On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy:

Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is.

We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

I have lots of questions:

1. Is this the Fed’s fault?

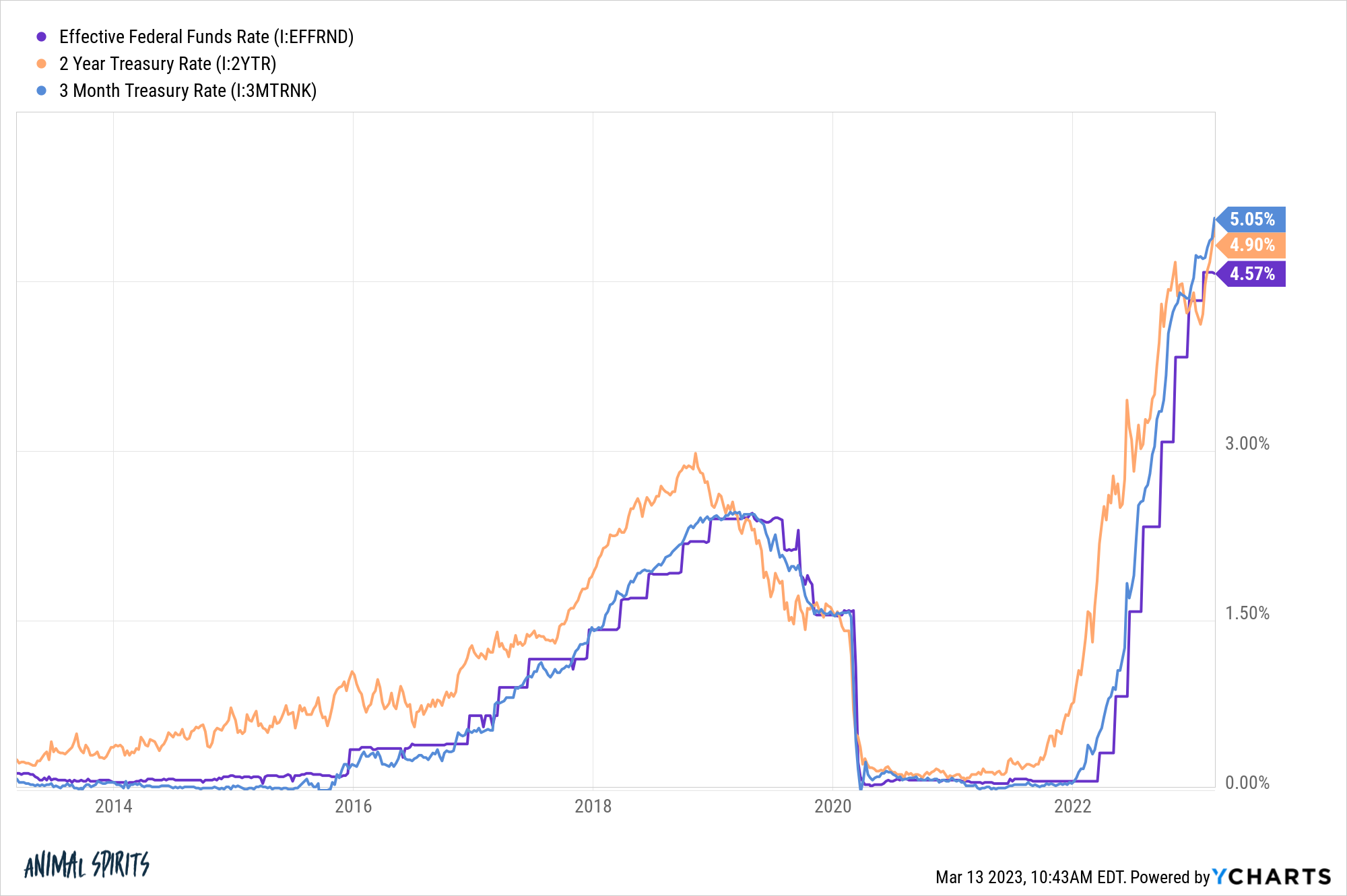

The Fed certainly played a role. It’s obvious in retrospect that they held rates too low for too long but they compounded that mistake by raising rates too far too fast:

Something was bound to break by going from 0 to 60 so quickly.

Silicon Valley Bank executives deserve a lot of blame too. They mismanaged their interest rate and liquidity risk, they had a concentrated set of clients and those clients all rushed to the exit doors at the same time. There are plenty of other banks that held up just fine with rapidly rising interest rates.

It’s never just one thing when something like this blows up.

The tech sector obviously doesn’t have a firm grasp on the financial sector just yet. But the Fed has blood on its hands here too.

