One of the things I’ve learned in the investment business is it’s never a good idea to trust someone who is 100% certain about any outcome in the markets.

I’ve seen enough best ideas portfolios over the years to know most portfolio managers have no clue what their best ideas truly are until after the fact. There are simply too many unknowns and outside factors that can impact the economy, markets, sectors and companies to ever give yourself permission to have complete certainty about the future.

Sure strong opinions are fine but they better be weakly held because the markets are a humbling place if you’re not willing to look at both sides of an argument.

The most certain investors are often those who get trapped in the recency bias and assume what has worked will continue to do so forever or the contrarians who assume only that which has performed poorly is worth owning.

Both of these camps can be right depending on their time horizon and market environment but always thinking in either a momentum or value framework is a sure way to be disappointed eventually.

You could make a compelling bull and bear care for every asset class or market right now. What you believe about these cases depends on how you’re positioned or what you believe about investing.

I don’t know what the future will hold so here are the bull and bear cases right now:

S&P 500

Bull Case. The United States has been the cleanest dirty shirt in the global laundry hamper for years and the S&P 500 has been a huge beneficiary of this.

The S&P is dominated by some of the best and brightest companies in the world which now includes nearly a one-quarter weighting in the 5 biggest technology companies which seem to be taking over the world.

Growth stocks also benefit from lower interest rates and it sounds like the Fed is going to keep rates low for a long time.

Bear Case. Sure, the S&P 500 has beaten pretty much every other stock market in the world since the financial crisis but this may be the biggest reason it won’t continue.

How quickly we all forget the precursor to an unbelievable run in the S&P 500 over the past 10+ years was a lost decade from 2000-2009. The S&P 500 lost money over the entire decade of the aughts. There is certainly no guarantee the current U.S. outperformance will last.

Concentration risk works both ways. Yes, it’s helped on the way up but it could hurt investors in the S&P if those companies ever stumble or their lofty expectations aren’t met.

