This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

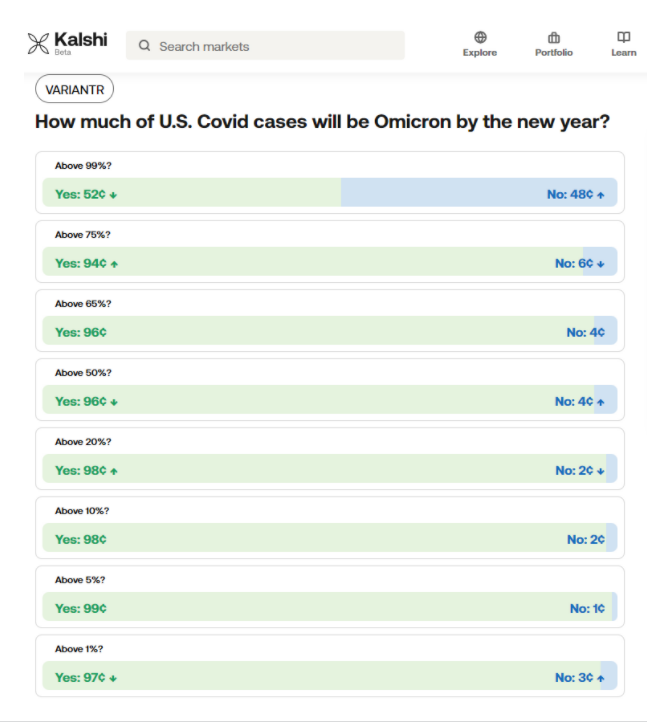

- Preparing for a disrupted winter of Omicron

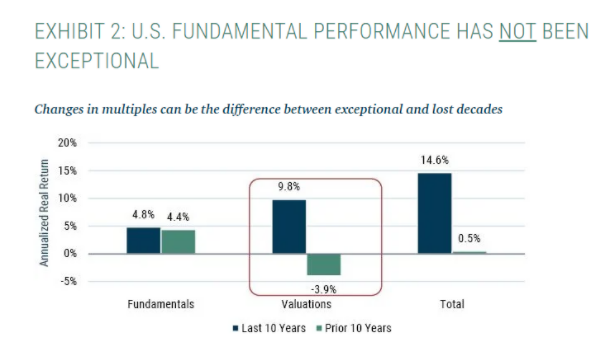

- Does anyone think stocks can do 9-10% a year for the next 10-20 years?

