Today’s Animal Spirits is brought to you by Kraneshares and Composer:

See here to learn more about KraneShares suite of thematic ETFs

See here for more information on Composers’ new one-click portfolio

On today’s show we discuss:

- Carmax earnings

- America’s love affair with pickup trucks

- Restaurant staffers are returning to work after Covid flight

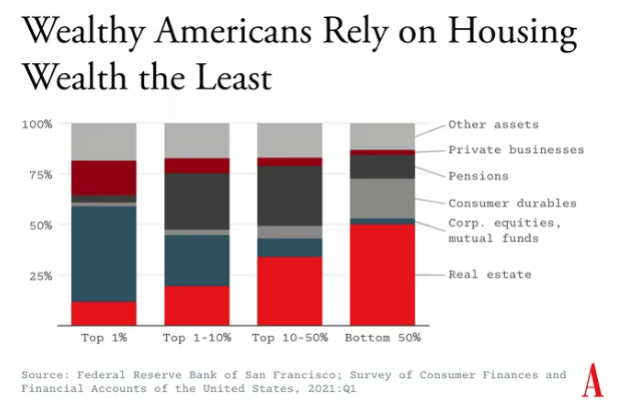

- The homeownership society was a mistake

- Goldman’s misadventures on Main Street

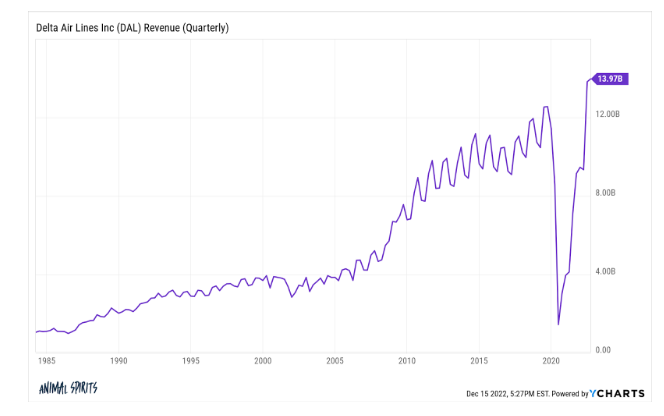

- The leisure traveler – coming to the rescue of airlines everywhere

- Florida treasury divests from BlackRock

- Republicans’ ESG fight with Wall Street clashes in small-town Texas

- BlackRock faces further ESG backlash as Arizona and North Carolina pile on

Listen here:

Recommendations:

Charts:

Tweets:

Economists surveyed by @Bloomberg say there is a 70% chance the U.S. economy will fall into a recession next year … probability rose from 65% in November and is more than double what it was six months ago pic.twitter.com/FaWtWKSnZC

— Liz Ann Sonders (@LizAnnSonders) December 21, 2022

https://twitter.com/psarofagis/status/1605598075732430848

The 2-Year Treasury is now well below the Fed Funds Rate (chart below).

This is the market telling the Fed to stop hiking.

Historically, a FFR-2YR inversion kicks off a chain reaction in fed policy and fixed income.

Quick thread on what history says is next. pic.twitter.com/lcW09upiPY

— Warren Pies (@WarrenPies) December 20, 2022

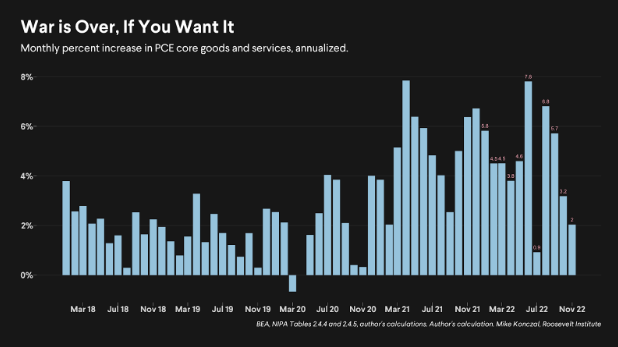

The core PCE index rose 3.6% in November on an annualized basis over the previous three months.

That is the smallest rise in 3-month core PCE inflation since February 2021 https://t.co/wNaAj2HCT8 pic.twitter.com/3gae2c0IBz

— Nick Timiraos (@NickTimiraos) December 23, 2022

Imagine you’re a 750+ credit score.

