Today’s Animal Spirits is brought to you by KraneShares:

See here to learn more about investing with KraneShares ETFs

On today’s show we discuss:

- Novembers CPI print

- Carvana could run out of cash within months: analyst

- The Federal Reserve is deflating financial bubbles, without a crash

- Slowing growth edges out inflation as top concern

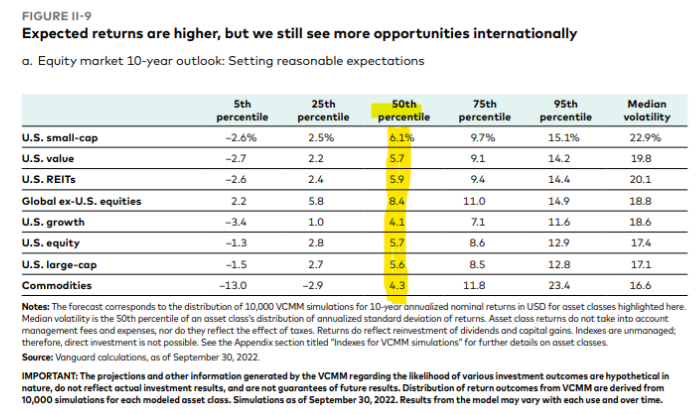

- Vanguard economic outlook for 2023: beating back inflation

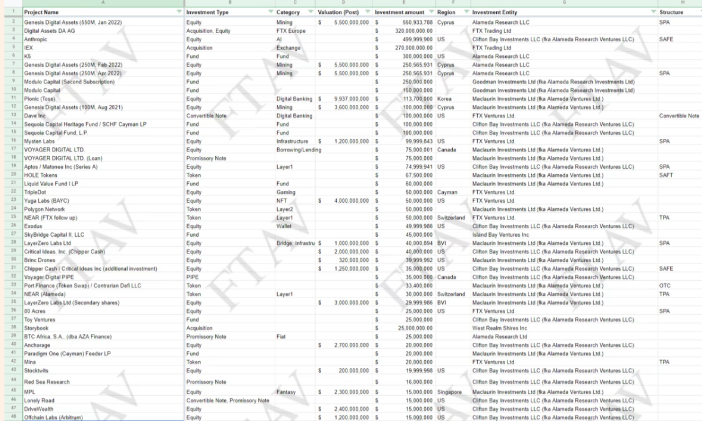

- SBF secretly funded crypto news site

- Semafor Business on SBF

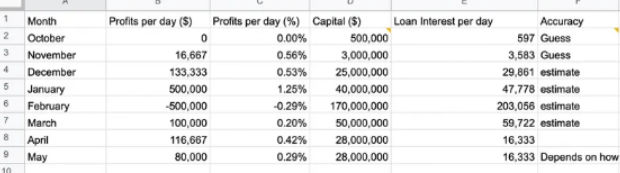

- The Alameda VC portfolio

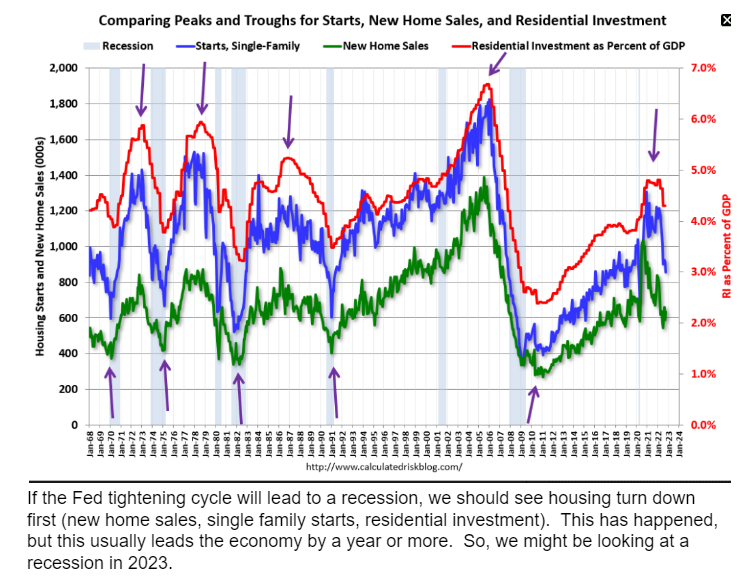

- Calculated Risk on recession watch

- LULU earnings

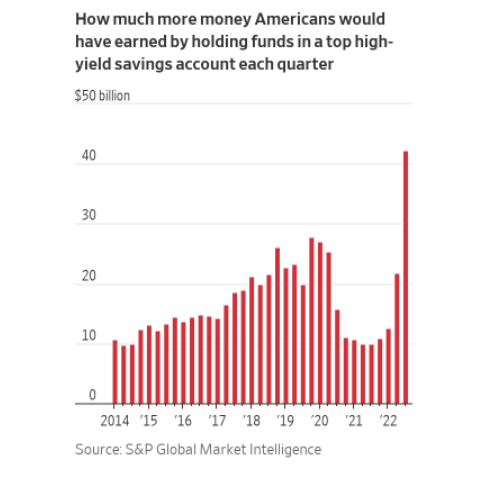

- Why aren’t Americans ditching big banks?

Listen here:

Recommendations:

Charts:

Tweets:

