Today’s Animal Spirits is brought to you by Helios:

Enter your information here to get 10% off for the first year!

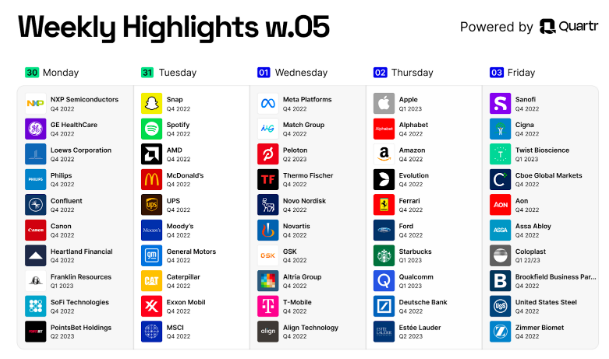

On today’s show, we discuss:

- After a timeout, back to the meat grinder!

- What businesses do > what businesses say

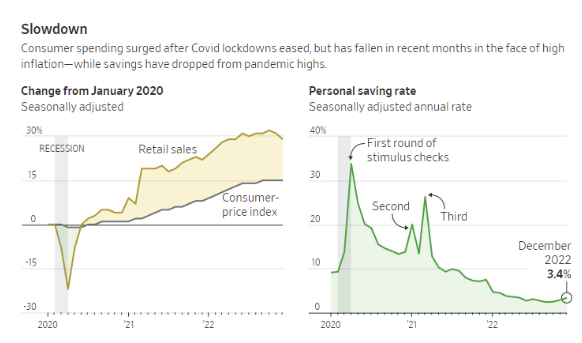

- The US consumer is starting to freakout

- Has housing “bottomed”?

- Wall Street is losing out to amateur buyers in the housing slump

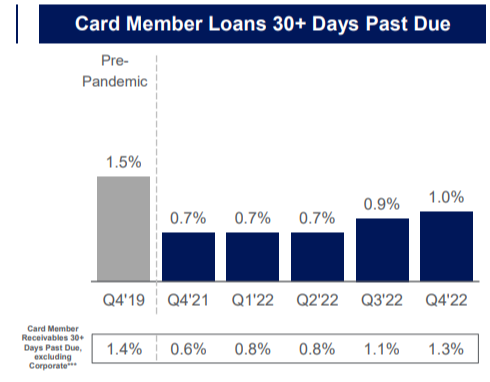

- American Express earnings

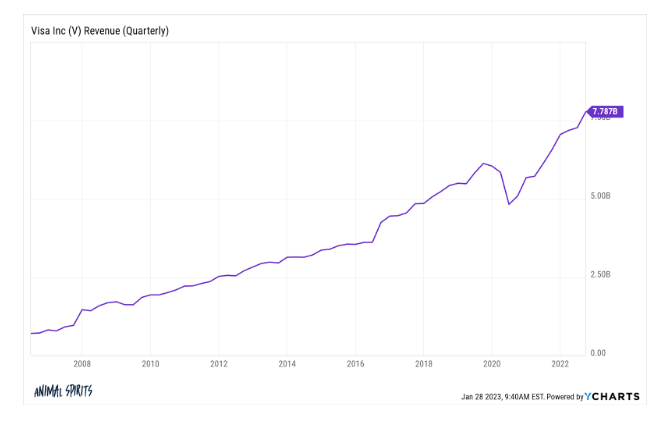

- Visa earnings

- How parenting today is different and harder

- Car leasing plummeted during pandemic, could take years to recover

- Americans are gobbling up takeout food, restaurants bet that won’t change

Future Proof Festival 2023:

Listen Here:

Recommendations:

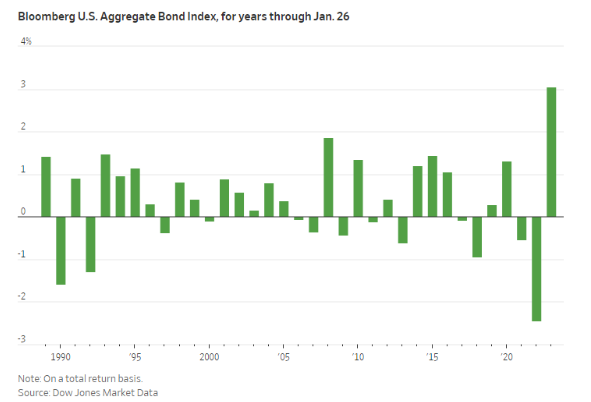

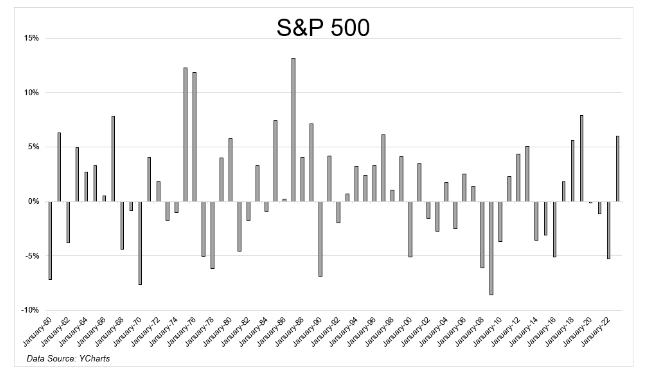

Charts:

