Brandolini’s law states: The amount of energy needed to refute bullshit is an order of magnitude bigger than the amount needed to produce it.

Carlson’s law of finance is similar: The amount of energy needed to refute bad news is an order of magnitude bigger than the amount needed to produce it.

It’s much easier to take bad news at face value than good news. People are skeptical of good news these days. They only want to see potential downsides in the markets and economy.

I get it.

People have been predicting a recession for a long time and it hasn’t happened. Everyone hates high inflation.

A year and a half ago, I asked the following: Has the consumer ever been more prepared for a recession?

Strong household balance sheets coming out of the pandemic are likely one of the biggest reasons we still haven’t gone into a recession.

Consumers make up 70% of the U.S. economy and we love spending money.

I made a comment last week that consumers are still in pretty decent shape and someone asked me how that’s remotely possible.

What about inflation?! Credit card debt?! Mortgage rates?! Excess savings are gone?!

All fair points.

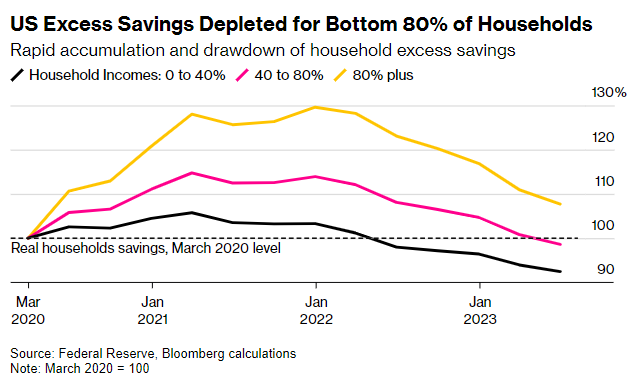

Household balance sheets were in a better place 18 months ago than they are now. The Fed says excess savings from the pandemic are gone for the majority of Americans:

Inflation and a spending binge will do that for you.

But remember, these are excess savings, which means they were over and above the savings we would have expected people to have had the pandemic not happened. So there are still savings, they’re just not as high as they once were.

Let’s look at a few other markers to see how consumers are doing.

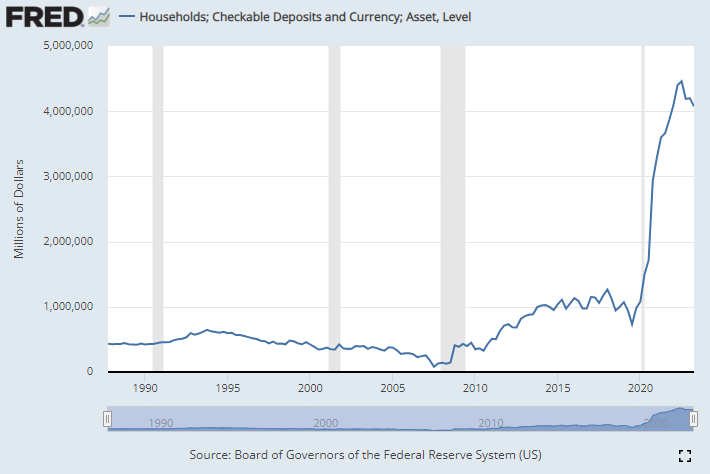

Households are still sitting on a ton of cash in the bank:

