Today’s Animal Spirits is brought to you by YCharts:

Submit your email here to claim 20% off YCharts

On today’s show we discuss:

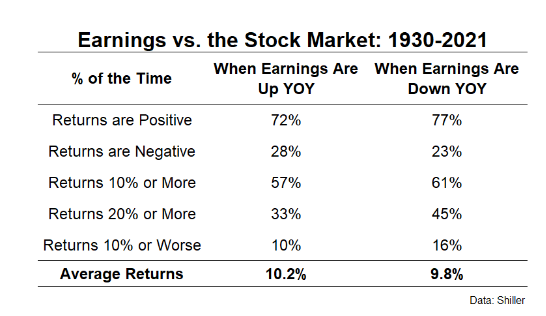

- Good news is bad news

- 8 ways to invest with a strong dollar

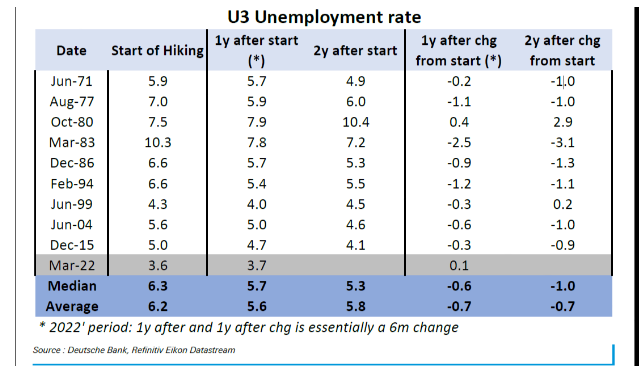

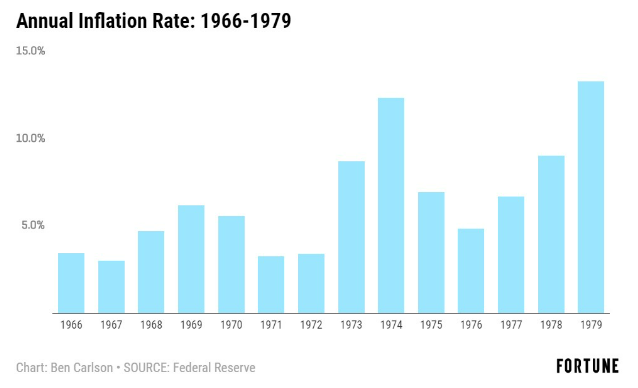

- The awful economy Paul Volcker inherited in 1979 (AWOCS)

- Cathie Woods open letter to the Fed

- Things are getting weird in the housing market

- Calculated Risk on housing prices

- Luxury home market is the first to go

- Homebuilders selling houses at a discount

- The US rental market is cooling

- Peleton to cut 500 more jobs

- Economists say it’s okay to not save money in your 20s

Listen Here:

Recommendations:

Charts:

Tweets:

We're now in the longest streak of better than expected Non Farm Payroll reports (6) since at least 1998.

https://t.co/4DFpirWvrA pic.twitter.com/E2jraqGe2y— Bespoke (@bespokeinvest) October 7, 2022

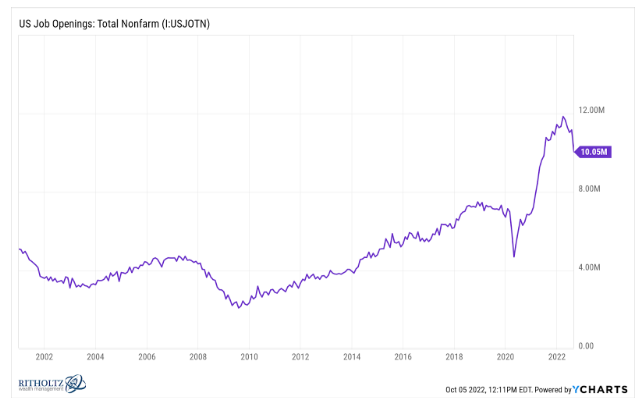

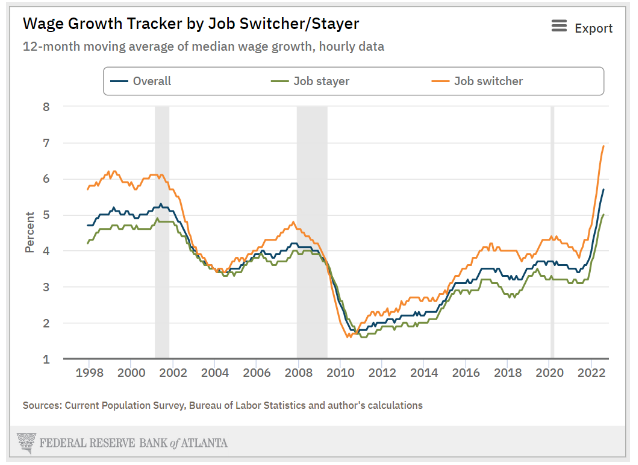

What if companies just went thru laying off a bunch of ppl during the pandemic and had such a hard time finding workers these past few years that they don’t want to turn around and do it again so soon?

