Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to get 20% off YCharts (new clients only)

On today’s show, we discuss:

- The retreat of the amateur investors

- Jim Cramer versus the world

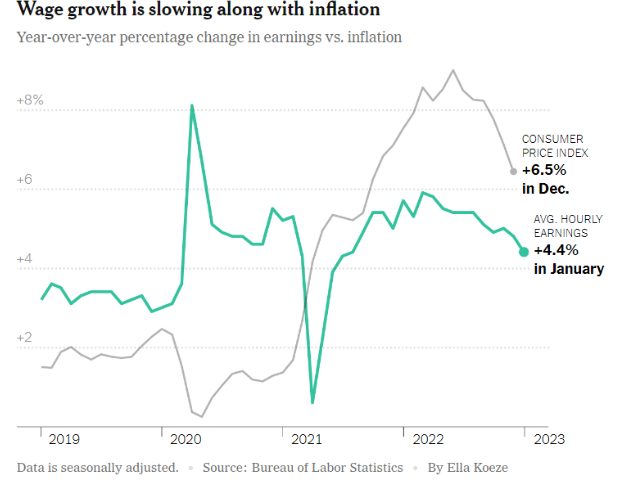

- Booming job gains could fuel Fed debate over whether more is needed to corral inflation

- US hiring surges with January gain of 517,000 jobs

- Jeremy Siegel expects rate cut, stock surge in second half of 2023

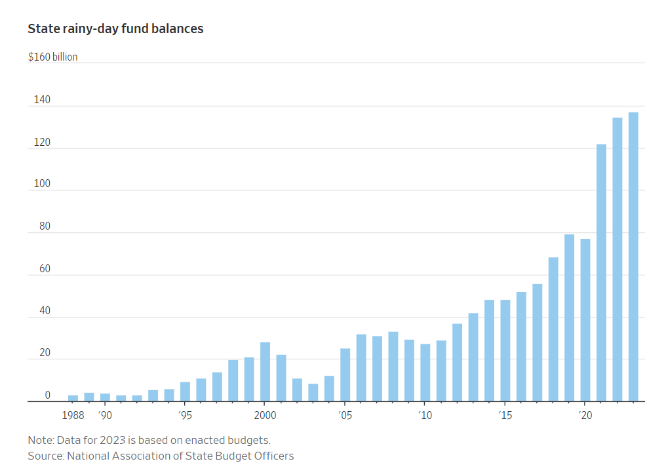

- States are flush with cash, which could soften a possible recession

- Whole Foods asks suppliers to lower prices

- PayPal to lay off 2,000 employees

- Rolex reseller Chrono24 cuts jobs as pre-owned watch prices fall

- Why America should ban Crypto

- Single women own more homes than single men

- META earnings

- Short on cash, more Americans tap 401K savings for emergencies

- Airbnb and Expedia turn customer cash into profit, aided by rising interest rates

Future Proof:

Listen Here:

Recommendations:

Charts:

Tweets:

Retail trading orders, as a percentage of volume, have surpassed the 2021 meme-mania peak.

(via @business @luwangnyc)https://t.co/iVJh5T7sby pic.twitter.com/VQFRukInMn

— Carl Quintanilla (@carlquintanilla) February 2, 2023

Value vs. Growth has stopped caring about interest rates.

Last year: "If rates are going higher, I want to own Value, not Growth. Once rates start falling again, Growth will start working again."

But rates ARE now falling…and Growth is still not working.

It's a Value cycle. pic.twitter.com/9qsSgfDJQh

— Jeff Weniger (@JeffWeniger) February 3, 2023

“The market – rightly in our view – faded the hawkish jawboning, focused on the Fed’s recognition that disinflation is underway and perceived that there is a path to a pause after one more 25bp in March”

Evercore

— Jonathan Ferro (@FerroTV) February 2, 2023

founders: You don’t need a lot of people to make a lot of money pic.twitter.com/y4omt1GNgc

— @jason (@Jason) February 1, 2023

Fed Chair Powell is optimistic about a soft landing:

"I continue to think there's a path to getting inflation back down to 2% without a really significant economic decline or a significant increase in unemployment."

"This is not like the other business cycles in so many ways" pic.twitter.com/F7acCKJOVz

— Heather Long (@byHeatherLong) February 1, 2023

I’m a supply chain professional and I’ve never seen the labor market so desperate for workers. So many ppl in and out of tolls quickly as well.

I don’t see this ending soon either.

— ddreery (@DDreery) February 3, 2023

Incredible collapse in M2 money supply growth.

People were very concerned this would cause hyperinflation back in 2020…. pic.twitter.com/BZyZm0XVQC

— Cullen Roche (@cullenroche) January 24, 2023

Green Shoots?

IMF upgrades global growth outlook for 2023.

Biggest upward revision among major economies seen in Germany and China.https://t.co/oaXX9T4ABI pic.twitter.com/D14AU85JK2— Jeffrey Kleintop (@JeffreyKleintop) January 31, 2023

* US auto sales: 20-month high

* incentives DOWN

* inventory UP#ThingsYouDontSeeInRecession(via MS/Jonas) $TSLA $GM $F pic.twitter.com/aDXRXe9TQJ

— Carl Quintanilla (@carlquintanilla) February 2, 2023

A lot of talk about how new vehicle prices have surged over the past couple years — here’s new vehicle prices as measured by the CPI divided by average hourly earnings. Not sure we get lucky like we did from 1995-2020 again: pic.twitter.com/ftg6ppje3K

— Conor Sen (@conorsen) February 4, 2023

MORGAN STANLEY: “.. demand for services, especially travel, held up well last year but we think consumers and companies will tighten their belts as we progress through 2023.” [Wilson] $JETS $XAL pic.twitter.com/l8rDhAteKB

— Carl Quintanilla (@carlquintanilla) January 23, 2023

"…the average price of a dozen eggs is down more than 40% from its December peak of about $5.30. A dozen eggs now cost just over $3." @MatthewPhillips @axios https://t.co/Pj2iHsb3qZ pic.twitter.com/uL5dRSnt9G

— Sam Ro 📈 (@SamRo) February 1, 2023

Last 24 hours:

* NetApp: 8% of workforce

* HubSpot: 7%

* PayPal: 7%

* Workday: 3%

* Impossible Foods: 20% https://t.co/CesUamwZtE— Carl Quintanilla (@carlquintanilla) February 1, 2023

For every headline you read about the surge in layoffs, it's worth turning to nationally representative data to get some context. Here's the latest numbers. pic.twitter.com/xKI9GuonlD

— Justin Wolfers (@JustinWolfers) February 1, 2023

https://twitter.com/AP_Abacus/status/1621678845974700033

We're in a bifurcated housing market correction.

San Francisco is down 10.5% from its peak.

Chicago is down just 0.1%. https://t.co/5qVLGQtoGs pic.twitter.com/eM6EY1UYth

— Lance Lambert (@NewsLambert) February 1, 2023

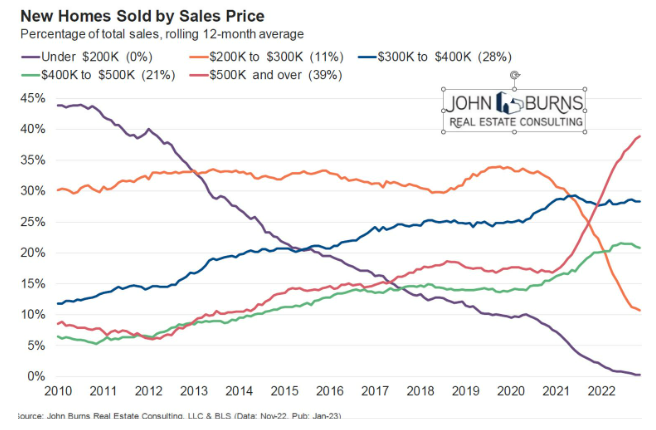

New homes priced below $200K are now 0% of the market.

They were 40% of the market one decade ago.$500K+ homes have grown from 17% of the market to 38% of the market during Covid.

Expect both of these trends to reverse this year. pic.twitter.com/Q8Ftcojg2G

— John Burns (@johnburnsjbrec) January 31, 2023

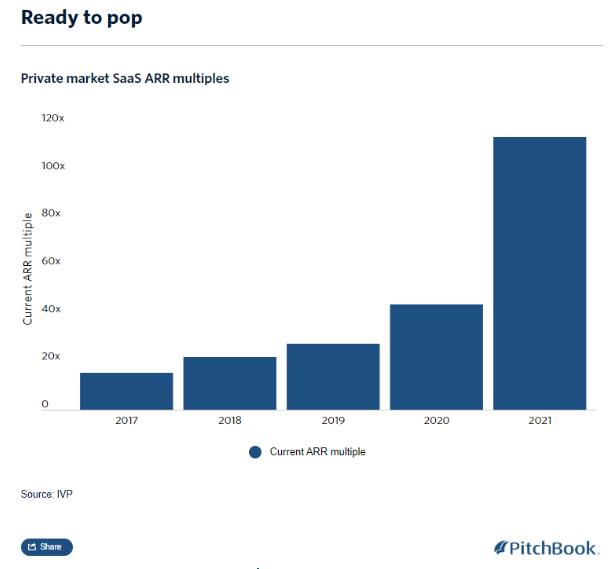

1) Stripe doing a clean down round is healthy for ecosystem.

Many companies that raised at absurd multiples (avg SaaS deal in 21 was done at 114x ARR per IVP) will need to raise again soon.

Majority will be down rounds or heavily structured. Both options should be considered.

— Gavin Baker (@GavinSBaker) January 31, 2023

AAPL product revenue pic.twitter.com/yo73gTQV1I

— zerohedge (@zerohedge) February 2, 2023

https://twitter.com/nmasc_/status/1620940487078350848

Median weekly earnings for Americans working full-time is $1,084, or $4,336 every 4 weeks. A median-earning couple would thus have around $9,000 of income every month, making median rent just 22% of their incomehttps://t.co/UG207jgDNz https://t.co/jLioK2EvAV

— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) January 30, 2023

We did it everyone! Credit card debt is right back on trend. pic.twitter.com/HGFpDFe2vi

— Arpit Gupta (@arpitrage) February 3, 2023

@michaelbatnick @awealthofcs just a PSA: a few months back you guys were trying to decipher the definition of “gas lighting”. the old woman who hit michael in the parking lot is a textbook example of gaslighting lol

— Tucker Donahue (@TuckeRyan) February 1, 2023

ChatGPT reaches 100 million active users in 2 months, the fastest growing consumer app in history.

— Watcher.Guru (@WatcherGuru) February 3, 2023

Fun take: Approximate number of mentions of "AI" in earnings calls in the latest earnings call: $GOOG: 62 Times$META: 33 Times$MSFT: 31 Times$AAPL: 2 Times$AMZN: 0 Times

— The Transcript (@TheTranscript_) February 3, 2023

BOX OFFICE: The Big Stories..

– #Avatar Dethroned! #KnockAtTheCabin tops weekend w/ $14.2M, becoming first 2023 film to open #1 at BO

– This is M. Night’s 7th film to open #1

– #80ForBrady nabs #2 w/ $12.5M. More on this one shortly..

– Domestic BO nearly +50% from 2022 so far. pic.twitter.com/1wcPC1g912— Erik Davis (@ErikDavis) February 5, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.