Today’s Animal Spirits is brought to you by Masterworks:

See here to learn more about investing in contemporary art and here for important disclosures

See here for tropical gear, free shipping, and sunglass straps on all orders (code ANIMAL20 for 20% off)

On today’s show we discuss:

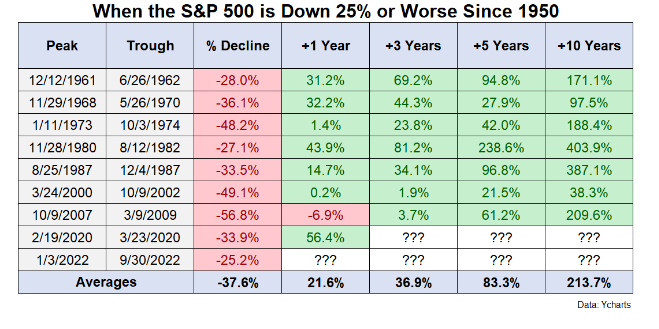

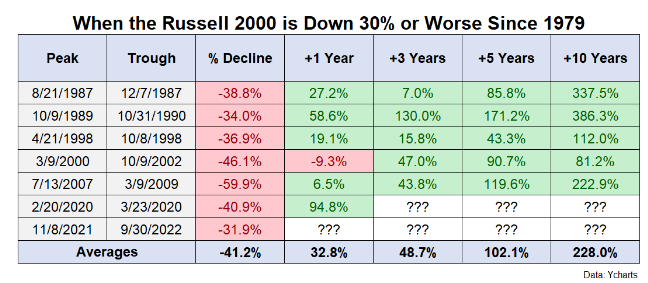

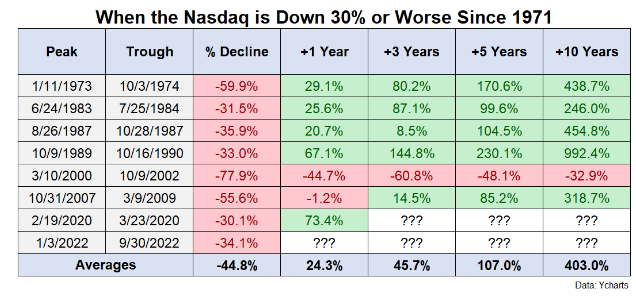

- Looking for a bright spot (AWOCS)

