A reader asks:

Since Ben is a data junkie, does he have any data or opinions on when markets hit a bottom? Does the adage ‘catching a falling knife’ always hold true?

Guilty. I am a data junkie.

I can’t help it.

I know you can’t predict the future based on historical data but you can analyze the present and try to calculate reasonable probabilities from the past. Past data doesn’t tell you what will happen but it can help you prepare for what can happen.

As far as market bottoms go, fundamentals are basically useless.

The only real difference is what kind of correction we’re in — recessionary or non-recessionary.

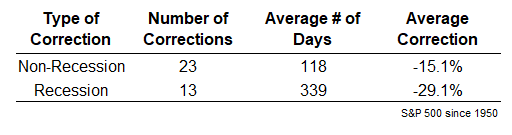

Non-recessionary corrections are much milder than those that occur because of a recession. This is the data for the S&P 500 since 1950:

Corrections that occur outside of a slowdown in the economy tend to be shallower and shorter. This makes sense when you consider how much financial pain is inflicted on households during your typical recession.

Obviously, the hard part here is knowing if you’re going into a recession or not. It’s hard to tell most of the time (save for when Tom Hanks contracts Covid, the NBA shuts down its season and everyone is told in no uncertain terms to stay home for 8 weeks in a pandemic).

But let’s say you did have the foresight to be able to predict the economic environment. You still wouldn’t be able to use fundamentals to nail the bottom.

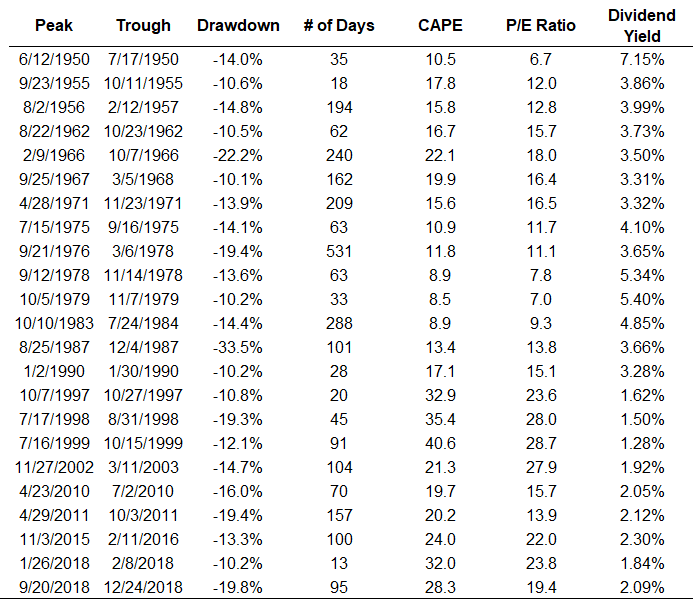

This is a list of the non-recessionary corrections going back to 1950 along with the CAPE ratio, P/E ratio and dividend yield at the bottom of those corrections:

The only thing that sticks out here is that valuations were much lower and dividend yields much higher back in the day. Otherwise, there are no discernable patterns where you can pick a valuation metric that tells you when a bottom is imminent.

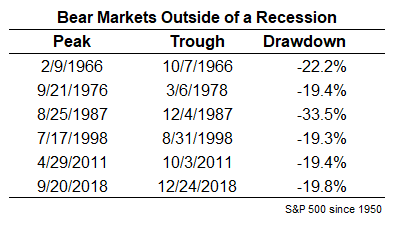

It is interesting to note bear markets outside of a recession are rare. There have technically only been two since 1950 (although I included the four times we came close):

Never say never, but unless the economy goes into a recession it would seem a correction is more likely than a crash in the current environment.

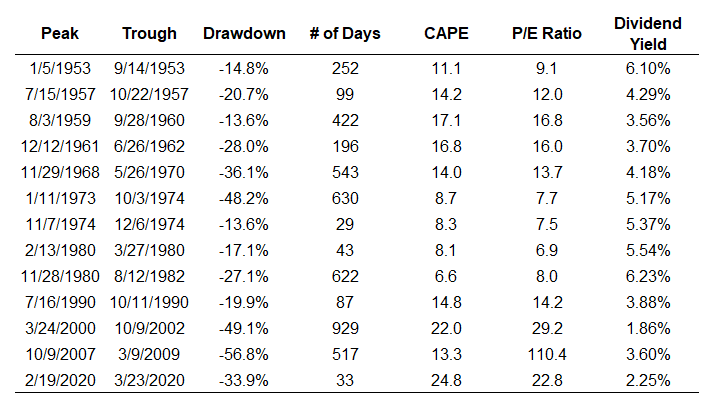

Now here is a look at the recessionary corrections:

There is no line in the sand when it comes to this stuff.

Not only are all market environments different but human beings are unpredictable by our very nature. And we become even more unpredictable when we’re losing money and panicking.

Therefore price is arguably your best indicator but even technicals are waning as an indicator of when the selling pressure will end.

Volatility in the markets tends to cluster during downtrends. This is why we tend to see the biggest up days and the biggest down days in history occur during bear markets. The swings in price are bigger when people are nervous.

This is why so many traders say “markets don’t bottom on big up days.”

And that makes sense in theory…until you realize the last two bear markets did just that. In 2018, the S&P 500 was up 5% on the trading session the day after Christmas following a 19.8% downturn. It never looked back.

The March 2020 bottom came on a 9.4% up day. No one actually thought it was THE bottom but it was. Stocks were up 1.2% and 6.2% over the next two days (for a total gain of 17.6% in just 3 days) and we were off to the races.

I wish I had the secret sauce for picking a bottom but even if there was some formula it would eventually stop working once enough people learned of it.

It’s always impossible to predict what the stock market will do in the short-term but for some reason investors seem to try even harder to guess what comes next during a correction.

You want your hands on the steering wheel when the excrement hits the fan. It gives you feel a sense of control to predict what comes next, even when that control is an illusion.

In 1966, Warren Buffett was still running his investment partnership.1 The stock market went into a correction that year after the Dow first broke through 1,000 for the first time ever. That correction would eventually reach losses of more than 20%.

Buffett had some new investors in the partnership who were a little nervous after experiencing their first pullback. They called Buffett to warn him the market would likely go even lower.

He responded in his next letter to investors by raising two questions:

(1) If they knew in February that the Dow was going to 865 in May, why didn’t they let me in on it then; and,

(2) If they didn’t know what was going to happen during the ensuing three months back in February, how do they know in May?

Buffett continued:

Let me again suggest that the future has never been clear to me (give us a call when the next few months are obvious to you — or, for that matter, the next few hours).

The future is never clear to any of us, no matter how confident we are in our assertions.

The market bottom will only be known with the benefit of hindsight (and it will look crystal clear after the fact).

We discussed this question on this week’s Portfolio Rescue:

I also had Bill Sweet back on to discuss where you should pull your money from to minimize taxes in retirement and how to manage clients during a correction.

Further Reading:

Returns From the Bottom of Bear Markets

1Buffett bought Berkshire Hathaway in 1965 but didn’t close his investment partnership until 1969.