Is the Fed just gonna keep raising until they break the economy?

— Ben Carlson (@awealthofcs) October 7, 2022

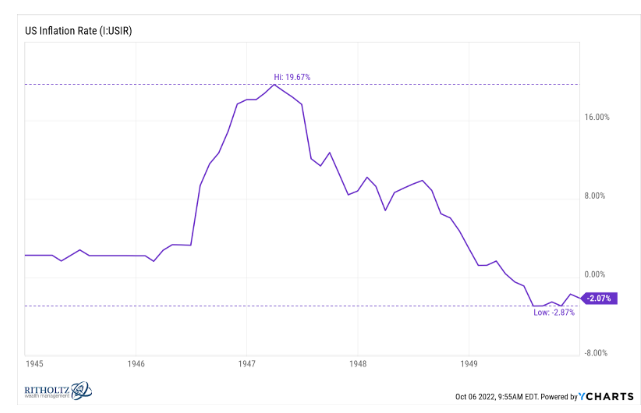

I’m becoming increasingly convinced we went through an “inflation burp” rather than some structural 1970’s-type thing. It’s fair to point out that Fed hikes this year have had an impact in squashing it, but it’s clearly happening now imo. pic.twitter.com/vi87XPXI3V

— Conor Sen (@conorsen) October 6, 2022

Year/year % change for @Manheim_US Used Vehicle Index has gone negative for first time since May 2020 pic.twitter.com/nVQbNMmgUU

— Liz Ann Sonders (@LizAnnSonders) October 10, 2022

5y inflation breakevens are down -130 bps since March, the biggest correction in 20+ years outside a major recession.

Inflation expectations have now lapped the supply chain/inflation drama of 2021-2022. pic.twitter.com/eC9slEkx2R

— Eric Finnigan (@EricFinnigan) October 6, 2022

MORGAN STANLEY: has a 56-page report on inventory:

“.. We believe many will turn to aggressive discounting .. which is likely to spark a ‘race to the bottom’ as companies attempt to cut prices faster than peers and move out as much inventory as possible ..” pic.twitter.com/lCrHcSpUI1

— Carl Quintanilla (@carlquintanilla) October 10, 2022

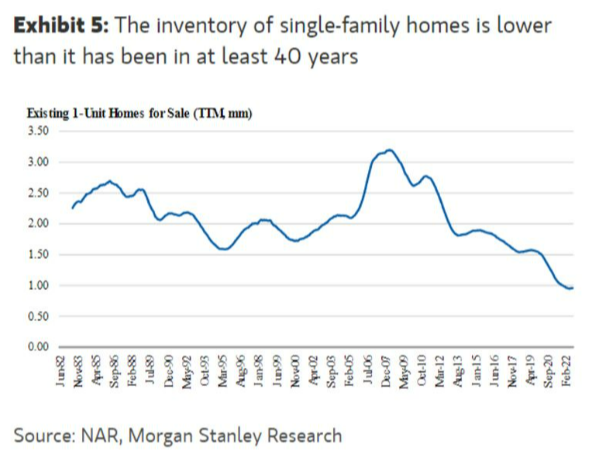

Unlike in the mid-2000s, homebuilders have shown restraint this cycle and have not overbuilt. As a result, inventories for existing homes remain relatively tight. 4/5 pic.twitter.com/6RQR3kk7YF

— Rob Anderson (@_rob_anderson) October 6, 2022

And here's the data: The weakest Q3 for U.S. apartment leasing in the 3 decades we've tracked the market.

It's not a collapse (vacancy and turnover are still lower than normal), but it's a remarkable change of momentum.

Here's what it means… https://t.co/MPP1gekFcb pic.twitter.com/o6qPSjb3vL

— Jay Parsons (@jayparsons) October 4, 2022

42% of buy now, pay later users made late payments toward those loans, a survey finds. @sharon_epperson reports. https://t.co/6uktJ8Te4g pic.twitter.com/BbQGacgejt

— CNBC (@CNBC) September 29, 2022

On May 29, 2022 Treasury Direct's quarterly website traffic surpassed Ethereum's. Now it is 1.8x larger.

Very exciting project. Congratulations to the team pic.twitter.com/Z0nkJx8iId

— goodalexander (@goodalexander) October 10, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: