Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to claim a FREE YCharts Professional account through December 16th, 2022 (first 100 submissions)

On today’s show we discuss:

- The S&P 500 is not the economy

- Why hasn’t the crypto contagion spilled into the stock market?

- Atlanta Fed GDP estimate

- The auto industry is the economy’s best hope right now

- How long until excess savings are gone?

- Bob Iger returns as CEO, Bob Chapek exits

- Grayscale trusts – what should be done and why

- Vast majority of retail investors in bitcoin lost money

- FTXs SBF cashed out $300M during funding spree

- Inside SBFs doomed FTX empire

- FTX and fomo

- People are already buying depositor claims on FTX

- The effects of remote work on US housing markets

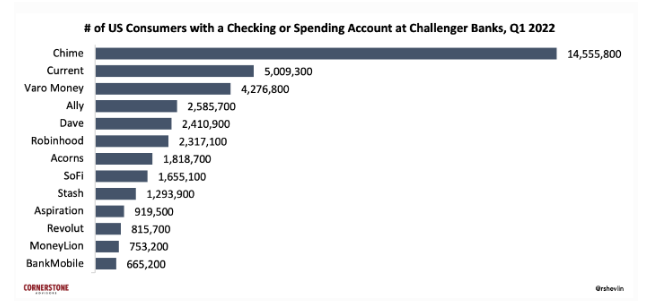

- Fintechs steroid era

- Warner Brothers Discovery CEO speaks on weak advertising market, DC plans, and HBO losses

Listen Here:

Recommendations:

Charts:

Tweets:

Fed speak at work: Bullard talks of potential 7% fed funds and 3mo/10yr treasury yield curve inversion falls back to the 2019 lows. A few more rate hikes and it can test the 2000 and 2007 lows in the -75 to -80 region. (But Bullard doesn't vote in 2023.) pic.twitter.com/fQqPHDilc8

— Kathy Jones (@KathyJones) November 17, 2022

17% yields. Is anyone farming this? pic.twitter.com/fE80mNBni8

— Joe Weisenthal (@TheStalwart) November 21, 2022

There is “no consistent pattern” to economic trends right now, says B of A. The job market is “hot,” consumer spending is “solid,” but housing is “weakening even faster than normal. .. Is this unusual? Yes.” pic.twitter.com/Jk5ekSrdeU

— Carl Quintanilla (@carlquintanilla) November 17, 2022

Retail Sales in the United States increased 1.30 percent in October of 2022 over the previous month. https://t.co/weoPiAQNO8 pic.twitter.com/MspXHh8Xdd

— TRADING ECONOMICS (@tEconomics) November 16, 2022

Since the NY Fed started its Survey of Consumer Expectations in 2013, there has only been one other month where sentiment towards the stock market was lower. https://t.co/pAEquALlqe pic.twitter.com/huV8qzyXyD

— Bespoke (@bespokeinvest) November 15, 2022

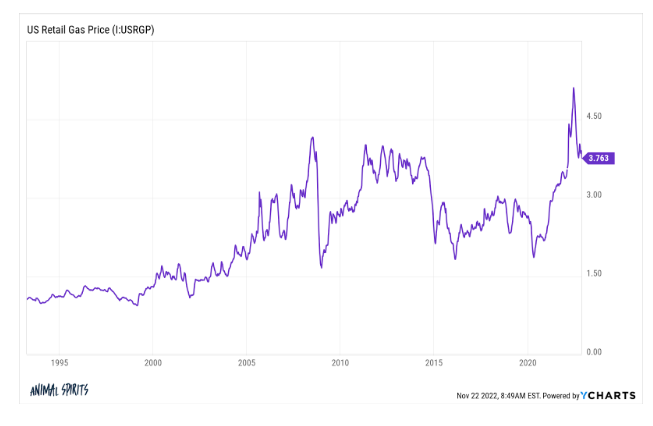

Average retail gasoline prices are about to hit their lowest level since February: pic.twitter.com/kG1XHQfXqU

— Conor Sen (@conorsen) November 21, 2022

We’re finally about to get deflation in food.

(via @JavierBlas) https://t.co/1tQmiip3QE pic.twitter.com/yNYYv1vLv1

— Carl Quintanilla (@carlquintanilla) November 16, 2022

Container shipping costs are down nearly 80% from a year ago. pic.twitter.com/cpGIkGpwEV

— (((The Daily Shot))) (@SoberLook) November 18, 2022

GOLDMAN: “Tech Layoffs Are Not a Sign of an Impending Recession .. the unemployment rate would rise by less than 0.3pp even in the inconceivable event that all workers employed in the ‘internet publishing, broadcasting and web search portal’ industry are immediately laid off ..” pic.twitter.com/cHoWGCBboH

— Carl Quintanilla (@carlquintanilla) November 15, 2022

Wait did FTX try to "bailout" BlockFi using $250M worth of marked to market FTT? pic.twitter.com/wMjm7C6gPn

— Steven (@Dogetoshi) November 17, 2022

Coinbase affirms all the Grayscale assets are secure …should help sentiment a bit pic.twitter.com/sOjKZkcRxd

— FxMacro (@fxmacro) November 21, 2022

Demand Driver #2 Age of Housing Stock.

A major remodeling wave is coming in 2025: pic.twitter.com/eef1aompuh

— Quartr (@Quartr_App) November 17, 2022

Malcolm Gladwell on Jack Welch. Very enjoyable read. https://t.co/PyTd6ZIlHw pic.twitter.com/V4hU8Idglu

— Ian Leslie (@mrianleslie) November 20, 2022

E-scooter company Bird trading at $0.24 a share after telling investors on Monday that its financial statements of the past 2.5 years "should no longer be relied upon" and there is "substantial doubt about the Company's ability to continue as a going concern"

— Ali Griswold (@alisongriswold) November 18, 2022

just learned the series finale of the walking dead airs tonight, which will finally complete this incredibly funny and informative graph pic.twitter.com/EWUmFCwqz5

— largest rodent (@capybaroness) November 20, 2022

GDP around the world massively undervalues the actual quality of life gains we get from Internet services, most at no cost.

Large-scale experiments show that average Americans would need to be paid $15k a year to give up search engines and $6k for email. https://t.co/oHvyYB38ie pic.twitter.com/Au1TkRcpy8

— Ethan Mollick (@emollick) November 20, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.