Nasdaq 100

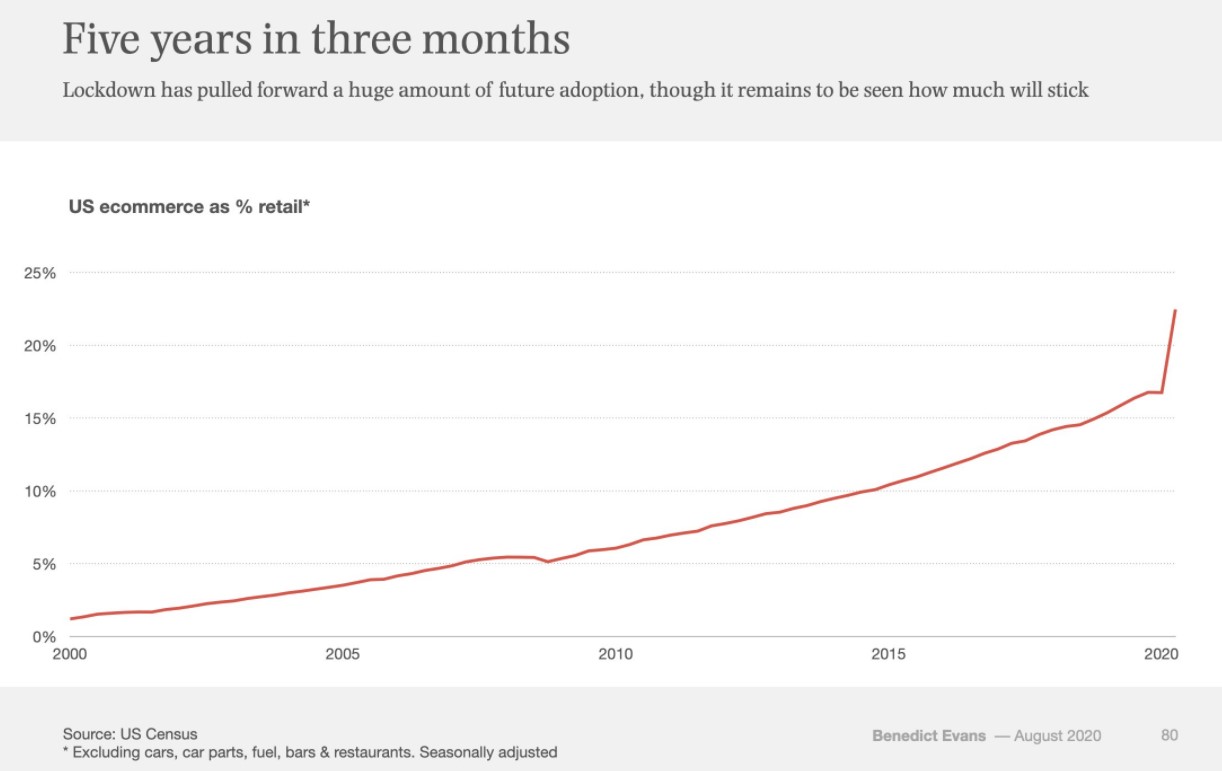

Bull Case. The Nasdaq 100 is up 38% in 2020. It’s bizarre to think it would probably be up far less this year if there wasn’t a global pandemic. The pandemic has pulled forward an enormous amount of adoption in trends like e-commerce:

This has further strengthened the position of the incumbent tech firms and helped bring along newer companies much faster than they ever dreamed possible. Technology is now more firmly entrenched in all of our daily lives than ever.

These companies can also borrow at ridiculously low rates to use their equity to go on an acquisition spree. If they start buying up Roku, Sonos, Peloton, Slack, Twitter or Spotify an M&A boom is a possibility to keep the part going.