Now imagine you come to buy a car and I offer you 9% APR 🤢

I don’t need to say much more.

High rates are killing the car business right now.

— Car Dealership Guy (@GuyDealership) December 22, 2022

Carmax misses on top & bottom line.

CEO: "In response to the ongoing pressures across the used car industry…we are managing our business prudently & prioritizing initiatives that reduce costs, unlock operating efficiencies, profitably grow market share…"$KMX -13.3% PM pic.twitter.com/B2SYAhwRlY

— The Transcript (@TheTranscript_) December 22, 2022

US consumer confidence rose by more than forecast to the highest since April as inflation eased and gasoline prices dropped. https://t.co/JCg1YMqu9m via @markets @apgmonteiro @economics pic.twitter.com/d3zvEIRsfh

— Steve Matthews (@SteveMatthews12) December 21, 2022

The U.S. economy grew at a 3.2% annualized rate in Q3, up from the 2.9% rate estimated a month ago. https://t.co/qHGf5n47pp

— BEA News (@BEA_News) December 22, 2022

Using IRS tax records, researchers at the JCT and Federal Reserve found that the lowest-income earners saw earnings gains in 2021 while the top quintile saw declines — the opposite of what occurred after the recessions in 2001 and 2008 https://t.co/KQxSyRjlES pic.twitter.com/FFu9uQD595

— Nick Timiraos (@NickTimiraos) December 22, 2022

Just one of the 270 jobs in the 1950 census has been eliminated by automation… elevator operator.

Other jobs that were expected to be automated by tech, like bank tellers by ATMs, just shifted the nature of the job. Hopefully, AI follows this pattern. https://t.co/F7dGbApCyH pic.twitter.com/Ck5b0ae3eO

— Ethan Mollick (@emollick) December 20, 2022

Coinbase raised money in 2018 at an $8b valuation. It's currently trading at a $9b valuation. Meanwhile:

2018 Revenues: $520m

2022 Revenues: $3.3b2018 Users: 22m

2022 Users: 101m2018 Assets on Platform: $11b

2022 Assets on Platform: $101b— Matt Hougan (@Matt_Hougan) December 20, 2022

#NEW U.S. home prices, as measured by the seasonally adjusted Case-Shiller, are -2.4% since June 2022.

That's the 2nd biggest home price correction of the post-WWII era.

It tops the -2.2% between May '90 and April '91, however, remains far below the -26% between '07 and '12.

— Lance Lambert (@NewsLambert) December 27, 2022

We bought our first house in FL in 07 and it got cut in half in about 2 years. We sold it a decade later for a loss and the one we bought seemed to double in value almost instantly. My opinion and anxiety around real estate are irrevocable at this point.

— Nate Clare (@nates_radio) December 21, 2022

Nearly 32% of U.S. home purchases were paid for in all cash in October—the highest share in eight years.

High mortgage rates are motivating affluent buyers to avoid loans and pay in cash, especially in Florida where all-cash purchases were most common. #Florida

— Redfin (@Redfin) December 21, 2022

Existing home sales have plunged over past year; November clocked in 28.4% y/y decline, which was worst since February 2008 pic.twitter.com/MKh5nkINK3

— Liz Ann Sonders (@LizAnnSonders) December 22, 2022

Rough year for growth software stocks. Even though they've executed well (C23 sales estimates RISING 14% this year), their prices are down more than slow growers where forecasts fell

Upshot: public comps for private growth co's that are *crushing* #'s point to marks down ~60% pic.twitter.com/oMmI6wWaCZ

— Chris Conforti (@Chris_Conforti) December 22, 2022

“Overall, households are entering 2023 with balance sheets at least as strong as pre-pandemic and by some metrics with more room to take on more debt” -Citi

— Gunjan Banerji (@GunjanJS) December 20, 2022

Vehicle Sales Forecast: "Sales to Weaken Again in December" https://t.co/Y6I8FZHz0T

The Wards forecast of 13.0 million SAAR, would be down 8% from last month, but up 2% from a year ago. pic.twitter.com/SAusDeCjeH

— Bill McBride (@calculatedrisk) December 22, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product