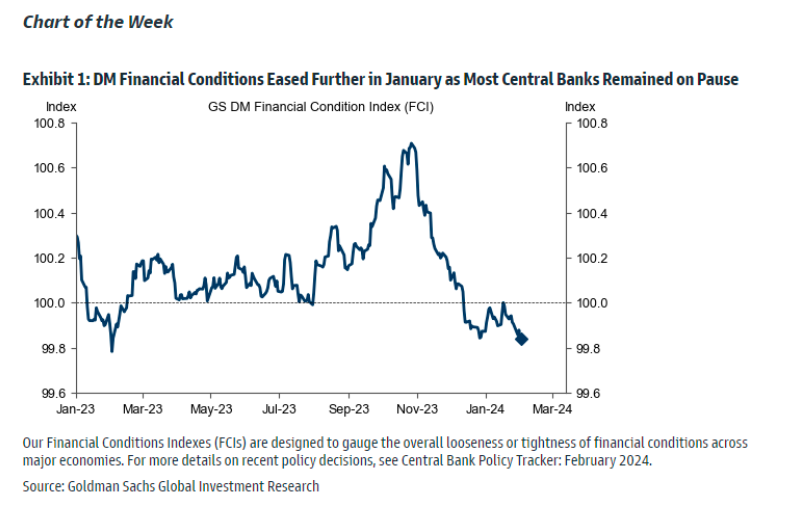

- US winning world economic war

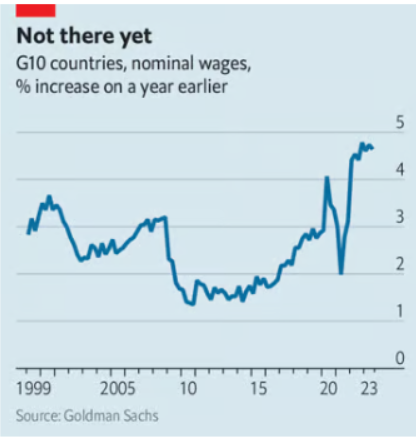

- America Powers On via Goldman Sachs

- Why Tim Cook is going all in on the Apple Vision Pro

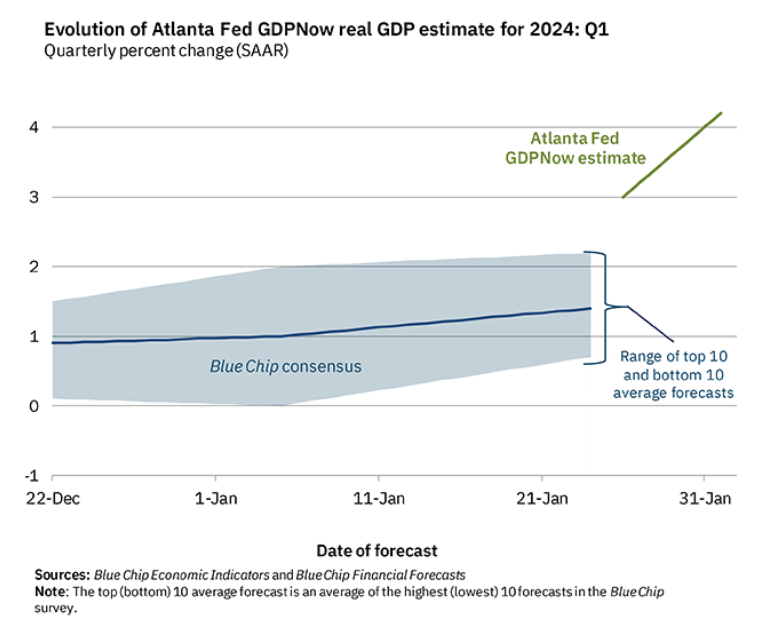

- GDPNow real GDP estimate for Q1 2024

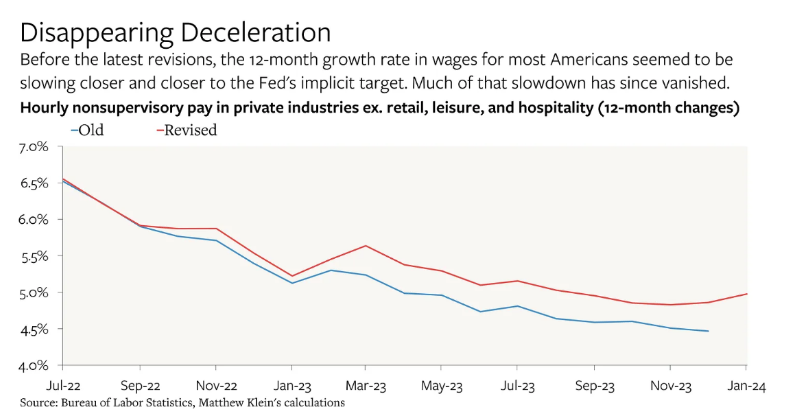

- Wages are rising faster than we thought

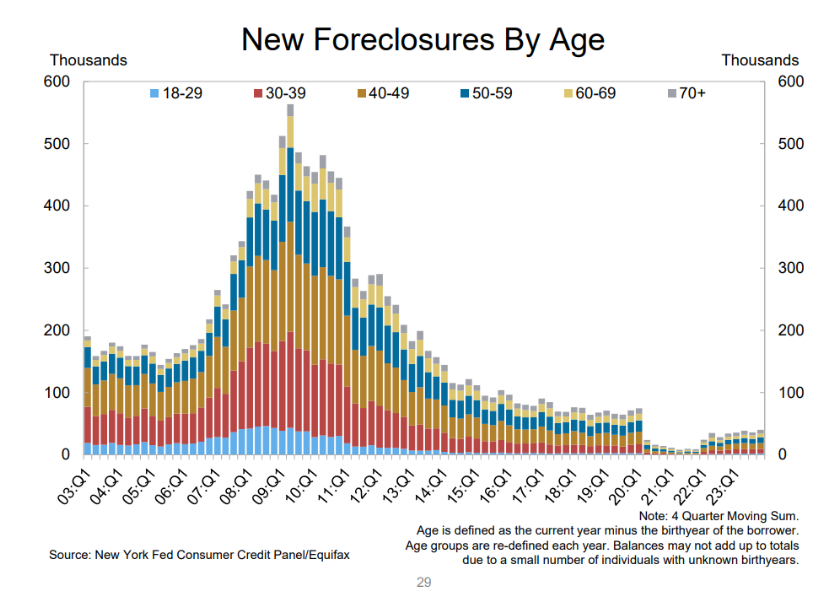