2. Is the Fed done raising rates?

It’s amazing how quickly inflation has gone from being the biggest worry to a potential afterthought. The Fed still has price stability as a mandate and we’re not done fighting the war on inflation.

I just don’t see how they can remain so aggressive in the face of a banking crisis.

I don’t know if this bank run will have a material impact on the economy but it had to spook the Fed.

It was the failure of Continental Illinois in the early-1980s that made the Paul Volcker-led Fed realize they probably went too far with rate hikes.

3. Why are interest rates collapsing?

Last week the 2 year treasury yield hit 5%. That was on Wednesday. It briefly dipped below 4% on Monday, ending the day at a little more than 4%.

Rates fell across the board.

This could be a signal from the bond market that it thinks the Fed is done tightening (and might even have to cut rates if there are more banking problems). There is also an element of a flight to safety, which should be a welcome sign to bond investors after the drubbing fixed income took last year.

The worst-case scenario is the bond market predicting further pain in the financial sector and the economy.

This all happened so fast that the bond market itself probably doesn’t know for sure.

4. Is the banking industry changed forever?

The way FDIC insurance works is the banks essentially pay a premium like you would for any other form of insurance.

The technical FDIC deposit insurance limit is $250,000 but the past few days make it clear the government is not going to allow depositors to lose their money at a bank.

It sure seems like that means FDIC insurance on deposits is now implicitly limitless

Crossover tweet:

The new FDIC deposit insurance limit has been lifted from $250,000 to Everything Everywhere All at Once

— Ben Carlson (@awealthofcs) March 13, 2023

If that happens the biggest banks would be the biggest beneficiaries because they can afford it.

So while it could be a lack of trust that caused a bunch of regional banks to get their teeth kicked in on the stock market, I think the bigger realization could be that depositors will concentrate more money at the bigger financial institutions.

To be fair, stock prices for the big banks are down too but that could be because the cost of doing business for everyone has gone up.

Unfortunately, I think this means ever worse yields for banking consumers.1

5. Is a banking crisis bullish for the stock market?

It’s bizarre to think that a banking crisis could be bullish for the stock market but it is a distinct possibility.

A loss of trust in the financial system is almost always deflationary. If that causes the Fed to slow their interest rate hikes and leads to an inflation slowdown we could be setting up for a stock market rally.

As always, this is far from guaranteed but it’s wild to think about how much the world has changed in the past week.

Maybe this is a blip and things settle down but it’s hard to put the genie back in the bottle once trust in the financial system is shaken.

6. Is technology making the world less stable?

I wrote on Sunday about how J.P. Morgan helped slow the pace of bank runs in 1907 by having bank tellers count out customer withdrawals very slowly.

That wouldn’t work today.

A combination of rumors, social media and some panicked VCs led to more than $40 billion of depositor withdrawals in a single day from Silicon Valley Bank. And those withdrawals didn’t require bank tellers to count out cash by hand.

They were done with the push of a button.

Technology certainly made the world more stable during the pandemic but it also made it much easier for one of the biggest banks in the country to go under in a matter of days.

As always, there are trade-offs when it comes to innovation.

7. What are the unintended consequences of this bank run?

This is always one of the hardest questions to answer in the moment. Sometimes we feel the unintended consequences right away and sometimes they’re not known for years down the road.

This crisis feels like it could lead to reverberations for years to come.

8. Is my money safe?

This is a question a lot of people didn’t think they had to worry about until these past few days. People tend to freak out when they are forced to worry about things they didn’t think they had to worry about.

The good news is most of us will never have to worry about what it’s like to have more than $250,000 in the bank but plenty of business owners do.

Putting aside the rules that are currently in place and your personal feelings about moral hazard, it’s hard to think regulators and politicians would ever willingly let the banking system collapse.

And if you own stocks, bonds, mutual funds or ETFs, no financial institution (assuming you’re not in Madoff Securities) can utilize them on your behalf. If Vanguard or Fidelity or Blackrock or Charles Schwab went down tomorrow for whatever reason, you still own your securities. They are simply storing them for you.

I can’t make any promise that there won’t be more pain to come in the banking sector because faith and trust are psychological variables that are impossible to forecast.

If you’re sitting on a whole lot of cash you might need to be more considerate about where that cash resides and how you manage it. This should be a wake-up call if that’s the case.

For the rest of us, there are plenty of protections in place to safeguard your money.

Further Reading:

Bank Runs, Now & Then

1I bank with JP Morgan. Their rates are ridiculously low on deposits but I don’t ever worry about them going under. Right or wrong if they ever do run into trouble they are getting bailed out. I do wonder if a lot of people will now feel that way if they had most of their money with smaller regional banks.