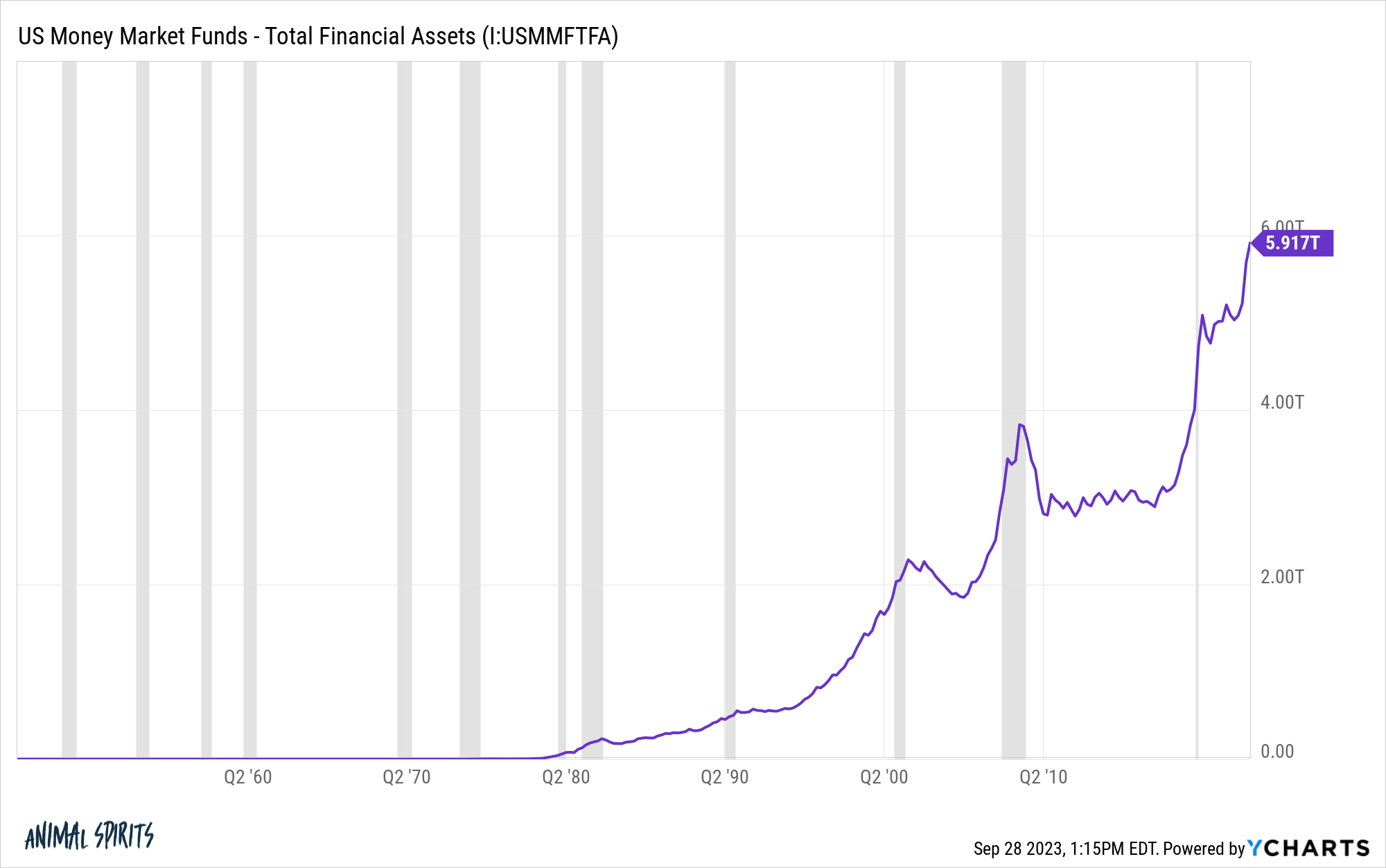

And look at the increase in money market funds:

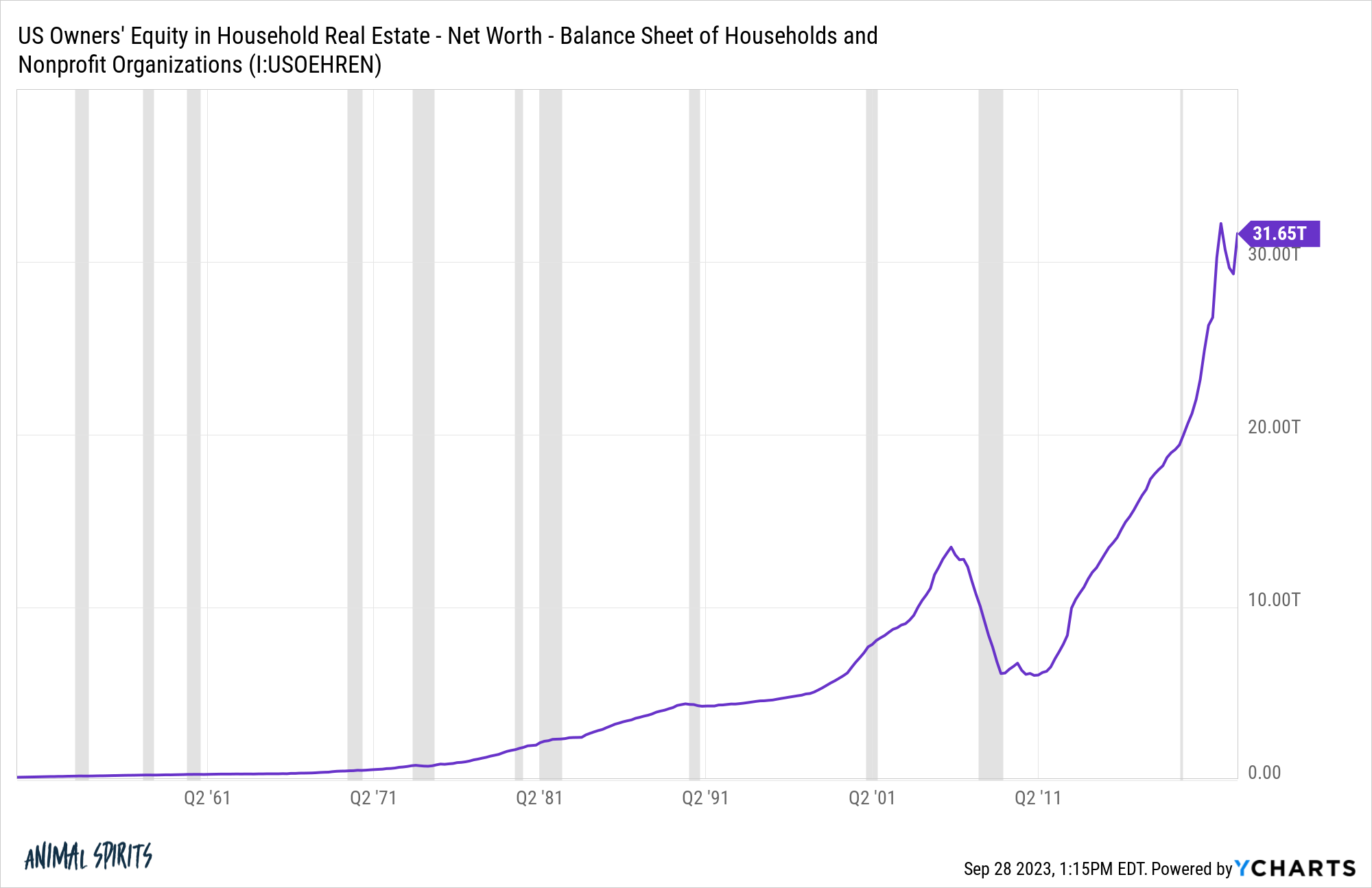

Home equity remains strong as well:

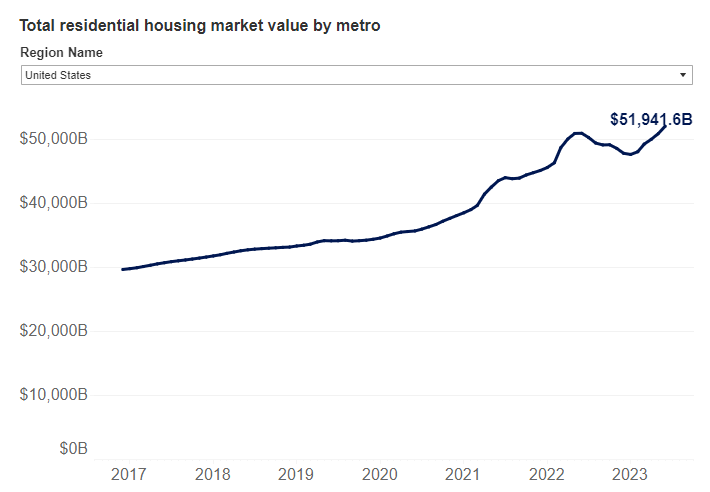

Zillow reported this week the total value of residential real estate in America broke a new record at $52 trillion. That’s up 49% since before the pandemic:

Yes higher housing prices and mortgage rates have made it unaffordable for new buyers but two-thirds of Americans own their home. Homeowners have never had a built-in margin of safety like they have now.

I would expect people to tap their home equity in droves in the years ahead, higher interest rates or not. Do you really think people are going to slow their spending when they have a giant piggy bank they can break open in case of emergency?

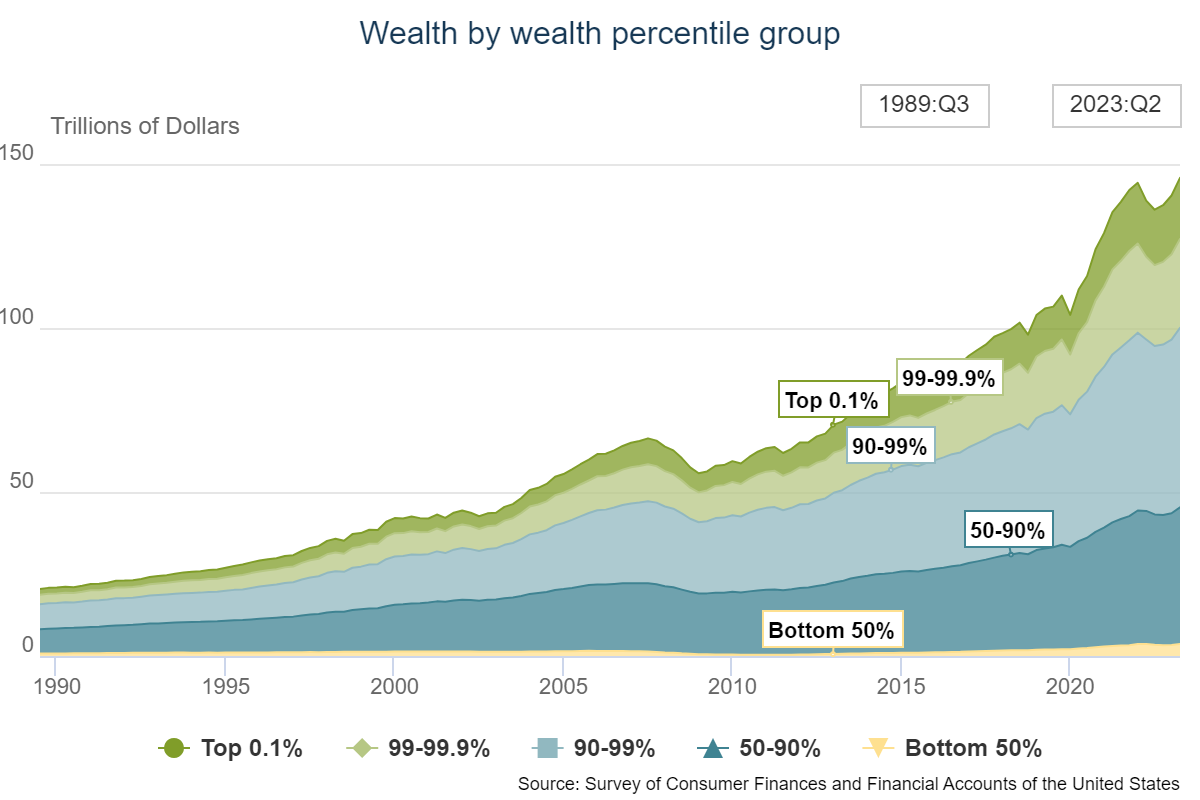

Some people would claim it’s only the top 10% or top 1% who are in a good position financially but that’s not true.

Here is the growth in household net worth since 2020:

The net worth of U.S. households is up 33% since the start of 2020. These are the gain by wealth percentile:

- Top 1%: +$12.3 trillion

- 90-99%: +$12.2 trillion

- 50-90%: +$9.9 trillion

- Bottom 50%: +$1.5 trillion

Yes, most of the absolute gains have gone to the wealthy.

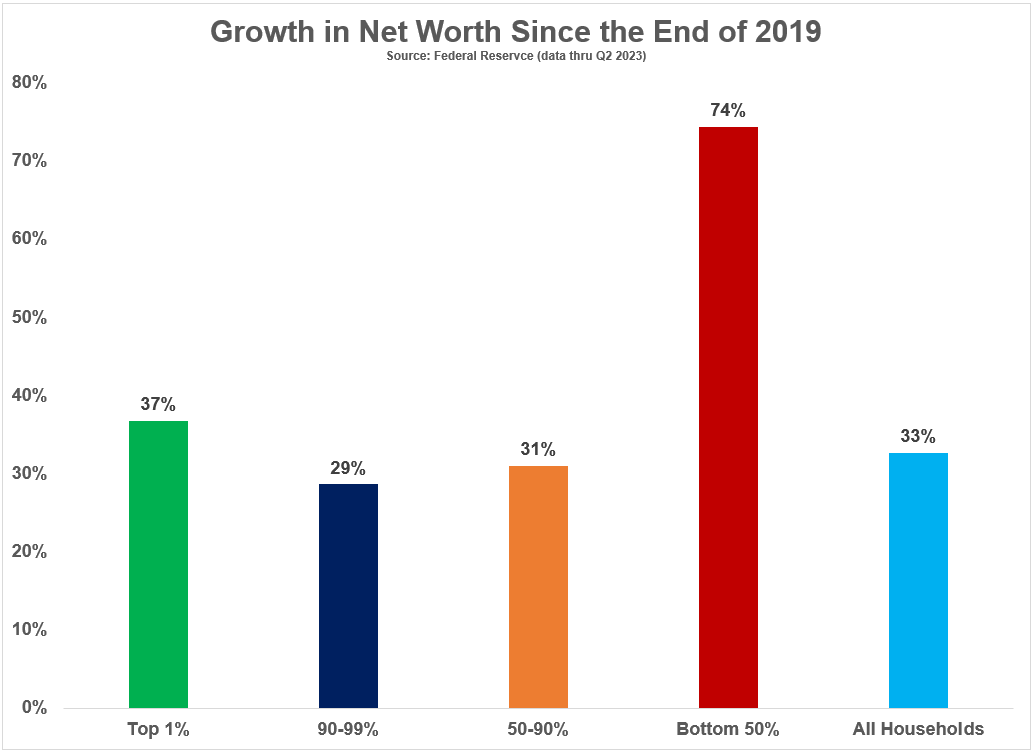

The top 10% makes up 68% of the total gains in net worth since the pandemic started. But on a relative basis, the bottom 50% has seen by far the biggest growth as a percentage of previous totals:

While the average household has experienced an increase of 33% in net worth since the start of 2020, the bottom 50% is up nearly 75%.

This is unheard of since probably the end of World War II.

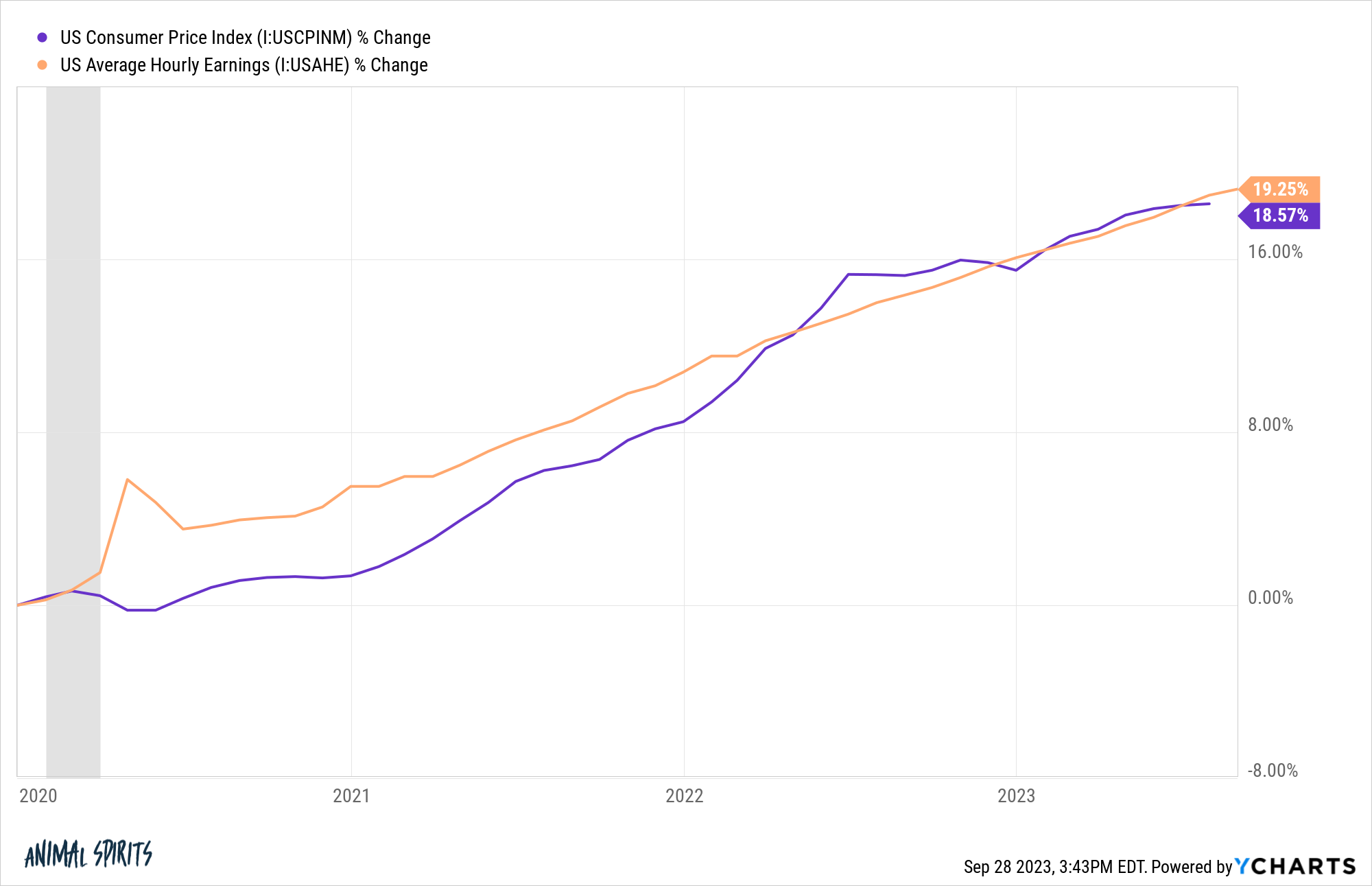

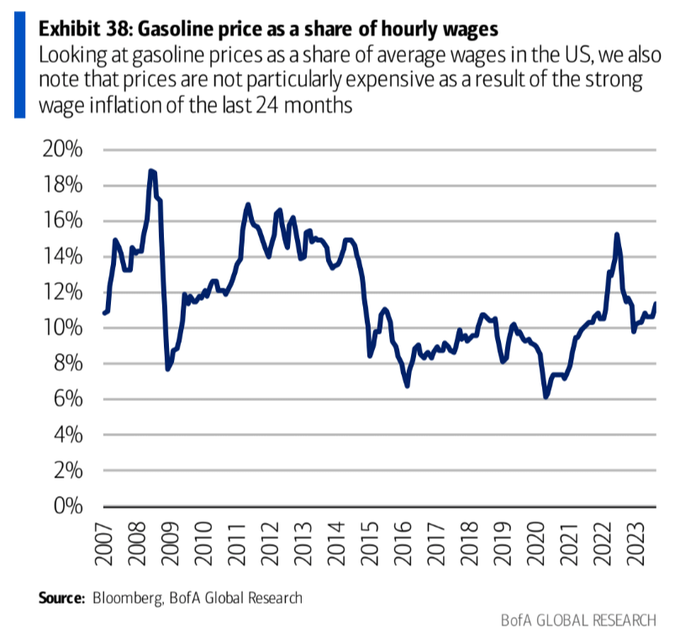

I know everyone hates inflation but you can’t simply look at prices in a vacuum. Wages have gone up too.

The Wall Street Journal has a great chart that shows wages versus inflation since 2019:

Unfortunately, prices were growing faster than wages for most of 2021 and 2022 but wages were growing way faster than inflation in 2019 and 2020.

And earnings have kept pace with price hikes since the start of the pandemic:

People hate paying higher prices but the consolation prize for higher inflation is higher wages.

When you consider the wage growth, prices aren’t as high as they may seem.

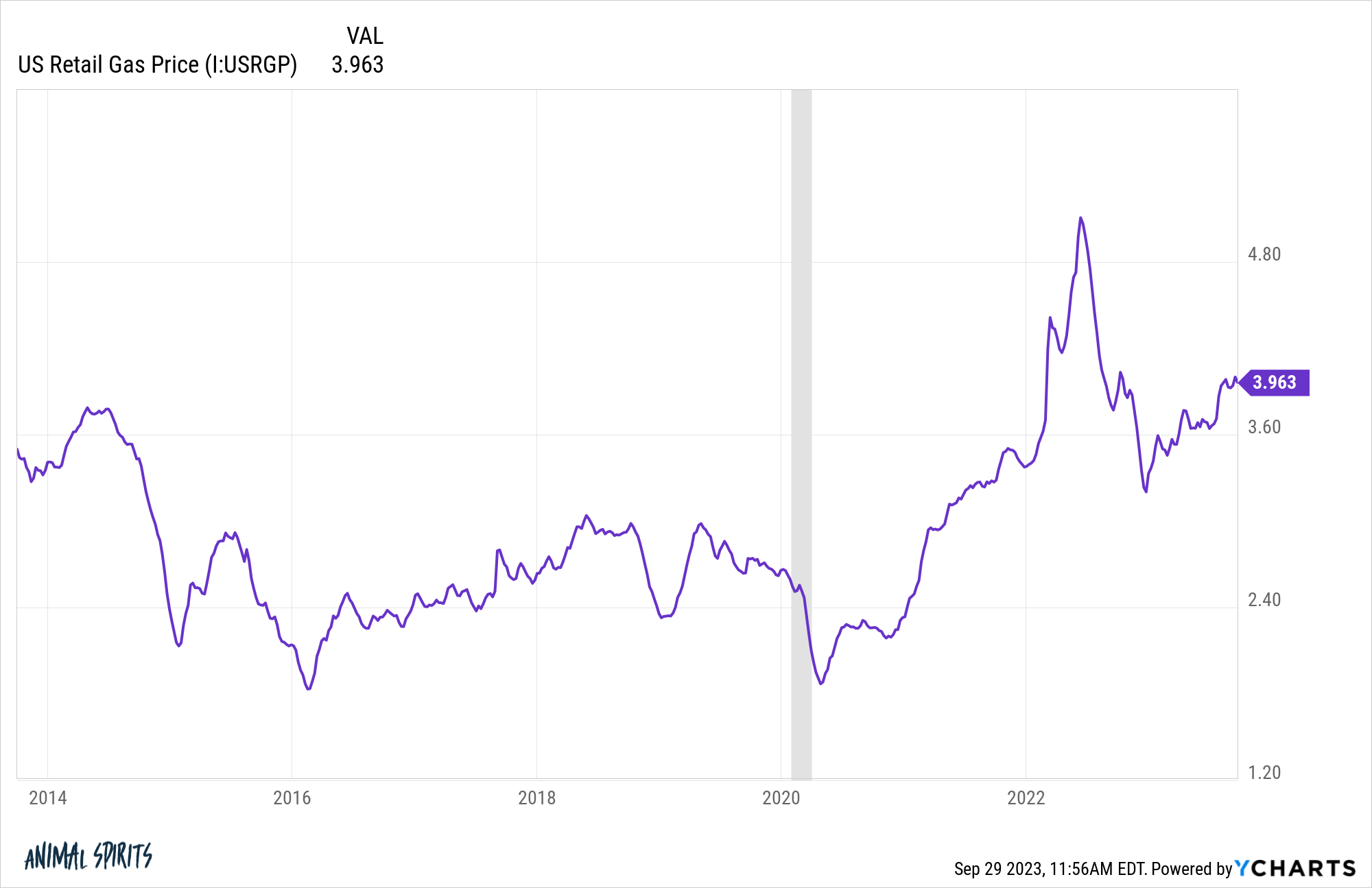

Take gas prices for instance. They seem pretty high right?

We’re not used to paying nearly $4/gallon.1

It feels high because we’ve anchored to lower prices on those huge numbers we see every time we drive by a gas station.

But look at gas prices relative to wages:

Not so bad, right?

Listen, I’m not here to tell you things are perfect. They’re not (and never will be).

However, things aren’t as bad as you might think right now.

If we do get a recession the record levels of net worth will fall. People will rack up more debt. The consumer will be in pain. That’s what happens in a recession.

But consumers are still in pretty good shape and people have been psychologically preparing for a recession for some time now.

Most households have a decent margin of safety built into their finances when the inevitable economic downturn hits.

I just don’t know when that will be.

Further Reading:

Has the Consumer Ever Been More Prepared for a Recession?

1People in California and Europe can’t believe some people still pay less than $4/gallon right now.