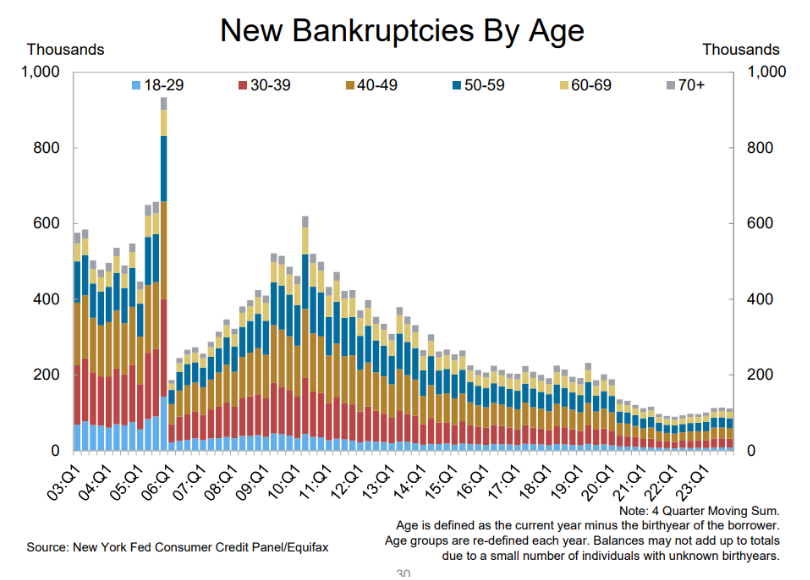

- The NY Feds quarterly report on household debt and credit

- Realtor commissions are still a hefty part of home sales. Maybe not for long

- Tony Robbins returns with alternative investing book

- Gen Z is splurging on luxury goods to soothe their economic despair

- We’re DINKs struggling to make ends meet – our 6-figure salaries aren’t enough to support our lifestyle anymore

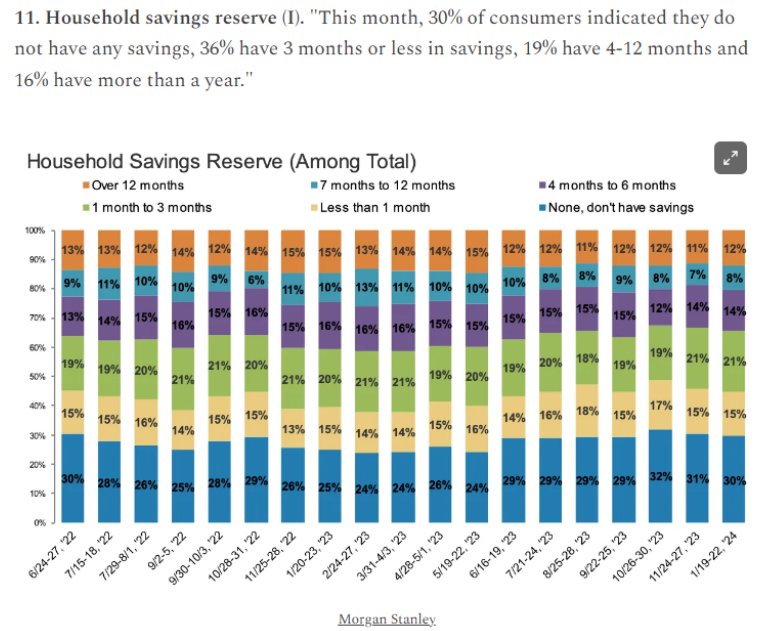

- Daily Chartbook: 30 charts on the US Consumer

- Netflix dropped bombs this week

Listen here:

Recommendations:

Charts:

Tweets:

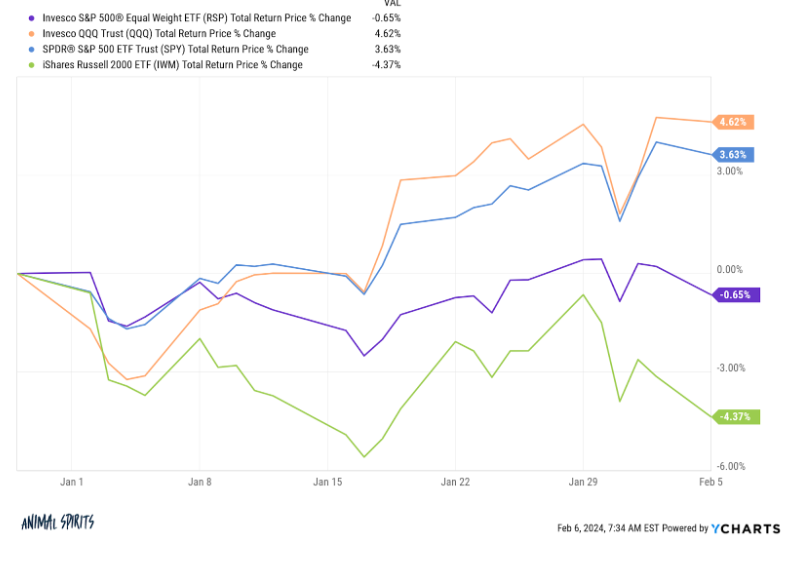

Well, that was weird. Thanks $META.

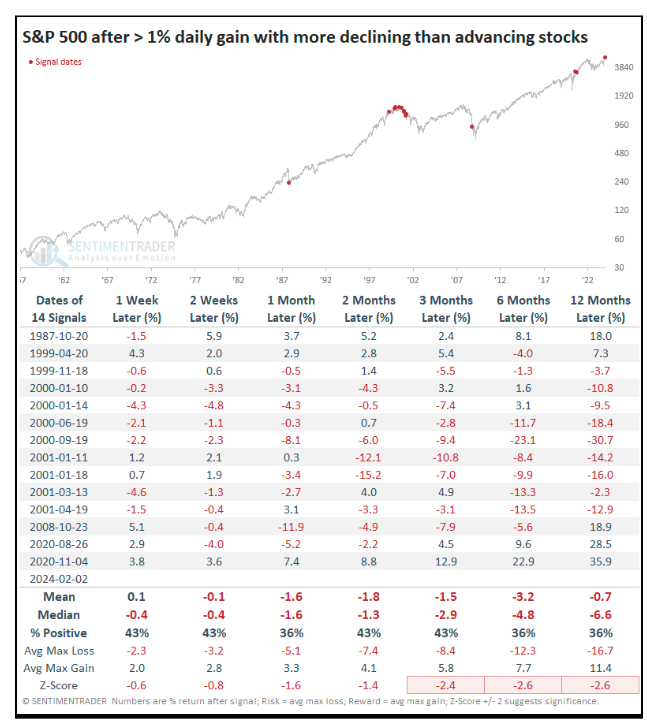

This seems like it's going down as one of the very few times since the S&P 500 became a 500-stock index that it jumped more than 1% on a day when more of its stocks declined than advanced.

Forward returns weren't great. pic.twitter.com/Ey0KmXfKZt

— Jason Goepfert (@jasongoepfert) February 2, 2024

Man, this is weird.

The S&P 500 is within .35% of a 3-year high.

Fewer than 40% of its stocks are above their 10-day avg, fewer than 60% above their 50-day, and fewer than 70% above their 200-day.

Since 1928, that's only happened once before: August 8, 1929.

— Jason Goepfert (@jasongoepfert) February 6, 2024

The S&P 500 closed within 0.35% of an all-time high yet fewer than 20% of NYSE issues rallied today.

That's never happened, since at least 1962.

There were only 2 days when fewer than 30% of issues rallied:

November 22, 1999

January 18, 2018— Jason Goepfert (@jasongoepfert) February 5, 2024

The most WILD stat of the week

Over the last 3-months $NVDA has added $TSLA's entire market cap to its valuation, which is over $550 billion 🫨 pic.twitter.com/f0irKtOd2V

— Stocktwits (@Stocktwits) February 6, 2024

Always have to wrestle with the question of whether the relative cheapness of an index is appropriate given fundamentals.

Underperformance of R2K vs nasdaq in large part driven by the significant divergence in the level and trend of earnings. pic.twitter.com/DmYaHOxlTm

— Bob Elliott (@BobEUnlimited) February 4, 2024

Grey lines are where Fed Fund Futures (the market) expected the actual Fed Funds Rate to track. Blue line is where the Fed Funds Rate actually tracked. What do you notice? pic.twitter.com/UApzzrOIHy

— Bespoke (@bespokeinvest) February 4, 2024

One measure of sentiment among individual investors, the Yale School of Management One-Year Confidence Index, is at the highest level since **2007** pic.twitter.com/yorEDScKcj

— Gunjan Banerji (@GunjanJS) February 4, 2024

Household debt outstanding as a share of US GDP is down over the past decade pic.twitter.com/1cG9i3KQl5

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 31, 2024

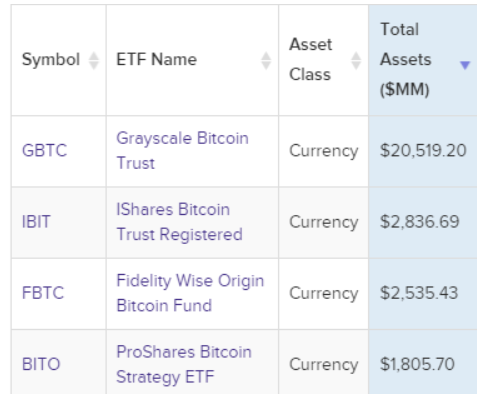

iShares Bitcoin Trust & Fidelity Wise Origin Bitcoin Fund now #1 & #2 in AUM out of *all* ETFs launched since beginning of 2023…

That’s over 600 ETFs.

IBIT & FBTC did this in less than 3 weeks.

— Nate Geraci (@NateGeraci) January 31, 2024

President Abraham Lincoln, today 1865, at age fifty-five: pic.twitter.com/ZZiDBW0Yyq

— Michael Beschloss (@BeschlossDC) February 6, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.