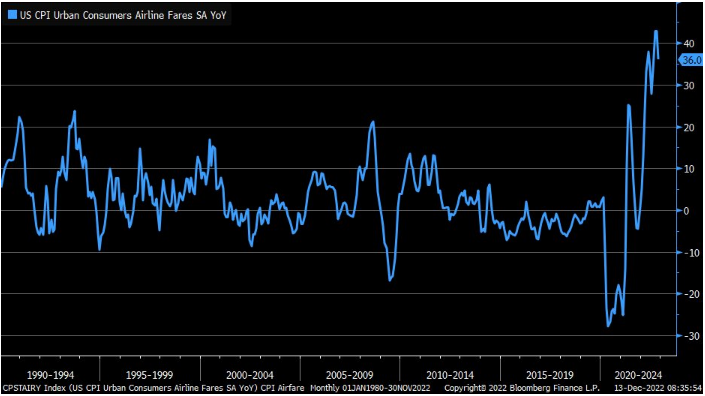

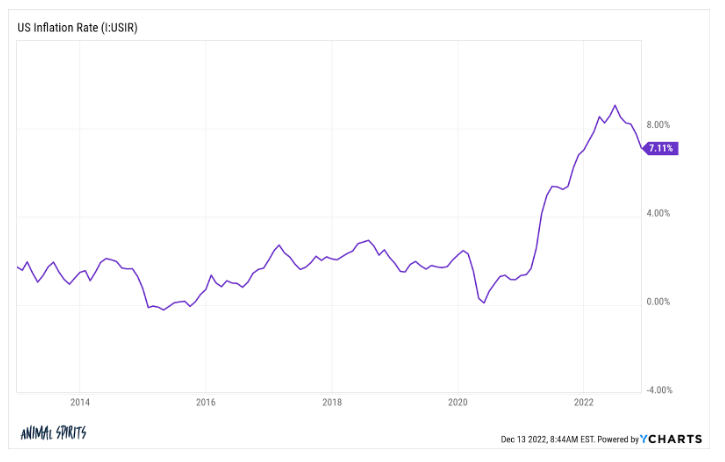

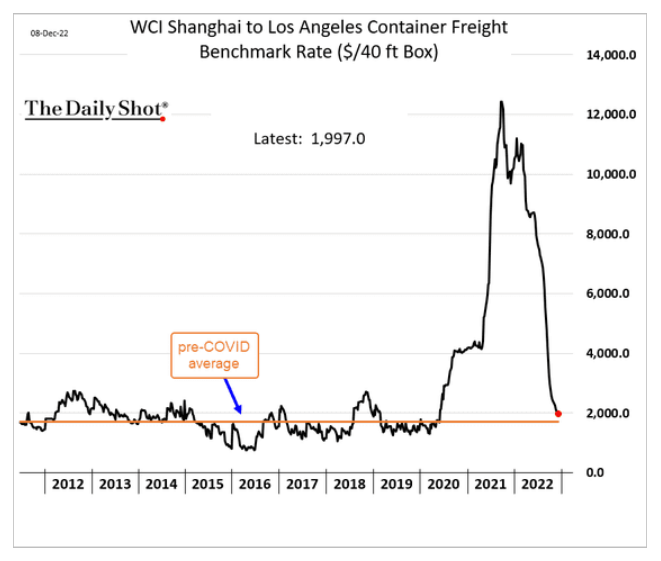

Inflation is still too high (7.1%), but there are lots of encouraging signs it's trending down…

Monthly growth slowed to just 0.1%

Gas -2% in November

Utilities -1.1%

Used cars -2.9%

Airfare -3%

Food 0.5% –> slowest in months

**Services inflation without shelter was flat** pic.twitter.com/dmfYYU6QYY— Heather Long (@byHeatherLong) December 13, 2022

Core CPI over the last three months, annualized: +4.2%.

That number peaked at +7.9% in the April to June quarter.

— Neil Irwin (@Neil_Irwin) December 13, 2022

This is the chart you need to watch from here on out.

Goods inflation is slowing.

Services inflation isn't.

The Fed has more control over services inflation. pic.twitter.com/qnbH9PLXQr

— Callie Cox (@callieabost) December 13, 2022

peak is in pic.twitter.com/xmjBUDgKq5

— Dario Perkins (@darioperkins) December 13, 2022

The Atlanta Fed's Wage Growth Tracker, updated today, shows pay growth for job switchers moved up last month

Hourly wage growth rose 6.4% from a year earlier (unchanged from October) for all workers, but ticked up for job switchers—8.1% from 7.6% https://t.co/PDcoMi2iaI pic.twitter.com/stuTaCXWZc

— Nick Timiraos (@NickTimiraos) December 8, 2022

#Deflation in used cars.

(via @Manheim_US)#CPI $F $GM $TSLA https://t.co/H1oiH9IGkI pic.twitter.com/8yvh7yyFxw

— Carl Quintanilla (@carlquintanilla) December 7, 2022

"Pessimism reigned, inflation raged, Fed tightened + investors revalued downward. But resultant bear market was a mild one as bears go. If it ended on Oct 12, the S&P 500 actually was in bear-market territory—down more than 20%—for only 45 days of the 282-day span."

— Barry Ritholtz (@Ritholtz) December 5, 2022

Buying risk assets at the point of the last rate hike has been profitable in environments with declining inflation.

Nice case for a tailwind after March or so. pic.twitter.com/JHdMypZExu

— Tom Dunleavy (@dunleavy89) December 9, 2022

https://twitter.com/psarofagis/status/1600962445702762496

Among US stock funds, there have been 11,517 funds that have had at least one five-year return since 1997. Those funds had 132,210 five-year measurements vs. their style-specific indexes over that span. They beat the index in 50,564 of those instances, lagged in the other 81,646.

— Jeffrey Ptak (@syouth1) December 10, 2022

Rare combination of profitability and low multiples in $XLE at the end of November (3rd most profitable and simultaneously the 4th cheapest) pic.twitter.com/8uUy8uSU6M

— Daniel Sotiroff (@DanielSotiroff) December 7, 2022

People never seem to commend oil companies when gas prices decline.

— John Arnold (@JohnArnoldFndtn) December 8, 2022

Exxon Mobil boosts stock buybacks and plans to double cash flow by 2027 https://t.co/GXUNbGxWHo

— MarketWatch (@MarketWatch) December 8, 2022

Yesterday's $RH earnings call with CEO & Chairman Gary Friedman was, mildly speaking, bearish. We have in this thread curated the 16 best quotes 🧵

1. The housing market is in a "free fall": pic.twitter.com/js43PO9BR4

— Quartr (@Quartr_App) December 9, 2022

"We haven't seen any weakness with our consumer," Lululemon CEO Calvin McDonald says of how the high-end activewear company is looking forward to the holidays. https://t.co/SRNoSvCSrh pic.twitter.com/418bAnmuv7

— CNBC (@CNBC) December 10, 2022

Just 8% of Americans have a positive view of cryptocurrencies now, CNBC survey finds https://t.co/sVcbgJp8Oi

— Steve Liesman (@steveliesman) December 7, 2022

By way of comparison, Bill Hwang was arrested 13 months after Archegos collapsed https://t.co/BW92tn4vNZ

— Tina Davis (@tina_davis) December 13, 2022

Housing starts fell off a cliff in November. Many home builders in our monthly survey hitting the pause button until costs drop.

— Rick Palacios Jr. (@RickPalaciosJr) December 7, 2022

John Burns: "In early December, 75% of nationally surveyed home builders confirmed they are buying down buyers’ mortgage rates to make payments more affordable."

— Bill McBride (@calculatedrisk) December 9, 2022

YoY change in "homes for sale" searches on Google Trends — @Redfin has cited this series, I've never looked at it myself, but looks like there might be something here: pic.twitter.com/fUaCCpKCXY

— Conor Sen (@conorsen) December 9, 2022

American teenagers were happiest in the mid-to-late 2000s. pic.twitter.com/Xw1c5OKBhF

— Noah Smith 🐇🇺🇸🇺🇦🇹🇼 (@Noahpinion) December 6, 2022

Yesterday's $RH earnings call with CEO & Chairman Gary Friedman was, mildly speaking, bearish. We have in this thread curated the 16 best quotes 🧵

1. The housing market is in a "free fall": pic.twitter.com/js43PO9BR4

— Quartr (@Quartr_App) December 9, 2022

Here's a chart that puts current credit card debt levels in proper context.

As a % of total salaries & wages, even at these higher nominal levels, credit card debt is lower than at any time in the last 20+ years (except for plunge during the pandemic). pic.twitter.com/gDUj3fGswV

— Bill (@wabuffo) December 7, 2022

"Households do not appear to be increasing their credit card utilization rates (the % of their limits they run up to) at a fast rate…" – BofA https://t.co/HfLAD1keUx pic.twitter.com/zxMFZBBxg9

— Sam Ro 📈 (@SamRo) December 8, 2022

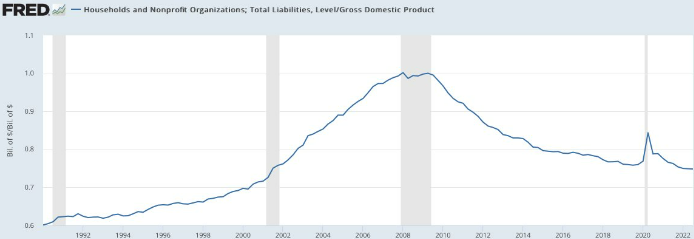

Household liabilities as a % of GDP have been trending down for 15 years and are back at 2001 levels, but might finally be stabilizing… pic.twitter.com/uY3omDTrtB

— Conor Sen (@conorsen) December 9, 2022

Disneyland the happiest place on Earth pic.twitter.com/59p6SWk10I

— Evan (@StockMKTNewz) December 10, 2022

I got youhttps://t.co/qMWJnp6eVa

— Thaddeus Venture (@venture42069) December 12, 2022

NEW: The first trailer for the Adam Driver sci-fi film 65 drops tomorrow. Written and directed by the duo who wrote #AQuietPlace, Scott Beck and Bryan Woods. In theaters March 10.pic.twitter.com/JlzOdmHA0M

— Erik Davis (@ErikDavis) December 13, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.