Tweets:

Stocks bottom 6-9 months before earnings. pic.twitter.com/UE0U2ktaGZ

— zerohedge (@zerohedge) January 17, 2023

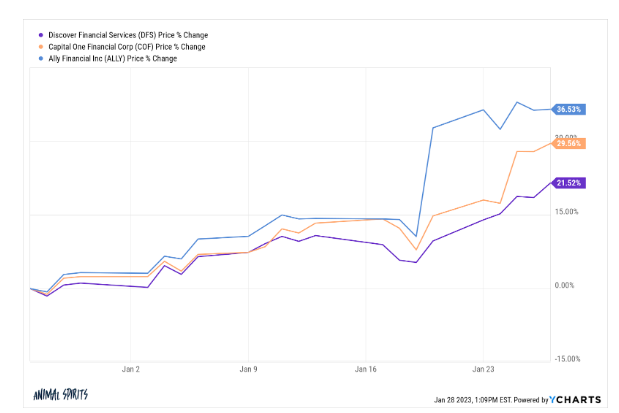

Post-earnings rallies in $DFS and $COF are an effective giant middle finger to the narrative about consumers buckling under debt-loads pic.twitter.com/8GXtrgHFR5

— Oliver Renick (@OJRenick) January 25, 2023

Worst 3-week stretch for Value vs Growth in at least 19 years pic.twitter.com/N2KG4nQURN

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 27, 2023

THINGS YOU NEVER SEE: A Europe ETF leading YTD flows w/ $3.6b. No doubt this is JPMorgan's own model, but that's a MASSIVE number, they must be ALL IN on this trade. Also, only one Vgrd ETF in Top 10. That won't last, neither will Europe, so good thing I captured the moment here: pic.twitter.com/410XjelaJv

— Eric Balchunas (@EricBalchunas) January 31, 2023

Sometimes you need to look at the big picture: It's been an incredible rebound from the 2020 pandemic recession.

The US has recovered all output lost in the crisis and gotten back on trend.

GDP

2022: +2.1%

2021: +5.9%

2020: -2.8%https://t.co/gAM6bebF0l via @abhabhattarai pic.twitter.com/cEExbsVH95— Heather Long (@byHeatherLong) January 26, 2023

Um…

"A new working paper from the Federal Reserve argues that the central bank’s recent increases in benchmark interest rates may be exacerbating wealth inequality rather than reducing it." https://t.co/vgS0MmYrjs by @tracyalloway

— Joe Weisenthal (@TheStalwart) January 26, 2023

APOLLO: Average hotel room rates in Manhattan, Midtown, and Times Square, are “now above pre-pandemic level. .. the consumer is still doing fine. The interest rate-sensitive components of GDP are softer, but the overall picture continues to look like a soft landing ..” [Slok] pic.twitter.com/p3TwTpgM48

— Carl Quintanilla (@carlquintanilla) January 28, 2023

Remember when Fintwit became geo-political energy experts and were convinced we are going to run out of Nat Gas and we'd be chipping the frozen bodies off the streets in Europe, whilst cheering the bull run in energy?

Nat Gas -73% so far and unlikely to stop until we hit $2 pic.twitter.com/bci0uUvNIW

— Raoul Pal (@RaoulGMI) January 26, 2023

Natural Gas Down 0.6% at $2.661 and Set for Largest 1-Month Decline in 22 Years, Down 41%

— *Walter Bloomberg (@DeItaone) January 31, 2023

Alaska Air plans to hire 3,500 https://t.co/lL7Wrudl7z

United plans to hire more than 2,500 pilots https://t.co/Ty4MSjrFhb

— Sam Ro 📈 (@SamRo) January 27, 2023

@awealthofcs love the show, I’ve worked in HR for 8+ years now. LinkedIn is great for higher level roles. The others you mentioned are vital for positions below 100,000. They’re great for both job seekers and hiring managers because of their filtering and organization tools

— stef (@stefcpop) January 26, 2023

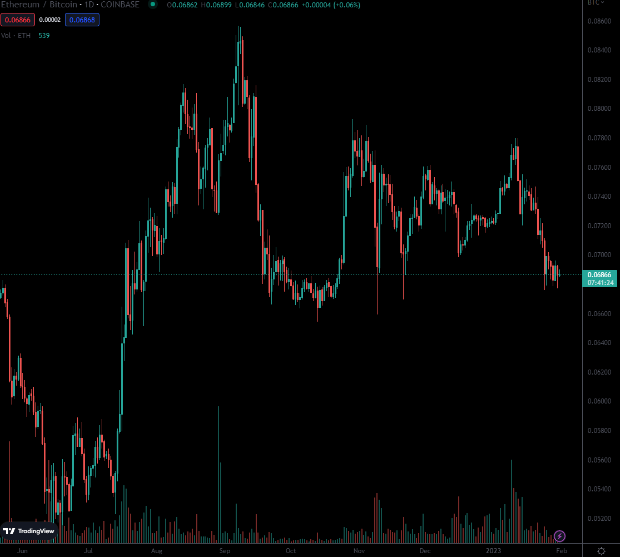

$117 million of inflows into crypto last week, biggest week since July of last year, according to CoinShares.