- Asness on expected returns

- Druckenmiller predicts the Dow won’t be much higher in 10 years

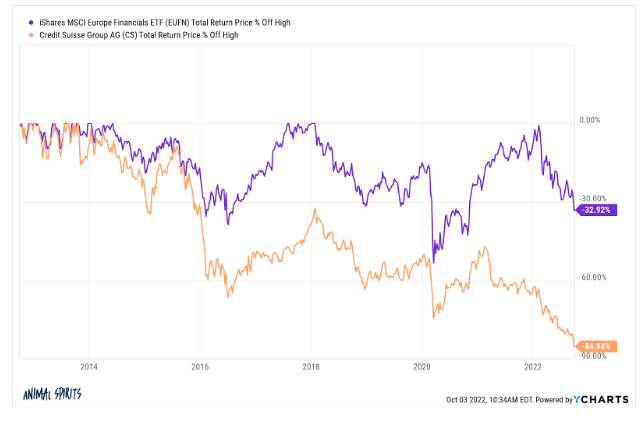

- Credit Suisse tries to calm the market

- Credit Suisse and the CDS spread

- Some weekend reading from Cullen Roche

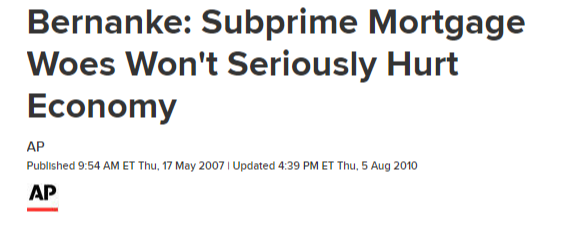

- Paul Krugman may be right

- UK pensions forced the Bank of Englands hand

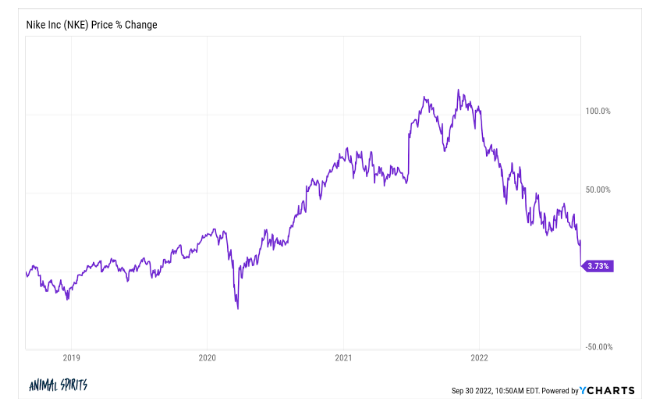

- Nike earnings

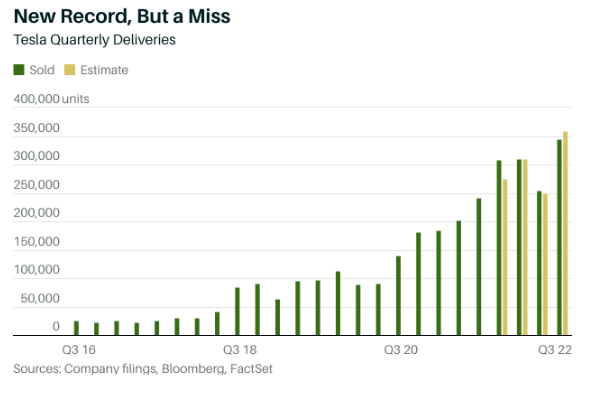

- Tesla earnings

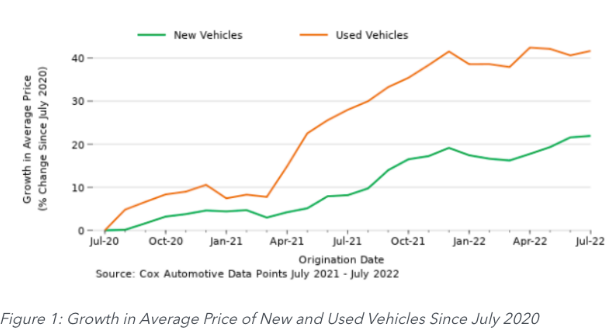

- Car Max earnings

- Elon Musks’ rich friends

Listen here:

Recommendations:

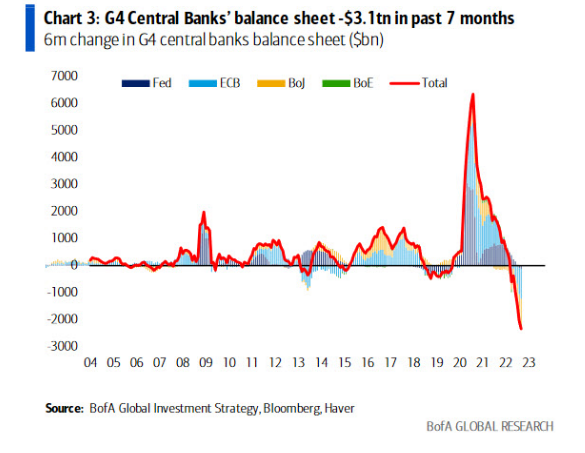

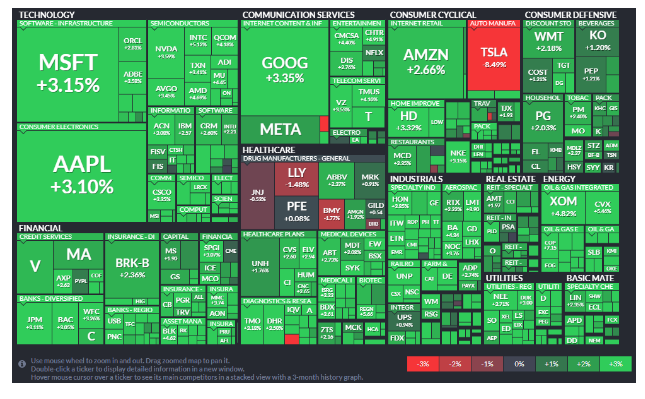

Charts:

Tweets:

“Here are years when $SPX was down (20%) or worse at the 9-month mark. Ex-2008, things got better between then and year-end.” – B of A desk pic.twitter.com/JwSxVEJqEE

— Carl Quintanilla (@carlquintanilla) October 3, 2022

* DRUCKENMILLER SAYS DOW WON'T BE MUCH HIGHER 10 YEARS FROM NOW@Reuters @CNBC #DeliveringAlpha

— Carl Quintanilla (@carlquintanilla) September 28, 2022

ETFs used by buy and hold investors have seen steady inflows as usual, even in Sept as 'big long' advisors still unfazed. Meanwhile, ETFs used by traders seen net zero flows for a few months now, rare pattern that is result not of inactivity but ppl coming in then bailing. pic.twitter.com/rPwocMlRSD