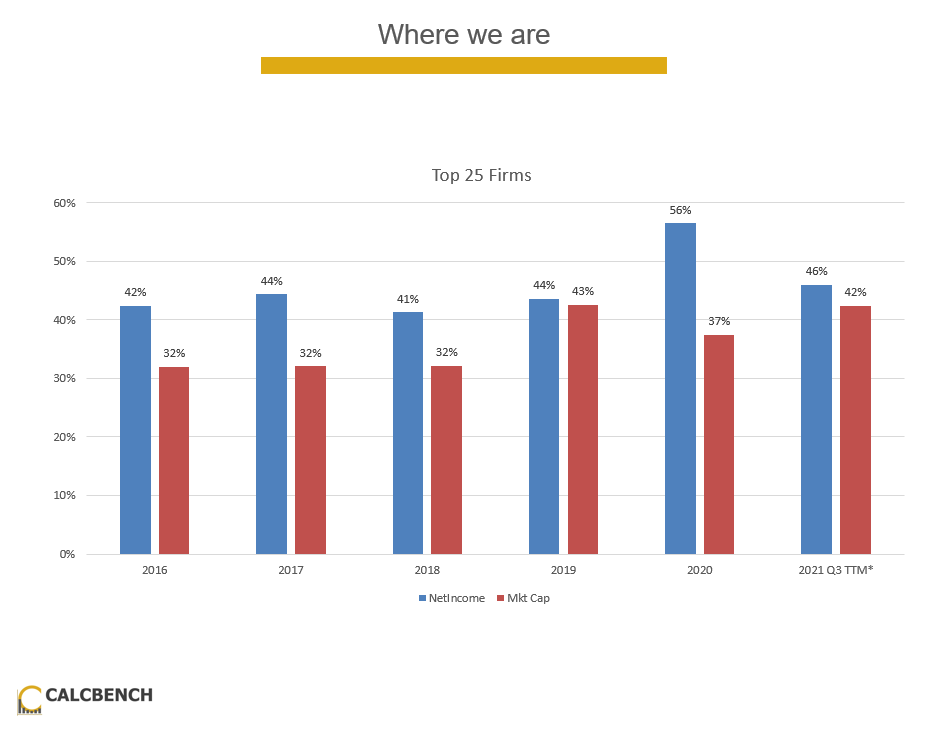

- Why fundamentals back up U.S. stock gains

- Multiples are not valuation

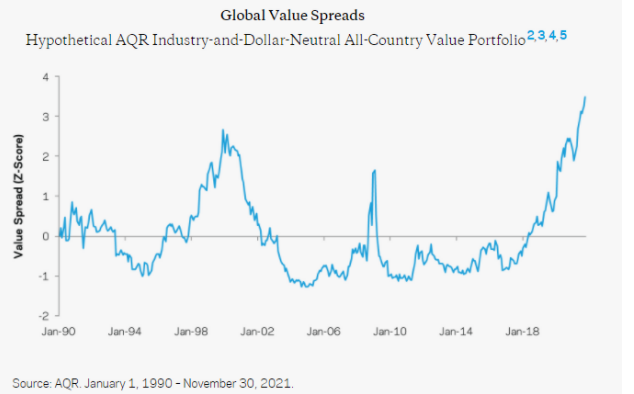

- Is ARKK really in deep value territory?

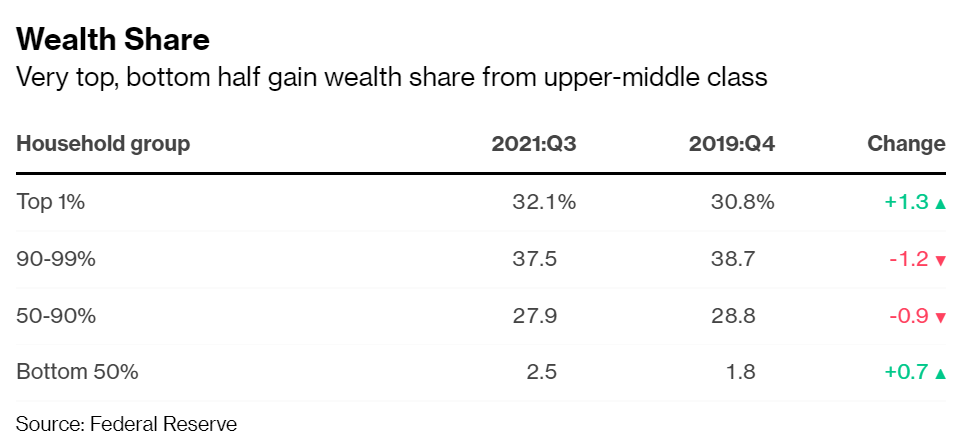

- Why the middle class feels left behind

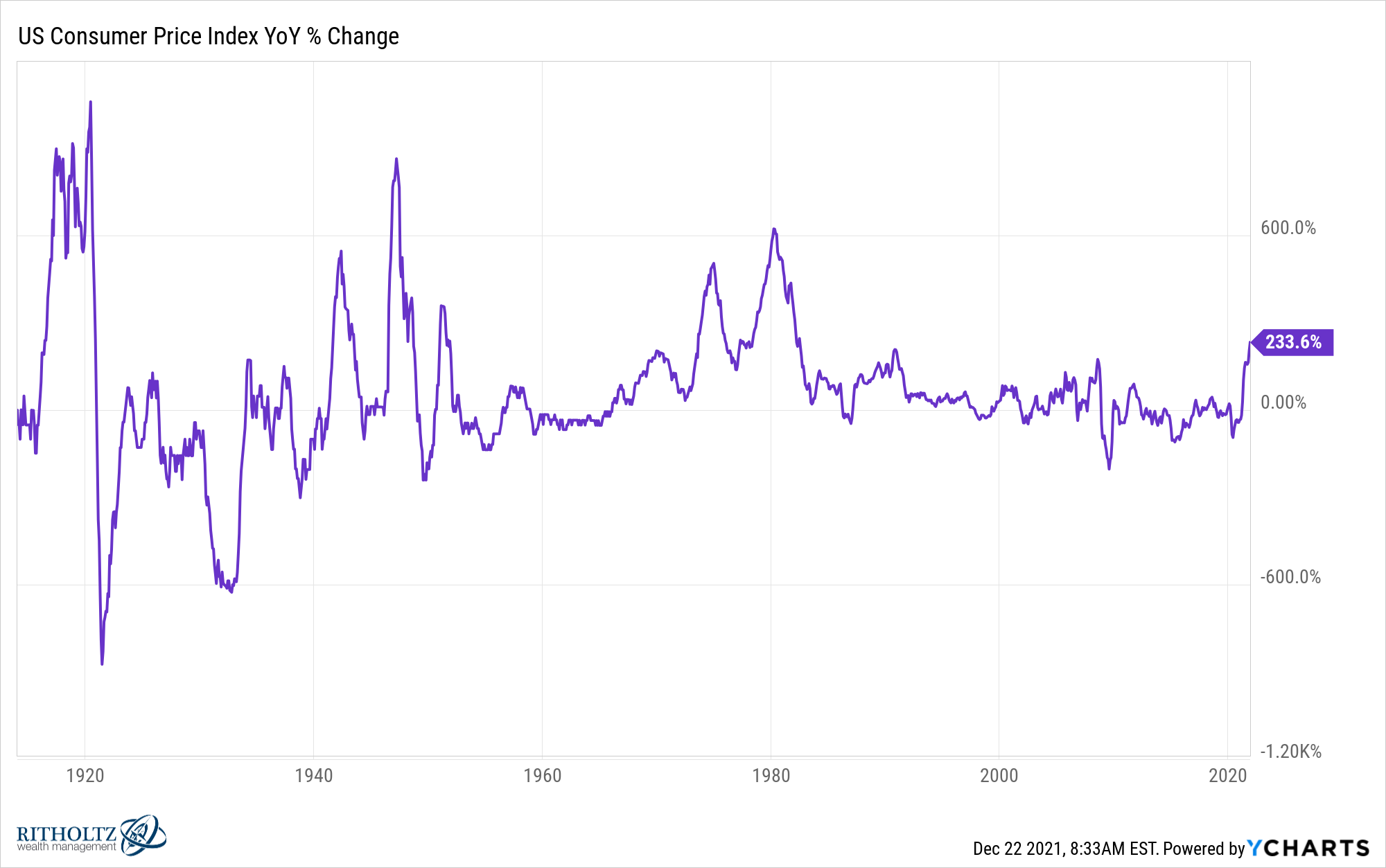

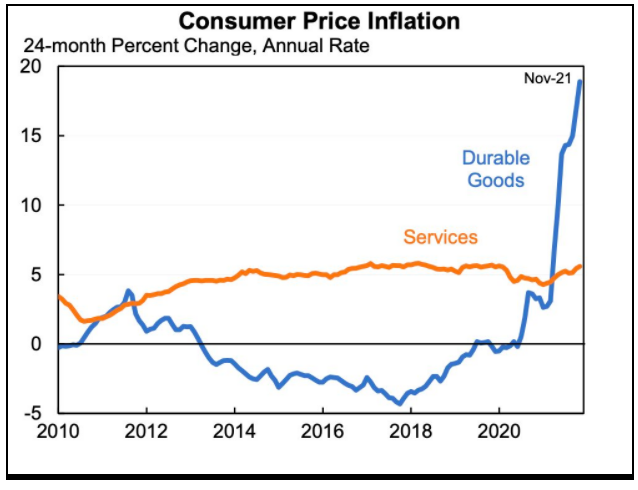

- Is there anything the government can do about inflation?

- Credit card rewards as an inflation hedge?

- Billionaires are just like us online

- Robinhood lives by the meme stock and dies by the meme stock

- How many millennial millionaires own crypto?

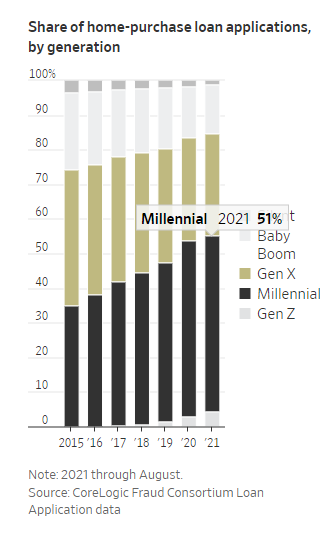

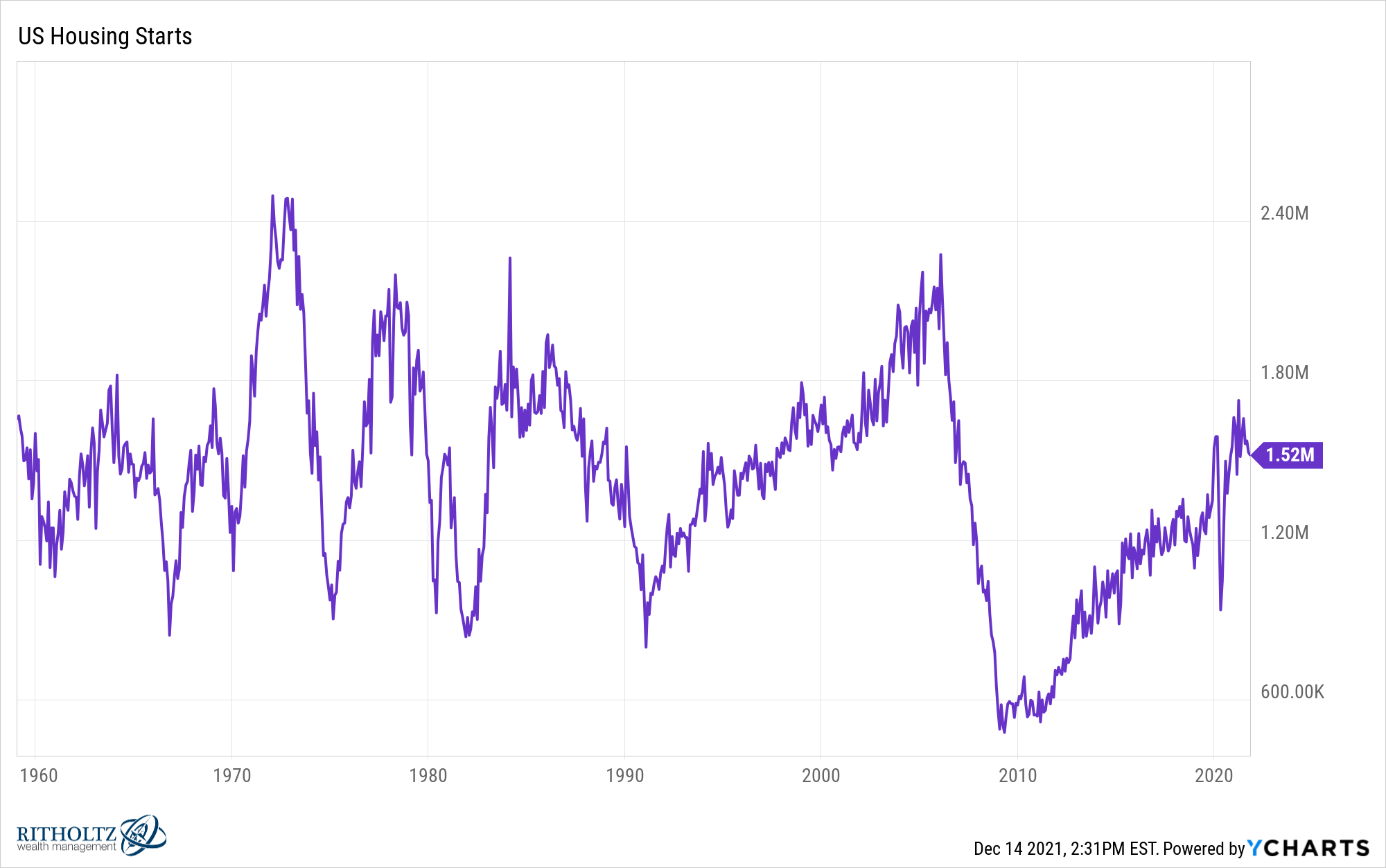

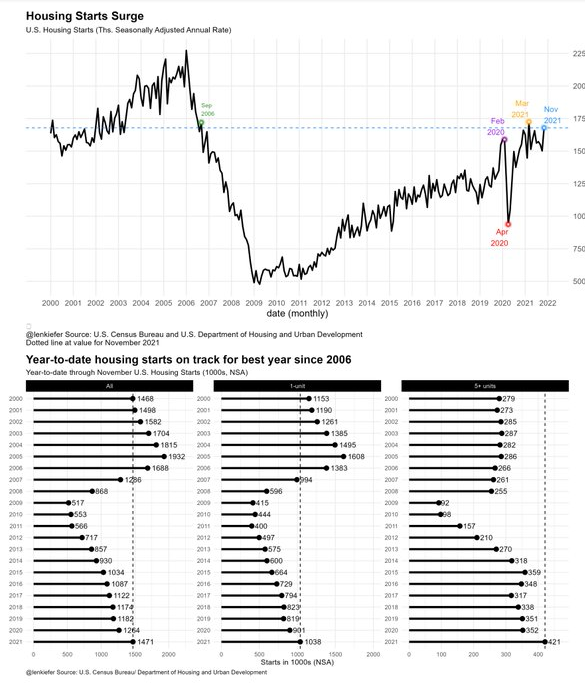

- Millennials are driving the housing market

- The future of the movie industry

Listen here:

Transcript here:

Stories mentioned:

- Omicron now dominant U.S. covid strain

- How much of US cases will be Omicron by next year?

- Long-term capital market assumptions

- GMO quarterly letter

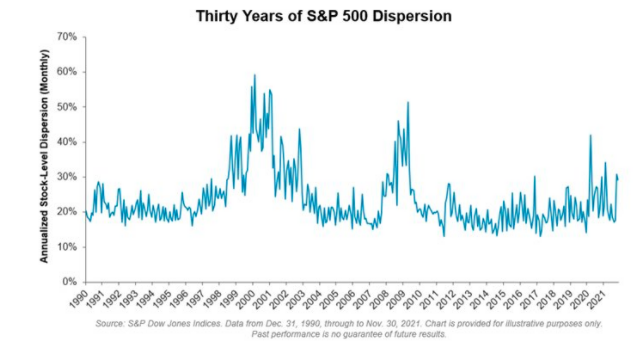

- Michael Mauboussin on stocks

- Poorest Americans see record increase in wealth

- Finding some middle ground between Paul Volcker and Jerome Powell

- Crypto theses for 2022

- Digital asset outlook

- We built s crypto index

- Innovation stocks are not in a bubble

- New survey reveals 83% of millennial millionaires now own crypto

- Millennials are supercharging the housing market

- A new year brings a new surge in housing prices

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: