Today’s Animal Spirits is brought to you by Nuveen and Kaplan Schweser:

See here for more information on investing with Nuveen

See here to save 10% on Schweser CFA exam prep materials

On today’s show, we discuss:

- The worlds priciest stock market

- Why a US recession is still likely – and coming soon

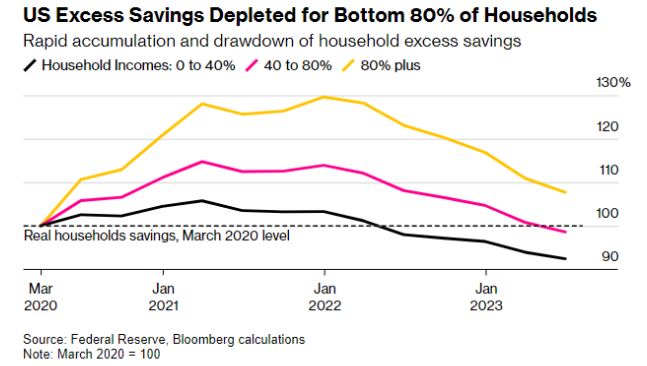

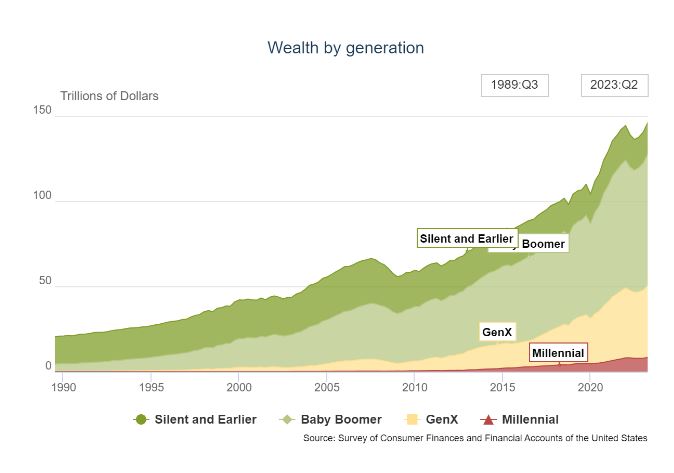

- Only richest 20% of Americans still have excess pandemic savings

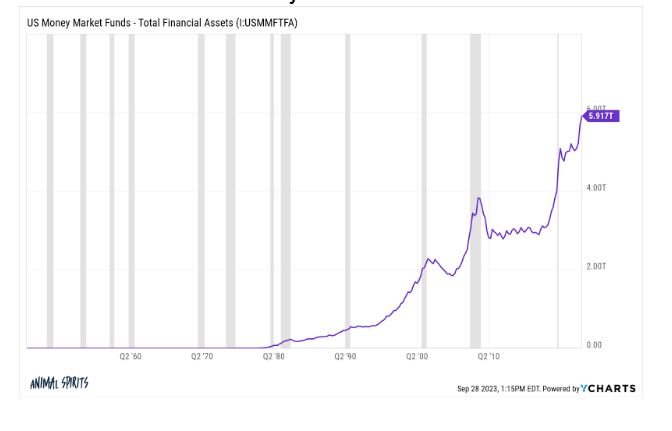

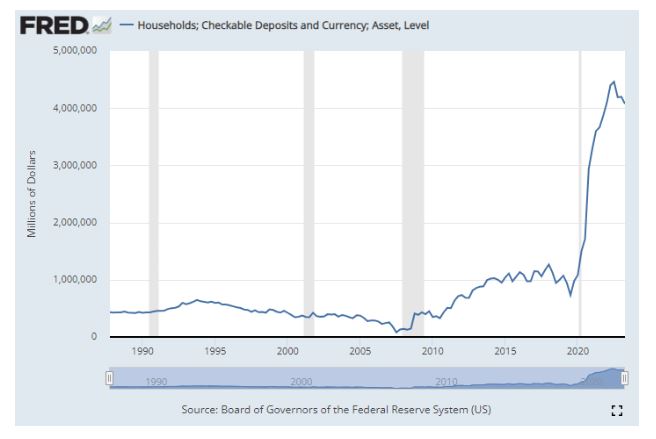

- Americans are still spending like there’s no tomorrow

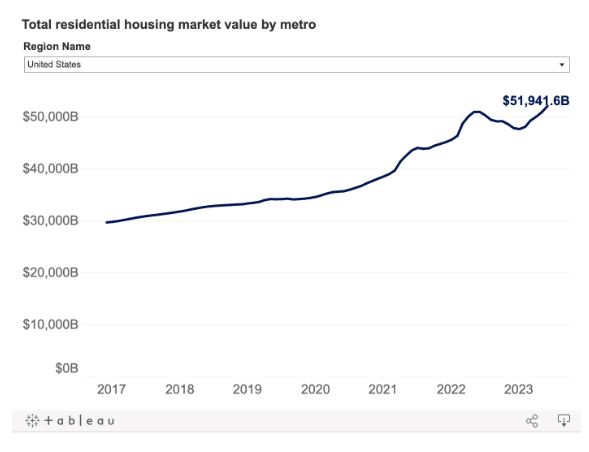

- The value of residential real estate broke a new record $52T

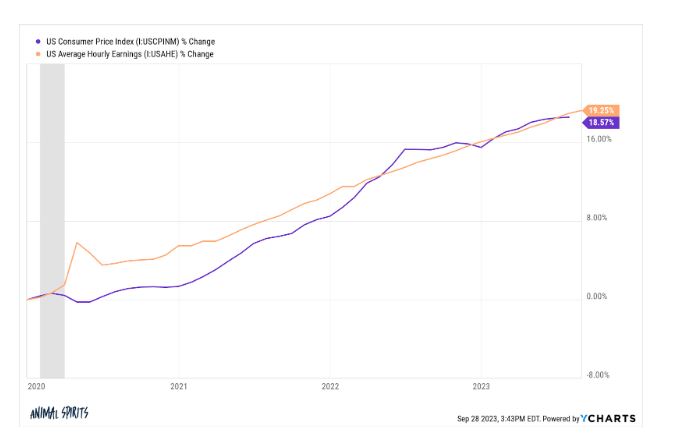

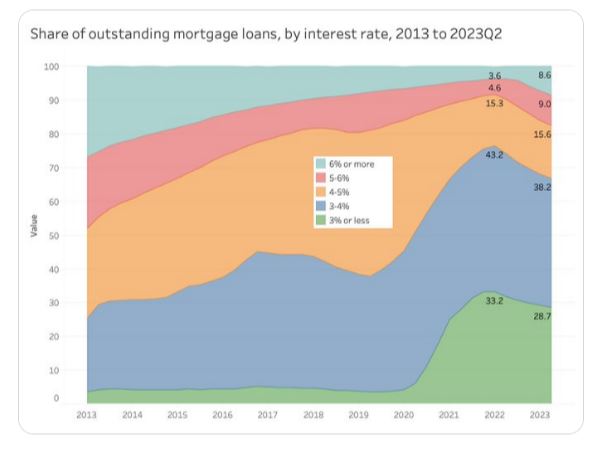

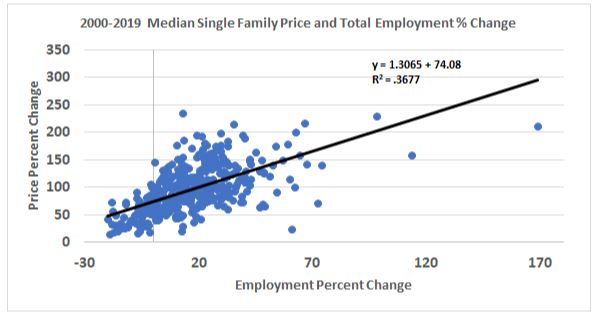

- A longer-term look at housing prices versus employment

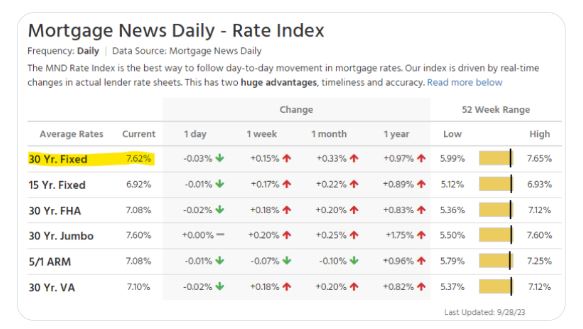

- UK homeowners say jump in interest rates will force more to sell

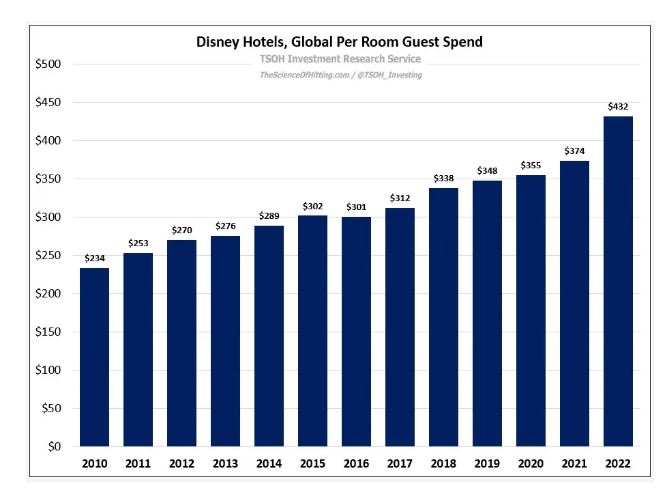

- The Science of Hitting on Disney

- 20% of adults own crypto and the vast majority see an urgent need to update the financial system

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

Still no recession, but core PCE down to 2.2% on a three-month basis. Team Long Transitory for the win.

— Paul Krugman (@paulkrugman) September 29, 2023

Good episode as usual. I think you and @michaelbatnick were discussing active/passive and wondered aloud whether active might boast better dollar-wgtd. returns (despite the long-term underperformance vs passive). We've done some work looking at that fwiw. https://t.co/RxNYGPpW0T pic.twitter.com/bULLFouIHD

— Jeffrey Ptak (@syouth1) September 27, 2023

First weekly outflow for US fixed income in 39 weeks.

via TD Securities pic.twitter.com/XXXGHsBhnP

— Daily Chartbook (@dailychartbook) September 29, 2023

The inflation data from PCE–which is what the Fed focuses on–were much better for August than the CPI data.

We now have three unambiguously good months in a row for core PCE.

Annual rates:

1 month: 1.8%

3 months: 2.2%

6 months: 3.0%

12 months: 3.9% pic.twitter.com/gyCCTHYe5A— Jason Furman (@jasonfurman) September 29, 2023

These numbers are wrong. Actual changes (Aug 2023):

gas: -3%

airline tickets: -13%

used cars: -7%

hotels: 3%

suits: -5%

bacon: -6%

oranges: -4%

tires: 2%

furniture: -1%

milk: -4%

coffee: 1%

deliveries: 6%

bread: 6%

baby food: 8%

soup: 4%

cereal: 4%

eggs: -18%

dry cleaning: 6% https://t.co/5J9N9lRNFB— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) September 28, 2023

"He becomes toxic. Like, nobody wants to talk to him. He has no friends,’" says Michael Lewis.

“There is still a Sam-Bankman-Fried-shaped hole in the world that now needs filling” for someone driven by their ideals to do good on a large scale, Lewis says. https://t.co/Xyofx7MQUU pic.twitter.com/NSDTGqnYaW

— 60 Minutes (@60Minutes) October 1, 2023

U.S. Pending Home Sales Index has now fallen by 44% from its peak, which is worse than during GFC pic.twitter.com/QdoorLDlJ4

— Liz Ann Sonders (@LizAnnSonders) September 28, 2023

#NEW Goldman Sachs reaffirms its U.S. home price outlook.

GS expects U.S. house prices to rise +1.8% in 2023 and +3.5% in 2024. pic.twitter.com/fFzSEcKFDy

— Lance Lambert (@NewsLambert) October 2, 2023

You: millennials are gonna crash this economy, they spent all their student loan $ on Taylor Swift tickets

Me: nah, they're in the best position to pay off their debt in over a decade pic.twitter.com/QsIccT5OWE

— Callie Cox (@callieabost) September 30, 2023

Current situation:

1. Stocks are falling like a recession is coming

2. Oil prices are rising like there's no recession in sight

3. Interest rates are rising like we have 10% inflation

4. Gold is falling like inflation is gone

5. Housing prices are rising like rates are…

— The Kobeissi Letter (@KobeissiLetter) September 27, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.