— Eric Balchunas (@EricBalchunas) October 3, 2022

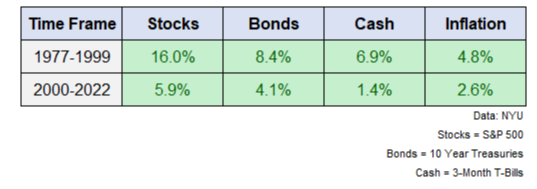

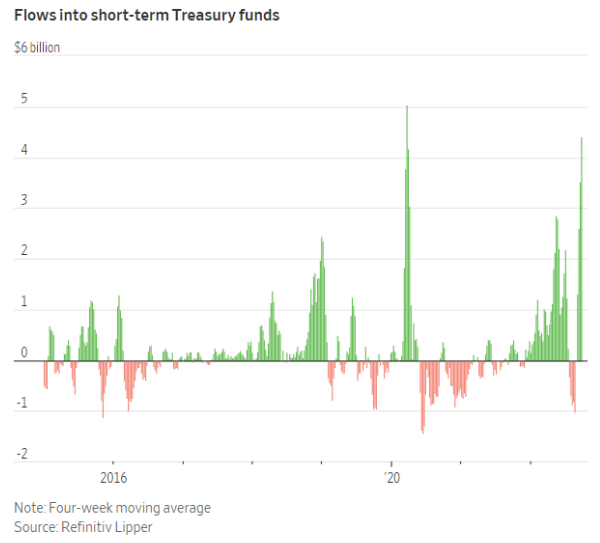

GOLDMAN: A weaker economy “will drive households to continue selling stocks. .. causing a shift in investor mindsets from TINA (‘There Is No Alternative’) to TARA (‘There Are Reasonable Alternatives’) ..

We expect households to sell $100 billion in equities in 2023.” [Kostin] pic.twitter.com/rzyULor37M— Carl Quintanilla (@carlquintanilla) October 3, 2022

$LQD posted its biggest one-day inflow since March 2020 yesterday

LQD -1.5% this morning pic.twitter.com/OOIzCeUj85

— Katie Greifeld (@kgreifeld) September 29, 2022

The Sept Chicago PMI was 45.7 this AM. Badly missing the consensus 51.8 and even below 49.5, the lowest of 24 estimates via Bloomberg.

Only 1 time has this measure been this low, and it was NOT a recession, Dec 2015.

The other 7 times, it has been 45.7 it was in a recession. pic.twitter.com/bfsUNKjWCw

— Jim Bianco (@biancoresearch) September 30, 2022

FED'S MESTER: RECESSION WON'T STOP FED FROM RAISING RATES

— *Walter Bloomberg (@DeItaone) September 29, 2022

US TREASURY SECRETARY YELLEN: I DON'T SEE ANY ERRATIC FINANCIAL MARKET CONDITIONS.

— FinancialJuice (@financialjuice) September 27, 2022

For a $2,500/month payment and 20% down, one can afford a $476K house today. In early 2021, the figure was $759K — via @M_McDonough @LizAnnSonders @business pic.twitter.com/cfjKpSuXGL

— Scott Galloway (@profgalloway) September 29, 2022

"With 30-year mortgage rates approaching 7.0%, we estimate that 18mn fewer households now qualify for a mortgage to buy a median-priced existing home compared to the end of 2021." @OxfordEconomics pic.twitter.com/DryS0P8ehy

— Sam Ro 📈 (@SamRo) October 3, 2022

GM ends Q3 with 359,292 vehicles in dealer inventory — "nearly three times the inventory available" at the end of Q3 2021, notes @knowledge_vital.

The dramatic jump reflects "supply chain/production normalization. As supply chains normalize, so too will inflation."$GM

— Carl Quintanilla (@carlquintanilla) October 3, 2022

42% of buy now, pay later users made late payments toward those loans, a survey finds. @sharon_epperson reports. https://t.co/6uktJ8Te4g pic.twitter.com/BbQGacgejt

— CNBC (@CNBC) September 29, 2022

Unbelievable decline in shipping rates … cost to send 40-ft container from Shanghai to Los Angeles has fallen by 74% from peak and is back to August 2020 levels pic.twitter.com/GB40j4SatH

— Liz Ann Sonders (@LizAnnSonders) September 30, 2022

I'm old enough to remember when we used to have shortages of everything pic.twitter.com/wwCw945btp

— Sam Ro 📈 (@SamRo) September 30, 2022

DOCUSIGN WILL CUT CURRENT WORKFORCE BY ABOUT 9%$DOCU

— *Walter Bloomberg (@DeItaone) September 28, 2022

Amazon Prime Video’s “The Lord of the Rings” expansion #TheRingsofPower took the No. 1 position on Nielsen’s streaming rankings for the week of Aug. 29-Sept. 4, with 1.3 billion minutes viewed.https://t.co/Te0Mlx0Ikx

— Variety (@Variety) September 29, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: