This fall is going to be weird.

There are a lot of people that want school to happen but there’s no way it occurs under normal conditions.

If it’s all in-person there will likely be outbreaks that make it a disjointed process. And if it’s fully or partially online it will make life more challenging for young people and families alike.

This week Harvard announced they will be bringing up to 40% of undergrads on campus but the majority of classes will take place online. And a well-endowed Ivy League university has the resources to take precautionary steps to make life safer for their student body:

All students living on campus will be required to sign a community compact agreeing to new health measures, which include mandatory video training, daily symptom attestation, viral testing every three days, participation in contract tracing, and standard safety practices such as wearing masks and physical distancing. Students who test positive will be isolated and cared for by medical professionals at Harvard University Health Services, which is preparing quarantine accommodations for up to 250 individuals.

How many other schools will have the ability to take such precautions? A handful at best?

The rest of the schools will bring students back to a more dangerous environment or conduct all of their classes online.

Harvard announced they will be keeping their tuition at the same rates without offering a discount for online classes.

Some people say this is a crock because you’re not getting the full college experience. Why should you pay the same amount? Others counter that a college degree is worth it regardless of the format.

What is a college student to do this fall?

I honestly don’t know.

When I was an 18-to-22-year-old there’s no way I was mature enough to make a level-headed decision about something like this. How could you ever prepare yourself for this type of situation?

The way I see it there are four legitimate options:

1. Take a gap year. This is the option most romanticized by the wealthy class but not realistic for the majority of the country. What are you going to do if you take a year off? Live in your parent’s house and play video games all day?

Maybe get a job? Good luck with that. Tens of millions of people are out of work and also looking for employment. And the only jobs available to college-aged kids may be the ones that put them most at risk.

This seems like a good option but probably doesn’t work for most young people.

2. Go the community college route. This is the spreadsheet answer that most financial professionals would suggest.

Going to community college for a couple of years to knock out some pre-requisites and then transferring to a 4-year school is a great way to minimize student loan debt. If you have the ability to make a sensible financial decision like this at age 18, I salute you.

I most certainly did not but this makes sense for those worried about the finances of higher education.

3. Bite the bullet and take online classes with your peers. If life in the fall is going to be weird you could simply embrace the weirdness with the rest of your peers and go with whatever your college of choice decides to do.

Everyone is in the same boat so taking all or most of your courses online with the rest of your classmates just means you’ll be going through the same experience as everyone else. It’s not ideal but not much is right now.

4. Load up on coursework now to be able to enjoy the social aspects later. I was an incoming college freshman 20 years ago. I’m trying to put myself in that mindset again.

When I was in school socializing took up the majority of my time. I could tell you I spent all of my waking hours in the library studying but that would be a lie.

If socializing is in a severe bear market for most college students, I would take advantage by loading up my schedule with classes. That way when things get back to normal in a year or two you could take a lighter course load and spend more time on the social aspects of the college experience then.

There are no easy answers but I don’t understand the VC bros and successful entrepreneurs who tell young people college is not worth it.

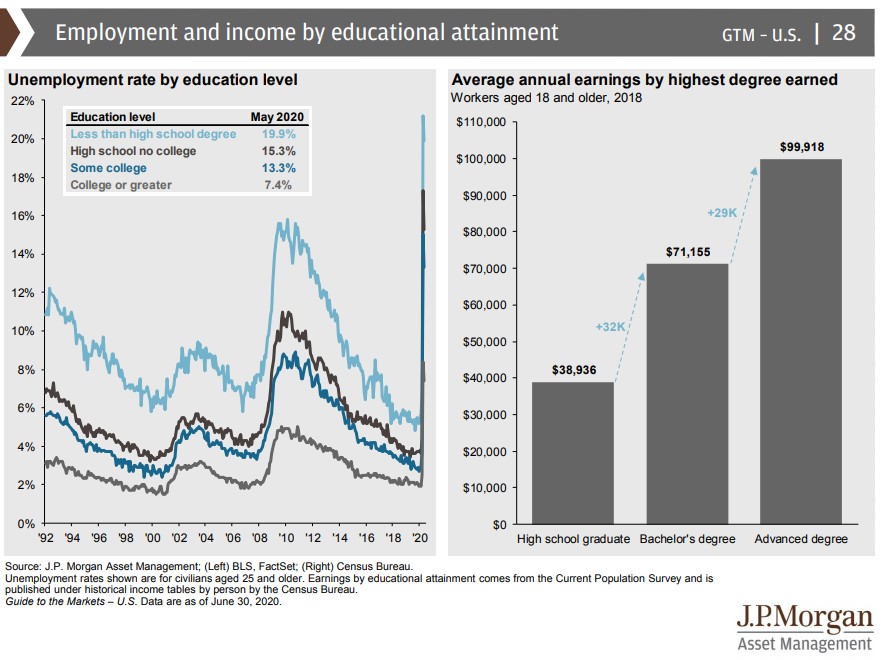

College is still a good investment for those of us who didn’t drop out to start Facebook:

You just have to be intelligent about the field of study you choose to make sure that investment pays off. When I entered school I did no research whatsoever on the types of career paths or potential starting salaries for the positions that could be available.

If you’re going to make the college leap in the midst of extreme uncertainty, it’s more important than ever to ensure you’ve done your homework on the ROI in your chosen field of study.

Michael and I discussed the options for college students this fall along with the Tesla rocketship, low yields around the globe, borrowers vs. savers and more on this week’s podcast:

Further Reading:

What They Don’t Teach You in Business School

Now here’s what I’ve been reading lately:

- Don’t fall in love with your stocks (Belle Curve)

- Earning $800/month with Spotify (Steve Benjamins)

- What if finance is a solved problem? (I’m Late to This)

- The diversification imperative (Notion)

- 5 questions for unhappy investors (Big Picture)

- The UK’s worst stock market crash ever (Monevator)

- The biggest threat to your retirement plans (A Teachable Moment)

- How to win $1 million (Trace Wealth Advisors)