$116m went to Bitcoin, $1m to everything else.— Gregory Zuckerman (@GZuckerman) January 30, 2023

Exactly one year ago pic.twitter.com/sMYpib6rQH

— future canon 🇵🇸 (@futurecanon) January 24, 2023

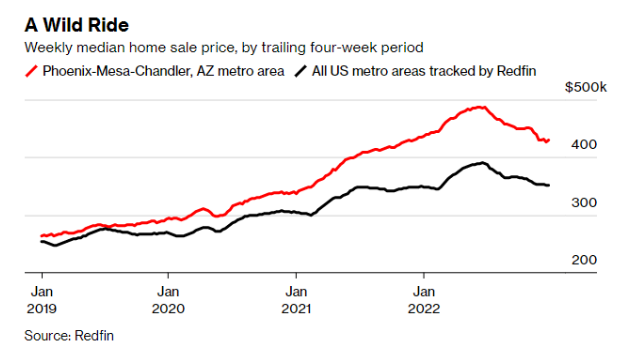

The ongoing home price correction won't be like ones of the past, says Goldman Sachs.

The hardest punch came right out of the gate.

The nominal price declines will slow from here, and fizzle out later this year, according to GS. pic.twitter.com/dfDjgI9sa2

— Lance Lambert (@NewsLambert) January 24, 2023

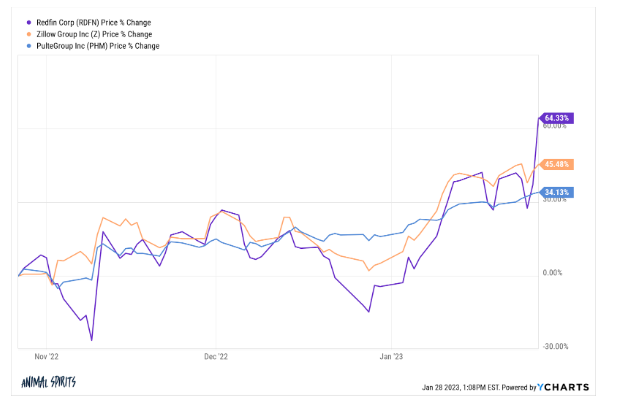

Has the housing market already found the bottom?

Inventory keeps declining. Down 1.4% to only 466,000 single family homes. Fewest since June! Multiple offers (what?!)

Prices holding up as a result.

Details in this week's @AltosResearch video 🧵📽️👇

1/6 pic.twitter.com/TfcJDkzpMh

— Mike Simonsen 🐉 (@mikesimonsen) January 30, 2023

"Black Knight Estimates That the Share of Mortgage Borrowers That Are Underwater Would Increase by Only 3pp to 2016-2017 Levels if Home Prices Decline 15%" -GS @awealthofcs pic.twitter.com/iSnbR9rB1m

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 24, 2023

$AXP CEO: "We aren't seeing recessionary signals…the consumer is really strong, travel bookings are up over 50% vs pre-pandemic…. T&E spending is still really strong with the consumer…. We're feeling good" https://t.co/lMwbHUSPIb

— The Transcript (@TheTranscript_) January 27, 2023

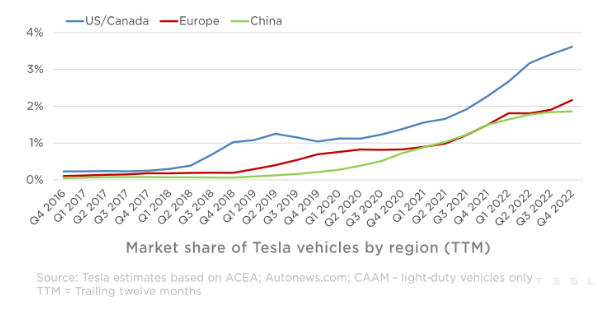

The resilience of the American economy is astounding:

– Financing rates at record highs.

– Monthly payments at record highs.

– New car prices at record highs.

– Used car prices slightly below record highs.

And… Car dealers are having a very strong month.

I can’t explain it

— Car Dealership Guy (@GuyDealership) January 31, 2023

Could we kick off @MakingMediaPod with anyone other than @patrick_oshag? We covered:

– origins of building Colossus

– traits of a great interviewer

– lessons from media building.If you want a taste of the debates we have at @joincolossus – check this out. pic.twitter.com/8Zwc3NiTn9

— Matt Reustle (@ReustleMatt) January 30, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.