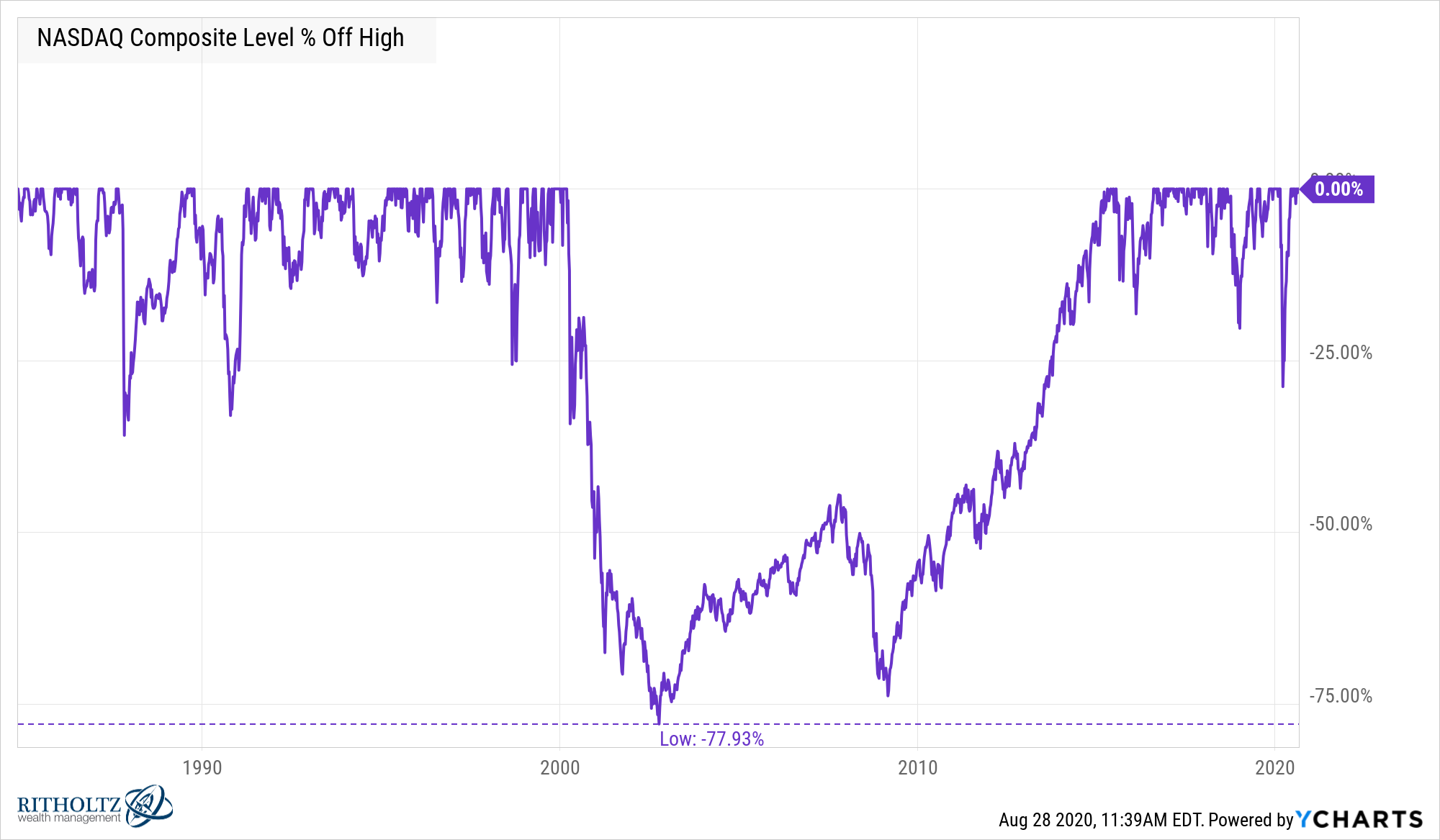

Bear Case. Everything people were predicting in the late-1990s for the Internet happened and more. But we still had to go through the tech bust because expectations were far too high by 1999 that the companies couldn’t possibly live up them.

The Nasdaq fell close to 80% after the huge run-up in prices during the dot-com bubble:

The index didn’t reach the 2000 peak price levels again until 2015. Things were far crazier back then than they are now. Today’s tech companies actually have solid businesses, cash flows and profits in most cases. They didn’t back then.

But there is a case to be made for expectations getting ahead of themselves and that’s probably the biggest risk for tech stocks other than government regulation.

And if you think the S&P 500 is concentrated, Apple, Amazon, Microsoft, Google, Facebook and Tesla make up more than 51% of the Nasdaq 100. This is a huge bet on a handful of companies continuing to knock the cover off the ball.

Small Caps

Bull Case. Since 1926, the Fama-French Small Cap Index has outperformed the S&P 500 by more than 2% annually (12.6% vs. 10.2%). Granted, it was nearly impossible to invest in many of those small cap names before the 1970s but here are the annual returns for the S&P 500 vs. the S&P 600 Small Cap Index since its inception in 1994 (through the end of July):

- S&P 500 +9.73%

- S&P 600 +9.66%

Pretty close. Now the annual returns since 2015:

- S&P 500 +10.88%

- S&P 600 +5.52%

Even if we assume there is no such thing as a small cap premium (which has never been a sure thing), we should eventually see some mean reversion.

Following the dot-com crash these were the annual returns from 2000-2007:

- S&P 500 +1.66%

- S&P 600 +9.99%

And in a post-Covid world, we could certainly see a snapback in many of the smaller corporations that have been hurt the most from this crisis.

Bear Case. It’s possible we’ve entered a winner-takes-all stock market where the biggest corporations either have semi-monopolies or simply buy out their competition. There is also competition from private equity buying up smaller corporations.

Small businesses have been hurt the most from this crisis and it’s possible this trend will continue. Bigger companies can borrow more easily and for lower rates too.

And companies are now staying private much longer than they did in the past and essentially skipping the small cap phase of being a public company.

Emerging Markets

Bull Case. I made the case for EM here a couple of weeks ago. In short, emerging markets are becoming more tech and consumer heavy in their sector make-up, a falling dollar would offer a huge boost to developing nations and the boom-bust nature of EM stocks means you can never count them out for a big run-up in prices.

Plus there’s the fact that emerging markets have lower valuations than the United States. Maybe the bad stuff is already priced in.

Bear Case. The pandemic could hit these countries even harder than developed nations because many of them don’t have the infrastructure in place to handle this crisis.

Developing countries also don’t treat their shareholders, corporations or intellectual property as well as we do in the U.S. And emerging nations don’t have mature economics, so they’re regularly experiencing currency and economic crises.

Foreign Developed Stocks

Bull Case. From 1970 through the end of 2007 the annual returns for European (MSCI Europe) and U.S. stocks (S&P 500) were basically the same:

- Europe +11.4%

- United States +11.1%

Now here are the returns from 1970 through July of 2020:

- Europe +8.6%

- United States +10.5%

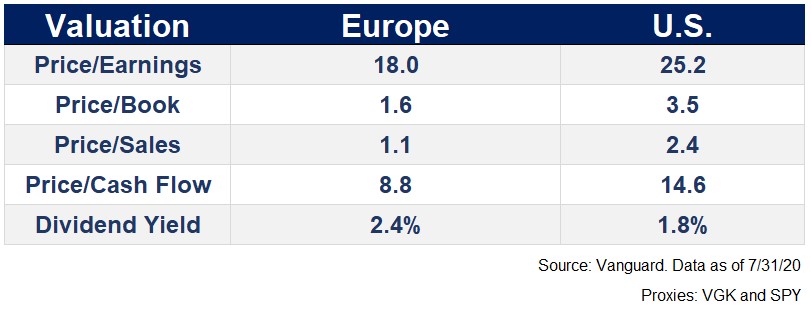

The entirety of the outperformance of U.S. stocks over European stocks has come since 2008. There are sector differences between these markets but this outperformance is also reflected in the valuations and yields:

If mean reversion still exists and the dollar strength of the past decade-plus relents, international stocks could finally outperform.

The fact that European countries have had a much better pandemic response could also play a factor in jump-starting their economies.

Bear Case. Many investors assume low rates are propping up U.S. stocks but rates have been lower for longer in Europe and Japan and these countries haven’t seen similar stock market performance.

Demographics are poor in many of these countries as well and they don’t have the same exposure to technology stocks.

It’s possible this time is different and the U.S. will continue to dominate the rest of the world.

Value Stocks

Bull Case. It can’t get any worse for value investors, right? Historically buying stocks with lower valuations has led to higher returns and assuming that hasn’t changed value has to come back eventually, right?

An uptick in inflation could also be a catalyst for value to outperform.

Bear Case. Its possible software ate value investing and that premium is gone forever. Intangible assets are a much higher percentage of companies these days so valuing corporations might be much harder than it was in the past.

And every hedge fund manager and aspiring long-term investor on the planet has been reading Warren Buffett books since the 1990s. Maybe the cat is out of the bag and value is dead forever.

Bonds

Bull Case. Rates could always go negative. We could see deflation or slower economic growth. And even if there is inflation, TIPS can hedge that risk as well as any asset.

And demand for fixed income will likely stay high from retiring baby boomers and the Fed.

Bear Case. Many investors assume rising interest rates are the biggest risk to bonds but it’s actually inflation. An unexpected rise in prices would be harmful to bonds, assuming the Fed doesn’t completely control the credit markets at this point.

Bitcoin

Bull Case. My biggest bull case for bitcoin is the fact that it’s still here. It survived that massive mania in 2017 and another leg down last year. The fact that it’s been so resilient makes me believe bitcoin could end up being a store of value in the mold of gold for the Gen Z/millennial crowd.

I think that’s actually the best-case scenario.

Bear Case. None of the predictions from the 2017 frenzy have come true yet. It’s hard to believe all of the capital that rushed into all of those ICOs hasn’t led to anything tangible use cases yet. Where did all of that money go?

Bitcoin is also just made up Internet money that’s just a bunch of ones and zeros and the whole Satoshi thing just makes for a good story.

Further Reading:

Perma-Arguments